Risk Management for Homeowners Chapter 15

advertisement

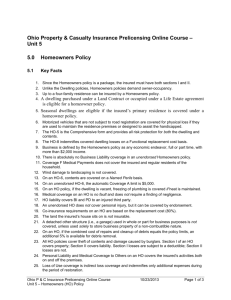

Trieschmann, Hoyt & Sommer Risk Management for Homeowners Chapter 15 ©2005, Thomson/South-Western Chapter Objectives • List the basic coverages in a homeowner’s policy and the limits of liability for each • Identify property that is excluded from the homeowners’ policy and the special dollar limits for certain types of property • Describe how additional living expense losses are determined and how the loss settlement clause in the homeowners’ policy operates • Explain the doctrine of concurrent causation and its role in property insurance policies • Identify the perils insured in homeowners’ policies • Identify and explain optional endorsements to the homeowners’ policy • List the coverages in the comprehensive personal liability section of the homeowners’ policy and identify the major exclusions • Determine appropriate insurance coverages for a personal risk management program 2 Introduction • Traditionally, homeowners’ insurance has been a very stable branch of the insurance industry • Premiums tend to increase each year at a moderate rate • This line of insurance is not as sensitive to losses as personal auto • However, occasionally events occur that dramatically impact homeowners’ insurance, as in 1992 – – – – Hurrican Andrew: Over $19 billion in losses Hurricane Iniki quickly followed Hailstorms in Texas and Oklahoma: $450 million in damages Los Angeles riotL: $500 million in damages – Losses combined push the combined ratio of (losses plus expenses) ÷ premiums from an average of 111 to 156 – Dozens of insurers went bankrupt 3 Introduction • The homeowners’ sector still not fully recovered from the setback • For all practical purposes, homeowners’ insurance is a necessity – You cannot obtain a mortgage to purchase a home unless you can prove that you have a valid homeowner’s policy – You must maintain that policy or a similar one • Homeowners in southern Florida and Hawaii have had availability problems – Florida: new laws passed to make insurance available in coastal areas 4 Introduction • Table 15-1 shows 10 most costly catastrophes from insured losses in U.S. history – These losses are all quite recent – Six are wind related – All but the terrorist attacks of 9/11 are primarily losses to residential property • Thus, are paid mostly by homeowners’ insurance 5 Table 15-1: Ten Most Costly U.S. Catastrophes 6 Homeowners’ Program: Development • The most comprehensive protection for owner-occupied, one- to four-family residences is found in the homeowners’ program • An outgrowth of several attempts by the insurance industry to develop policies to provide a more balanced and adequate program of insurance for the average homeowner – At lower cost than will be available if the coverages were purchased separately • Homeowners’ policy was developed in 1958 by the MultiPeril Insurance Conference – Major revisions have resulted in today’s homeowners’ policy: • • • • Is written in easy-to-understand English Is multiple-line Requires a minimum amount of coverage to be purchased Costs less than if coverages are purchased separately 7 Concise Language • The current version of the homeowners’ policy is much easier to read than earlier versions • Today’s version is 40% shorter and much easier to understand • Even the size of the print has been increased 25% so that it is easier to read 8 Multiple-Line • A basic objective of the homeowners’ program – To provide an opportunity for the homeowner to purchase in one policy any of the many variations of coverage • Coverage is provided for – Both the home and personal property – Broad named-perils or open-perils protection is offered – Coverages such as personal liability and medical payments to other persons are included 9 Minimum Amount of Coverage • Provides a definite minimum amount of coverage acceptable to the user • A single indivisible premium is charged – The insured cannot pick and choose among specific coverages 10 Lower Cost • Because the insured is buying a package of coverages, costs are lower • The savings results from a broader range of perils being insured – Which gives the insurer a better spread of loss exposures and lower administrative expenses • Allows insurers to charge substantially less for the total package than if the coverages were purchased separately 11 Outline of Homeowners’ Coverages • Certain coverages are mandatory in the homeowners’ program, but • Sufficient flexibility still exists in the amounts required to fit the needs of most people • Basic coverages of the homeowners’ program are 12 Outline of Homeowners’ Coverages • Table 15-2 summarizes the coverage offered by most of the primary homeowners’ forms – Designated HO-2, HO-3, HO-4, HO-5, HO-6, and HO-8 • A dwelling must be owner-occupied to qualify for dwelling coverage in this program – Minimum dwelling coverage as specified by the insurer must be purchased • The term limited named perils means – Fire, lightning, windstorm, hail, explosion, riot, civil commotion, aircraft, vehicles, smoke, vandalism and malicious mischief, theft, and volcanic eruption • Open perils is the new name for what used to be called all-risk coverage • Coverage is for any direct loss to property except for certain losses specifically excluded in the policy 13 Table 15-2: Basic Coverages of Homeowners’ Program 14 Outline of Homeowners’ Coverages • • HO-2, HO-3 and HO-5 forms are all for owner-occupants and differ primarily in terms of the perils they cover HO-4 form is for tenants – Commonly called renter’s insurance • HO-8 form was developed because many people are moving back into older neighborhoods and renovating houses – The market value of the home might be $100,000, but its replacement cost could be twice that – The standard homeowners’ policy would encourage the policyholder to insure at least 80% of replacement value • However, insurance companies were reluctant to do this because of the potential moral hazard, so coverage was unavailable for such older dwellings – Insureds cannot collect on a replacement cost basis—instead they collect on a cost-to-repair basis • No deduction is made for depreciation, and repairs may not be made with like labor and material – The rates are high compared to other forms • The insured must pay more for less coverage, but they have homeowners’ insurance available where previously it was not 15 HO-3 Coverage A—Dwelling • Coverage A is for the dwelling on what the policy calls the residence premises – The one- to four-family dwelling where you reside, other structures and grounds of that location, or that part of any other building where you reside and that is shown as the residence premises in the declarations • Includes structures attached to dwelling – Such as a patio roof, a carport or an attached greenhouse • Dwelling coverage also involves materials and supplies located on or next to the residence premises – For use in the construction, alteration, or repair of the dwelling or of other structures on the residence premises 16 HO-3 Coverage B—Other Structures • Other structures are defined as those separated from the dwelling by clear space or connected by only a fence or utility line • A garage that is not attached to the dwelling is an example of such a structure – As is a greenhouse or a tool shed • Coverage B is designed for structures for personal use – Other structures used for business purposes or held for rental are not protected 17 HO-3 Coverage C—Unscheduled Personal Property • Covers personal property owned or used by an insured while anywhere in the world – Subject to exclusions • Types of property protected include such items as – Jewelry, kitchen appliances, furniture, clothes, stereos, video cassette recorders, televisions, currency, guns, and bicycles • Besides the insured’s property, property of others while on the residence premises is protected – If the insured requests it 18 HO-3 Coverage C—Unscheduled Personal Property • Personal property that is taken to a secondary residence while the insured is temporarily residing there is insured for the full limit of Coverage C • For most families, Coverage C does not have to be modified when one or more children go to college – Each child’s property would be covered for 10% of the Coverage C amount • Certain types of personal property are excluded and others have dollar limitations 19 HO-3—Property Excluded • Articles separately described and specially insured in this or any other insurance (Such as an expensive camera, watch, or a diamond ring) • Animals, including birds and fish • Motorized land vehicles (Except those not licensed for road use that service an insured’s residence or assist the handicapped) • Sound equipment while in an automobile • Aircraft and hovercraft and their parts • Property of roomers, boarders, and other tenants (Except those related to an insured) • Property contained in an apartment regularly rented or held for rental • Property rented or held for rental to others away from the residence premises • Books of account, drawings, or other paper records, or electronic data processing tapes, wires, records, desks, or other software media containing business data 20 HO-3 Coverage D—Additional Living Expenses • Covers the increased cost of living that results from an insured peril damaging the residence premises and making them uninhabitable • The insured is allowed to maintain his or her normal standard of living – However, only the increased cost of living is covered • Table 15-3 shows an example 21 Table 15-3: Additional Living Expense Example 22 HO-3 Coverage D—Additional Living Expenses • Pays for loss of rental income less rental expenses – This lost income would arise from a situation in which the insured rented a basement room to someone and fire made it uninhabitable • For many home owners in south Florida, coverage D limits were exhausted after Hurricane Andrew – Little rental property was available and what could be found was expensive – Repair time was much longer than normal because the demand for repair was much greater than the supply 23 HO-3 Additional Coverages • Debris removal – Included in the limit of liability – However, when the limit has been exhausted, an additional 5% may be used to pay for debris removal • Reasonable repairs – Repairs made by the insured to protect the property from further loss, after loss from an insured peril has occurred • Are covered by the policy • However, this provision does not increase the insured’s limit • Trees, shrubs, and other plants – Up to 5% of the coverage A limit can be used to pay for loss to trees, shrubs, and other plants • Subject to a limit of $500 for any one item 24 HO-3 Additional Coverages • Fire department service charge – In situations where the insured lives in a rural area and a city fire department makes a charge for responding to a call • The policy will pay up to $500 for such charges – The charge must resolve from an insured peril, and no deductible applies to the coverage • Removed property – If property must be removed from the premises due to an insured peril • The removed property provision gives all-risk coverage during removal and 30 days thereafter 25 HO-3 Additional Coverages • Credit card, electronic funds transfer card, forgery and counterfeit money – Although federal law limits a person’s liability to $50 per lost credit card • A stolen or missing wallet full of cards can lead to loss of several hundred dollars • However, if the unauthorized user is a member of the insured’s household, no coverage exists – Coverage exists for forged or altered checks, fundtransfer cards, and counterfeit money accepted in good faith • No deductible applies to any of these items • The insurer will pay defense costs for court suits brought against the insured under the credit card or forgery coverage 26 HO-3 Additional Coverages • Collapse – Covered if resulting from • • • • • The perils insured against in coverage C, personal property Hidden decay and hidden insect or vermin damage The weight of contents, equipment, animals, or people The weight of rain that collects on the roof The use of defective materials or methods in construction or remodeling – If the collapse occurs during remodeling – Collapse caused by an earthquake, mudslide, or flood are not covered • Glass or safety glazing material replacement – Provides coverage for breakage of glass or safety glazing material (safety glass) of a covered building, storm door, or storm window 27 HO-3 Additional Coverages • Landlord’s furnishings – If the insured rents out part of the residence premises as an apartment • The insured’s appliances, carpeting, and other furnishings in the apartment are covered for the coverage C perils, except theft • Loss assessment – Provides the insured $1,000 of coverage if he or she is assessed for damage to property that is owned by an association of property owners of which the insured is a member – The damaged property must be collectively owned by all members of the owners’ association • The peril causing the loss must be covered under coverage A 28 HO-3 Additional Coverages • Ordinance or law – Up to 10% of the limit for coverage A is provided as additional insurance for increased costs resulting from an ordinance or law related to repair of a covered structured damage by a covered peril • Grave markers – Policy will pay up to $5,000 for loss to grave markers on or away from the residence premises • As long as the loss is caused by a coverage C peril 29 Loss Settlement Clause • Determines how the items will be valued for adjustment purposes • The homeowners’ policy provides replacement cost coverage on the dwelling and actual cash value (ACV) coverage for personal property • The law settlement clause helps classify certain items as to whether recovery is on an ACV basis or on a replacement cost basis 30 Loss Settlement Clause • When a loss occurs to a building or other structure under coverage A or B – The insured can make a claim on either an ACV or replacement cost basis • It may sometimes be to the insured’s advantage to collect on an ACV basis because of the policy’s coinsurance clause – If the claim is filed on a replacement cost basis, then an 80% coinsurance requirement applies • The insured can choose the basis of the claim after the loss occurs 31 Pair-and-Set Clause • When part of a set or one of a pair is lost, this clause is used to determine the loss payment • The insurance company will pay only for the difference between the ACV of the item before and after the loss – The loss of one of a pair of items, such as diamond earrings, is not a total loss – Only the difference in value of the earrings before and after the loss is paid • In many cases an insurance company will take possession of the remaining item and pay a total loss or replace the item 32 Perils Covered in Homeowners’ Insurance • HO-3 gives – Open-perils coverage on the dwelling and other structures – Broad named-perils coverage on unscheduled personal property 33 Open-Perils Dwelling Exclusions • Open-perils coverage includes all physical losses except certain specifically excluded losses • To determine what is insured, you must investigate the exclusions • Homeowners’ policies with open-perils coverage contain a number of exclusions 34 Open-perils Dwelling Exclusions • Freezing – Loss caused by freezing of plumbing, heating, or air conditioning systems is excluded • While the dwelling is vacant, unoccupied, or under construction • Unless heat is maintained or the water system is shut off and the water pipes are drained • Fences, pavement, patios, and similar structures – When fences, pavement, patios, swimming pools, foundations, retaining walls, bulkheads, piers, wharves, or docks are damaged by freezing, falling, or the weight of ice or snow, no coverage exists 35 Open-Perils Dwelling Exclusions • Buildings under construction – No theft coverage exist for materials and supplies – Coverage begins when the dwelling is completed and occupied • Vacancy beyond 60 days – When a building is vacant for more than 60 days, coverage for vandalism, malicious mischief, breakage of glass, and safety glazing materials is suspended – For the purposes of this coverage, a dwelling under construction is not considered vacant • Mold, fungus, or wet rot – Generally excluded – However, an exception provides coverage for mold, fungus, or wet rot that is hidden within the walls, floors, or ceilings of a structure • If the loss results from water or steam from a plumbing, heating, or air conditioning system, or a household appliance 36 General Open-Perils Exclusion • Open-peril contracts have one exclusion provision that is almost universal to such coverage • Excluded by this clause are such things as – – – – – – – – – Wear and tear Inherent vice Latent defect Mechanical breakdown Rust, mold, and wet or dry rot Contamination Smog Smoke from agricultural smudging or industrial operation Settling, cracking, shrinking, bulging, or expansion of pavements, patios, foundations, walls, floors, roofs, or ceilings – Loss due to birds, vermin, rodents, insects, or domestic animals 37 All-Property Exclusions • Several general exclusions apply to all property including – – – – – Earth movement Flood and several other types of water damage War Intentional loss Neglect by the insured to protect the insured property from loss at and after the time of loss – Spoilage • Spoilage resulting from the interruption of electrical power or other utility service caused by an off-premises event is not covered • However, if lightning strikes the power line pole on the premises and causes power interruption – Then the policy will pay for the ensuing loss 38 Concurrent Causation • This doctrine greatly expanded coverage under openperils insurance policies – So that if a peril is not excluded, it is covered • The courts held that even if an excluded peril such as flood, earthquake, or contamination occurred – Coverage would exist if a concurrent event occurred and that concurrent event was not excluded • Because of the court’s decision on concurrent causation and a similar decision on the collapse peril – Today’s insurance policies have a rather lengthy exclusion with respect to events that might result from concurrent causation 39 Named-Perils Protection • Fire and lightning – The fire must be a hostile fire • Outside normal confines – Direct loss caused by fire also includes such losses as damage from water or chemicals used to fight the fire and broken windows or holes chopped into the roof by firefighters • Windstorm and hail – Certain types of property are excluded such as • Watercraft and their trailers, furnishings, equipment, and outboard motors except when inside a fully enclosed building • When windstorms as such as Hurricane Andrew occur, insureds may seem helpless – However, as citizens, insureds can require strong enforcement of building codes – Much of the damage from Andrew could have been prevented if existing building codes had been enforced 40 Named-Perils Protection • Explosion – The term explosion is undefined in the policy and thus is broadly interpreted by the courts (It would include a natural gas explosion as well as a sonic boom) • Riot and civil commotion, aircraft, and vehicles – These terms are undefined in the HO-3 form – Damage to trees, shrubs, and plants by a vehicle driven or owned by a resident of the residence premises is excluded – Aircraft include self-propelled missiles and space craft • Smoke – This peril only includes sudden and accidental damage from smoke – Loss caused by smoke from agricultural smudging or industrial operations is excluded • Vandalism or malicious mischief – Typically involves the concept of willful intent to damage the property – However, the HO-3 form does not mention this limitation (So a liberal definition of the term can be assumed) 41 Named-Perils Protection • Theft – The policy states that the theft peril “includes attempted theft and loss of property from a known location when it is likely that the property has been stolen” – In the case of loss, the police must be notified if the insured expects to collect under the policy – The insured is required only to show that theft of the item is a reasonable explanation of the loss – It is not the intent of the insured to pay for property that the insured simply loses – No coverage exists if any insured steals the property – Limitations on the premises • Any materials or supplies used in the construction of a dwelling are not covered for theft until the building is completed and occupied • No coverage is available for any property in that part of the residence premises rented by the insured to another unless they are an adult relative – Off-premises limitations • Restrictions exist involving trailers and campers, watercraft, secondary residents, and student property 42 Named-Perils Protection • Falling objects – Falling objects does not pertain to property inside the building unless the roof or an exterior wall is first damaged by the falling object • Weight of ice, snow, or sleet – Coverage applies only to contents inside the dwelling – The roof would have to collapse from the weight of ice and snow, and then the contents would have to be damaged, for coverage to exist • Accidental discharge or overflow of water or steam – The overflow or accident must come from within a plumbing, heating, or air-conditioning system or from within a household appliance – Coverage does not exist for the appliance from which the steam or water escaped nor for loss due to freezing, overflow, or discharge that occurs off the residence premise 43 Named-Perils Protection • Sudden and accidental tearing apart, cracking, burning, or bulging of a steam, hot water, or air-conditioning system or an appliance for heating water – The obvious example of this peril is a water heater that explodes – No coverage for freezing is provided under this peril • Freezing – Covers freezing of a plumbing, heating, or air-conditioning system or a household appliance – No coverage exists if a dwelling is unoccupied • Unless the insured takes reasonable care to maintain heat in the building or shuts off the water supply and drains the system and appliances of water – Many people might expect to see most of this type of damage in the northern part of the United States • However, much of the destruction occurs in the South as the buildings are not designed for freezing temperatures 44 Named-Perils Protection • Sudden and accidental damage from artificially generated electrical current – An air conditioner damaged by a power surge would be covered by this peril – However, the policy specifically excludes loss to a tube, transistor, or similar electronic component • Stereos, televisions, and PCs are the main targets of this exclusion • Volcanic eruption – A fairly new coverage for the homeowners’ program – Addresses problems that arose after the eruption of Mount Saint Helens – Loss caused by earthquake, land shock waves, or tremors is not covered 45 Optional Property Endorsements to Homeowners’ Policies • Many property endorsements are available • Personal risk managers must decide which, if any, of these endorsements are appropriate for their circumstances 46 Earthquake • The peril of the earthquake is catastrophic in nature • However its frequency is so low that few people purchase the coverage even though they should • The endorsement eliminates a loss from flood or tidal wave cause by an earthquake and loss to exterior masonry veneer • Two earthquake deduction endorsements are available – A 5% deductible – A 10% deductible • Most often found in the western states where earthquakes are most likely • On a dwelling with a replacement cost of $150,000 the deductible would be $15,000 – Perhaps this is why some people do not purchase earthquake insurance 47 Inflation Guard • When inflation occurs at a rapid pace, the problem of maintaining adequate property limits has to be addressed • It as not uncommon for construction costs to rise 10% per year • When replacement cost protection is desired, an 80% coinsurance clause must be maintained – And policy limits need to be adjusted periodically • However, if one adjusts only once a year – Problems can arise because the loss may occur right before it is time to increase the policyholder’s limit • The inflation guard endorsement is a partial solution – A person’s limit is raised a set percentage every three months 48 Guaranteed Replacement Cost • Applies to the dwelling and provides the policyholder with full replacement cost at the time of the loss • The policyholder is required to insure 100% to value when the policy is purchased – And increase the stated value as requested by the insurer • Most versions of this endorsement limit the policy to 125 to 150 percent of the stated value – May or may not increase the limits for coverages B, C, and D • An attractive endorsement and a good way to eliminate the potential coinsurance problem that can occur when a hurricane or tornadoes strikes a city and building costs explode during the rebuilding period 49 Personal Property Replacement Cost • Before 1980 an individual could not purchase replacement cost coverage on an unscheduled basis on personal property in the homeowners’ program • In 1980 a new endorsement was introduced – The insured could collect the smallest of four amounts for personal property • • • • Replacement cost at the time of loss Full repair costs of the time of loss Any special limits of liability pertaining to coverage C The limit of liability for unscheduled personal property and coverage C – Which is usually 50% of the dwelling coverage 50 Personal Property Replacement Cost • Certain types of property are excluded from the replacement cost recovery including – – – – Fine arts, paintings, and antiques Memorabilia and collectors’ items Property that is not kept in working condition Obsolete property • Usually no payment is made until the item is actually repaired or replaced – Unless the loss is less than $500 51 Unit Owners, Building Additions, and Alterations • Designed to meet the special needs of condominium unit owners – Who, in many states, hold an indivisible interest in the condominium complex and ownership of the air space inside their units • Called the bare wall doctrine – The unit owner owns everything inside the bare walls, except for some electrical and structural items • By endorsement, limits may be increased and coverage can be placed on an open-peril basis • The insurance protection on the condominium itself and swimming pools, tennis courts, and other buildings associated with the condominium complex is carried by the condominium association 52 Special Personal Property • Provides open-perils coverage for personal property • Has numerous exclusions – Such as enforcement of building laws or ordinances, earthquake, flood, war, and intentional loss • Several exclusions are unique to the special property form – Such as breakage of eyeglasses, glassware, statuary marble, and porcelain, collision, repair or refinishing of personal property, and dampness of atmosphere or extreme changes in temperature 53 Inboard Watercraft • Generally classified as yachts for insurance purposes • Insured on an ocean marine package policy that gives coverage on the boat and on liability arising from collision with other vessels – Appropriately called a yacht policy • Insured perils with respect to the hull include, but are not limited to, collision, windstorm, fire, and theft 54 Outboard Watercraft • The outboard watercraft policy is not uniform • Typically, the policy covers outboard motors and outboard motorboats used for personal pleasure • Coverage applies while on the water and onshore • Insured perils may be on an open-perils or a broad named-peril basis • Open-perils approach is the most popular – The boat, its motor or motors, its equipment, and its trailer are covered – Recovery is on an ACV basis – No replacement cost protection is available – The premium rate can be expensive, but high deductibles may be used to help lower the cost 55 Flood Insurance • Flood insurance for residential properties is generally administered by the Federal Emergency Management Association (FEMA) – Underwrites losses and works through private vendors and insurance agents to market and service the policies • To be eligible, a community must apply and – Conduct extensive floodplain studies – Make floodplain maps – Develop a floodplain management program • FEMA program is attractive to insureds because the federal government subsidizes the rates 56 Flood Insurance • The peril of flood is defined in the policy as including the following – Overflow of inland or tidal waters – Unusual and rapid accumulation of runoff of surface waters from any source – Mudflow – Collapse or subsidence of land along the shore of a lake or similar body of water as a result of erosion or undermining caused by waves or currents of water exceeding anticipated cyclical levels that result in a flood as previously defined • Definition covers water damage from hurricanes along Atlantic and Gulf coasts, flash floods in desert areas, mudslides in California, and unusual erosion around the Great Lakes and the Great Salt Lake • Table 15-4 shows the limits of the federal insurance program 57 Table 15-4: Federal Flood Insurance 58 Personal Articles Floater (PAF) • An open-perils contract designed to give broad coverage to valuable personal possessions including such items as – Personal jewelry, furs, fine arts, cameras, golfer’s equipment, musical instruments, silverware, and stamp and coin collections 59 Mobile Home Endorsement to Homeowners’ Policy • Millions of year-round mobile home units exist in the U.S. • The number of mobile homes has increased significantly and the quality of their construction has improved • Construction codes are more demanding, units are often permanently attached to a foundation, and mobile home parks have been upgraded 60 Mobile Home Eligibility • The mobile home endorsement is designed for mobile home that is – – – – – A portable unit Built to be towed on its own chassis Comprised of frame and wheels At least 10 ft. wide and 40 ft. long Designed for year-round living • The unit is supposed to be used for private residential purposes and may be occupied by the owner or a tenant 61 Mobile Home Coverage • The term mobile home means – The unit itself, equipment originally built into it, steps, and oil or gas tanks connected to it for the purpose of furnishing heating or cooking • Mobile home coverage has been made a part of the homeowners’ approach • Coverage A is for the mobile home unit and must be for at least $10,000 – Recovery is on a replacement cost basis – Carpeting and appliances are considered part of the coverage • Coverage B is for separate structures and is 10% of coverage A – Subject to a minimum of $2,000 • Coverage C is unscheduled personal property and is 40% of A – Subject to a $4,000 minimum • Coverage D is for additional living expenses and is 20% of coverage A • If the insured does not want replacement cost, or if the insurer does not want to offer it – Endorsement MH-0401 can be used to change the basis of recovery from replacement cost to ACV 62 Shopping Tips for Homeowners • It pays to shop around for a homeowners’ policy • Following are some tips for covering property with a homeowners’ policy – Buy adequate limits – Determine if the property is in a flood plain or earthquake zone – Make a complete written inventory of personal property on a room-by-room basis and videotape the room – Determine the value of personal property and, if needed, increase the limit of coverage C – Purchase replacement cost coverage on personal property – Identify and insure valuable jewelry, guns, stamp and coin collections, and fur coats with a personal article floater – Have adequate limits for business property – Is best to insure outboard and/or inboard motors under a separate policy – Choose a deductible that matches your situation 63 Personal Liability and Medical Payments Insurance • Coverage E provides comprehensive personal liability (CPL) protection – Basic amount of coverage is $100,000 • Coverage F provides medical payments to others – Basic amount of coverage is $1,000 • If additional protection is needed, the limits may be raised • If catastrophic loss limits are desired – A personal umbrella policy should be purchased 64 HO-3 Coverage E—Personal Liability • Provides liability coverage for bodily injury and property damage claims against an insured • It also provides standard supplementary benefits including – Defense costs – Premiums on appeal bonds – Reasonable expenses incurred by the insured at the request of the insured to aid in the investigation or defense of a suit 65 Damage to the Property of Others • The insurer promises to pay up to $500 per occurrence for damage to the property of others caused by any insured • It is not necessary to prove liability due to negligence • The insurer will not pay for the following – Property damage covered under section I of this policy – Property damage caused intentionally by any insured who is 13 years of age or older – Damage to property owned by any insured, or owned by or rented to any tenant of any insured, or owned by or rented to a resident of the insured’s household – Property damage arising out of • Business pursuits • Any act or omission in connection with premises loaned, rented, or controlled by any insured, other than the insured location • The ownership, maintenance, or use of a motor vehicle, aircraft, or watercraft 66 Persons Insured • In the homeowners’ program the terms you and your refer to the named insured • The insurance company is identified as we, us, and our • The term insured in the policy means the following members of your household – You – Your resident relatives – Any other person under the age of 21 who is in the care of any person previously named – For liability coverage it also means with respect to animals or watercraft to which this policy applies – With respect to any vehicle to which this policy applies 67 Exclusions • Intentional losses expected or intended by one of the insureds • Loss arising out of business activities or the rental of an insured location • Loss arising out of rendering or failing to render professional services • Liability loss arising out of any premises owned or rented to any insured that are not insured premises under the CPL policy • Exclusions regarding motor vehicle liability, watercraft liability, aircraft liability, and hovercraft liability • Liability losses due to war 68 Exclusions • Loss resulting from liability assumed under unwritten contracts – Types of liability losses resulting from business contracts • Damage to property owned by or rented to the insured or in the insured’s care • Bodily injury to any person eligible to receive workers’ compensation benefits • Lawsuits between insureds covered by the CPL • Losses arising out of the transmission of communicable disease by an insured • Losses arising out of sexual molestation, corporal punishment, or physical or mental abuse • Losses arising out of the use, sale, manufacture, delivery, transfer, or possession by any person of a controlled substance 69 HO-3 Coverage F—Medical Payments to Others • The coverage applies to bodily injury – To a person on the insured location with the permission of the insured or – To a person off the insured location if the bodily injury • Arises out of the condition on the insured location or the ways immediately adjoining • Is caused by the activities of the insured • Is caused by a residence employee in the course of the residence employee’s employment by insured or • Is caused by an animal owned by or in the care of an insured 70 HO-3 Coverage F—Medical Payments to Others • The insurer agrees to pay the necessary medical expenses incurred or medically ascertained within three years from the date of the accident • Coverage for medical payments to others – The named insured and regular residents of the insured household are not covered for medical expenses • Coverage is on a no-fault basis • The subrogation clause does not apply to medical benefits – An injured party may collect medical payments and still sue a negligent third party 71 HO-3 Coverage F—Medical Payments to Others • The description of coverage E refers to the insured location which is defined to include the residence premises as well as – The part of any other premises, other structures, and grounds used by you as a residence and that is shown in the declarations or that is acquired by you during the policy period for your use as a residence – Any premises used by you in connection with the premises included in residence premises or in the previous item – Any part of premises not owned by any insured but where any insured is temporarily residing – Vacant land owned or rented to any insured, other than farmland – Land owned by or rented to a insured on which a one- or twofamily dwelling is being constructed as a residence for the insured – Individual or family cemetery plots or burial vaults of any insured – Any part of premises occasionally rented to any insured for other-than-business purposes 72 HO-3 Coverage F—Medical Payments to Others • Coverage for medical payments to others has a number of exclusions – All the relevant exclusions discussed under personal liability also apply to medical payments coverage – Injury to a resident employee is excluded if it occurs off the premises and is not in the course of employment – Workers’ compensation-related losses are not insured – Losses resulting from radiation or radioactive contamination are not covered 73 Optional Liability Endorsements to the Homeowners’ Policy • Watercraft liability – When an insured owns a watercraft that is larger than those covered by the CPL • The policy may be endorsed to cover such boats • However, because physical damage to the vessel cannot be covered in the homeowners’ policy – Most people insure their watercraft exposure in a separate policy • Personal injury – Basic CPL does not insure loss resulting from slander, false arrest, malicious prosecution, defamation of character, and the like – CPL can be endorsed to cover these exposures through the personal liability endorsement 74 Optional Liability Endorsements to the Homeowners’ Policy • Business pursuits – CPL can be endorsed to give limited business pursuits coverage – Protection is only available for the business specified on the endorsement – The insured cannot be the owner or have financial control of the business – Teachers are likely persons to purchase this coverage – The endorsement can be modified to cover liability resulting from corporal punishment • Business insurance coverage – Many new technology companies have their start in the home of the company’s founder • This exposure can be insured through the whole business insurance coverage endorsement • Business must be solely owned by the named insured and resident relatives • Bodily injury, personal, and advertising liability may be insured, as well as products • No professional liability coverage is provided 75 Personal Umbrella • Certain persons, such as physicians, corporate executives, and successful business owners – Need broad coverage and high limits to protect their assets in today’s litigation-conscious society • The personal umbrella is designed to do this • The umbrella is designed to give protection against catastrophic losses – It assumes an underlying CPL exists, as well as certain other coverages – The umbrella will not contribute on a loss until the limit of these policies has been exceeded • Umbrellas are purchased by people who need to protect large accumulations of assets and/or high incomes • However, insurers will not sell the policy to all such people – Sometimes certain categories of persons have been deemed unattractive for the purpose of selling personal umbrellas, such as • Assigned-risk drivers, professional politicians, professional entertainers, newspaper reporters, editors, and publishers, labor leaders, and athletes 76 Limits of Liability and Self-Retained Limits • The minimum limit for an umbrella is $1 million above the self-retained limit (deductible) or the required property coverage • Policies may be purchased with limits as high as $10 million • A $1 million policy can cost as little as several hundred dollars 77 Underlying Limits • Umbrellas require certain types and amounts of underlying insurance • Table 15-5 shows some typical underlying limit requirements 78 Table 15-5: Typical Underlying Policy Limits Required for Umbrella Policies 79 Umbrella Contract Provisions • Umbrella policies are not standardized and their content has significant variation – Personal injury • Definition has a much broader meaning than that used in primary coverages • Includes bodily injury, property damage, libel, slander, defamation of character, invasion of privacy, humiliation, wrongful eviction, wrongful entry, malicious persecution, false imprisonment, wrongful detention, and false arrest – Property in the insured’s care, custody, or control • Property owned by or rented to the insured is excluded • However, with respect to other nonowned property the umbrella is designed to provide some protection – For example, if you borrow your neighbor’s expensive digital recorder and break it, the umbrella will cover the loss 80 Umbrella Contract Provisions • Incidental business pursuits – Typically, insured’s umbrella will cover this, but often it is no broader than the underlying primary coverage – If an insured is on the board of directors of a religious, charitable, or a civic nonprofit corporation, coverage is often given • No coverage exists if the board of directors is for business purposes • Automobiles – Some umbrellas give broader coverage than underlying auto policies; however, many do not – With the business auto section some umbrellas provide bodily injury liability coverage for the operation of trucks in a business situation 81 Dwelling Program (Not Homeowners) • Monoline (property only) program designed to provide coverage for properties that cannot be insured under the homeowners’ program – Or where the insured does not want to purchase a homeowner’s policy 82 Underwriting Eligibility • To meet the criteria used in determining eligibility for a dwelling policy, the property must be one of the following – A dwelling used exclusively for dwelling purposes • Not excluded are incidental occupancies, such as – Offices, private schools, music or photography studios, small service occupancies – The dwelling should not have more than five rooms for boarders in total – A one- to four-family dwelling in a townhouse or rowhouse structure – Household and personal property in an apartment or private living quarters of the insured – A dwelling used as a temporary residence while in the course of constructing a permanent residence 83 Property Insured • • • • A = dwelling B = other structure C = unscheduled personal property In the broad and special form, two additional coverages apply – Fair rental value • Includes the rent the building could have earned if a covered loss had not made it unfit for use – Additional living expense • May be added by endorsement to the basic dwelling form • Table 15-6 summarizes the three forms available 84 Table 15-6: Dwelling Program Covered Perils 85 Insured Perils of Dwelling Forms • The basic form is quite limited in its perils coverage – Unendorsed, this form insures against fire, lightning, removal, and internal explosion • Coverage may be modified to include – Windstorms, hail, explosion, riot, civil commotion, aircraft, vehicles, and smoke • This collection of perils is often written together and called extended coverage • Vandalism and malicious mischief can also be added • The broad form and the special form are much like their homeowners’ counterparts, HO-2 and HO-3, with respect to insured perils • A personal liability supplement is available 86 Farmowners’-Ranchowners’ policy • Designed to cover – The dwelling and commercial structures on the farm – The personal and commercial liability that might arise from living and working on the farm • The main farm dwelling must be a one- or two-family dwelling used exclusively for residential purposes • The standard incidental office, professional and private schools, and studio activities are excepted • The farm dwelling does not have to be owner-occupied – But it must not be vacant • The farm owner may occupy the dwelling and not operate the farm 87 Risk Management—Personal Lines • A reason commonly given by a business for not self-insuring is – “The firm may not have a sufficient number of homogeneous exposure units so situated that aggregate losses to which they are subject can be predicted with insufficiently narrow limits” • For the same reason, little self-insurance takes place in personal lines • However, risk management principles of loss control and loss retention should and can be practiced 88 Loss Control • The purchase of smoke detectors is a very wise investment • A house alarm system is another good option • All doors should have deadbolt locks • The police will periodically check homes of residents who are on vacation or away for a while • The insured, when going on vacation, should leave with a friend or neighbor a set of house keys, a travel itinerary, and a telephone number where they can be reached • Valuable stamp and coin collections should be kept in safe deposit boxes • Minimal amounts of cash should be kept in the dwelling • Good lighting should be provided around the house 89 Loss Control • College students should take the following loss prevention steps to protect personal property – Keep your doors locked – Engrave valuable electronic equipment and bikes with an identification number – Leave very expensive items at home – Protect your notebook computer at all times – Secure desktop computers to furniture – Backup all important data – If you have to leave your book bag unattended • Don’t put anything in it that you can’t afford to lose 90 Loss Retention • In the personal lines area, about the only reasonable loss retention step a homeowner can take is the use of deductibles • A deductible of $250 or more deserves attention • The problem with higher deductibles in homeowners’ insurance – Sometimes the insured receives little premium savings 91 Claims-Settling Procedure • An important precaution that should be taken to reduce losses is to identify possessions before loss occurs • If one cannot remember what was lost, it is quite difficult to recover losses from the insurer • Take several pictures and videos of the items in the room and put the pictures in the safe deposit box • Make an inventory of clothing, furniture, silverware, appliances, and jewelry and place the list in a safe deposit box 92 Claims-Settling Procedure • The insurance company pays the insured on a replacement cost basis only after the insured replaces or repairs the damaged dwelling • The only exception to this rule is with losses less than $2,500 and less than 5% of the amount of insurance on the building – However, the contract states that the policyholder may collect immediately on an ACV basis and later make replacement cost recovery • By filing the ACV claim first, insureds receive their cash sooner so that they can pay the contractor or invest the money in some interest-bearing security while the house is being rebuilt • It seems logical to most people to exercise this option 93 Open-Perils Versus Broad NamedPerils Coverage • HO-3 gives a open-perils coverage on the dwelling and other structures – Whereas HO-2 only covers broad named perils • HO-3 costs more, and consequently you should receive better coverage • One advantage of an open-perils form – The burden of proof is placed on the insurance company – It has to prove the loss was excluded • The insured must only prove an accidental loss occurred 94 Open-Perils Versus Broad NamedPerils Coverage • Numerous cases have occurred where HO-3 gave coverage and the HO-2 did not • Most of those cases are situations in which falling objects damaged the dwelling without causing exterior damage – In named-perils coverage, exterior damage must occur before damage by a falling object to an interior portion of the dwelling is covered – In the open-perils coverage, no exterior damage has to occur 95