BrionesSemester Topics and Graphs: Guide to Basics KEYMACRO

advertisement

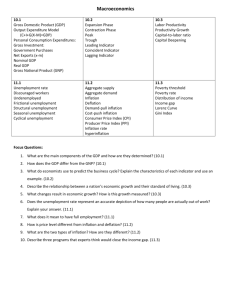

Briones Semester Topics and Graphs: Guide to Basics KEY MACRO Topic 1: Introductory Materials and Production Possibilities 1. For an economist, everything is scarce. 2. All decisions require an opportunity cost. 3. Most problems of predicting changes will require ceteris paribus assumptions. 4. The most common labels on the PPC are Y Axis = Capital Goods, X Axis = Consumer Goods 5. Students must know the significance of points inside the Frontier, on the Frontier, and outside the Frontier. These are equal to: inefficient, efficient, not available. 6. Students must understand that moving the Frontier requires more Factors of Production Graph to know: Production Possibilities Curves/Frontiers Topic 2: Supply and Demand Basics and Currency Exchanges 7. When product prices are changed first, move points on the line. This is known as a “Quantity” Change and this will create a surplus or a shortage. 8. When government steps in with artificial price floors and ceilings, they are trying to help suppliers with floors and consumers with ceilings. 9. Artificial floors always create greater surpluses. 10. Artificial ceilings always create greater shortages. 11. When any other product factor changes first, move either the S or the D lines. This is known as a “Supply or Demand” Change. 12. This will create a new EP and EQ for that market. 13. When the price of a good increases, a substitute’s demand will increase. 14. When the price of a good increases, a complement’s demand will decrease. 15. Perfectly inelastic supply lines are vertical For the rest of a macro course, skip discussions or lessons on elasticity. Currencies are supply and demand products. 16. Demand for currencies will flow to the “better” economy. 17. If D changes for one currency, S must change for the other currency. 18. The two currency graphs will move in the same direction. 19. One currency will always appreciate, the other will depreciate. 20. Appreciation of a currency hurts exports, depreciation helps make them cheaper. Graphs: Ceilings, Floors, Dollar Graph, Other Currency Graph Topic 3: Goods and Government 21. Durable goods and non-durable goods are based on length of product life. 22. Transfer payments are from government to individuals. 23. Subsidies are payments from government to businesses. Topic 4: GDP Accounting 24. The expenditure approach of C + Ig + G + Xn must be memorized. 25. The expenditure approach is equal to AD. 26. The expenditure approach is also equal to GDP. 27. C is the most significant in the US, G has no savings leak, Ig is affected by interest rates (in an inverse way for the domestic market). 28. For GDP accounting, intermediate goods are not counted. 29. Unsold inventory is counted as Ig at year’s end. 30. Used goods do not count in the year the re-sell. 31. Goods and services are both counted as Consumption. 32. GDP to NDP accounts for Depreciation of Capital or Consumption of Fixed Capital (CFC). This gives the real measure of growth. 33. Nominal minus Inflation = Real Topic 5: Business Cycles 34. The up-sloping Secular Trend is a Classical Theory of gradual improvement of lifestyles over time. It can be connected to Say’s Law. 35. The minimum time span for a change in the cycle is 6 months (2 “quarters”). 36. The cycle is measured from trough to trough. 37. Peaks and troughs can only be recognized after they have occurred. Briones Semester Topics and Graphs: Guide to Basics KEY MACRO Expansions and Contractions/Recessions can be recognized as they occur. 38. The average cycle for the US has been about 6 years (200 years of data). 39. Recessions have historically lasted about 14 months (20 century and beyond). 40. It will be assumed that Recession will have excess unemployment. 41. It will be assumed that Expansions will have some excess inflation. Graph: Business Cycles Topic 6: Employment and Unemployment 42. Part time workers are counted as “employed”. 43. Discouraged workers are not counted as unemployed. 44. “Full Employment Unemployment” (FE) is the Natural Rate of Unemployment (NRU) for a country. The differences between frictional and structural unemployment are important. Topic 7: CPI, GDP Deflators, Inflation 45. An Index Year is always made equal to 100. Real change of values over time can always be calculated with the formula: Later Year – Earlier Year/Earlier Year. This = Rate of Change. The Rate x 100 = Inflation %. 46. CPI measures monthly purchases by consumers, the GDP deflator looks at all the economy. 47. G spending changes are assumed to be more important that private C changes because C changes always have a savings leak. 48. Demand Pull inflation is caused by excessive consumption. It can be manipulated by governmental policies. 49. Cost Push inflation is a loss of Supply and often can’t be corrected. 50. Stagflation is the presence of rising unemployment and rising inflation, and can be created by Supply Shocks. Topic 8: Spending Multipliers Marginal Propensity to Consume or Marginal Propensity to Save are results of new money being given to citizens, or being taken away from citizens. 51. The MPC + MPS must always = 1. The Spending Multiplier Formula is therefore a guess on how many times new income will be spent by a series of consumers. The formula will be: 1/1-MPC or 1/MPS. Topic 9: Investment Demand 52. On the domestic market, interest rates (i) are a cost of borrowing and have an inverse effect on the willingness to create Ig. Graph: Investment Demand Graph Topic 10: Aggregate Analysis (AD and SRAS) (AD/AS) 53. Any change that can be connected to C + Ig + G + Xn will be a change in AD first. Students often miss the Ig (Investment) part. 54. Any change that can be connected to input costs, resource availability, wage rates, or worker productivity will change the SRAS. The LRAS is approximately equal to the PPF and Full Employment GDP. Graphs: AD/AS (3 Versions while using McConnell Edition #15) Topic 11: Schools of Economics 55. Classical economists believe that competition is good and the invisible hand will create better goods, cheaper goods, and more competition. 56. Classical economists believe in flexible prices and wages, long run balance near Full Employment GDP (Say’s Law). 57. Classical economists want government to promote competition, stop monopolies and cheating, stop actions that limit flexible prices and wages. 58. Neo-classical economists like the idea of tax cuts for trickle down growth. 59. Neo-classical economists also like the idea of tax cuts to starve government’s ability to interfere with competition. 60. Keynesians believe that competition is flawed and must be corrected in the Short Run. Briones Semester Topics and Graphs: Guide to Basics KEY MACRO 61. Keynesians believe that Fiscal Policies will focus on C and G. 62. Keynesians believe that wages are sticky and prices are stuck by the Ratchet effect. 63. Monetary policy advocates don’t think Keynesians can time policy correctly. 64. Monetary policy advocates don’t think Keynesians can fight inflation. 65. Monetary policy advocates support fine tuning with interest rates. Topic 12: Countercyclical Policies: Fiscal and Monetary 66. Always connect Fiscal Policies to Keynes and Congress. 67. Congress can change taxes and government spending and target C and G of AD. Use the terms “expansionary and contractionary” policies 68. When in a recession, assume that tax cuts and spending increases will create deficits and that crowding out can occur. Always connect Fiscal Policies to automatic stabilizers like Social Security and Unemployment Compensation. 69. Always connect Monetary Policies to the FED (Central Bank). The Fed can control Bonds, target the Fed Fund Rate, change the Discount Rate, and change the Reserve Requirement. 70. When the Fed buys bonds it is “Easy Money” policy (expansionary). Remember BB = BB (Buy Bonds = Big Bucks). 71. When the Fed sells bonds it is “Tight Money” policy (contractionary). Remember SB = SB (Sell Bonds = Small Bucks). The OMC (FOMC) is always connected to the bond markets. 72. Bond “prices” and interest rates are inverse in values. 73. All Fed policies target the Money Supply, interest rates, Ig, AD. Graphs: Money Market, Loanable Funds/Private Savings Market, Versions of Crowding Out Topic 13: Banks Creating Money 74. The Loan Multiplier/Reserve Multiplier formula is 1/reserve requirement (rr). 75. Demand Deposits (DD) are a bank liability and must equal bank assets 76. Required Reserves (RR) are a bank asset and are set by the rr. Excess Reserves (ER) are the monies banks can lend from each DD. 77. RR and ER must equal DD. 78. ER x the Loan Multiplier will equal to new loans for the economy which are assumed to be new Demand Deposits. If someone is using cash to create a new DD, then the ER x Loan Multiplier will equal New Money Supply. If the Fed is buying bonds that become DDs, then the ER x Loan Multiplier plus the original bond amount will equal New Money Supply. Topic 14: Phillips Curves 79. The relationship between inflation and unemployment is assumed to be inverse. 80. Combining the inflation % and the unemployment % is known as the Misery Index. 81. The changes in the business cycle due to changes in AD will move points along the Short Run Phillips Curve (SRPC). 82. Changes in SRAS will move the entire SRPC. The two curves will move in opposite directions. 83. When the SRPC moves outward, it will usually be connected to Stagflation. 84. The Long Run Phillips Curve (LRPC) is equated to the Natural Rate of Unemployment (NRU) for a country. It is assumed by Classical Economists that the NRU is greater for countries that give the unemployed more help, or time to find a new job. Graphs: Phillips Curve, Phillips-AD/AS Connection Topic 15: Monetarism (Not the Same as Monetary Policy by the Fed!) 85. The Equation of Exchange is MV = PQ. 86. Monetarists assume that velocity is “stable”. 87. The general assumption of this thinking is that most inflation can be controlled by limiting the growth of the Money Supply. Briones Semester Topics and Graphs: Guide to Basics KEY MACRO Topic 16: International Comparative Advantages 88. If two countries have similar resources, the country that can produce the most has the Absolute Advantage. 89. The country with the lowest opportunity cost has Comparative Advantage. Countries will trade to gain beyond their own domestic opportunity cost. 90. Both countries must gain for trade to occur, but both will gain if they trade their own comparative advantage products. Topic 17: International Balance of Payments Accounting 91. BOP Assets (Credits) are Demand for a country’s money and are “inflows”. 92. BOP Liabilities (Debits) are Supply of a country’s money and are “outflows”. 93. Current Accounts are the transfer of money/wealth that is immediate. 94. Capital/Financial Accounts are the transfer of money/wealth that occur between countries, but hope to create future revenue. 95. Reserves are used by countries if Current Accounts do not equal Capital/Financial Accounts.