Tim Gilbert presentation

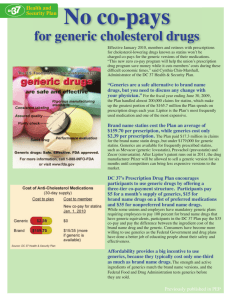

advertisement

Hatch-Waxman: Upsetting the Balance Tim Gilbert Hatch-Waxman: A Delicate Balance Innovation Access Background on the Generic Drug Industry The Need for A Strong Generic Industry: • Generics cost, on average, 30% to 80% less than their brand counterparts. • Generics accounted for 56% of all prescriptions dispensed in 2005, according to IMS Health data, but less than 13.1% of every dollar spent on prescription drugs. • According to a 1998 study by the Congressional Budget Office, generic drugs save consumers between $8 billion and $10 billion each year. Branded products coming off patent are valued at over $27 billion in 2007, and $29 billion in 2008. Exploding the Myth on Copying: Generics Innovate Bringing generics to market involves more than copying • Innovation by generic sector can involve developing new forms of the active ingredient, new processes and new formulations • Along the way, generic companies often get their own innovative patents on a more efficient manufacturing process, new formulations or new forms of the active ingredient Generic Drug Development Cycle Time from Initial Product Selection to Market: 5 - 7 years General Steps in Process Intellectual Property Hurdles 1 Assess Patent Landscape Evaluate all IP Hurdles 2 Product Selection & Sourcing API Non-infringing API / process or invalidate patent 3 Formulation Experimentation Non-infringing formulation / process or invalidate patent 4 Testing for Pharmaceutical Equivalence & Bio Equivalence 5 Submission Non-infringement of use patent / invalidate patents 6 Preparation of certification Address all listed patents 7 Litigation Continue to monitor for new IP Why Do We Need 180-day Period? The Free-Rider Problem: • First-filer does all the heavy lifting to get a generic to market (R&D, litigation etc.) Subsequent entrants “piggy-back” on first-filers efforts. 180-day period creates incentive for first filer to incur risk, but not only recouping litigation costs, but also creating a “war chest” for future development. • Just like brand companies need a “war chest” from blockbuster drugs to develop new products The Promise: 180-day Exclusivity Period 21 U.S.C. 355(j)(5)(B)(iv) (iv) 180-day exclusivity period.— (I) Effectiveness of application.— Subject to subparagraph (D), if the application contains a certification described in paragraph (2)(A)(vii)(IV) and is for a drug for which a first applicant has submitted an application containing such a certification, the application shall be made effective on the date that is 180 days after the date of the first commercial marketing of the drug (including the commercial marketing of the listed drug) by any first applicant. Why Was 180-day Period Granted by Congress? What the FTC Said “Through this 180-day provision, Hatch-Waxman provides an incentive for companies to challenge patent validity and to ‘design around’ patents to find alternative, non-infringing forms of patented drugs. The 180-day marketing exclusivity provision was intended to increase the economic incentives for a generic company to be the first to file an ANDA containing a paragraph IV certification and get to market.” How the 180-Day Exclusivity Should Work: Generic Prozac® • • Barr Labs. launches generic Prozac® (fluoxetine) in August 2001 After the 180-day exclusivity ends, 4 generic applicants enter the market Effect on Barr Labs.: • During the 180-day exclusivity, Barr earns a return on investment following its successful patent litigation and development of a new drug product • Barr invalidated the patent on Prozac® Generic came to market 3 years early (Commissioner Leibowitz, FTC) How the 180-day Exclusivity Should Work: Generic Prozac 100% Generics 90% Generic Exclusivity (Q3 2001 to Q4 2001) 80% 70% 60% Market Share 50% 40% 30% Barr Pharmaceuticals, Inc. (1st Generic) 20% 10% Eli Lilly and Company (Brand) 0% Jun-01 Sep-01 Dec-01 Mar-02 Jun-02 Sep-02 Dec-02 What Congress Did Not Intend 20-year patent term 5-year data exclusivity for NME’s 3-year data exclusivity supplement for clinical trials 6-month pediatric exclusivity 30-month automatic stay Up to 5 year patent term extension Brand Innovation 180-day exclusivity Generic Access How the 180-Day Exclusivity Should Not Work: Generic Paxil® • • Apotex launches generic Paxil® (paroxetine) in Sept. 2003 On same day, Par launches an authorized generic Paxil® Effect on Apotex: • Apotex had expected to earn revenues of ~$530-575 million, but actually earned revenues of ~$150 million • Apotex lost revenues of ~$400 million in the first 180 days alone • During the 180-day exclusivity, Par achieved generic market share of 65%, and Apotex of 35% • GSK and Par had combined market share of over 70% during the 180-day exclusivity How The 180-day Exclusivity Should NOT Work: Generic Paxil 100% 90% 80% Brand and Authorized Generic 70% 60% 50% Par Pharmaceutical, Inc. (Authorized Generic) Market Share 40% Apotex Inc. 30% 20% 10% 0% GlaxoSmithKline PLC (Brand) Jul-03 1 Aug-03 Sep-03 Oct-03 2 3 4 Nov-03 5 Dec-03 Jan-04 6 7 Feb-04 Mar-04 8 9 Apr-04 1 May-04 11 The Authorized Generic Attack Unveiled “The idea was somebody has a six month exclusivity, but we are king maker; we can make a generic company compete during a very profitable time… We are not a generic company, and do not wish to become one. If we acquired the most successful generic company in the world, it would barely move the needle on profit.” - Statement by J.P. Garnier, CEO, GlaxoSmithKline, Q4 2003 Earnings Conference Call and Presentation, Feb. 13, 2004 The Authorized Generic Attack Unveiled “For this [strategy] to really work, you’d have to have the whole industry do that systematically each time a patent expires so that you truly eliminate the incentive in the calculation that generic companies would make. We cannot agree to do that as an industry [because of antitrust concerns, but] it’s a very interesting and intriguing idea. Food for thought.” - Statement by Sidney Taurel, CEO, Eli Lilly, The Pink Sheet, Dec. 8, 2003 Number of Products The Rising Tide of Authorized Generics 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 0 1998 1999 2000 2001 2002 2003 Number of Authorized Generics Released/Threatened During 180-Day Exclusivity – 1998 to Present 2004 2005 The Authorized Generic Attack Unveiled “If the generic, the true generic is run out of the market because they can’t recoup their costs of developing the drug and filing the ANDA and possibly undergoing years of litigation, isn’t it in point of fact that the ultimate winner there would be the brand and this would have the deleterious effect of driving the generics out of the market?” - Judge Keeley in Mylan v. FDA (N.D.W.Va. Aug. 27, 2004) The Case Against Authorized Generics (1) PRICING Do authorized generics lower prices for consumers? (2) INCENTIVES Do authorized generics undermine incentives for generics to innovate? The Case Against Authorized Generics But authorized generics increase competition, so doesn’t that mean lower prices for consumers? But do authorized generics actually lower prices? The Case Against Authorized Generics: Impact on Prices PhRMA-Sponsored Report • Conducted by IMS Consulting; • Looked at effect on generic drug prices when authorized generics were released during 180-day exclusivity period, using IMS data for 18 drugs; Findings: • Concluded that the wholesale price discounts off brand prices on average were 15.8% greater in markets with AGs than in those without them. BUT The PhRMA Report looked at wholesale prices, not retail prices that consumer actually pay The Case Against Authorized Generics: Impact on Retail Prices Liang/Hollis Report • Replicated the PhRMA Study, but looked at effect on retail generic drug prices when authorized generics were released during 180-day exclusivity period, using IMS data for the same 18 drugs; Findings: • Discounts off retail brand prices were on average 0.6% less in markets with AGs than in those without them when weighting by sales revenues; • Discounts off retail brand prices were on average 5% more in markets with AGs when not weighting by sales revenues; The Case Against Authorized Generics: Impact Incentives Authorized generics gut the incentive to invent around and challenge brand patents by capturing critical market share and reducing returns during that period by at least 50% The Case Against Authorized Generics: Impact Incentives But Aren’t the Number of ANDA’s Filed Increasing? • There is an increasing number of “me-too” ANDA’s, Para. III ANDA’s and ANDA’s for products which already have a generic version; • Impact of authorized generics on Para IV ANDA’s will be seen in several years – decision to pursue development of a generic drug is made 5-7 years before ANDA is filed. The Case Against Authorized Generics: Possible Impact of Diminished Incentives • Continuance of invalid brand patents • Reduced incentive to invent around patents • Slower generic entry • One month delay in true generic entry = enormous losses to consumer. The Case Against Authorized Generics: It’s All Brand Tactic BOTTOM LINE: No authorized generic would ever come to market unless a generic was already there – A brand will only release an authorized generic if it has to in order to undercut true generic competition A Word On Patent Settlements Increasing number of brand-generic patent settlements. Why? • Coincides with an increase in authorized generics • Negotiating power in settlement discussions has shifted: Generic is faced with the release of an authorized generic even if the generic wins in litigation. • Generic is faced with choosing to incur cost and risk of continuing the patent challenge and facing at least 50% fewer returns during the 180-day period, or settle. The Ideas for Reform (1) Elimination of Authorized Generics – Rockefeller, Leahy, Schumer bill; (2) Creation of an Effective Declaratory Judgment Provision – Remove potential for patent settlements to bottleneck market entry by allowing subsequent filers to trigger exclusivity period; (3) Possible Limitation on Reverse Payments in Patent Settlements – Kohl bill? Hatch-Waxman: Restore the Balance Innovation Access Thank You Tim Gilbert phone: email: 416.703.1100 tim@gilbertslaw.ca