Lauren Schroth*s AP Government Exam Review Project

advertisement

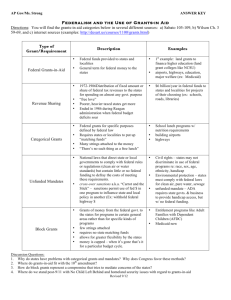

Lauren Schroth’s AP Government Exam Review Project D EVOLU T I ON FI SCA L POLI CY G RA N T I N A I D CAT EG ORI CA L G RA N T S B LOCK G RA N T S Devolution Devolution is the current effort to scale back the size and activities of the national government and to shift responsibility for a wide range of domestic programs from Washington to the states. In recent years these areas have included welfare, health care, and job training. Devolution is the transfer of power from a central government to sub national (e.g., state, regional, or local) authorities. Throughout history, there has been a tendency for governments to centralize power. During the late 20th century, however, groups in both federal and unitary systems increasingly sought to reduce the power of central governments by devolving power to local or regional governments. For example, supporters of states’ rights in the United States favored diffusing power away from Washington, D.C., toward state and local governments. This trend was also experienced throughout the world, though perhaps the two most notable instances of devolution occurred in France in the 1980s and the United Kingdom in the late 1990s. Fiscal Policy Fiscal policy is an attempt to use taxes and expenditures to affect the economy Fiscal policy is the means by which a government adjusts its levels of spending in order to monitor and influence a nation's economy. It is the sister strategy to monetary policy with which a central bank influences a nation's money supply. These two policies are used in various combinations in an effort to direct a country's economic goals. Here we take a look at how fiscal policy works, how it must be monitored and how its implementation may affect different people in an economy. Before the Great Depression in the United States, the government's approach to the economy was laissez faire. But following the Second World War, it was determined that the government had to take a proactive role in the economy to regulate unemployment, business cycles, inflation and the cost of money. By using a mixture of both monetary and fiscal policies (depending on the political orientations and the philosophies of those in power at a particular time, one policy may dominate over another), governments are able to control economic phenomena. Grant In Aid Grant-in-aid are federal funds provided to states and localities. Grants-in-aid are typically provided for airports, highways, education, and major welfare services. A grant-in-aid is money coming from central government for a specific project. This kind of funding is usually used when the government and parliament have decided that the recipient should be publicly funded but operate with reasonable independence from the state. A grant-in-aid is funds allocated by one level of government to another level of government to be used for specific purposes. Such funds are usually accompanied by requirements and standards set by the governing body for how they are to be spent. An example of this would be how the United States Congress required states to raise the drinking age for alcohol from 18 to 21 in order for the individual states to continue to qualify for federal funds for interstate highways located within each state. Categorical Grants A categorical grant is one for a specific purpose defined by federal law: to build an airport or a college dormitory, for example, or to make welfare payments to low-income mothers. Such grants usually require that the state or locality put up money to “match” some part of the federal grant, though the amount of matching funds can be quite small. Categorical grants are grants, issued by the United States Congress, which may be spent only for narrowly-defined purposes. Additionally, recipients of categorical grants are often required to match a portion of the federal funds. About 90% of federal aid dollars are spent in categorical grants. Categorical grants are the main source of federal aid to state and local government, can only be used for specific purposes and for helping education, or categories of state and local spending. Categorical Grants, cont. During the development of the Interstate Highway System, congressional grants provided roughly 90% of the funding. Categorical grants may be spent only for narrowly defined purposes and 33% of categorical grants are considered to be formula grants. More examples of categorical grants include Head Start, the Food Stamp Program, and Medicaid. This type of grant differs from block grants in that block grants are issued in support of general governmental functions such as education or law enforcement. State and local recipients have more leeway in determining how best to use the money. Governors and mayors complain about these categorical grants because their purposes were often so narrow that it was impossible for a state to adapt federal grants to local needs. One response to this problem was to consolidate several categorical grants into a single block grant devoted to some general purposes…with fewer restrictions on its use. Block Grants Block grants are grants of money from the federal government to states for programs in certain general areas rather than specific kinds of programs. Allowed devotion for a general purpose with fewer restrictions. The Federal government awards block grants to state or local governments, in a lump sum for a specific issue or problem. The local/state governments set up more specific granting guidelines within their own jurisdictions, for making smaller grants to various agencies and nonprofits. The local government creates and manages a process to identify local needs and for coordinating the grant making process, monitoring and evaluating the outcomes. For Example: The federal government has awarded many block grants to states for drug addiction education. The End Have fun taking the AP Government Exam! #13 Free-Response Question Free Response The figure above demonstrates that proportions of elderly and children have moved in opposite directions over time. The distribution of government benefits for the elderly has gone up; while the children proportion of spending has gone down. This change in distribution of government benefits between children and the elderly has been affected by a number of things. First, there was a recent rising in the elderly population and a shrinking in birth rates that caused the government to pay closer attention to the elderly. With a sufficient adult population the government needed to change its focus from child to adult. Furthermore, an increased life expectancy helped continue to push the need for the elderly to receive government benefits over time. Lastly, children cannot vote and are generally not politically organized; thus, politicians need to spend more time and money on the elderly because the elderly are the ones who vote. As the elderly population increases, an increasing number of elderly start receiving benefits. Mostly, those who receive benefits exert pressure on politicians or fund interest groups. Continuing, since the elderly vote there is a lot of pressure to appeal to them. Politicians are looking to gain election and the only way they will be able to do this is by appealing to the elderly population. When the government gives more benefits to the elderly they can ensure that they have won their vote.