primarily rental property. - McGraw Hill Higher Education

advertisement

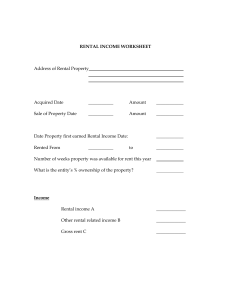

Chapter 8 Rental Property, Royalties, and Income From FlowThrough Entities (Line 17, Form 1040 and Schedule E) “There is no simple tax, at least no simple tax that is also fair.” -- Joel Slemrod McGraw-Hill Education Copyright © 2015 by the McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website in whole or part. LO #1: Rental Property • Income and expenses from rental property are generally reported on Schedule E. • All ordinary and necessary expenses related to a rental property are deductible. 8-2 LO #1 Rental Property • Ordinary expense is an expense that is customary or usual for the rental property activity. • Examples of common rental activity expenses include advertising, repairs and maintenance, management fees and depreciation. 8-3 LO #1: Rental Property • Rental property is depreciated using straight-line depreciation over 27.5 or 39 years. • The IRS depreciation tables are used to calculate the depreciation amount. • Depreciate structure only. • The tables to use for rental properties are found in Ch 6. 8-4 LO #1 Rental Property • If a taxpayer’s rental property is considered a trade or a business, the related income and expenses are reported on Schedule C. • Generally, if a taxpayer materially participates in the rental activity and is considered a real estate professional, then the activity is considered a trade or business. 8-5 LO #1 Rental Property • Expenses paid by the tenant or services provided in lieu of rental payments are considered rental income. As such, the amount must be included as rental income and reported. 8-6 LO #1 Rental Property • Example: Brady owns a rental property that he rents to his friend, Jack, for $800 per month. In November, Jack repairs a leaky roof of the rental property for $450 and pays Brady $350 for rent. • Brady would report $800 for rental income and $450 for repair and maintenance expenses in November. 8-7 LO #1: Rental Property 1. Rental income is generally reported on Schedule E. True 2. All expenses related to rental property are deductible in the current year, including capital improvements. False 3. Rental property structures must be depreciated using the straight-line method. True 8-8 LO #1: Rental Property 4. If a taxpayer’s rental property is considered a trade or a business, he or she reports the income on Schedule E. False 5. If a tenant provides a service in lieu of rent, the taxpayer is not required to report the value of that amount as rental income. False 8-9 LO#2 Rental of Vacation Homes • A property that is used for both personal use and rental activity, falls into one of three categories for tax purposes: – (a) primarily rental, – (b) primarily personal, or – (c) personal/rental. 8-10 LO #2: Rental of Vacation Homes • The three categories are determined based on the number of rental use days compared to the number of personal use days. • For example: Jose owns a vacation home. He uses it over Christmas for 7 days and he rented to vacationers for 90 days. Those days determine the category of the property (one of three discussed in the previous slide.) • Jose’s home is a primarily rental property. 8-11 What is personal use of the home? • Personal use is - use by the taxpayer, or his family or non-family, free of charge. • In case of a family member, the use is considered personal even if that member pays fair market value. • Time spent working on the property (such as doing repairs) is not considered personal use. 8-12 Primarily Rental Homes – A rental property that is used no more than 14 days for personal purposes (or 10% of total rental days, whichever is greater), is considered primarily rental property. • All income and expenses of a primarily rental property are reported on Schedule E. • The expenses must be allocated between personal and rental use, and if a net loss results, the loss is allowed against other income up to $25,000 (subject to passive activity loss rules). 8-13 Primarily Rental Homes EXAMPLE: Mandy rented her home in Laguna Beach, California for 190 days for $36,000 and she used it for 17 days. Categorized: primarily rental Note: 10% of 190 days is 19. 8-14 Primarily Personal Homes – A home that is rented for less than 15 days but otherwise used as a personal residence is considered a primarily personal property. • All income derived from the short rental period does not have to be reported. Likewise, none of the expenses are deductible except those allowed as itemized deductions on Schedule A (mortgage interest and property taxes). 8-15 Primarily Personal Homes EXAMPLE: Maya rented her cabin in Big Bear for $2,000 for 10 days over the holidays, and she and her family used it for the rest of the year. Categorized as primarily personal – rented less than 14 days. 8-16 Personal/Rental Homes – A rental property that is used more than 14 days for personal purposes (or 10% of total rental days, whichever is greater), and rented for 15 days or more, is considered a personal/rental property. • All income and expenses are reported on Schedule E. The expenses must be allocated between personal and rental. However, the expenses are deductible only to the extent there is rental income available (that is, no net loss is allowed). 8-17 Personal/Rental Homes EXAMPLE: Adrianna rented her lake house for 90 days for $13,500, and she and her family used it for 50 days. Categorized as personal/rental 8-18 Vacation Homes Review Darren rented his house at the lake for 48 days for $9,000 and stayed there on weekends with his family for a total of 18 days. During his stay, he worked to replace the roof for 6 days, while his family went out on the boat and fished. How should this property be categorized? 8-19 Vacation Homes Review • Categorized as primarily rental. • A rental property that is used no more than 14 days for personal purposes (or 10% of total rental days, whichever is greater), is considered primarily rental property. • Darren’s personal use days is 12 days (18-6)! • The days spent working on the roof does NOT count as personal days! 8-20 Reporting Vacation Homes • Rental expenses must be allocated between personal and rental use. This is true for a personal/rental property or a primarily rental property. There are two methods available: – The IRS method. Allocated based on the ratio of the number of days of rental use to the total number of days used. – The Tax Court method. Interest and taxes are allocated based on the ratio of the number of days of rental use to the number of days in the year (365 days). The remaining expenses are allocated using the IRS method. 8-21 Reporting Vacation Homes The IRS method vs. Tax Court method: – A rental property has the following expenses: $4,300 of mortgage interest, $2,300 of property taxes, $1,000 in repairs & maintenance and $2,500 in depreciation. – The rental income from the property was $6,300. The property was used 22 days for personal use and rented for 84 days. – THIS PROPERTY IS CONSIDERED PERSONAL/RENTAL PROPERTY. All expenses must be allocated. 8-22 Reporting Vacation Homes IRS method: The ratio for allocation would be – – – – 84/106 FOR ALL EXPENSES (22+84 = 106). Rental income $6,300 Mort interest ($4,300x 84/106) $3,408 Prop taxes($2,300x 84/106) $1,823 R & M ($1,000x 84/106) $ 792 Depreciation ($2,500x 84/106) $1,981 Net income (loss) ($1,704) Since this is a personal/rental property; the amount you report on Schedule E would be $0. REMEMBER: you cannot have a net loss on personal/rental homes! The net loss of $1,704 must be carried forward. 8-23 Reporting Vacation Homes • Tax Court method: The ratio for allocation would be 84/365 for interest and taxes AND 84/106 FOR ALL OTHER EXPENSES. Tax court allows 365 days for interest & taxes only. Rental income $6,300 Mort interest ($4,300x 84/365) $ 990 Prop taxes($2,300x 84/365) $ 529 – R & M ($1,000x 84/106) $ 792 – Depreciation ($2,500x 84/106) $1,981 – Net income $2,008 These amounts would be reported on Schedule E. The amounts NOT deducted above for interest and taxes will still be deductible in Schedule A. 8-24 Reporting Vacation Homes Review Jane & Richard own a vacation home. During the year they rented the home for 75 days and used it for personal use for 30 days. The following are income and expenses related to the property: Rental income Mortgage interest Property Taxes Insurance Repairs & maintenance Depreciation $15,000 6,000 1,400 1,000 800 2,000 8-25 Reporting Vacation Homes Review Which of the three categories of vacation rental property would apply to this property and why? Answer: • Jane & Richard’s home is categorized as personal/rental; • It was rented for 15 days or more and used for personal use for greater than 14 days. 8-26 Reporting Vacation Homes Review Using the IRS method, how much of the expenses can be allocated to Jane & Richard’s rental property? Answer: • Expenses to allocate is $8,000 as follows: Mortgage interest 6,000 Property taxes 1,400 Insurance 1,000 Repairs & maintenance 800 Depreciation 2,000 Total expenses $ 11,200 • $11,200 x (75/105) = $8,000 8-27 Reporting Vacation Homes Review IF using the Tax Court method, which expenses would use a different ratio (NOT 75/105) to allocate the expenses of the rental property? Answer: • Mortgage interest ($6,000) and property taxes ($1,400). What is the ratio? • 75/365 8-28 LO #3: Royalty Income • A royalty is a payment for the right to use intangible property. • Generally, royalty income is reported on Schedule E. • If the royalty payment is a result of a trade or business, then the income should be reported on Schedule C. 8-29 LO #3: Royalty Income • Additionally, if a royalty payment is received while performing a service related to the royalty-producing asset, the royalty income should be reported on Schedule C. 8-30 LO #3: Royalty Income • Here are some examples: • Jay is a full-time author and receives royalties from his novels. Since the royalty income is received from Jay’s trade or business, the income is reported on Schedule C and any related expenses are deductible. • Katherine owns land that produces oil and receives royalty income. Katherine is a full-time dentist. Since Katherine’s royalty income is derived from an investment rather than a trade or business, the income is reported on Schedule E. Any related expenses are also deductible. 8-31 LO #3: Royalty Income Indicate whether the following items would be reported on Schedule E or Schedule C. 1. Royalty income received by Debra, a full-time author, for her mystery novel. Schedule C 2. Royalty income received by Mark, a professional baseball player, for coal mined on his land in Wyoming. Schedule E 8-32 LO #3: Royalty Income 3. Nathan recently wrote a book on proverbs. He received income for his readings at various bookstores throughout the country. Schedule C 4. Royalty income that Jane, a full-time professor of psychology at the University of San Diego, received for a textbook she wrote. Schedule E 8-33 LO#4: Flow-Through Entities • Partnerships, Limited Liability Companies (LLC), S corporations, certain types of trusts and estates, are called flow-through entities. • These entities are known as flow-through entities because rather than being taxed directly, the income and expenses “flowthrough” to the partners (shareholders or owners). 8-34 LO#4: Flow-Through Entities • Flow-through entities file “informational returns” and provide its partners (shareholders or owners) with Schedule K-1s. • The information from the K-1 is reported on the individual partner’s (shareholder’s or owner’s) personal tax return. • The income and loss from K-1 is reported on the partner’s or shareholder’s or owner’s Schedule E. 8-35 LO#4: Flow-Through Entities • Depending on the particular partner’s (shareholder’s or owner’s) situation, certain items may also be reported on a Schedule A, B, or D. • Certain limited partnerships and rental activities are considered passive activities and as such, the amounts of net loss that may be deductible against active or portfolio income, are limited by the passive activity rules. 8-36 LO#4: Flow-Through Entities • Generally, losses from a passive activity may ONLY be offset against passive income (and not against active or portfolio income). • One exception to this tax rule is rental activities. Although rental activities by definition are considered passive activities, tax law allows up to $25,000 in net losses that may be offset against active or portfolio income. This is subject to an AGI amount limitation and phase outs (discussed in more detail in a later chapter). 8-37 LO#4: Flow-Through Entities 1. Flow-through entities allocate an appropriate share of the entity’s income, expenses, or loss to their partners or shareholders or owners, on a Schedule K-1. True 2. Ordinary income from all flow-through entities is considered self-employment income. False 3. The partners (shareholders or owners) must report the income and loss from the K-1s they received on a Schedule E of their individual tax returns. True 4. By definition, rental properties are passive activities. However, a taxpayer may deduct rental losses, subject to limitations and phase outs. True 8-38