BL Study Guide, Chapter 10 Answer Section

advertisement

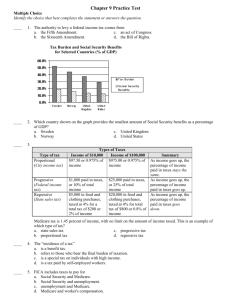

BL Study Guide, Chapter 10 True/False Indicate whether the statement is true or false. ____ 1. The most common type of negotiable instrument is the check. ____ 2. A promissory note is difficult to transfer. ____ 3. A negotiable instrument may be oral or written. ____ 4. The promise in a note or the order in a draft must be unconditional. ____ 5. Drawers are responsible for altered or forged checks regardless of their care in making out the check. ____ 6. A qualified indorsement limits the liability of the indorser. ____ 7. Holders in due course take instruments of value in good faith and without notice that the instrument is defective. ____ 8. Personal defenses, such as breach of contract, can be used against a holder in due course. ____ 9. The Check 21 Act allows electronic processing to clear checks quickly and safely. ____ 10. If your bank refuses to cash your check when sufficient funds are available, it would be a breach of the bank’s contract. Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 11. An order to a third party to pay money is called a a. draft. c. certificate of deposit. b. note. d. bill of lading. ____ 12. A draft that is payable upon presentation to the drawee is a(n) a. time draft. c. sight draft. b. accepted draft. d. immediate draft. ____ 13. A note issued by a bank that earns interest over time is called a a. certificate of deposit. c. time draft. b. secured interest. d. security agreement. ____ 14. The person who writes a promissory note is called a(n) a. drawer. c. payee. b. maker. d. acceptor. ____ 15. A check that is more than six months old is a a. void check. b. stale check. c. voidable check. d. bad check. ____ 16. If you want to cancel a check that you have written but that has not been paid, you can issue a a. material alteration order. c. stop-payment order. b. stale check order. d. substitute check order. ____ 17. Negotiability allows for the transferee to become a holder, while assignability allows for the a. transferee to avoid liability for errors made as the instrument is transferred. b. instrument to be transferred to someone else without the transferee becoming a holder. c. transferee to obtain legal indorsements in a timely fashion. d. instrument to be void of dates and controlling words. ____ 18. In order to be negotiable, negotiable instruments must a. be made orally or in writing. c. have a signature. b. be conditional. d. not have a definite time they are due. ____ 19. Which of the following is not authorized under the Electronic Fund Transfer Act (EFTA)? a. paying your bills electronically b. making purchases with your debit card c. direct deposits into your checking account d. overdraft protection on all purchases over $500 ____ 20. The Check 21 Act allows for a substitute check and a(n) a. electronic signature to replace the original signature. b. quick reconciliation process of your checking account. c. stop-payment order as needed. d. direct withdrawal from your checking account when requested. Completion Complete each statement. 21. A written promise by one person to pay money to another person is called a(n) ____________________. 22. The words "to the order of" and "to bearer" are words of ____________________. 23. Certificates of deposit generally pay higher ____________________ than regular savings accounts. 24. Negotiable instruments must be payable ____________________. 25. The omission of the ____________________ does not affect the negotiability of an instrument. 26. It is important to ____________________ a checking account soon after a receiving a statement. 27. The bank accepts liability for the payment of money involved in an international business transaction where a(n) ____________________ of credit is used. 28. Retail stores often use a(n) ____________________ indorsement by stamping the words “for deposit only” when they receive checks from customers. 29. Personal defenses against a(n) ____________________ include breach of contract, lack of consideration, fraud in the inducement, lack of delivery, and payment. Matching Match each term with its definition. a. negotiable instrument b. note c. maker d. payee e. assignment f. g. h. i. j. drawer drawee holder in due course holder indorsement ____ 30. Someone who takes an instrument for value, in good faith, and without notice that the instrument is defective ____ 31. Also known as commercial paper ____ 32. A written promise by one person to pay money to another person ____ 33. A person who has a written promise to be paid money by another person ____ 34. The transfer of your rights under a contract to someone else ____ 35. The act of placing one’s signature on an instrument to transfer it to someone else ____ 36. A person who orders money to be paid in a draft ____ 37. A person to whom an order is given to pay money in a draft ____ 38. Someone who receives a check made out in his or her name ____ 39. A person who has written a promise to pay money to another person BL Study Guide, Chapter 10 Answer Section TRUE/FALSE 1. ANS: NAT: 2. ANS: NAT: 3. ANS: NAT: 4. ANS: NAT: 5. ANS: NAT: 6. ANS: 7. ANS: 8. ANS: 9. ANS: 10. ANS: NAT: T PTS: 1 DIF: NBEA VI | NBEA VIA F PTS: 1 DIF: NBEA VI | NBEA VIA F PTS: 1 DIF: NBEA VI | NBEA VIA | NBEA VIA3c T PTS: 1 DIF: NBEA VI | NBEA VIA | NBEA VIA3c F PTS: 1 DIF: NBEA VIA3g T PTS: 1 DIF: T PTS: 1 DIF: F PTS: 1 DIF: T PTS: 1 DIF: T PTS: 1 DIF: NBEA VIA3e 1 REF: 235 1 REF: 227 1 REF: 228 1 REF: 229 2 REF: 236 2 2 2 1 1 REF: REF: REF: REF: REF: 1 REF: 227 2 REF: 227 1 REF: 227 1 REF: 227 1 REF: 235 1 REF: 236 3 REF: 231 2 REF: 229 2 2 REF: 239 REF: 236 232 232 232 236 235 MULTIPLE CHOICE 11. ANS: NAT: 12. ANS: NAT: 13. ANS: NAT: 14. ANS: NAT: 15. ANS: NAT: 16. ANS: NAT: 17. ANS: NAT: 18. ANS: NAT: 19. ANS: 20. ANS: A PTS: 1 DIF: NBEA VI | NBEA VIA C PTS: 1 DIF: NBEA VI | NBEA VIA A PTS: 1 DIF: NBEA VI | NBEA VIA B PTS: 1 DIF: NBEA VI | NBEA VIA B PTS: 1 DIF: NBEA VI | NBEA VIA C PTS: 1 DIF: NBEA VIA3f B PTS: 1 DIF: NBEA VIA3b C PTS: 1 DIF: NBEA VI | NBEA VIA | NBEA VIA3c D PTS: 1 DIF: A PTS: 1 DIF: COMPLETION 21. ANS: note PTS: 1 DIF: 1 22. ANS: negotiability REF: 227 NAT: NBEA VI | NBEA VIA PTS: 1 23. ANS: interest DIF: 2 REF: 230 NAT: NBEA VI | NBEA VIA PTS: 1 24. ANS: on demand DIF: 1 REF: 227 NAT: NBEA VI | NBEA VIA PTS: 1 DIF: 2 REF: 229 NAT: NBEA VI | NBEA VIA | NBEA VIA3c 25. ANS: date PTS: 1 26. ANS: balance reconcile DIF: 2 REF: 230 PTS: 1 27. ANS: letter DIF: 1 REF: 236 PTS: 1 28. ANS: restrictive DIF: 2 REF: 228 PTS: 1 29. ANS: holder DIF: 2 REF: 232 PTS: 1 DIF: 2 REF: 232 PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: DIF: DIF: DIF: DIF: DIF: DIF: DIF: DIF: DIF: DIF: MATCHING 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: H A B D E J F G I C 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 NAT: NBEA VI | NBEA VIA