File - London Central DECA Team

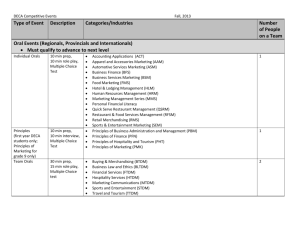

advertisement