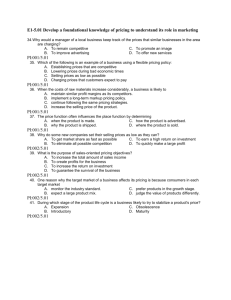

Pricing and Credit

Decisions

Part 4 Focusing on the Customer:

Marketing Growth Strategies

PowerPoint Presentation by Charlie Cook

The University of West Alabama

Copyright © 2006 Thomson Business & Professional Publishing.

All rights reserved.

Looking Ahead

After studying this chapter, you should be able to:

1.

2.

3.

4.

5.

Discuss the role of cost and demand factors in setting

a price.

Apply break-even analysis and markup pricing.

Identify specific pricing strategies.

Explain the benefits of credit, factors that affect credit

extension, and types of credit.

Describe the activities involved in managing credit.

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

Student 15–2

Setting a Price

• The revenue of a firm is a direct reflection of two

components: sales volume and price.

• Price must be sufficient to cover total cost plus some

margin of profit.

• A firm should examine elasticity of demand—the

relationship of price and quantity demanded—when

setting a price.

• A product’s competitive advantage is a demand factor in

setting price.

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

Student 15–3

Break-Even Analysis and Markup Pricing

• Analyzing costs and revenue under different price

assumptions identifies the break-even point, the quantity

sold at which total costs equal total revenue.

• The usefulness of break-even analysis is enhanced by

incorporating sales forecasts.

• Markup pricing is a generalized cost-plus system of

pricing used by intermediaries with many products.

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

Student 15–4

Pricing Strategies

• Penetration pricing and skimming pricing are short-term

strategies used when new products are first introduced

into the market.

• Follow-the-leader and variable pricing are special

strategies that reflect the nature of the competition’s

pricing and concessions to customers.

• A price lining strategy simplifies choices for customers

by offering a range of several distinct prices.

• State and federal laws must be considered in setting

prices, as well as any impact that a price may have on

other product line items.

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

Student 15–5

Credit

• Credit offers potential benefits to both buyers and

sellers.

• Type of business, credit policies of competitors, income

level of customers, and availability of adequate working

capital affect the decision to extend credit.

• The two broad classes of credit are consumer credit and

trade credit.

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

Student 15–6

Managing Credit

• Evaluating the credit status of applicants begins with the

completion of an application form.

• Customers are evaluated through the five Cs of credit:

character, capital, capacity, conditions, and collateral.

• Pertinent credit data can be obtained from several

outside sources, including formal trade-credit agencies

such as Dun & Bradstreet.

• An accounts receivable aging schedule can be used to

improve the credit collection process.

• A small firm should establish a formal procedure for

billing and collecting from charge customers.

• It is important to follow all relevant credit regulations.

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

Student 15–7

Key Terms

price

follow-the-leader pricing

credit

strategy

total cost

variable pricing strategy

total variable costs

dynamic pricing strategy

total fixed costs

price lining strategy

average pricing

consumer credit

elasticity of demand

trade credit

elastic demand

open charge account

inelastic demand

installment account

prestige pricing

revolving charge account

break-even point

trade-credit agencies

markup pricing

credit bureaus

penetration pricing strategy

aging schedule

skimming price strategy

bad-debt ratio

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

Student 15–8