TAX

advertisement

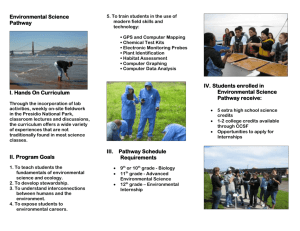

TAX • “You can’t spit on the sidewalk without considering the tax consequences.” • - An old tax saying - • “The avoidance of taxes is the only pursuit that still carries any reward.” • - John Maynard Keynes “Topics Businesses Most Often Ask About” • • • • • Tax – 24% HR - 21% Accounting – 13% Info Technology – 10% Market Research – 7% • - E & Y’s Ernie Trend Watch • Top Educational Areas Accounting Practitioners Would Like to See More of in Student’s Resumes - Continued - • Speaking • Writing • Computers • Tax CPA EXAM New Computer Based Test (CBT) SECTIONS 1) Auditing & Attestation 2) Financial Accounting 3) Regulation 4) Business Environment & Concepts HOURS 1) 4.5 2) 4.0 3) 3.0 4) 2.5 5) Total 14.0 Regulation Section I. Ethics & Professional & Legal Responsibilities – (17.5) II. Business Law (22.5%) III. Federal Tax Accounting Issues – (10%) IV. Federal Taxation – Property (10%) V. Federal Taxation – Individuals (15%) VI. Federal Taxation – entities (25%) Regulation Section CBTCPA Exam • 60% Tax • Plus some ethics/professional responsibilities possibly for tax CSUSB TAX COURSES CSUSB Tax Courses (continued) ACCT 426 Tax 1 Federal Individual Income Tax and Introduction to Taxes CSUSB Tax Courses (continued) ACCT 536 Tax 2 Federal Income Taxation of Entities CSUSB Tax Courses (continued) 556 Tax 3 Tax Research, IRS & Practitioners, Estate & Gift Tax, Trust & Estate Income Tax, AMT, CA Individual Income Tax • FIN 360 Personal Financial Planning • ACCT 595 VITA TAX CAREERS Tax Careers (continued) Government – IRS, FTB, SBE Tax Careers (continued) Private Practice Tax Careers (continued) Industry Tax Careers (continued) Education FURTHER TAX EDUCATION CPA Masters in Tax JD, LLM (Tax) • Concentrations in which tax courses may be used • (Required or Elective) Accounting Finance Financial Planning Real Estate AIS Entrepreneurial Management Minors in Which Tax Courses May be Used Accounting Business Administration Certificate Programs in Which Tax Courses May be Used Accounting For Further Information - Accounting & Finance Department, 909-880-5704 Jack Brown Hall, Room 459 - John R. Dorocak, Professor, 909-880-5750 Jack Brown Hall, Room 435, jdorocak@csusb.edu CA CPA Exam & Licensure Requirements California Board of Accounting http:// www.dca.ca.gov/cbq Pathway 1 • • • • BA 24 Semester units accounting courses 24 Semester units business-related courses Retain credit for each exam section passed for 18 months Pathway 1 (continued) • 2 Years general accounting experience, 500 hours “attest” experience to sign all reports • Select Pathway 1 or 2 when apply for licensure Pathway 2 • • • • BA 24 Semester units accounting courses 24 Semester units business related courses Retain credit for each exam section passed for 18 months Pathway 2 (continued) • 150 Semester units (226 quarter units) for license • 1 year of general accounting experience, 500 hours “attest” experience to sign all reports • Select Pathway 1 or 2 when applying for licensure Pathway 2 • 150 semester hours = 226 quarter units • 198 quarter units current CSUSB Accounting Concentration • 7 additional 4 unit courses needed • Can be in anything: practitioner desires and student multiple concentrations • Flexibility