McGraw-Hill/Irwin

33-1

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

P

A

R

T

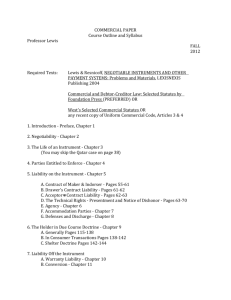

Commercial Paper

7

• Negotiable Instruments

• Negotiation and Holder in Due Course

• Liability of Parties

• Checks and Electronic Transfers

33-2

C H A P

T

E R

33

Liability of Parties

Always do right.

This will gratify some people, and astonish the rest.

Mark Twain, Speech to Young People’s Society (1901)

33-3

Learning Objectives

• Explain difference between primary

and secondary liability

• List five warranties made to transfer

negotiable instruments and three

warranties made when presenting

these for payment or acceptance

• Discuss three exceptions to normal

liability rules

33-4

Primary vs. Secondary Liability

• A person may be primarily liable if s/he

agreed to pay the negotiable instrument.

– The maker of a promissory note is primarily

liable for paying the debt

• A person who is secondarily liable is a

contract guarantor and, under UCC

Article 3, must pay the instrument only if

the person who is primarily liable defaults

on the obligation

33-5

Acceptor and Drawee Liability

• The acceptor of a draft must pay the

draft according to the terms at the time

of acceptance (drawee’s signed

engagement to honor the draft as

presented)

• A drawee has no liability on a check or

draft unless it certifies or accepts it

– In Harrington v. MacNab, the drawee

bank had no liability to a payee for a

drawer’s insufficient funds

33-6

Indorser Liability

• A person who indorses a negotiable

instrument usually is secondarily liable

– Indorsers are liable to each other in

chronological order, from the last indorser

back to the first

• To trigger secondary liability, the instrument

must be properly presented for payment or

acceptance, the instrument must be

dishonored, and notice of the dishonor must

be given to the person secondarily liable

33-7

Discharge of Indorser Liability

• An indorser is discharged from liability if:

– A bank accepts a draft after indorsement

[3–415(d)]

– Notice of dishonor is required and proper

notice is not given to the indorser [3–415(c)]

– No one presents a check or gives it to a

depositary bank for collection within 30

days after the date of an indorsement [3–

415(e)]

33-8

Presentment of a Note

• Since the maker of a note is primarily liable

to pay it when due, dishonor occurs if the

maker does not pay amount due when:

1) it is presented in the case of (a) a demand note

or (b) a note payable at or through a bank on a

definite date and presented on or after that

date, or

2) if it is not paid on the date payable in the case

of a note payable on a definite date (but not

payable at or through a bank) [3–502]

33-9

Presentment of a Draft or Check

• To obtain payment or acceptance on a

draft or check, holder must present it to

drawee by any commercially reasonable

means

– Written, oral, or electronic [3–501]

• Drawee obligated when it accepts (certifies)

33-10

Warranty Liability

• Person who transfers negotiable

instrument or presents it for payment

may have liability for implied warranties

of presentment or transfer

– Bank One, N.A. v. Streeter: Person who

deposited checks to his account on which

the payee’s name had been altered

breached transfer warranties and was not

entitled to enforce the instruments

33-11

33-12

33-13

Mistake in Payment or Acceptance

• Revised Article 3 follows

general rule that payment

or acceptance is final in

favor of a holder in due

course or payee who

changes position in

reliance on payment or

acceptance

– Bank bears burden of

mistake

33-14

Other Liability Rules

• Imposter rule: If impostor convinces drawer

to make check payable to the impersonated

person or organization s/he “represents,”

UCC makes any indorsement substantially

similar to that of named payee effective

• Fictitious payee rule: If check written to

fictitious payee, UCC allows any indorsement

in name of fictitious payee to be effective as

payee’s indorsement in favor of any person

that pays in good faith or takes for value or

collection

33-15

Other Liability Rules

• Fraudulent indorsements by employees:

Risk of loss for indorsements by

employees given responsibilities for

instruments (e.g., checks) falls on

employer rather than bank that takes

check or pays it

• Conversion: Law applicable to

conversion of personal property applies

to instruments

33-16

Discharge of

Negotiable Instruments

• An obligor is discharged from liability by:

1.

2.

3.

4.

Payment of the instrument

Cancellation of the instrument

Alteration of the instrument

Modification of principal’s obligation causing a

loss to a surety or impairing collateral

5. Unexcused delay in presentment or notice of

dishonor with respect to a check

6. Acceptance of a draft by a bank (e.g., if a

check is certified by a bank)

33-17

Thought Questions

• What steps would you take to make sure

that fictitious payees and fraudulent

indorsement did not occur in your

business?

33-18