Fair Value Measurement Disclosures

advertisement

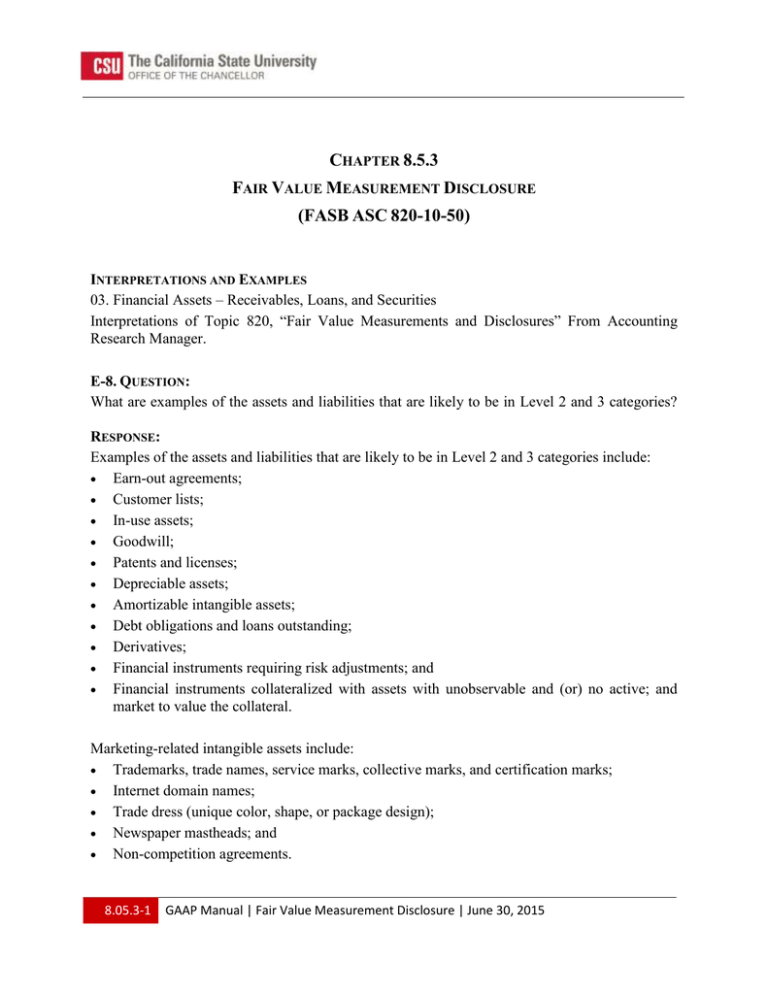

. CHAPTER 8.5.3 FAIR VALUE MEASUREMENT DISCLOSURE (FASB ASC 820-10-50) INTERPRETATIONS AND EXAMPLES 03. Financial Assets – Receivables, Loans, and Securities Interpretations of Topic 820, “Fair Value Measurements and Disclosures” From Accounting Research Manager. E-8. QUESTION: What are examples of the assets and liabilities that are likely to be in Level 2 and 3 categories? RESPONSE: Examples of the assets and liabilities that are likely to be in Level 2 and 3 categories include: Earn-out agreements; Customer lists; In-use assets; Goodwill; Patents and licenses; Depreciable assets; Amortizable intangible assets; Debt obligations and loans outstanding; Derivatives; Financial instruments requiring risk adjustments; and Financial instruments collateralized with assets with unobservable and (or) no active; and market to value the collateral. Marketing-related intangible assets include: Trademarks, trade names, service marks, collective marks, and certification marks; Internet domain names; Trade dress (unique color, shape, or package design); Newspaper mastheads; and Non-competition agreements. 8.05.3-1 GAAP Manual | Fair Value Measurement Disclosure | June 30, 2015 . Customer-related intangible assets include: Customer lists; Order of production backlog; Customer contracts and the related customer relationships; and Non-contractual customer relationship. Contract-based intangible assets include: Licensing, royalty, and standstill agreements; Advertising, construction, management, service, or supply contracts; Lease agreements; Construction permits; Franchise agreements; Operating and broadcasting rights; Use rights such as drilling, water, air, mineral, timber-cutting, and route authorities; Servicing contracts (e.g., mortgage servicing contracts); and Employment contracts that are beneficial contracts from the perspective of the employer because the pricing of those contracts is below their current market value. Technology-based intangible assets include: Patented technology; Computer software and mask works; Unpatented technology; Database; and Trade secrets such as secret formulas, processes or recipes. Artistic-related intangible assets include: Plays, operas, and ballets; Books, magazines, newspapers, and other literary work; Musical works (e.g., compositions, song lyrics, and advertising jingles); Pictures and photographs; and Video and audiovisual material, including films, music videos, and television programs. 8.05.3-2 GAAP Manual | Fair Value Measurement Disclosure | June 30, 2015 . COMMON CLASSIFICATIONS IN THE FAIR VALUE HIERARCHY LEVEL 1 LEVEL 2 Money market funds or certificates of deposit X X Derivatives X X ASSET OR LIABILITY – FAIR VALUE Loans LEVEL 3 X X Corporate bonds X X X Debt securities available for sale, including collateralized debt obligations and other asset-based securities X X X Reverse purchase agreements X U.S. Treasury securities X X Sovereign debt X X Equity investments X X X Private equity investments X Nonperforming loans X Residual interest generated from sale of mortgage-backed securities or receivables X Mortgage or other loan servicing rights X Nonfinancial assets X 8.05.3-3 GAAP Manual | Fair Value Measurement Disclosure | June 30, 2015 . REVISION CONTROL Document Title: CHAPTER 8.5.3 – FAIR VALUE MEASUREMENT DISCLOSURE REVISION AND APPROVAL HISTORY Section(s) Revised General 8.05.3-4 Summary of Revisions Previously in Chapter 8.8 Attachment F GAAP Manual | Fair Value Measurement Disclosure | June 30, 2015 Revision Date April 2015