Bacanora Minerals Ltd. Building a high grade

advertisement

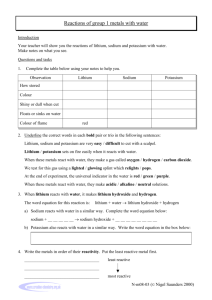

Bacanora Minerals Ltd. Building a high grade lithium producer to become a quality supplier to innovative and growing industries Corporate Presentation: Q1, 2016 Disclaimer IMPORTANT INFORMATION The information contained in these slides has been prepared by Bacanora Minerals Ltd (“Company”). The information in these slides and the presentation made to you verbally is subject to updating, completion, revision, further verification and amendment without notice. These slides have not been approved by the United Kingdom Listing Authority as a prospectus under the Prospectus Rules (made under part VI of the Financial Services and Markets Act 2000 (“FSMA 2000”)) or by the London Stock Exchange. These slides and the presentation do not constitute or form part of any offer for sale or solicitation or any offer to buy or subscribe for any securities nor will they or any part of them form the basis of, or be relied on in connection with, or act as any inducement to enter into, any contract or commitment. Recipients of these slides who are considering acquiring common shares in the capital of the Company (“Common Shares”) are reminded that in relation to any such purchase or subscription no reliance may be placed for any purpose on the information or opinions contained in these slides or the presentation or on their completeness, accuracy or fairness. These slides are presented purely for information purposes. No undertaking, representation, warranty or other assurance, express or implied, is made or given by or on behalf of the Company or any of its directors, officers, partners, employees, agents or advisers, or any other person, as to the accuracy or completeness of the information or opinions contained in these slides or the presentation. Accordingly, no responsibility or liability is accepted by any of them for any such information or opinions or for any errors, omissions, misstatements, negligence or otherwise for any other communication, written or otherwise, but except that nothing in this paragraph will exclude liability for any undertaking, representation, warranty or other assurance made fraudulently. The Company’s nominated adviser is Cairn Financial Advisers LLP (“Cairn”) and its broker is HD Capital Partners Ltd (“HD Capital”). HD Capital and Cairn, which are regulated by the Financial Conduct Authority, will not be responsible for the contents of these slides, nor for providing the protections afforded to customers of HD Capital and Cairn, nor for providing any advice in relation to the contents of these slides. Neither HD Capital nor Cairn has authorised the contents of these slides or any of them. These slides are for distribution in or from the UK only to persons authorised or exempted within the meaning of those expressions under FSMA 2000 or any order made under it or to those persons to whom these slides may be lawfully distributed pursuant to the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (“Financial Promotion Order”) as amended, including investment professionals as defined in article 19(5) and high net worth entities as defined in article 49(2) of the Financial Promotion Order. Persons who do not fall within any of these definitions should not rely on these slides nor take any action upon them, but should return them immediately to the Company. These slides are confidential and are being supplied to you solely for your information and may not be reproduced, redistributed or passed to any other person or published in whole or in part for any purpose. By accepting receipt of this document, you agree to be bound by the limitations and restrictions set out above. Neither these slides nor any copy of them may be taken or transmitted into the United States of America or its territories or possessions (“United States”), or distributed, directly or indirectly, in the United States, or to any U.S. Person as defined in Regulation S under the Securities Act 1933 as amended, including U.S. resident corporations, or other entities organised under the laws of the United States or any state of the United States, or non-U.S. branches or agencies of such corporations or entities. Neither these slides nor any copy of them may be taken or transmitted into or distributed in Canada, Australia, Japan, South Africa or the Republic of Ireland, or any other jurisdiction which prohibits such taking in, transmission or distribution, except in compliance with applicable securities laws. Any failure to comply with this restriction may constitute a violation of United States or other national securities laws. Canadian Securities Law Reader Advisory: This document contains forward-looking information within the meaning of applicable Canadian securities legislation relating, but not limited to, Bacanora Minerals Ltd.’s expectations, intentions, plans and beliefs. Forward-looking information can often be identified by forward looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intent”, “estimate”, “may” and “will” or similar words suggesting future outcomes or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information. Forward-looking information in this presentation includes, but is not limited to, the estimated future value of the Magdalena Borate Project and the Sonora Lithium Project. Disclosure pertaining to such projects is derived from a Preliminary Economic Assessments (a "PEA") (in the case of the Magdalena Borate Project) and resource estimates prepared in accordance National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") (in the case of the Sonora Lithium Project) and applicable Canadian securities laws and regulatory policies. Such reports are available under Bacanora's corporate profile on SEDAR at www.sedar.com and readers are encouraged to review such reports in their entirety. It should be noted that in the case of the Magdalena Borate Project, the PEA and all figures reproduced herein are based upon indicated mineral resources. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. The NI 43-101 report in respect of the Sonora Lithium Project includes estimates for both indicated resources and inferred resources. Inferred mineral resources are those that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorised as mineral reserves. In order to complete the aforementioned PEA and NI 43-101 report, the Qualified Person in respect of such reports has used forward looking information including, but not limited to, assumptions concerning lithium commodity prices, cash flow forecasts, project capital and operating costs, commodity recoveries, mine life and production rates. Readers are cautioned that actual results, should they be realised, may vary from those presented in the PEA and the NI 43-101 report. Further testing will need to be undertaken in order to confirm the economic feasibility of both the Magdalena Borate Project and Sonora Lithium Project. There have been no prior pre-feasibility or feasibility studies undertaken for either the Magdalena Borate Project or the Sonora Lithium Project. Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: commodity price volatility; general economic conditions in Canada, the United States, Mexico and globally; industry conditions, governmental regulation, including environmental regulation; unanticipated operating events or performance; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; competition for, among other things, capital, skilled personnel and supplies; changes in tax laws; and the other risk factors disclosed under our profile on SEDAR at www.sedar.com and within the body of the PEAs. Readers are cautioned that this list of risk factors should not be construed as exhaustive. www.bacanoraminerals.com 2 Overview Transitioning from exploration into development at its world class lithium asset o AIM/TSX-V listed mineral development company advancing a fully funded prefeasibility study at the Sonora Lithium Project o 5 million tonnes (LCE), large scale high grade Indicated NI 43-101 resource, located in Mexico, a low cost, mining friendly jurisdiction o Pilot plant lithium testwork, ongoing for past 24 months, has produced high quality lithium carbonate o Over CAD$15M million invested to date o Strong cash position of CAD$20* million o Strong management team with extensive experience in developing production and off-takes for lithium projects o Lithium hydroxide testwork ongoing www.bacanoraminerals.com (*See press release 16.11.15: £8.8 Million Raised to Advance Sonora Lithium Project ) 3 Board and Key Data Highly experienced Board with proven track records in the natural resource arena Colin Orr-Ewing Chairman & Director • • • Shane Shircliff Director • • James Leahy Non-Executive Director • • • • Kiran Morzaria Non-Executive Director • • Mark Hohnen Non-Executive Director • Began career as an investment manager for the Shell Pension Fund 35 years’ experience spanning both the oil and mining industries Mr. Orr-Ewing also consults to a fund management company on its natural resources portfolios 15 years’ experience in the mining and resources industry in various senior executive roles Worked on a range of projects including uranium, gold, silver, coal, industrial minerals, diamonds as well as oil, gas and coal Significant Shareholders Rare Earth Minerals Plc 16,632,915 17.21% Igneous Capital Ltd (1) 15,000,000 15.52% Colin Orr-Ewing 10,968,793 11.35% M&G Investment Funds 8,399,642 8.69% D&A Income Ltd 5,303,030 5.49% Saorse Limited 3,510,046 3.63% Began his career at the LME 29 years in the mining industry as a specialist corporate broker, including mining finance, origination and equity sales Worked on a wide range of projects, worldwide Substantial experience with international institutional fund managers, hedge funds and sector specialists Holds a Bachelor of Engineering (Industrial Geology) from the Camborne School of Mines and an MBA (Finance) from CASS Business School Fifteen years’ experience in the mineral resource industry Extensive international business experience in a wide range of industries including mining and exploration, property, investment, software and agriculture. He was founding Chairman of Cape Mentelle and Cloudy Bay wines, was also a director of Kalahari Minerals and Extract Resources. www.bacanoraminerals.com Market Ticker NOMAD Market Cap 23.11.15 Broker AIM/ TSX-V BCN Cairn Financial Advisers £78.75 m HD Capital Partners Ltd (1) Graham Edwards is the ultimate beneficial owner of Igneous. Mr. Edwards is also one of the potential beneficiaries of a trust that owns D&A Income Limited, which owns 5,303,030 Common Shares representing 5.49 per cent. of the issued share capital of the Company. 4 Management Led by a CEO who negotiated the 1st large scale, long term lithium off-take with a Chinese SOE Peter Secker CEO Mining engineer with over 30 years’ experience in the resources industry. During his career he has built and operated a number of mines and metallurgical processing facilities in Africa, Australia, China and Canada. His operating and project experience spans a number of commodities, including titanium, copper, iron ore, gold and lithium. For the past 10 years Peter has been Chief Executive of a number of publicly listed companies, most recently as CEO of Canada Lithium Corporation whilst developing the Quebec Lithium project. Martin Fernando Vidal Torres President and Director Mr. Vidal has been with Bacanora since 2011 when he joined the firm as Vice President, Exploration – Mexico. Besides his role as President and Director of Bacanora, he currently serves as Director and sole administrator of MITSA and MSB, two fully-owned Mexican subsidiaries of Bacanora and the operating vehicles for the development of the Company's projects owned in Mexico. He also serves as Director and sole administrator of Mexilit and Megalit, two Mexican subsidiaries that are owned by Bacanora (70%) and Rare Earth Minerals Ltd (30%). Mr. Vidal started his career as geologist with the US Borax exploration team and has many years of experience working in Northern Mexico, particularly in the project areas that Bacanora are now developing. Eric Carter Project Manager Over 22 years’ lithium carbonate production expertise with FMC in North America, with extensive experience of lithium hydroxide and lithium metal process operations. David Serratos Pilot Plant Manager Joined Bacanora in 2012. Currently he serves as Plant Manager on the Bacanora pilot plant, being responsible of design and manufacturing of plant equipment, process development, working systems and general control of the plant. Prior to that, he served as General Manager in the automotive industry, being responsible designing and assembling automotive components. His expertise also includes the design and manufacturing of thermal-solar systems including its automation and later involved in process development and project and construction management. David graduated from the University of Sonora (1991) and holds a BSc in Industrial Engineering. Derek Batorowski CFO and Director Over 22 years’ experience in the mineral exploration industry at both the national and international level. Derick’s specific focus has been in accounting, finance, corporate planning, treasury and taxation sectors with both public and private companies. Lizeth Soriano Laboratory Manager Joined Bacanora in 2012 as laboratory analyst and served as Laboratory Manager since 2013, being responsible for the experimental metallurgical area at laboratory and pilot plant scales on the different projects that the Company is developing. Prior to joining us, Lizeth served as professor in the Universidad del Valle de México and participated in various research programs focused in the production of clay-based photo-catalyzers for water treatment plants. She is a graduate of the University of Sonora where she holds a BSc in Process Engineering and a Master Science degree in Chemical Engineering. Daniel Calles Senior Geologist With Bacanora since 2011 and currently serves as Principal Geologist, being responsible for all of the fieldwork conducted by the Company in its different projects as well as responsible for supervision, logging, sampling and reporting on the continuous drilling campaigns that the Company is conducting. Prior to joining Bacanora, Daniel had nine years of experience working in different companies as exploration geologist in base and precious metals, mostly in northwestern Mexico. Daniel has a BSc. in Geology from the University of Sonora (2006). Cordelia Orr Ewing Corporate Manager Joined Mirabaud Securities, the broking arm of the Swiss private bank, in 2009 where she supported the Corporate Broking and Natural Resources teams. Subsequent to that, she joined Williams de Broe, a well established private client stockbroker, where she was involved in assessing client / transaction suitability. Cordelia joined Strand Hanson, in June 2010, as a analyst within the Corporate Finance team, specialising in Natural Resources transactions. Thereafter she joined Bacanora Minerals (in 2014) to assist with the AIM flotation and ongoing management of the Company’s UK operations. Cordelia is Company Secretary for the Association of Mining Analysts. www.bacanoraminerals.com 5 Strategy Strategy to become a large scale lithium producer, combining high grades and scalability, with potential upside from borates Target to complete Feasibility process at Sonora Lithium Project o Deliver a pre-feasibility study for 35,000tpa Li2CO3 operation by Q1 2016 o Evaluate significant resource upside with potential to grow project to 50,000tpa Li2CO3 The Magdalena Borate Project will potentially provide up to 50,000tpa of boric acid production for domestic use: o Boric acid pilot plant and study work ongoing in tandem with lithium development o Complete Bankable feasibility study by Q1, 2017 o Ongoing testwork lithium hydroxide www.bacanoraminerals.com (LiOH) 6 Lithium Portfolio Ideally positioned for infrastructure and proximity to markets www.bacanoraminerals.com 7 The Lithium Market A key component in a range of innovative industries providing strong market dynamics o High energy storage (lithium batteries), insulating and heat resistant capabilities o 11% annual growth in global consumption between 20122017 forecast o Total global production for 2013 was 186,000 tonnes of lithium carbonate equivalent (LCE) (source: USGS) o Expected increase in global demand to 280,000 tonnes pa LCE by 2020 (source: USGS) Smart phone batteries Tablet rechargeable batteries o Tesla aiming for 500,000 vehicles per year by 2020 and over 40 new models of HEV and EV to be released in China by 2015 o 85% of lithium production is from 4 companies, (FMC, Rockwood, SQM and Tianqi) Electric Vehicles o Sector M&A activity increasing - US$6 billion merger between Albemarle and Rockwood (July 2014) Smart Grids *LCE is the industry standard terminology for, and is equivalent to, Li2CO3. 1 ppm Li metal is equivalent to 5.32 ppm LCE / Li2CO3. Use of LCE is to provide data comparable with industry reports and assumes complete conversion of lithium in clays with no recovery or process losses. Sources: www.cleantechnica.com and Lithium Market Outlook 2017, Roskill Information www.bacanoraminerals.com 8 Lithium Views Toyota said last month it has sold more than 5 million gasoline – electric hybrid vehicles as of the end of March since they first went on sale in 1997 "Lithium supply security has become a top priority for Asian “ The global lithiumion battery market was estimated at $17.5bn in 2013. Market size to technology companies" quadruple ($70B) U.S. Geological Survey by 2020 ” “ The total Current forecasts predict the global market for Li- addressable market ion batteries in passenger size for Tesla vehicles will grow from Energy products is $3.2 billion in 2013 to $24.1 billion in 2023. enormous and much easier to scale globally than vehicle sales ” Sources: www.insideevs.com / www.bloomberg.com www.bacanoraminerals.com 9 EV’s to Grid Storage Lithium Consumption Estimated at 410,000tpa by 2025 Lithium carbonate consumption by application*: Cell phone: Laptop: Hybrid: EV Grid 3g 30g 7kg 25-50kg 500 kg/ MWh “The global lithium battery market estimated at $17.5bn in 2013 expected to quadruple ($70B) by 2020” Historical Price Declines in Consumer and Automotive Lithium-ion Batteries www.bacanoraminerals.com NEC and Amergin Energy’s 60-MW storage network will provide over 525 MW‐hours of flexible power *http://www.evworld.com/article.cfm?storyid=1826 10 Lithium Supply and Pricing Recent 2015 pricing from China shows a range of $5-6,500 per tonne** Roskill’s Analysis of Production Costs Growth Across all Applications to 2018* www.bacanoraminerals.com Lithium Carbonate Prices – US$/ metric tonne**** Growth Across all Applications to 2025*** (*Fox-Davies: The Lithium Report) (** Metal Bulletin) (*** SignumBOX estimates, March 2013) (**** SignumBOX 2015) 11 Sonora Lithium Project – Overview Amongst one of the world’s largest lithium resources – high grade and scalable o 104,064 Ha licence area, located 190km NE of Hermosillo in northern Mexico, consisting of 10 contiguous concessions o Scalable production strategy to produce up to 50,000 tpa of lithium carbonate o o o Pre-feasibility at La Ventana concession and design of full scale lithium plant currently ongoing Due for completion in Q1 2016 2 years of pilot plant operations to produce high grade lithium carbonate undertaken o Working with a number of potential off-take customers for its future lithium production o NI43-101 resources o o Indicated: 5.0 Mt of LCE (364Mt at 2,600 ppm Li) Inferred 3.9 Mt of LCE (355 Mt2,000 ppm Li) o Further expansion and resource drilling planned for late 2016 o Access to excellent infrastructure www.bacanoraminerals.com 12 Sonora Lithium Resource Large resource lends itself to conventional open pit mining with planned low strip ratio Classification Concession La Ventana Owner Minera Sonora Borax El Sauz Indicated Fleur Mexilit (JV-1) El Sauz1 Indicated Total La Ventana Minera Sonora Borax El Sauz Inferred Fleur Mexilit (JV-1) El Sauz1 Inferred Total Geological Unit Clay Tonnes (Mt) Clay Grade Contained Contained Metal Contained LCE attributable to (Li ppm) Metal (Kt Li) (Kt LCE) Bacanora (Kt LCE) Lower Clay 75 3,500 261 1,385 1,385 Upper Clay 66 1,500 99 523 523 Lower Clay 60 2,900 174 924 647 Upper Clay 47 1,100 52 274 192 Lower Clay 60 4,300 258 1,365 956 Upper Clay 50 1,600 81 428 300 Lower Clay 4 4,000 15 80 56 Upper Clay 3 1,200 3 18 13 Combined 364 2,600 943 4,997 4,070 Lower Clay 55 3,800 209 1,108 1108 Upper Clay 80 1,500 120 636 636 Lower Clay 85 1,600 136 721 505 Upper Clay 55 800 44 233 163 Lower Clay 20 4,200 84 445 312 Upper Clay 20 1,500 30 159 111 Lower Clay 20 4,000 80 424 297 Upper Clay 20 1,200 24 127 89 Combined 355 2,000 727 3,853 3,220 See press release dated 23.11.15: Indicated Mineral Resource Estimate increased to 5.0 million tonnes of LCE at the Sonora Lithium Project 1.LCE is the industry standard terminology for, and is equivalent to, Li2CO3. 1 ppm Li metal is equivalent to 5.32 ppm LCE / Li2CO3. Use of LCE is to provide data comparable with industry reports and assumes complete conversion of lithium in clays with no recovery or process losses . www.bacanoraminerals.com 13 Lithium Extraction Estimated Operating Costs Source $/t Li2CO3 Brines 2,000-3,000 Clays* 2,500-3,300 Hard rock 3,000-5,000 Li2CO3 product SX and IX purification Na2CO3 addition Leach and precipitation Gypsum roast (1,000 degrees and 30 mins) Tromel and screen Open pit mining www.bacanoraminerals.com (* Western Lithium PEA) 14 La Ventana, Fleur and El Sauz Production potentially near the bottom of the cost curve o PEA(1) completed on La Ventana o Proposes that operating costs are towards the bottom of the cost curve when compared with other lithium producers o Optimisation underway - current plans focused on roasting which is cheaper as opposed to pugging which was considered in the PEA o International engineering groups completing PFS: o o o o SRK: Resources IMC: Mining SGS: Metallurgical testwork Ausenco: Process engineering infrastructure and 1. It should be noted that a Preliminary Economic Assessment was previously completed in respect of the Ventana concession only. Since the time of that PEA, a renewed resource estimate has been produced in respect of the entirety of the Sonora Lithium Project. As a result, reliance on the prior PEA is very limited and is mention here solely to illustrate cost estimates, as discussed above. www.bacanoraminerals.com 15 Pilot Plant in Hermosillo A cost effective way of conducting analysis & increasing BCN staff’s technical expertise o An integrated lithium carbonate facility with preconcentration, roasting and leaching circuits o High grade (99.5%) lithium carbonate lab production achieved o On-site laboratory with equipment and facilities to process and test assays from samples sourced from the borate and lithium concessions o Able to process up to 125 assays per day o Metallurgical tests on-going to refine and optimise the boric acid production o Enables development and refinement to beneficiate and upgrade the materials o Grade enhancements have been achieved www.bacanoraminerals.com 16 Mexico* Supportive operational environment with positive fiscal terms applied by a stable government Economy: o Second largest GDP in Latin America at US$1.0 trillion o Free market economy and part of NAFTA o US$23 billion mining foreign investment over last 10 years o Fourth biggest exporter of cars globally Mining: o World’s largest silver producer, 8th largest gold producer, 10th largest copper producer o Generates >330,000 direct mining jobs o International investment ranking at #33 (out of 122 countries) by Fraser Institute* o Over 15% of Mexico’s land mass registered under mining concessions o Approximately US$18 billion investment in mining industry between 1999 and 2013 www.bacanoraminerals.com (* Source: www.promexico.gob.mx) (**Fraser Institute 2014) 17 Borate Portfolio www.bacanoraminerals.com 18 The Borate Market Borates are used in a variety of important materials and industrial applications Global Boron Compound Uses. Source: US Borax o Uses include: o o o o Insulation fibreglass, glass manufacturing, ceramic glazes and porcelain enamels Agriculture is also a large user of borates worldwide given it is one of the seven essential micronutrients vital for fertilisation, fruit and seed production Found in most cleaning and detergent products Boron is also uniquely capable of capturing neutrons and is used in nuclear shielding and cooling for nuclear reactors o Boric acid is a widely used industrial mineral, current market price: $620-900 per tonne (source: Industrial Minerals) o China is the largest consumer of boron based materials with consumption of approx. 1.1Mtpa* o Major constraints for the supply of boron are low abundance, concentrated reserves and historically complex manufacturing process* o 72% of global production from 2 producers – Rio Tinto and Eti Maden (State owned Turkish business)** www.bacanoraminerals.com Other, 25% Glass and Fibreglass, 43% Detergents, 3% Agriculture Nutrients, 10% Ceramics and Tiles, 19% Demand is growing, fuelled by: Rising urban populations particularly in Asia Growth within the agricultural sector Improved standards in construction industry Discovery of new technological applications * Source: www.transparencymarketresearch.com ** http://www.etimineusa.com/en 19 Magdalena Borate Project – Overview Represents an opportunity to develop domestic Mexico boric acid production Map of Bacanora Minerals’ Concessions o 100% owned, 16,503 Ha borate project located in the Magdalena Basin, Sonora State in northern Mexico o 7 concessions with El Cajon the most advanced o NI 43-101 indicated resource of 11.06m tonnes at 10.6% grade for 1,170,000 tonnes of boron trioxide (B₂O₃) o Boric acid pilot plant work ongoing o Test pit and pilot plant operational with new boric acid circuit o o o o o Produced 99% boric acid purity (independently verified) 930 tonnes from the borates have been processed through the pilot plant with samples of 99% boric acid sent to potential off take customers Pilot plant study to be commenced based on higher value boric acid Indicated Resources Estimate for El Cajon Deposit Unit Cut-off (B₂O₃)% Tonnage (mt) Grade (B₂O₃) Tonnes (B₂O₃) A 8 7.49 10.8 808,000 B 8 0.81 9 72,000 C 8 2.76 10.5 290,000 11.06 10.6 1,170,000 Previous CAPEX estimate of approximately US$10 million Established infrastructure; grid supply, road, water and rail nearby Total (A+B+C) www.bacanoraminerals.com 20 El Cajon The open pit at El Cajon, Magdalena Geological Cross Section through the El Cajon Deposit www.bacanoraminerals.com 21 Borate Processing www.bacanoraminerals.com 22 Estimated Development Timeline Sonora sits at the heart of BCN; Magdalena has the potential to provide boric acid production Q4 15 Q1 16 Q2 16 Q3 16 Q4 16 Lithium PFS 43-101 Resource Update PFS 43-101 Pre-Feasibility Study Lithium pilot plant operations Off-take negotiations Bankable Feasibility Study Borates Borate pilot plant studies Borates production strategy report www.bacanoraminerals.com 23 Investment Case Large scale lithium asset with significant production potential High grade and scalable Stable jurisdiction Proven management LiOH testwork underway Strong cash position www.bacanoraminerals.com 24 Contact Bacanora Minerals Ltd Peter Secker E: info@bacanoraminerals.com www.bacanoraminerals.com St Brides Partners Ltd Financial PR Elisabeth Cowell/ Frank Buhagiar T: +44 (0) 20 7236 1177 www.stbridespartners.co.uk www.bacanoraminerals.com 25