Lecture 11: Resumption and the Politics of Silver and Gold

advertisement

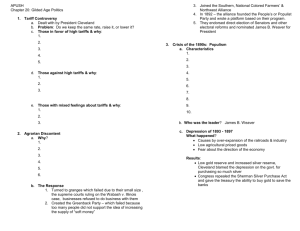

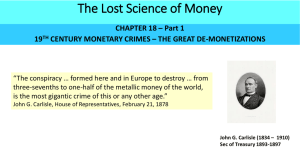

“Resumption” and the Politics of Silver and Gold Macroeconomics:Civil War to World War I • Civil War, 1861-1864 – Fiscal: Huge DeficitsHuge Increase in Federal Debt – Monetary: Abandon the Bimetallic (Effectively Gold) Standard – Monetary: Inflation in North, Hyperinflation in the South • Greenback Period, 1864-1879 – Fiscal: SurplusReduction in the Debt – Monetary: Deflation • “Resumption” 1879 – Monetary: Return to the Gold Standard • The Gold Standard, 1879-1914 – Fiscal: SurplusReduction in the Debt – Monetary: Continued Deflation and Silver Politics, 1879-1897 – Monetary: Gold Inflation, 1897-1914 Greenback Period, 1864-1879 • Fiduciary or paper money standard—print money to finance Civil War---greenbacks fall in value relative to gold/silver, i.e. inflation • Floating exchange rate—Dollar depreciates • Deflate to return to price level consistent with the bimetallic standard. • Price Level Falls by ½ by reducing Greenbacks in circulation • Two Questions: HOW? And WHY? £/$ Or $4.86 per £ Inflation Deflation £0.206 £0.103 “HOW” Quantity of $ “Why?” The Problem • 1860 Exchange Rate £1 = $4.86 under specie standard • Cotton dress in U.S. costs $4.86 and in U.K it costs £1. So it is competitive because $4.86/($/ £)4.86 = £1 • But in war, no promise to exchange $ for gold or silver. Prices in U.S. rise by 232%. In U.S. prices of dress now: $4.86x2.32=$11.32 • At end of war, U.S. cannot compete, $11.32 dresses cost 11.32/4.86= £2.32, would result in huge outflow of specie to Britain • Two choices (1) devaluation so £1=$11.32 or (2) deflation reduce prices so that dress is again $4.86 • Problem of the Debt: $100 principal with 6% coupon sold with promise that will repay in gold. • Annual coupon is $6 but this is now only worth $6/2.32=$2.89, imply that $100 bond is worth less if investors continued demand in 6% in real terms: 2.89/.06=$43.10. Bond holders would feel defrauded. So government picks deflation over devaluation. Moving from Greenbacks to Gold • 1866 House of Rep.votes 144 to 6 to return to gold---but parties soon split: Republicans generally “hard money” and Democrats “soft money” • Coinage Act of 1873, (later called the “The Crime of 1873”)—lists coins to be minted: gold and subsidiary silver but not silver dollar. Decision by Secretary of the Treasury and leading Senators--but no popular protest. • 1874 Congress sets maximum for greenback issue • Resumption Act of 1875---sets resumption of specie standard on gold basis on January 1, 1879. . • 1879---Resumption of convertibility of dollar into gold!!! SURPRISE! PRICES CONTINUE TO FALL-DEFLATION!!! U.S. Price Level (GDP Deflator) 190 Crime of 1873 180 Return to Pre-War Price Level 170 160 Resumption 1879 150 140 130 120 110 100 90 18 50 18 52 18 54 18 56 18 58 18 60 18 62 18 64 18 66 18 68 18 70 18 72 18 74 18 76 18 78 18 80 18 82 18 84 18 86 18 88 18 90 18 92 18 94 18 96 18 98 19 00 19 02 19 04 19 06 19 08 19 10 19 12 19 14 80 Surprise of More Deflation!! Gold Standard Deflation, 1879-1897 • Increased world demand for Gold coincides with slowing production of gold. • Rising productivity, increasing world output. • Result: Upward pressure on prices • Deflation in U.S. 1875-1896 1.7% p.a. (but agricultural goods fall at 3.0%---terms of trade!). • Farmers and debtors susceptible to propaganda representing “Crime of 1873” as a result of evil Wall Street plot. • Formation of the Greenback Party in 1876, Alliance in 1880s and Populists in 1890s Resumption: M* + V* = P* + Q* (growth rates) Silver Interest’s Sops • Bland-Allison Act of 1878 authorizes the Treasury to buy $2-4 million of silver. Buys silver at market price—lower than legal price. Coins silver, most in Treasury vaults for which silver certificates issues---effectively fiat money. • “Inflationists” and Mining Interest are unhappy. • Sherman Silver Purchase Act of 1890 increases silver purchases to $4.5 million of silver per month. Repealed in 1893---political struggle Who opposed “hard money?” • Political Constituency: largely rural, farmers and small-business, Southern and Western supporters of Jackson in 1834 and William Jennings Bryan in 1896 against the bankers, financiers, big business of East and Northeast • Why? Inflation reduces the value of debts and deflation increases it. Also: the Tariff and Resumption • Initially East Coast and Midwest manufactures were hostile to resumption. Why? • In Civil War (1861-1864) Morrill and War Tariffs • Decline after the war • Later restored to to high level. • Why did that satisfy manufacturing? Opposition to Gold becomes largely about Agrarian Unrest • 1890 Census: state foreclosure rate for – Farms in Illinois was 0.61% and 0.93% in 1880 and 1888 – Farms in Minnesota in 1881 and 1891, 1.38% and 1.55%. • Is this small? Large enough for a movement? Your neighbors….. Battle Over Deflation • Initially some wanted reissue of Greenbacks. • Too clearly Inflationist and seems irresponsible. • Becomes Battle between Bimetallism and the Gold Standard • Why? – Hope that two metals would reduce deflation – Yet not seem irresponsible because supply of silver is limited unlike paper – But silver appears to be unstable in value! So great resistance The problem of the gold-silver price ratio • U.S. legal rate at 16:1 since 1834---most countries are on a bimetallic system---Britain the world’s financial center is on gold. • Market rate fluctuated around 15.5 for decades then falls to 15 by 1859 with California gold discoveries. Afterwards it starts to rise. Discovery of the Comstock Lode of silver in Nevada in 1859 • 1871 Germany defeats France uses gold indemnity to abandon bimetallism---sells silver--moves to gold standard 1873. Followed by France, Italy, Belgium and Switzerland, Denmark, Norway, Sweden, the Netherlands, Austria and Russia. Only India and China on silver standard. • Silver is Dumped---price falls---silver producers unhappy. Silverites of early 1890s want to reverse monometallism • But too late, the market gold-silver ratio was not 16:1 BUT 30 to 1. • For U.S. mint to set a ratio of 16:1 would have produced huge increase in demand for silver— huge silver inflows, inflation---with major worldwide disturbances. • Furious when Sherman Act of 1890 repealed in 1893, as a result of election, no more silver purchases…..then as if to make their point….. The Disturbed Years of 1891 to 1897 • Sherman Silver Purchase Act 1890, repealed 1893 • Sharp contraction of 1892-1894, fiscal crisis for government---increasing deficits • 1893: Banking panic and bank failures. A run on U.S. gold reserves by foreigners fearful that silver agitation would force U.S. off gold standard. • Who want to hold $? Investments in U.S. would fall in value. • Speculative Attack on the $$$$ P. Garber and V. Grilli (European Economic Review, 1986) Congressional deadlock prevents Treasury from borrowing by issuing more debt—issue more legal tender notes, expanding circulation. Crisis • Run on gold reserve begins in late 1894. • In 1895, Treasury contracts with a Syndicate of J.P. Morgan and August Belmont(for Rothschild of London) for loan • Syndicate to market a bond issue in return for a large spread • Loan: 30 years 4% bonds for $65.1 million are for purchase by gold coin. • If the public took legal tender to Treasury for gold coin, the syndicate would replace lost gold. Also promise to intervene in the foreign exchange market if individuals borrowed exchange on London and sold it in New York. • Defeat of speculative attack on the dollar. • Brief and mild recovery 1894-1895 • Contraction 1895-1896, unemployment at 14% Democratic Convention, Chicago 1896 • Convention divided between Hard Money and Silver Democrats • One of the most famous speech in American political history was delivered by William Jennings Bryan on July 9, 1896, at the Democratic National Convention in Chicago. • After speeches on the money question by several U.S. Senators, Bryan rose to speak. The thirty-six-year-old former Congressman from Nebraska aspired to be the Democratic nominee for president, and he had been skillfully, but quietly, building support for himself among the delegates. • His dramatic speaking style and rhetoric roused the crowd to a frenzy. The response, wrote one reporter, “came like one great burst of artillery.” Men and women screamed and waved their hats and canes. “Some,” wrote another reporter, “like demented things, divested themselves of their coats and flung them high in the air.” • The next day the convention nominated Bryan for President on the fifth ballot. Silverites hijack the Convention The Cross of Gold Speech • It is the issue of 1776 over again. Our ancestors, when but 3 million, had the courage to declare their political independence of every other nation upon earth. Shall we, their descendants, when we have grown to 70 million, declare that we are less independent than our forefathers? No, my friends, it will never be the judgment of this people. Therefore, we care not upon what lines the battle is fought. If they say bimetallism is good but we cannot have it till some nation helps us, we reply that, instead of having a gold standard because England has, we shall restore bimetallism, and then let England have bimetallism because the United States have. • If they dare to come out in the open field and defend the gold standard as a good thing, we shall fight them to the uttermost, having behind us the producing masses of the nation and the world. Having behind us the commercial interests and the laboring interests and all the toiling masses, we shall answer their demands for a gold standard by saying to them, you shall not press down upon the brow of labor this crown of thorns. You shall not crucify mankind upon a cross of gold. • http://historymatters.gmu.edu/d/5354/ • http://www.historicalvoices.org/earliest_voices/bryan.html#recordings The Combatants: William Jennings Bryan v. William McKinley Or viewed by cartoonists The Election The Wizard of Oz by L. Frank Baum (1899) Well, there was also a movie in 1939 with Judy Garland, Bert Lahr, Ray Bolger… Where Does the Story Start? What’s the Premise? Who Does Dorothy Meet? And the Wicked Witch of the East is…… The arrive at Oz…the color of…. The confront the Wizard How does Dorothy get back to Kansas? Questions for review.. • Why is Bryan a cowardly lion in 1899? • When the foursome arrive at the Emerald City and stay the night in the Emerald Palace, why does Dorothy have to go through 7 passages and 3 flights of stairs to get to her room? • Irving Fisher’s 1896 paper: would indebted farmers gain from inflation (Hint: time to maturity of average mortgage was 2.33 years) The “what” effect for new mortgages. • Was Bryan a fool? • The quantity theory—Jevons, Laughlin, Fisher 18 50 18 52 18 54 18 56 18 58 18 60 18 62 18 64 18 66 18 68 18 70 18 72 18 74 18 76 18 78 18 80 18 82 18 84 18 86 18 88 18 90 18 92 18 94 18 96 18 98 19 00 19 02 19 04 19 06 19 08 19 10 19 12 19 14 Gold Inflation, 1897-1914 U.S. Price Level (GDP Deflator) 190 180 170 160 150 140 130 120 110 100 90 80 Contributing Factors • New gold discoveries in South Africa, Alaska and Colorado and new techniques • Poor European harvests, excellent American harvests---balance of payments surplus • Dingley tariff holds down imports. • U.S. Capital exports Friedman and Schwartz (1963)