Public and Common Goods

advertisement

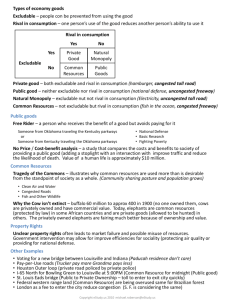

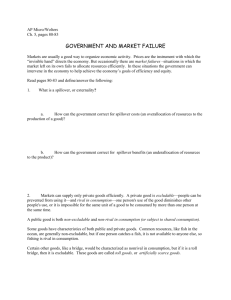

Chapter 11 Public Goods and Common Resources The Different Kinds of Goods • Two criteria for classifying different kinds of goods 1. Excludability • Can a person can be prevented from using it? – Yes – Private Good (PMB=SMB, no externality) – No – Public Good or Common Property/Resource » Externality (either SMB > PMB or PMC < SMC) 2. Rivalry in consumption • Does one person’s use diminishes other people’s use? – Yes – Private Good – No – Public Good or Common Property 2 Figure 1 Four types of goods Rival in consumption? Yes Yes Excludable? No No Private goods Natural monopolies - Ice-cream cones - Clothing - Congested toll roads - Fire protection - Cable TV - Uncongested toll roads Common resources Public goods - Fish in the ocean - The environment - Congested nontoll roads - Tornado system - National defense - Uncongested nontoll roads Goods can be grouped into four categories according to two characteristics: (1) A good is excludable if people can be prevented from using it. (2) A good is rival in consumption if one person’s use of the good diminishes other people’s use of it. This diagram gives examples of goods in each category. 3 The Different Kinds of Goods • Types of goods – Public goods • Not excludable & Not rival in consumption – Common resources • Rival in consumption & Not excludable – Private goods • Excludable & Rival in consumption – Natural monopoly • Excludable & Not rival in consumption 4 The Different Kinds of Goods • Public goods & Common resources – Not excludable: people cannot be prevented from using them (free riders) – Externalities • Public Good: positive externality/benefits for the public, but not compensated for in market – SMB > PMB -> 2 different demand curves » Produce too little when PMB = PMC (Market) • Common property resource: negative externality/costs – PMC < SMC -> 2 different cost curves » Overuse of the resource 5 Public Goods • The free-rider problem (can’t exclude) Free rider = not excludable • Person who receives the benefit of a good but avoids paying for it 1. Public goods = can’t get everyone to pay for benefits derived (e.g., fire protection) • Free-rider prevents the private market from supplying the economically efficient as SMB > PMB but people only pay for PMB 2. Common Property • Others use of the property degrades productivity -> imposing costs on others (SMC > PMC) 6 Public Goods • The free-rider problem – Government - can remedy the problem • If total benefits > costs of a public good, then: 1. Provide the public good (or subsidize it) 2. Pay for it with tax revenue – Makes everyone better off 7 Public Goods • Some important public goods – National defense • Very expensive public good – Basic research • General knowledge – Fighting poverty • Welfare system • Food stamps – Education 8 Are lighthouses public goods? • Lighthouses (an older example) – Mark specific locations so that passing ships can avoid treacherous waters • Benefit - to the ship captain – Not excludable, not rival in consumption • Incentive – free ride without paying – Most - operated by the government • In some cases – Lighthouses - closer to private goods • Coast of England, 19th century – Lighthouses – privately owned and operated – The owner - charged the owner of the nearby port 9 Are lighthouses public goods? • Decide whether something is a public good – Determine who the beneficiaries are – Determine whether the beneficiaries can be excluded from using the good • A free-rider problem – When the number of beneficiaries is large – Exclusion of any one of them is impossible 10 Public Goods • The difficult job of cost–benefit analysis – Government • Decide what public goods to provide • In what quantities – Cost–benefit analysis • Compare the costs and benefits to society of providing a public good • Don’t have any price signals to observe – See Harris • Government findings on the costs and benefits – Rough approximations at best 11 How much is a life worth? • Cost: $10,000 – new traffic light • Benefit: increased safety – Risk of a fatal traffic accident • Drops from 1.6% to 1.1 % • Obstacle – Measure costs and benefits in the same units • Put a dollar value on a human life – Priceless = infinite dollar value – Expected future earnings • Underestimates – “non-pecuniary” ($) benefits • Lower bound (or minimum value) 12 How much is a life worth? • Put a dollar value on a human life – Implicit dollar value • Courts - award damages in wrongful-death suits – Ignores other opportunity costs of losing one’s life • Occupational Risks - people are voluntarily willing to take – Value of human life = $10 million • Cost-benefit analysis • Traffic light – Reduces risk of fatality by 0.5 percentage points • Expected benefit = 0.005 × $10 million = $50,000 • Cost ($10,000) < Benefit ($50,000) • Approve the traffic light 13 Common Resources • Common resources – Not excludable – Rival in consumption • The tragedy of the commons – why are common resources used more than is desirable • Social and private incentives differ • Arises because of a negative externality – Don’t take into account costs imposed on others when equating PMB and PMC 14 Common Resources • The tragedy of the commons – Negative externality • One person uses a common resource – Diminishes other people’s enjoyment of it • Common resources tend to be”overused” – Government - can solve the problem • Regulation or taxes – Reduce consumption of the common resource • Turn the common resource into a private good – Tradable permits (Individually Transferable Quotas) 15 Common Resources • Some important common resources – Clean air and water – Congested roads – Fish, whales, and other wildlife 16 Property Rights • Externalities often arise because of a lack of clearly defined property rights. – Ask: Who owns the air? Can I pollute? • Private property – Provides exclusive right of ownership that allows for the use and exchange of property – Creates incentive to maintain, protect, and conserve property, as well as listen to the wishes of others Private Solutions to Externalities • The Coase theorem – If private parties can bargain without cost over the allocation of resources • They can solve the problem of externalities on their own – Private economic actors • Can solve the problem of externalities among themselves – Whatever the initial distribution of rights • Interested parties - reach a bargain: – Everyone is better off & Outcome is efficient 18 Private Solutions to Externalities • Why private solutions do not always work – High transaction costs • Costs that parties incur in the process of agreeing to and following through on a bargain – Bargaining simply breaks down – Large number of interested parties 19 Why the cow is not extinct • Species of animals – Public Goods • Have a commercial value - threatened with extinction – Buffalo » North America » Hunting to near extinction - 19th century (from trains) – Elephants (Ivory) » African countries » Hunting – today – Private good • The cow – Commercial value – Species - continue to thrive 20 Why the cow is not extinct • Elephant - common resource – No owners – Poachers - numerous • Strong incentive to kill them • Slight incentive to preserve them • Cows - private good – Ranches - privately owned – Ranchers • Great effort to maintain the cattle population on his ranch • Reaps the benefit 21 Why the cow is not extinct • Government intervention – help elephant population – Kenya, Tanzania, and Uganda (CAC solution) • Illegal to kill elephants; Illegal to sell ivory • Hard to enforce • Elephant population – still diminishing – Botswana, Malawi, Namibia, and Zimbabwe • Elephants – private good • Allow people to kill elephants – Only those on their own property • Landowners - incentive to preserve elephants • Elephant population – started to rise 22