Ch14-7Ed

Chapter 14

The Human Resources (HR)

Management and Payroll

Processes

Accounting Information Systems 7e

Ulric J. Gelinas and Richard Dull

Copyright © 2008 Thomson Southwestern, a part of The Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license .

1

Learning Objectives

• Define and understand the basic functions of the HR management and payroll processes.

• Describe the relationship between the HR management and payroll processes and their environment.

• Comprehend the relationship between the HR management and payroll processes and management decision making.

• Depict the logical and physical elements of the HR management and payroll processes.

• Describe some of the technology used to implement the HR management and payroll processes.

• Prepare a control matrix for a typical payroll process, including explanation of how business process control plans can accomplish payroll operations and information control goals.

2

Process Definition and

Functions

• Personnel management started by handling payroll and personnel administration, but evolved by adding functions to handle recruiting, employee relations, and so on.

• HRM still viewed personnel as something that could be controlled

• HCM philosophy is based on three major principles:

1.

An individual’s value to an organization is derived from his/her jobrelated knowledge, skills, attitude, and motivations

2. Human assets include full-time permanent employees, plus part-time employees, temporary employees, and independent contractors.

• With supply chain management , an organization’s human assets could include employees of suppliers, sales channel partners, and customers

3.

A person’s relationship with an organization, from hiring through termination, must be nurtured and managed to obtain maximum lifetime value

3

Duties of HR Managers

4

Duties of HR Managers

5

Definition of HR Management

Process

• Primary function of the HRM process is to create information flows that support the following:

1. Repetitive work routines of the HR department

2. Decision needs of those who manage the HR department

• The HRM process supports the work routines of the

HR department and provides information for management decisions by:

– Capturing, recording, and storing data concerning HR activities

– Generating a variety of HR forms and documents

– Preparing management reports

– Preparing governmental reports

6

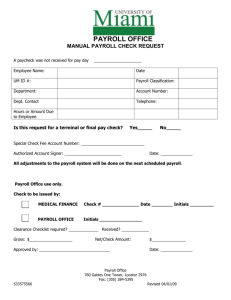

The Payroll Process

• Many companies often merge payroll and HR

• The payroll process maintains records of payroll taxes, fringe benefits, attendance/absence, time worked and employee paychecks

• The payroll process is generally automated because computers are much faster at handling the repetitive computations necessary (payroll is also the most frequently outsourced application in accounting)

• Current HR software reaches far beyond simply doing payroll and includes:

– Benefits admin, applicant tracking/processing, skills inventories and compliance reporting

• Much of HRM is NOT captured by GAAP

– But accountants must recognize the immense value of human capital and its affect on the long-term financial health of the organization

7

Organization Chart of the HR

Function

8

Technology Trends and

Developments

• HR self service systems

– HR Manuals

– Retirement programs

– Personal profile

– Expense reports

• Outsourcing

– Web-based collaboration

– Payroll

• Enterprise systems may integrate HRM with

– Financial Accounting

– Logistics

– Sales and Distribution

– The Workflow Module

9

Master Data related to

HR and PR Function

Payroll function

• Establishes authorization for payroll event

• Provides inputs

– Pay rates

– Exemptions

– Deductions

• Historical payroll data periodic reporting

– Taxes

– Insurance

– Retirement programs.

HR function

• Determine:

• Employee's assigned department

• Telephone number

• Supervisor

• Locate and manage human capital skills

• Performance evaluation data

10

Payroll Process Context Diagram

11

Payroll Process: Level 0 DFD

12

Payroll Process – Diagram 4

13

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

Accounting Entries – Payroll

Process

PAY EMPLOYEES

A.

ESTABLISH VARIOUS PAYROLL LIABILITIES

Payroll clearing

FIT withholdings payable

SIT withholdings payable

FICA tax withholdings payable

Accrued payroll

B. RECORD THE DISBURSEMENT OF CASH

XXXXX

XXXXX

XXXXX

XXXXX

XXXXX

Accrued payroll

Cash

XXXXX

DISTRIBUTE PAYROLL TO VARIOUS ACCOUNTS

Work in process (direct labor) XXXXX

Manufacturing overhead (indirect labor) XXXXX

General and administrative expense XXXXX

Selling expense

Payroll clearing

XXXXX

XXXXX

XXXXX

14

Accounting Entries Cont.

•

•

•

•

•

•

•

•

ACCRUE EMPLOYER PAYROLL TAXES

Manufacturing overhead (tax on factory workers)

General and administrative expense

Selling expense

FICA taxes payable

SUT taxes payable

FUTA taxes payable

•

•

•

•

•

•

•

•

• RECORD TAX DEPOSITS

FIT withholdings payable

SIT withholdings payable

FICA tax withholdings payable

FICA taxes payable

SUT taxes payable

FUTA taxes payable

Cash

XXXXX

XXXXX

XXXXX

XXXXX

XXXXX

XXXXX

XXXXX

XXXXX

XXXXX

XXXXX

XXXXX

XXXXX

XXXXX

15

Payroll Process Flowchart

16

Payroll Has High Fraud Potential

• Types of payroll frauds:

– Ghost employees (employees who don’t exist but are issued paychecks)

– Falsified hours (employees who overstate hours worked)

– Commission schemes (collecting commissions on false sales or using false commission rate)

– Worker’s comp schemes (faking injury to receive compensation)

17

Payroll System Controls

• Segregation of duties between HR (employee record creation), payroll (prepares payroll) and AP/cashier (disburses cash)

• Direct deposit (eliminates opportunity for check fraud)

• Review of employee master data for duplicate names and/or social security numbers

• Comparison of actual payroll to budget

18

Reimbursement Fraud

• Reimbursement for employee business expenses often clear the payroll system

– Claiming personal expenses as business related

– Altering receipts to increase expenses

– Submitting false receipts

– Submitting same expense multiple times

19

Payroll Process Control Matrix

Recommended control plans

A

Present Controls

P-1: Enter time data close to the data’s originating source

P-2: Computer agreement of batch totals

P-3: Approve attendance time data and job time data

P-4: Reconcile attendance time data and job time data

P-5: Distribute labor costs

P-6: Independent paycheck distribution

P-7: Approve payroll transfer check

P-8: Accumulate payroll data for reconciliation of the payroll clearing account

P-9: Use a payroll clearing account

P-10: Prepare miscellaneous reports

P-1

P-4

Control Goals of the Payroll Business Process

Control goals of the operations process

Ensure effectiveness of operations Ensure efficient employment of resources

Ensure security of resources

Control goals of the information process

For time data inputs, ensure: For empl/PR master data, ensure:

B

P-10

C

P-10

P-1

P-4

P-6

P-7

IV

P-3

P-4

P-5

P-6

P-8

P-9

IC

P-1

P-4

P-5

P-8

P-9

IA UC UA

P-1

P-3

P-4

P-5

P-8

P-9

P-2

P-8

P-9

P-2

P-8

P-9

20

Payroll Process Control

Matrix

Control Goals of the Payroll Business Process

Control goals of the operations process Control goals of the information process

Ensure effectiveness of operations Ensure efficient employme nt of resources

Ensure security of resources

For time data inputs, ensure:

For empl/PR master data, ensure:

Recommended control plans

A B C IV IC IA UC UA

Missing Controls

M-1 Independent reconciliation of payroll bank account

M-2 Use an imprest payroll bank account

M-2 Computer agreement of batch totals (agree run-to-run totals)

M-2

M-1

M-2

M-3

M-2 M-2

M-3 M-3 M-3 M-3 M-3

Effectiveness goals include:

A — Provide employees with timely paychecks

B — Provide timely filing of tax returns and other reports to government agencies

C — Comply with requirements of payroll and tax laws and regulations

21

Payroll Part of HR Module

• It is common for payroll to be part of the HR module in software (SAP example)

22

Figure 14.1

• The HR module includes options for both HR and payroll, among others

• The advantages gained by allowing the two processes to share common data include:

– Creating a single source for obtaining HR information

– Providing for faster data access

– Minimizing data redundancy

– Ensuring data integrity and consistency

– Facilitating data maintenance

– Improving data accuracy

23

Implementing the HRM

Process

• Process Inputs: In general, the HR forms in the figure capture information about three HR-related events:

• (1) selecting employees

• (2) evaluating employees, and

• (3) terminating employees

24

Implementing the HRM

Process

• Selecting employees may be initiated in one of two ways:

1. Departmental managers (outside the HR department) may initiate the process to satisfy their immediate hiring needs

2. Selection process may be started by the system automatically

25

Implementing the HRM

Process

• Evaluating employees comprises a multitude of activities

– Departmental managers and supervisors

(again, outside the HR function) usually initiate evaluations or other changes affecting employees

– The manager of personnel appraisal and development (in HR) typically approves the review and implements such changes

26

Implementing the HRM

Process

• Terminating employees closes the employment process loop

– Periodically, departmental managers and supervisors (in concert with HR managers) must make difficult decisions about the retention of employees

– If a termination is necessary, the employee change screen is used to initiate the process of changing an employee’s status from current employee to terminated employee

27

Implementing the HRM Process

• Processing Logic and Process Outputs.

• HR requests initiated outside of the HR department are approved within that department and then routed to HR for approval

• Some data may be entered within HR

• The employee/payroll master data, skills inventory data, and labor-force planning data within the enterprise database are updated and various reports are made available

• Several outputs are produced

– New hire:

• An employment letter is sent to the employee

• Selection notice is sent to the department manager

– Feedback on job performance:

• Employee review form

– Termination:

• Employees are notified of a dismissal through a dismissal letter

•

Termination notice sent to the operating department manager.

28

Implementing the HRM Process

• HRM process prepares reports for government and nongovernment entities

– Payroll reports: employee federal, state, and local taxes

• HR reports might include those provided to the following:

– • Unions

– • Equal Employment Opportunity (EEO)

– • Occupational Safety and Health Administration (OSHA)

– •

Department of Labor

• There are also numerous communications to employees of

HR-related information

– Job opening announcements

– Training information

– Phone books

– Benefits literature

– Policy and procedure manuals, and the like.

• Many companies have found that such materials can be disseminated effectively and efficiently through an HR portal, which serves as a central data source for such information.

29

HR Management Flowchart

30

Key Data Tables in the HR Process

• Though the flowchart shows only one data store, multiple database tables are contained:

– Employee/payroll master data

– Labor-force planning data

• Staffing requirements

• Skills required

• Turnover data

– Skills inventory data

31

The Payroll Process

• Payroll generally falls under the controller’s office with the treasurer participating in distributing paychecks

32

Payroll Data and Flows

• Tax rates data

– Contains current tax rates (federal, state, county and city) for employee withholding and employer accruals

• Attendance time record

– Lists hours employee are at the job site available for work; usually kept on time card

• Job time records

– Start and stop times for particular jobs for direct labor distribution

33

Federal Payroll Tax Reports

• 941 (report of FICA taxable wages)

• W-2 (employee wage and tax statement)

• 1099 (reports non-salary income)

• Employee Retirement Income Security

Act (ERISA) reports (reports on private pension fund assets management)

34