Navigating Workers' Compensation Law

advertisement

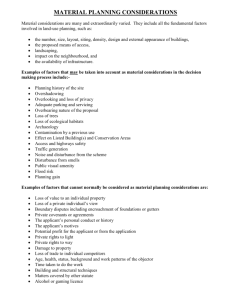

Navigating the Mine Field of Workers’ Compensation & Employment Laws January 30, 2014 Sponsored by Alliance Occupational Medicine, Callan Law Firm, and Slater, Hersey & Lieberman, LLP JENNIFER CALLAN Callan Law Firm 1100 Lincoln Avenue, Suite 261 San Jose, CA 95125 T: 408.337.0200 F: 408.337.0400 E-mail: jcallan@callan-law.com SB 863 Highlights: Increase PD values; Simplify PD rating method; Provide additional payments for workers with disproportionate wage loss; Resolve medical treatment disputes through IMR; Resolve bill payment disputes through IBR; Simplify SJDB/voucher; Lien Reform – Required payment of filing or activation fee; and Establish fee schedules for copy services, interpreters, vocational experts, and in-home health care. SB 863 PD Benefits: Rates: For all DOIs on or after 1/1/13, minimum rate is $160/wk. For all DOIs between 1/1/13 and 12/31/13, maximum rate will be $230/wk. [less than 55%], $270/wk. [55% to 69%], or $290/wk. [70% to 99%]. For DOIs on or after 1/1/14, maximum rate will be $290/wk. for all PD levels. Types of injuries: No PD benefits for compensable consequence sleep disorders or sexual dysfunction. PD for psyche add-on only if the physical injury is “catastrophic” or where claimant was the victim of or a witness to a violent crime. SB 863 PD Benefits: PD Advances: Can defer PD advances made before a formal award of PD if claimant returns to the same employer he/she worked for at the time of the injury and earns at least 85% of his/her preinjury wages and compensation. Can also defer PD if claimant works for a different employer and earns 100% of pre-injury wages and compensation. PD Rating: Pre-SB 863 rating formula includes a modifier of between 1.1 and 1.4, depending on the body part that is injured. For injuries on or after 1/1/13, the rating formula will no longer include the “future earning capacity modifier”. Instead all injuries will be adjusted by a factor of 1.4. SB 863 RTW Fund: $120 million per year RTW Fund established and administered by the DIR. The RTW Fund is to provide an additional payment to claimants whose PD ratings are disproportionately low compared to their wage losses after a workplace injury. SJDB/Voucher: For DOIs on or after 1/1/13, SJDB is fixed at $6,000 and due 60 days after the PTP, AME, or QME declares the I.W. P&S, and issues a report outlining the I.W.’s work capacities, if the employer does not offer the worker a job that meets certain criteria. SB 863 Independent Medical Review (IMR): As of 7/1/13 for all DOIs, Independent Medical Review (IMR) will be used to decide all disputes regarding medical treatment. IMR can be requested by I.W. following a denial, modification, or delay of a treatment request through the UR process. IMR not available if there is a dispute regarding causation. SB 863 Independent Bill Review (IBR): IBR process to resolve disputes regarding the amount to be paid to doctors. IBR will not apply to disputes regarding treatment authorization [which instead go through IMR], cases in which causation is at issue, or where there is a dispute about whether or not the provider is authorized to treat the I.W. SB 863 Lien Reform: Filing fee of $150 now required for all liens filed after 1/1/13, and $100 activation fee required for liens filed before 1/1/13, but activated for a conference or trial after 1/1/13.* Dismissal of liens by operation of law after 1/1/14 if filing or activation fee has not been paid, or if 18-month statute of limitations has been met for services after 7/1/13, or if 3-year statute of limitations has been met for services before 7/1/13. Fee Schedules: Fee Schedules for copy services, home vocational expert fees and interpreters. health care, AOE/COE Dufresne v. City of Hayward (2009) Alameda Superior Court No. 2002-067063 (Unpub.) Dufresne filed a workers’ compensation claim against the City of Hayward for “stress, depression, anxiety [and] paranoia due to prolonged discrimination [and] harassment.” The City accepted liability for the workers’ compensation claim and provided benefits. During the course of the Trial of Dufresne’s civil Complaint against the City for sexual harassment, evidence was admitted regarding the WC claim, including the City’s acceptance of liability for the claim. Jury returned a verdict in favor of Dufresne, awarding her $472,389.00 on her complaint for sexual harassment against the City. The City appealed, arguing that the court erred in admitting evidence that the city accepted liability in WC proceedings arising out of the same alleged harassment. Holding: Evidence of what transpired in the WC proceedings was admissible in the civil trial. When the City admitted that Dufresne’s WC claim was compensable, it was necessarily acknowledging that Dufresne had presented sufficient objective evidence of harassment and that the harassment was the predominate cause of her injury. CUMULATIVE TRAUMAS Kendall v. Open Wave Systems, Inc., APIC (August 2012) 2012 Cal. Wrk. Comp P.D. LEXIS 159 [Panel] Travelers sought contribution from American Protection Ins. Co. (APIC). Arbitrator found that there was one CT extending through June 7, 2004 and that Travelers was entitled to contribution from APIC. APIC filed a Petition for Reconsideration. The sole issue before the court was the determination of the CT period. Mr. Kendall was treated for bilateral hand/wrist pain and numbness in May 2003. At that time he was told to cut back on work hours, but he did not. He did wear wrist braces outside of work and took medication. On July 19, 2004, Mr. Kendall filed a DWC-1 claim for BCTS. TD began on September 30, 2004. The WCAB amended the F&A to find that the period of liability for the CT was through September 29, 2004. The WCAB noted that liability for a CT is determined according to the last year preceding either the DOI (Labor Code § 5412) or the last date on which the employee was employed with injurious exposure. (Labor Code § 5500.5) CUMULATIVE TRAUMAS Kendall v. Open Wave Systems, Inc., APIC (August 2012) 2012 Cal. Wrk. Comp P.D. LEXIS 159 [Panel] Labor Code § 5412 defines CT injury as “that date upon which the employee first suffered disability therefrom and either knew or in the exercise of reasonable diligence should have known that such disability was caused by his present or prior employment.” “Disability” in this context means either TD or PD. Mr. Kendall was not found to have suffered PD by the WCAB as he did not reduce his work hours or work modified duty. The WCAB then analyzed when Mr. Kendall first suffered TD, which it found to be September 30, 2004. Holding: Since the DOI under Labor Code § 5412 was September 30, 2004, and the last day of injurious exposure was Applicant’s LDW on September 29, 2004, it is appropriate to use the earlier of these two dates and find that the CT ends on September 29, 2004. CUMULATIVE TRAUMAS Campos v. Atascadero Unified School District, The Vons Companies (October 2012) 2012 Cal. Wrk. Comp. P.D. LEXIS 504 [Panel] Applicant sustained a CT injury extending through March 1, 2004. During that period, Applicant had concurrent employment at Atascadero Unified School District and at Vons. Atascadero and Vons arbitrated their dispute regarding the division of liability after the case in chief resolved. The arbitrator found that because Applicant worked for Atascadero for 365 days and for Vons for 193 days during the CT period, the division of liability was calculated at 65% to Atascadero and 35% to Vons. Atascadero sought reconsideration of the arbitrator’s F&O. The WCAB Panel noted that Applicant worked for Atascadero during the entire CT period as a playground assistant for “about 10 to 15 hours per week.” She also worked for Vons as a courtesy clerk and grocery stocker from March 1, 2003 to October 10, 2003, for “about 24 hours per week.” During the CT period, applicant had worked for 379.5 hours for Atascadero and 853 hours for Vons. CUMULATIVE TRAUMAS Campos v. Atascadero Unified School District, The Vons Companies (October 2012) 2012 Cal. Wrk. Comp. P.D. LEXIS 504 [Panel] The Panel stated that “[w]hile the Arbitrator divided liability based on a comparative number of days applicant was employed by each employer, we are persuaded that, on this record, liability should be calculated based on the number of hours that applicant worked for each employer.” The Panel noted that “[w]hile we conceded that there is no controlling precedent employing this calculation method, the current version of [Labor Code] section 5500.5 does not preclude it.” The Panel rescinded the arbitrator’s decision and substituted it with a new F&O finding that the assignment of liability between defendants is 31% to Atascadero and 69% to Vons. MEDICAL PROVIDER NETWORKS (MPNs) Grossman v. Aramark Uniform Service 2013 Cal. Wrk. Comp. PD Lexis 149 (WCAB Panel 2013) Applicant sustained an accepted low back injury and underwent low back surgery. AME Dr. Steven Isono examined Applicant and opined that he was entitled to future medical care (including conservative medical treatment and potential future surgery). Applicant then changed his PTP to Dr. Charles Lewis, to obtain the additional medical treatment outlined by Dr. Isono. Defendant notified Applicant via letter that Dr. Lewis was outside of the employer’s MPN, and listed the name of five physicians from within the MPN. Applicant continued to treat with Dr. Lewis, whose medical services underlie a lien claim by San Joaquin Accident & Medical Group (SJAMG). Following the lien trial, the WCJ found that Applicant was aware of defendant’s MPN when he changed his treating physician to Dr. Lewis, that Applicant’s knowing referral to Dr. Lewis for treatment outside the MPN was invalid, and that SJAMG is to take nothing on its lien claim. MEDICAL PROVIDER NETWORKS (MPNs) Grossman v. Aramark Uniform Service 2013 Cal. Wrk. Comp. PD Lexis 149 (WCAB Panel 2013) During the lien trial, Applicant testified that he called the doctors on the list but did not receive a call back. Applicant’s attorney also testified that when he called four physicians, none would accept the PTP role, as they did not wish to take on the reporting requirement. The fifth physician told Applicant’s attorney that he wanted to review the medical file before making a decision. Applicant’s attorney also attempted to access the website listed in defendant’s letter but was unable to gain access to the MPN list. Holding: The WCAB reversed the WCJ’s decision, finding that the lien claimant was entitled to reimbursement for its lien for medical treatment self-procured by applicant outside of defendant’s MPN. Defendant’s failure to take steps to reasonably assure that Applicant had access to a PTP within the MPN was a neglect or refusal to provide reasonable medical treatment that rendered it liable for the cost of medical treatment reasonably self-procured by applicant. MEDICAL PROVIDER NETWORKS (MPNs) Valdez v. WCAB 57 Cal. 4th 1231 (CA Supreme Court, Nov. 2013) Applicant initially began treatment with a physician in her employer’s MPN. She later received treatment from a physician outside the MPN. Applicant requested temporary disability benefits, relying on reports by the non-MPN physician. The WCAB concluded that the reports from the non-MPN physician were inadmissible in the proceedings regarding the claim for temporary disability benefits. The Court of Appeal disagreed and annulled the decision of the WCAB. MEDICAL PROVIDER NETWORKS (MPNs) Valdez v. WCAB 57 Cal. 4th 1231 (CA Supreme Court, Nov. 2013) Holding: The admission of reports from privately retained and compensated physicians is not precluded in disability proceedings. Labor Code § 4616.6 restricts the admission of medical reports only in proceedings to resolve disputes over diagnosis and treatment within an MPN. Privately retained doctors’ reports cannot be the sole basis of an award of compensation, but can provide some basis for an award of compensation. MEDICAL TREATMENT Adventist Health v. WCAB (Fletcher) (November 2012) 2012 Cal. App. LEXIS 1208 [Court of Appeal, 3rd] Applicant had a future medical award and relocated to Maryland. Defendant had difficulty obtaining required reporting from applicant’s physician in Maryland, Dr. Malik. Defendant, therefore, filed a Petition with the AD and requested a change of PTP as Dr. Malik failed to comply with the reporting requirements. The AD granted the Petition. Applicant, however, still sought some treatment with an associate of Dr. Malik’s and requested reimbursement for such treatment. The Court of Appeal found that “by returning to the physician who had been administratively removed and his associate, [applicant] flaunted the administrative order [of the AD].” Additionally, “by seeking treatment from providers who failed to submit treatment plans or medical records, [applicant] denied [defendant] the ability to comply with utilization review.” Holding: The WCAB is without authority to allow applicant to flaunt not only the AD order, but also the rules of the workers’ compensation system. MEDICAL TREATMENT Mendez-Correa v. Vevoda Dairy 2013 Cal. Wrk. Comp. P.D. LEXIS 171 (WCAB Panel 2013) Applicant sustained an accepted industrial injury and was declared P&S by both his PTP and the Panel QME, while unrepresented. Applicant, thereafter, moved to Southern California where he obtained an attorney and began treating with a new PTP, over defendant’s objection that this new PTP was outside of defendant’s MPN. Numerous other non-MPN providers subsequently filed treatment liens. The WCJ found that applicant self-procured medical treatment outside of defendant’s MPN at his own expense under Labor Code § 4605 and that self-procured medical treatment liens for treatment outside of defendant’s MPN are not the defendant’s liability and are disallowed. MEDICAL TREATMENT Mendez-Correa v. Vevoda Dairy 2013 Cal. Wrk. Comp. P.D. LEXIS 171 (WCAB Panel 2013) Upon reconsideration, the WCAB agreed that applicant was obligated to treat within the MPN. However, the WCAB disagreed that the record supported the WCJ’s finding that applicant intended to self-procure treatment from any lien claimants at his own expense, following his move to So. CA. The WCAB rescinded the WCJ’s finding that applicant self-procured services for medical treatment at his own expense from all lien claimants who were not in defendant’s MPN pursuant to Labor Code § 4605. If applicant had intentionally self-procured medical treatment pursuant to Labor Code § 4605, he would be personally liable under that section for the cost of the treatment, and the WCAB would have no jurisdiction to determine its reasonable value or to hold defendant liable for it as part of the applicant’s workers’ compensation. PANEL QMEs Matthies v. WCAB (Paesano’s Restaurant) 78 CCC 718 (WCAB Panel 2013) Applicant filed a claim for injury to her back, neck and hips on 9/23/11 while employed as a server for Paesano’s Restaurant. While unrepresented, Applicant was examined by chiropractor QME Dr. Perry Carpenter pursuant to Labor Code § 4062.1. In conjunction with the evaluation by Dr. Carpenter, the claims adjuster sent a letter to Dr. Carpenter, with a copy to Applicant, outlining her theory of the case and setting forth questions to be addressed by the QME. A few days later, the claims adjuster sent a letter to Applicant, enclosing medical records that were concurrently sent to the QME. On three separate dates, the claims adjuster sent Dr. Carpenter subpoenaed records from multiple sources. Applicant was sent copies of all of the transmittal letters, but there was no record as to whether Applicant was provided with copies of the subpoenaed records referenced in the transmittal letters. PANEL QMEs Matthies v. WCAB (Paesano’s Restaurant) 78 CCC 718 (WCAB Panel 2013) Applicant objected to Dr. Carpenter’s report on the basis that it was a supplemental report prepared after review of unauthorized medical records. The WCJ overruled Applicant’s objection and admitted the report into evidence. Applicant filed a Motion to Disqualify Dr. Carpenter and Obtain a New Panel QME. Applicant alleged that Defendant inappropriately sent records to Dr. Carpenter in violation of Labor Code § 4062.3(f). WCJ issued a F&A ordering the DWC Medical Unit to issue a new QME Panel in the specialty of chiropractic. Defendant appealed. WCAB upheld the WCJ’s decision as relates to the Panel QME issue, concluding that Applicant did not receive timely or adequate notice of medical and non-medical records sent by the claims adjuster to the QME nor notice of her right to object to any provision of these records to the QME, as required by Labor Code § 4062.3(b) and Regs §35(c). PSYCHIATRIC CLAIMS County of Sacramento v. WCAB (Brooks) 78 CCC 379 (Ct. App. 2013) (opinion modified, 2013 Cal. App. LEXIS 348) Applicant worked as a supervising probation officer for the County of Sacramento. Applicant felt that the team he supervised at work, resisted and undermined his authority and supervision. His attempts to counsel those he supervised went awry. Applicant was admonished by management and was the subject of an internal affairs investigation. Applicant claimed he had sustained a psychiatric injury at work. Psychiatrist Ann Allen, M.D., served as AME. Dr. Allen found that Applicant sustained a psychiatric injury and concluded that one-third of causation was due to a complaint filed by another employee (which the parties agreed was not a personnel action), one-third was due to the internal affairs investigation (which the parties agreed was a personnel action), and one-third was due to Applicant’s feelings that his supervisors were not supporting him (the parties disputed whether this was a personnel action). The County denied liability for Applicant’s claim based on the good faith personnel action defense under Labor Code Section 3208.3. The WCJ found that the Applicant had sustained a compensable work injury and the WCAB affirmed. PSYCHIATRIC CLAIMS County of Sacramento v. WCAB (Brooks) 78 CCC 379 (Ct. App. 2013) (opinion modified, 2013 Cal. App. LEXIS 348) The Third District Court of Appeal vacated the WCAB’s award, finding that AME Dr. Allen’s reports and testimony “were so confusing and changing that Dr. Allen’s opinion cannot be deemed support for the Board’s conclusion that personnel actions were not a substantial cause of [Applicant’s] injury.” Holding: The medical evaluator has no authority to decide what is or is not a personnel action. The WCAB “erred by impliedly accepting Dr. Allen’s opinion concerning what is a personnel action when it did not consider the record for evidence concerning what caused [Applicant’s] feelings that he was unsupported by his supervisors.” As this was prejudicial error, the WCAB’s decision was annulled and the case was remanded for further development of the record. PERMANENT DISABILITY Grant v. Los Angeles Lakers, 2013 Cal. Wrk. Comp. P.D. LEXIS 125 (WCAB Panel 2013) Applicant played professional basketball from 1987 through 2004 and his last year of employment as a professional athlete was with the Los Angeles Lakers. At trial, the WCJ found that applicant sustained industrial injury to numerous body parts, post-traumatic head syndrome, sleep disorder, etc., causing 90% PD without apportionment, and a need for medical treatment. The WCJ based his findings upon the applicant’s QME report issued by Dr. Styner, who opined that the AMA Guides, 5th Edition did not apply to applicant, because he was a professional athlete and not a “normal person.” Dr. Styner also opined that Almaraz/Guzman allowed for a higher rating. PERMANENT DISABILITY Grant v. Los Angeles Lakers, 2013 Cal. Wrk. Comp. P.D. LEXIS 125 (WCAB Panel 2013) Holding: Dr. Styner’s reports failed to include a proper analysis of applicant’s condition pursuant to the AMA Guides, and, therefore, were not substantial medical evidence. Dr. Styner failed to support his departure from the AMA Guides and his departure was not supported by the medical record. Dr. Styner’s assessment of applicant’s PD using other than usual AMA Guides charts and tables on the basis that applicant was a professional athlete was unjustified since occupational factor is already accounted for in the rating string. WCJ’s decision rescinded and case returned to trial for further development of the record. PERMANENT DISABILITY Gerton v. City of Pleasanton 2013 Cal. Wrk. Comp. P.D LEXIS 105 (WCAB Panel 2013) Applicant sustained an accepted CT to 6/16/09 injury to his low back. At trial, the WCJ found that applicant sustained 62% PD with a need for future medical care. In the Opinion, the WCJ stated that the DFEC adjustment factor contained in the 2005 PDRS was rebutted at trial by the testimony from the applicant’s vocational expert. Citing Dahl v. Contra Costa County, the WCJ agreed with the vocational expert, who had opined that the applicant’s work preclusions resulted in a 65% DFEC. Holding: F&A rescinded and case returned to trial level for further development of the record. New decision required as to whether applicant carried his burden of rebutting the DFEC component of the 2005 PDRS and showing that he was entitled to a higher PD than as per the 2005 PDRS. While the Dahl analysis may be applied to this case of less than permanent total disability, the record must be developed on the issues of applicant’s post-injury earnings, his amenability to vocational rehabilitation and the relationship to his DFEC and percentage of permanent disability. PERMANENT DISABILITY Seymour-Jackson v. WCAB 78 Cal. Comp. Cases 352 (Ct. App. 2013 writ denied) Applicant sustained industrial injuries to various body parts in 1993, 1997, and 2003. At trial, she was found to have PD of 44.75% for the knee and 40% for back and psyche injuries. Applicant filed a Petition for Reconsideration, contending that the WCJ should have found the PD to be at 100%. At trial, the WCJ found defendant’s vocational expert to be more persuasive. The WCJ noted that applicant’s expert failed to explain why applicant’s need to stand for eight minutes after sitting for 15 minutes could not be accommodated by utilizing a “sit-stand station.” Defendant’s expert emphasized that applicant had extensive experience doing various clerical and office-type tasks, which were particularly amenable to, and within, applicant’s work restrictions. WCAB denied reconsideration and adopted and incorporated the WCJ’s report. Applicant’s Petition for Writ of Review was denied. APPORTIONMENT Acme Steel v. WCAB 218 Cal. App. 4th 1137 (Ct. App. 2013) Applicant sustained a CT injury to multiple body parts, including hearing loss, on October 16, 2003. Dr. Schindler performed an AME and apportioned hearing loss based on both nonindustrial causes and a prior injury, concluding that applicant had 100% hearing loss that was 40% apportioned to non-industrial factors and 60% apportioned to occupational factors, including an industrial injury for which there was a prior award for hearing loss. At trial, the WCJ found that applicant effectively rebutted any DFEC, instead showing 100% loss of earning capacity entitling him to 100% permanent and total disability. The WCJ based the latter finding on vocational expert testimony that there was no job in the open labor market that could accommodate App’s limitations, need for medications and rests, etc. The WCJ also found that Labor Code § 4664 is not pertinent because prior to the injury in question there was no earning loss due to the prior award of PD for hearing loss, reasoning that Applicant continued to work after the prior award for hearing loss. APPORTIONMENT Acme Steel v. WCAB 218 Cal. App. 4th 1137 (Ct. App. 2013) Defendant Acme sought reconsideration of the award, contending that the WCJ exceeded her powers by failing to apportion the disability pursuant to Labor Code § 4663, because there was evidence showing applicant’s hearing loss was 40% non-industrial. In response, the WCJ stated that she was not bound by the AME’s findings, given that there was convincing vocational testimony regarding loss of earning capacity. The WCAB denied defendant’s petition for reconsideration. Holding: The WCAB ignored substantial medical evidence presented by AME Dr. Schindler showing that applicant’s 100% loss of hearing could not be attributed solely to the current cumulative trauma. The WCAB should have parceled out the causative sources—nonindustrial, prior industrial, current industrial—and decided the amount directly caused by the current industrial source. Remanded back to the WCAB with directions to the WCJ to make an award consistent with this opinion. DISCOVERY Yera v. J.C. Penney 2013 Cal. Wrk. Comp. P.D. Lexis 189 (WCAB Panel 2013) Applicant claimed work injury to her neck, upper extremities, chest, nervous system, and other body parts while employed as a sales assistant by J.C. Penney. Defendant noticed Applicant’s deposition. Applicant appeared at the noticed time and location but refused to go forward with the deposition in the presence of the store manager, who was designated as the employer’s representative. Defendant petitioned to compel the deposition to proceed in the store manager’s presence, and the WCJ denied the petition. Applicant had not sought any kind of protective order prior to the deposition. DISCOVERY Yera v. J.C. Penney 2013 Cal. Wrk. Comp. P.D. Lexis 189 (WCAB Panel 2013) No evidence from Applicant identifying any right to privacy that would or could be affected if the store manager was present during the deposition. The only reason given by Applicant for not proceeding at the deposition was that Applicant would feel intimidated by the store manager’s presence. Holding: “[s]uch a summary assertion of subjective feelings is not sufficient reason to exclude the store manager from the deposition, particularly in light of the fact that Applicant is represented by counsel and has remedies available to address any improper behavior that may occur at the deposition.” WCJ’s decision denying defendant’s petition to compel is rescinded. DISCOVERY Lappi v. Regents of U.C. Irvine 2013 Cal. Wrk. Comp. P.D. Lexis 59 (WCAB Panel 2013) Applicant filed a claim for injury to her back, psyche, right knee, etc. During the course of discovery, Applicant sought to depose Defendant’s claims adjuster and obtained an Order that the adjuster was to produce all non-privileged portions of the claims file. Defendant produced some claims file documents but did not produce any documents created after the date that it retained an attorney. Following additional hearings, Defendant eventually produced a privilege log identifying 205 documents for which attorney-client privilege and attorney work product doctrine were claimed. DISCOVERY Lappi v. Regents of U.C. Irvine 2013 Cal. Wrk. Comp. P.D. Lexis 59 (WCAB Panel 2013) Applicant disputed Defendant’s claims of privilege in regard to 47 of the documents on the privilege log. A trial on this discovery issue was held and the WCJ issued a Findings and Order finding that communications between claims personnel were not privileged unless the communications specifically documented or summarized communications that had been made by counsel. Defendant filed a Petition for Reconsideration, asserting that per Defendant’s trial witness, claims communications including action plans and supervisor reviews contained confidential information including legal opinions as well as discussion and advice provided by counsel. DISCOVERY Lappi v. Regents of U.C. Irvine 2013 Cal. Wrk. Comp. P.D. Lexis 59 (WCAB Panel 2013) Holding: “[i]f the notes only contain an internal action plan for defendant’s claims employees and do not refer to an attorney’s communication, they may not be protected by the attorney-client privilege,” and “if a note with an action plan does not refer to an attorney’s impressions, it is difficult to see how the action plan would fall within the work product doctrine.” Special Master may be appointed by the WCJ in order to assess the actual substance of the communications at issue through an in camera review of the disputed documents. Defendant filed a Petition for Writ of Review in the Fourth Appellate District Court of Appeal, Division 3, on 3/28/13. A Writ of Review was issued on 8/1/13. LIENS Figueroa v. B.C. Doering Co. 78 CCC 439 (WCAB en banc 2013) Lien claimant did not pay lien activation fee* and argued that the fee was not payable when defendant has not served supporting documents, thus depriving lien claimant of the opportunity to resolve the lien. The WCAB held that where a lien claim falls within the lien activation fee* reqmts. of §4903.06: The fee must be paid prior to the scheduled start time of a lien conference; If the lien claimant does not pay the fee prior to the start time of the lien conf., and/or fails to provide proof of payment at the conf., the lien must be dismissed with prejudice; A defendant’s breach of its duty to serve required documents or engage in settlement negotiations does not excuse a lien claimant’s obligation to pay the lien activation fee; & Notice of intent to dismiss is not req’d prior to dismissing a lien with prejudice for failure to timely pay the activation fee or failure to present proof of timely payment at a lien conf. * Lien activation fees are no longer collected by DWC, in compliance with a ruling issued by the U.S. Dist. Ct. for the Central Dist. of CA in the matter of Angelotti Chiropractic, Inc., et al. v. Baker, et al. In Angelotti, the U.S. Dist. Ct. granted a temporary injunction on 11/12/13, which took effect 11/19/13, the prohibits the DWC from collecting the $100 lien activation fee and from dismissing any lien that has not been activated pending the outcome of an equal-protection challenge. SETTLEMENT Steller v. Sears, Roebuck and Co. (2010) 189 Cal.App.4th 175 Whether an Offer to Compromise under CA CCP Section 998 purporting to resolve both a civil disability discrimination claim and a workers’ compensation claim was sufficient to resolve both pending actions? Settlements of workers’ compensation claims must be approved by the WCAB to be effective. [Note: Employers seeking concurrent resolutions should ensure the settlement documents expressly provide for, and make payment conditioned upon, WCAB approval of the WC settlement.] Thank You!!