Day 4 in the am

advertisement

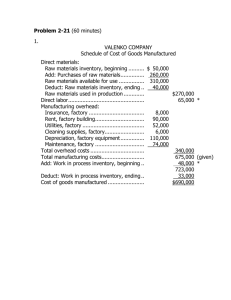

International Corporate Finance (ICF) Jim Cook Cook-Hauptman Associates, Inc. (USA) Agenda Thursday – (Sessions am: 8:30-12:00, pm: 1:30-5:00) am: Structures, Statements, Value, Analysis, Currency pm: Time & Currency Discounting/Trading of Money Friday – (Sessions am: 8:30-12:00, pm: 1:30-5:00) am: Workshop on Evaluating Financials. Discussion of the RMB pm: Internal Operations: Cash Management & Project Evaluation Saturday – (Sessions am: 8:30-12:00, pm: 1:30-5:00) am: Workshop on Financial Projections and Raising Capital pm: External Operations: Markets’ instruments and practices Sunday – (Sessions am: 8:30-12:00, pm: 1:30-5:00) am: Workshop on Mini-Cases: Process, Discrete, Software, eBay pm: Reviewing important points. Final Exam. On the Internet at: International Corporate Finance http://cha4mot.com/ICF0411 Day 4 in the am # 2 / 24 Case 1: American Chemical Factory Situation: The CFO has told the factory leader that the president insists that the “return on equity” be improved! (By that the CFO says that there must be more profit produced every month.) The factory leader’s reaction: “Of course, don’t you think we’ve been trying to do that all along. We don’t have spare capacity. Why don’t you invest more in more highly productive equipment?” Our job is to translate the CFO request into a series of tasks so that the factory can produce more every month, despite the fact that they have been trying hard to do that all along. International Corporate Finance Day 4 in the am # 3 / 24 Translating to Actions The first job of management is to translate broad goals into “Actionable Tasks” (this means, tasks stated in a way that they can be delegated and controlled. “Capital productivity” is only a clue to what needs doing. Now, let’s begin by breaking down this goal. From the “DuPont identity” we know that ROE = (Profit Margin)*(Asset Turnover)*(Equity Multiplier) (Profit Margin) means that the Margin / Unit could be increased. (Asset Turnover) means that the Volume / Time could also be increased. (Equity Multiplier) means that the Assets / Equity could also be increased, but the factory management has no authority to change this ratio. So, now how we should be able to tell the factory leader to: Increase their margin / unit and their Volume / time. International Corporate Finance Day 4 in the am # 4 / 24 Back to First Principles The factory leader knew this, but would like to discuss how to translate that into jobs for her top managers to do. We can help by pointing out that Profit Margin times Asset Turnover is called: Capital Productivity = Margin / Time = ( Margin / Unit ) * Volume / Time = ( Value / Unit - Cost / Unit ) * Volume / Time The factory leader likes the substitution of (Value/Unit – Cost/Unit) for (Margin/Time). Now she can begin delegating “Actionable jobs.” The factory leader then delegates: Higher Value / Unit Higher Value / Unit Higher Value / Unit Lower Cost / Unit Higher Volume / Time Higher Volume / Time International Corporate Finance Logistics manager with request for better delivery Scheduling manager for higher margin mix Engineering manager for hi-tech outputs upgrade Purchasing manager for reliable feedstock globally Engineering manager for higher speed processing Engineering manager for higher quality processing Day 4 in the am # 5 / 24 Our Questions Why do we believe the factory can do better? What about measurement? Simulation? What about prediction and investment? How long should we wait for results? What feedback do we give the president? How often should we monitor the situation? When will the leading signals of success be? How can we help the factory leader? Other important questions? … International Corporate Finance Day 4 in the am # 6 / 24 What actually happened? A. B. C. D. E. F. G. H. Marketing & Engr. : Heavy denier Fine denier (Value Cost) Marketing & Engr. : Solid denier Hallow denier (Value Cost) Logistics & Engr. : Select downstream Select upstream (Cost) Engr.: Industrial strength (only) Consumer grade when ok (Cost) Labor: Train to conform Inform to perform (Volume/Time) Scheduling: Maximize stability Balance flexibly (Volume/Time) Quality Engr.: Reduce waste Obviate or recycle waste (Cost) Engr.: Increase after design Design into processes (Volume/Time) Notes: 1) (A&B) The denier shift occurred in 3 months with minimum investment. 2) (D) Occurred instantaneously but with small (but lasting) effect. 3) (E&F) These had to both occur to have a good effect. 4) (G) Done with the help of Engineering. 5) (H) Only of long-term benefit. 6) Overall, success evident in 6 months; after 2 years a major turnaround! International Corporate Finance Day 4 in the am # 7 / 24 Case 2: European Auto Factory Situation: The owner has been greatly embarrassed by press reports that the Japanese are getting inventory turnover of over 40 times while his factories get inventory turnover of under 10 times! The CFO is told to lead a joint task force to improve the inventory turnover and to report to the owner within 6 weeks what they expect to achieve. Our job is to organize and inform this joint task force to be able to give the owner a reliable and acceptable forecast of our inventory turnover improvement. International Corporate Finance Day 4 in the am # 8 / 24 Our Preparations Define Inventory Turns = (Cost of Goods Sold)/Inventory Cannot increase the Cost of Goods Sold, so must decrease the Inventory! How to decrease the inventory size radically? Smaller lot sizes and more frequent deliveries (implications?) More assembly and less production (implications?) Higher productivity by quicker throughput (implications?) Evaluate the wasted material and time situation (implications?) Now we should know whom we need: Leaders of the factories (who, presumably, know production) Representative of Manufacturing Engineering Representative of Product Development & Design Representative of Factory Labor Representative from Purchasing Outcome of meeting: We need benchmarking of the situation. International Corporate Finance Day 4 in the am # 9 / 24 Benchmarking Results Item Comparison Basis America Japan 15 () 40 (2%) 1) Inventory turns / year 2) Value added / employee $50,000 (2%) $200, 000 (5%) 3) Mgmt’s. view of workers Servants Family 4) Workers’ suggestions / year .2 10 5) Machines worked on / week 1 5 6) Average lot size on hand 100 hours 3-4 hours 7) 1st Supplier involvement Late Early 8) % Parts subcontracted 40% (3%) 70% (2%) 9) Line start-up time 4 mo. (5%) 1 mo. (2%) Discipline Measurement 10) Role of Finance International Corporate Finance Day 4 in the am # 10 / 24 Observations & Discussion Which column is more like Europe? Rank the Items by effect on Inventory Turns? How does flexibility affect Inventory turns? Why might Start-up time, Suggestions, matter? What about Management’s view of workers? What data’s missing? (e.g., avg. distance to supplier?) If our company is like America, what should we change to get Inventory Turns higher? Note: Ask yourself, “Who is going to make this work?” International Corporate Finance Day 4 in the am # 11 / 24 How to effect changes? Get the essential missing data, while you … (cont’d on next line) Make a cost performance model of production Estimate sensitivity to Inventory turns (If turns lower, how much is margin higher? Under what conditions?) Begin a series of improvements, including: Reduce lot size on hand and Increase frequency of delivery Cross-train workers to work on machines with inventory Get the suppliers (& workers) involved in solutions Change relationship between supervision and workers Increase subcontracting and size of delivered components _________________________________________________ __________________________________________________ International Corporate Finance Day 4 in the am # 12 / 24 Likely Outcomes Easy gains of 20-30% in 1 year; stability takes 3 years Done well, Inventory turns will approach 20! But not 40! Around 20, bad effects appear (optimum around 18): quality productivity costs Need for deeper understanding takes hold Recognition of priority of profit and interdependencies Recognize difference of assembler vs. producer of cars Recognize start-up time is quite significant Lastly, the power’s in the workers’ hearts and minds! Role of Finance really is as a team player and catalyst! International Corporate Finance Day 4 in the am # 13 / 24 Case 3: Domestic Software Situation: You have just developed a piece of project integration software at a cost of 1,200,000 RMB. This is your 1st product and you only have 800,000 RMB investment left. How should you launch? The Product Line manager agreed (per the Business Plan) to price it at 900 RMB and selling 3,000 copies / year with the breakeven in 3 years. (+CF in 6 months.) This Plan projects the market at about 1,000,000 users in over 250,000 organizations/locations (i.e., servers). There is a competing launch plan which is risky. Your job is to render a business judgment as to which launch plan is better for your company. International Corporate Finance Day 4 in the am # 14 / 24 The Classical Launch The Business Plan calls for offering a 30 day trial for anyone who asks with the understanding that it will not work beyond 30 days unless it is registered. This Plan also calls for a “big splash” in the trade media and on the internet budgeted at 400,000 RMB and then putting 4 boxes x 250 distributors (50% margin). Your net sells at 900 RMB without discount. (Boxes cost 100 RMB each.) Distributors are also told that they could get training income as collateral sales. International Corporate Finance Day 4 in the am # 15 / 24 The “New Economy” Launch The New Economy Plan calls for offering a free copy anyone who downloads, registered or not! This Plan offers “professional” upgrades and features & manual (including file compatibility with MS) for around 100 RMB each (manual costs 60 RMB delivered). A free unannounced upgrade occurs around once a year. Distributors aren’t used as a marketing channel. The Business Plan marketing penetration was 1%; this marketing penetration is expected to be more like 40% with 8% (20%) paying, on average, 75 RMB per year (growing 20% per year to over 100 RMB in 2 years). Before you support either plan, what do you want? Hint: How do you predict a dynamic (non-linear) situation? International Corporate Finance Day 4 in the am # 16 / 24 Additional Information What is the history of such product launches? In what ways is this like Netscape? Yahoo? Google? Adobe? Can we get some academics to frame a measurable basis of benefit so we can do benchmarking of gains? Because it’s free, can we get some government, research, or university organizations to endorse it? Will they let us publicize their usage and benefits? Should we look to some advertising revenues to help support us; after all, project people are big spenders? Isn’t this a case of “Network effects?” How to: qualify, quantify, predict, control, manage, explain? Note see: http://www.fastcompany.com/online/27/neteffects.html International Corporate Finance Day 4 in the am # 17 / 24 The last analysis Does one plan preclude switching later to the other plan? (What does history tell us?) If so, the decision is critical, if not, then we can rest easily. What are the upside limits on B Plan vs. NE Plan? What are the downside limits on B Plan vs. NE Plan? What are the cash flow implications of B vs. NE Plan? What tests/sequence can reduce the decision risks? After all I learned about Marketing & Finance I need to know more about diffusion! The answer is you have to do plenty of homework, respect history, avoid the lack of history, and trust your instincts. (Who said business is “cut and dry”?) International Corporate Finance Day 4 in the am # 18 / 24 Case 4: eBay Phenomenum eBay is the world's largest trading community where millions of people buy and sell millions of items every day. They do this by posting items for sale on the internet and then have the buyers (registered users, below) bid on them up to the deadline. Founded 1995 as “World’s Online Marketplace™” a zero-inventory internet auction Financial measures: Market Cap: $72B; P/E: 103; Price/Sales: 24; Profit Margin: 24%; ROA: 11%; ROE: 13%; Growth: 78% (Revenues 83% 6 yr. CAGR to $800M) Registered users: 115% (125 M); Active: 48% (52 M) Listings: 83% (348 M); Auctioned: 87% ($8.3 B); Pmt: 71% ($4.6B) International: On most measures 100%, Mix: US 55%, ECM 35%, RoW 10%. Claims to have 1% of the $3.4T Retail market! Railroads created Sears; Interstate highways created Walmart; Internet created eBay! International Corporate Finance Day 4 in the am # 19 / 24 eBay Stock 1999-2004 International Corporate Finance Day 4 in the am # 20 / 24 eBay Globally International Corporate Finance Day 4 in the am # 21 / 24 What is PayPal? PayPal is an easy to use, free, online payment service. It is a secure, account-based system that allows anyone with an e-mail address and an Internet connection to send and receive online payments using a credit card or bank account. PayPal was founded in 1998 and purchased by eBay in 2002. It is a solution to the problem of safe payment for merchandise (or services) between parties who don’t know each other. As such, it enables person-to-person, consumer-to-business, and businessto-business online payments, and not just eBay’s. PayPal is the world's first and largest Web-based payment network, with a customer base of nearly 50 million in over 45 countries. International Corporate Finance Day 4 in the am # 22 / 24 Some questions about eBay Can they maintain 90% market share? How long can they maintain 50% growth? What are their dimensions of expansion? Could they ever have a $1T sales in 1 year? Overpriced at 10xSales and 100xEarnings? For 22 hours in 1999 they had no servers; it cost millions in sales, billions in stock! What other catastrophes might tumble them? Good stock investment? For whom? When? Ebay is betting big on China. Good idea? International Corporate Finance Day 4 in the am # 23 / 24 Concluding Remarks Questions and Answers Thank you, again. You can find a copy of this lecture (100 KB) on the Internet at: http://cha4mot.com/ICF0411 International Corporate Finance Day 4 in the am # 24 / 24