Principles of Economics

advertisement

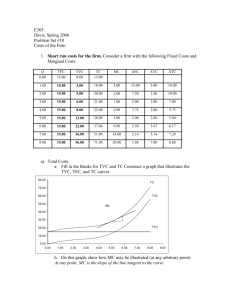

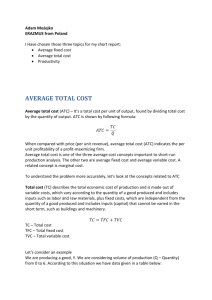

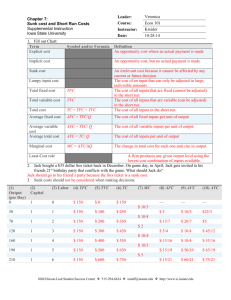

Principles of Economics Session 5 Topics To Be Covered Categories of Costs Costs in the Short Run Costs in the Long Run Economies of Scope The Firm’s Objective The economic goal of the firm is to maximize profits. A Firm’s Profit Profit is the firm’s total revenue minus its total cost. Profit = Total revenue - Total cost Costs as Opportunity Costs A firm’s cost of production includes all the opportunity costs of making its output of goods and services. Opportunity Cost The value of the next best use for an economic good, or the value of the sacrificed alternative. Explicit and Implicit Costs A firm’s cost of production include explicit costs and implicit costs. Explicit costs involve a direct money outlay for factors of production. Implicit costs, also called normal profit, refer to the opportunity cost of using the owner’s own resources. Economic Profit versus Accounting Profit Economists measure a firm’s economic profit as total revenue minus all the opportunity costs (explicit and implicit). Accountants measure the accounting profit as the firm’s total revenue minus only the firm’s explicit costs. In other words, they ignore the implicit costs. Economic Profit versus Accounting Profit When total revenue exceeds both explicit and implicit costs, the firm earns economic profit. Economic profit is smaller than accounting profit. Economic Profit versus Accounting Profit How an Economist Views a Firm How an Accountant Views a Firm Economic profit Accounting profit Revenue Implicit costs Explicit costs Revenue Total opportunity costs Explicit costs Total Cost of Production Total cost of production may be divided into fixed costs and variable costs. Fixed and Variable Costs Fixed costs are those costs that do not vary with the quantity of output produced. Variable costs are those costs that do change as the firm alters the quantity of output produced. Family of Total Costs TC TFC TVC TC = Total Costs TFC=Total Fixed Costs TVC=Total Variable Costs Fixed Cost vs. Sunk Cost Fixed Cost Cost paid by a firm that is in business regardless of the level of output Sunk Cost Cost that have been incurred and cannot be recovered e.g. advertising expenditure Variable Cost and Sunk Cost Personal Computers: most costs are variable e.g. components, labor Software: most costs are sunk e.g. cost of developing the software Total Cost Output (Units) 0 1 2 3 4 5 6 7 8 9 10 11 Fixed Cost ($) 50 50 50 50 50 50 50 50 50 50 50 50 Variable Cost ($) 0 50 78 98 112 130 150 175 204 242 300 385 Total Cost ($) 50 100 128 148 162 180 200 225 254 292 350 435 Total Cost Curves TC Cost 400 Total cost is the vertical sum of FC and VC. ($ per year) 300 TVC Variable cost increases with production and the rate varies with increasing & decreasing returns. 200 Fixed cost does not vary with output 100 50 0 TFC 1 2 3 4 5 6 7 8 9 10 11 12 13 Output Average Costs The average cost is the cost of each typical unit of product. Average costs can be determined by dividing the firm’s costs by the quantity of output produced. Family of Average Costs ATC AFC AVC ATC=Average Total Costs AFC=Average Fixed Costs AVC=Average Variable Costs Family of Average Costs Total cost TC ATC = = Quantity Q Fixed cost TFC AFC = = Quantity Q Variable cost TVC AVC = = Quantity Q Average Costs Output (Units) 0 1 2 3 4 5 6 7 8 9 10 11 TFC ($) 50 50 50 50 50 50 50 50 50 50 50 50 TVC ($) 0 50 78 98 112 130 150 175 204 242 300 385 TC ($) 50 100 128 148 162 180 200 225 254 292 350 435 AFC ($) -50 25 16.7 12.5 10 8.3 7.1 6.3 5.6 5 4.5 AVC ($) -50 39 32.7 28 26 25 25 25.5 26.9 30 35 ATC ($) -100 64 49.3 40.5 36 33.3 32.1 31.8 32.4 35 39.5 Average Cost Curves Cost ($ per unit) 100 75 50 ATC AVC 25 AFC 0 1 2 3 4 5 6 7 8 9 10 11 Output (units/yr.) U-Shaped ATC and AVC Curves The ATC curve is U-shaped. At very low levels of output average total cost is high because fixed cost is spread over only a few units. Average total cost declines as output increases. Average total cost starts rising because average variable cost rises substantially. The AVC curve is also U-shaped for its relationship with the ATC curve. Marginal Cost Marginal Cost (MC) is the cost of expanding output by one unit. Since fixed cost have no impact on marginal cost, it can be written as: VC TC MC Q Q Marginal Cost Output TFC (Units) ($) 0 50 1 50 2 50 3 50 4 50 5 50 6 50 7 50 8 50 9 50 10 50 11 50 TVC ($) 0 50 78 98 112 130 150 175 204 242 300 385 TC ($) 50 100 128 148 162 180 200 225 254 292 350 435 AFC ($) -50 25 16.7 12.5 10 8.3 7.1 6.3 5.6 5 4.5 AVC ($) -50 39 32.7 28 26 25 25 25.5 26.9 30 35 ATC ($) -100 64 49.3 40.5 36 33.3 32.1 31.8 32.4 35 39.5 MC ($) -50 28 20 14 18 20 25 29 38 58 85 Marginal Cost Curve Cost ($ per unit) 100 MC 75 50 25 0 1 2 3 4 5 6 7 8 9 10 11 Output (units/yr.) Cost Curves for a Firm Cost ($ per unit) 100 MC 75 50 ATC AVC 25 AFC 0 1 2 3 4 5 6 7 8 9 10 11 Output (units/yr.) From TC to AC and MC AFC= slope of line from origin to a point on TFC AVC = slope of line from origin to a point on TVC ATC = slope of line from origin to a point on TC MC = slope of tangent to a point on TC or TVC P P TC 400 100 TVC MC 75 300 B 50 200 B' A 1 2 3 4 5 6 7 8 9 10 11 12 13 AVC A' 25 100 0 ATC TFC Q AFC 0 1 2 3 4 5 6 7 8 9 10 11 Q Properties of Cost Curves Cost ($ per unit) AFC falls continuously When MC < AVC or MC < ATC, AVC and ATC decrease When MC > AVC or MC > ATC, AVC and ATC increase 100 MC 75 50 ATC AVC 25 AFC 0 1 2 3 4 5 6 7 8 Output (units/yr.) 9 10 11 Properties of Cost Curves Cost ($ per unit) 100 MC 75 50 ATC AVC 25 AFC 0 1 2 3 4 5 6 7 8 Output (units/yr.) 9 10 11 MC crosses AVC and ATC at the minimums of AVC and ATC, respectively. Minimum AVC occurs at a lower output than minimum ATC Costs in the Long Run For many firms, the division of total costs between fixed and variable costs depends on the time horizon being considered. In the short run some costs are fixed. In the long run fixed costs become variable costs. Costs in the Long Run Because many costs are fixed in the short run but variable in the long run, a firm’s long-run cost curves differ from its short-run cost curves. Long-Run Average and Marginal Cost If LMC < LAC, LAC will fall If LMC > LAC, LAC will rise LMC = LAC at the minimum of LAC Long-Run Average and Marginal Cost Cost ($ per unit of output LMC LAC A Output Average Total Cost in the Short and Long Runs Average Total Cost ATC in short run with small factory ATC in short run with medium factory ATC in short run with large factory ATC in long run 0 Quantity of Cars per Day Long-Run Costs and Returns to Scale The optimal plant size will depend on the anticipated output. Firms can change scale to change output in the long-run. The long-run average cost curve is the envelope of the firm’s short-run average cost curves. Long-Run Cost with Economies and Diseconomies of Scale Cost ($ per unit of output SAC1 SAC3 SAC2 A $10 LAC $8 B SMC1 SMC3 LMC SMC2 Q1 If the output is Q1 a manager would choose the small plant SAC1 and SAC $8. Output Economies and Diseconomies of Scale Economies of scale occur when long-run average total cost declines as output increases. Diseconomies of scale occur when longrun average total cost rises as output increases. Constant returns to scale occur when long-run average total cost does not vary as output increases. Economies and Diseconomies of Scale Average Total Cost ATC in long run Economies of scale 0 Constant Returns to scale Diseconomies of scale Quantity of Cars per Day Economies of Scope Economies of scope exist when the joint output of a single firm is greater than the output that could be achieved by two different firms each producing a single output. Chicken farm—poultry and eggs Automobile company—cars and trucks University—Teaching and research Advantages of Economies of Scope Both use similar, relative, and even the same capital and labor. The firms share management resources. The production of one good results in the production of another good at little or no extra cost. Measuring Degree of Economies of Scope C(Q1) C (Q 2) C (Q1, Q 2) SC C (Q1, Q 2) C(Q1)= cost of producing Q1 C(Q2)=cost of producing Q2 C(Q1Q2)=joint cost of producing both products If SC > 0 — Economies of scope If SC < 0 — Diseconomies of scope Economies of Scope vs. Economies of Scale There is no direct relationship between economies of scope and economies of scale. A firm may experience economies of scope and diseconomies of scale A firm may have economies of scale and not have economies of scope Assignment Review Chapter 7 Answer questions on P130 Preview Chapter 8 Thanks