Assignment 5

advertisement

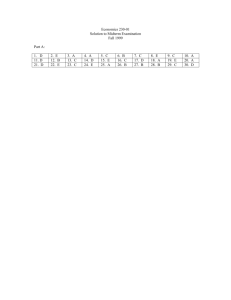

Mariela Tinajero MBA 6410 Professor Doris Geide-Stevenson Assignment 5 1. Use the IMF reading from Week 0 to identify one country that has had high inflation rates (at least double-digit) over the past year. Find the rate of inflation, rates of money growth and the current level of nominal interest rates for the high-inflation country of your choice. Relate your finding to the theories presented in chapter 4 of our textbook (Mankiw). The central bank for a country is a good source of data (if you cannot find it on the dismalscientist). According to the IMF article, Venezuela seems to have a high inflation rate since its CPI in 2009 was 27.1. This means that Venezuela had an average inflation rate of 27.1% for 2009. While its nominal interest rates amounted to a lending rate of 20.31%, savings rate of 13.43%, and 90 day deposit rate of 15.58% for the six main commercial and universal banks in 2009. In a similar manner for 2009 Venezuela’s narrow money (M1) growth amounted to 25.18%, broad money (M2) amounted to 21.7%, and extended broad money (M3) amounted to 21.17% (Banco Central de Venezuela, 2010). According to Mankiw the cost to Venezuela in having such high inflation rates includes shoeleather costs, menu costs, inefficient allocation of resources from constant inflation, tax laws which may cause problems when inflation isn’t considered, and the inconvenience from changing currency. For some loaners this may have been a loss in money from unanticipated inflation because borrowers are repaying in cheaper money. The one benefit that might apply to Venezuela according to Mankiw is that wage cuts can take place without cutting real wages by making inflation do the work. This makes since because i = r + π (i = nominal interest rate, r = real interest rate, π = inflation), for example say a person in Venezuela nominal wage was 10 and their real wage was 6 that means that inflation is 4. So if inflation increases to 6 and nominal wage cannot change from 10 then the employee’s real wage can be cut to 4. It’s also important to not the large increases in money supply in Venezuela which is most likely the cause of such inflation. 2. Compare the yield on the 'regular' 5-year and 10-year Treasury notes with the yield on the inflation-indexed 5-year and 10-year Treasury notes (bloomberg.com). The difference between the yields on the regular versus the inflation-indexed bonds can be interpreted as market expectations of inflation. According to this interpretation, what is the average expected inflation rate over the next 5, and next 10 years? Explain. How do your findings compare to the statement on inflation in the latest FOMC statement? Explain. Bloomberg.com states the yield of a 5 year bond as 1.26% and the 10 year yield as 2.51%. In the same instance it declares the inflation indexed 5 year bond as -0.19% and the 10 year bond inflation index as 0.695%. To get the average inflation you subtract the regular yield with the inflation indexed yield. This equates to 1.45% for the 5 year bond and 1.82% for the 10 year. Expected inflation is surmised in that way because if for example the regular yield was equal to 4% but inflation went up by 2% the real yield would be 2%. So if the inflation indexed yield was 2% and inflation rose by 2% you would actually earn 4% regular yield. Therefore, it makes since to use the formula i = r – π where i = regular yield, r = inflation indexed yield, and π = inflation. We can then solve for π to solve for the expected inflation for the 5 year and 10 year bond. The FOMC states “inflation is likely to remain subdued for some time before rising to levels the Committee considers consistent.” They will continue to set the federal fund rate to 0 to ¼ percent which seems to apply since inflation seems to stay fairly constant from 1.45% for a 5 year bond and rises to a target of 1.82% for the 10 year bond. Therefore the FOMC sees no need to raise the federal funds rate but perhaps in the future when it reaches its target inflation rate it will. 3. Real GDP (Y) can be decomposed into the sum of spending by consumers (C), firms (I), the government (G) and net exports (X-M). Y = C + I + G + NX. A common approach taken in exploring real GDP developments is to explore how each of these four spending components identified will develop in the near future. For example, if consumer confidence (an example of a forward looking indicator) is increasing, this is usually taken as a signal that C will be increasing at a 'healthy' growth rate in the near future. If consumer confidence is decreasing, then C is expected to be flat. Since the spending components feed into real GDP (go back to the circular flow diagram), the development of C gives some indication about near future developments in real GDP or economic growth. Thus, one can explore expected changes in C, I, G, and NX to get a handle on the expected real GDP growth for the next quarter or year. Use the Semiannual Report on Monetary Policy from July 21, 2010 (Part 2) to summarize the data (at least one solid paragraph) on C, I, G, NX and the Fed assessment of the current and future development of each of the four spending components. Make sure you review and briefly state the textbook definition of each spending component. Mankiw describes consumption as consumer purchases of goods and services; investment as firm and individual purchases of goods and services used to add to their accumulation of assets; government purchases as purchases by the federal, local, and state governments of good and services; and lastly net exports as exports minus imports. Currently consumption has increased for the current year coupled with an increase in real disposable personal income. However, equity (assets-liabilities) has fallen and has led to a lower consumer sentiment. On a similar note household debt (debt payments/disposable personal income) has fallen. As for housing sales increased in the spring, the likely result of tax credits for home buyers which are likely to decrease later in the year. The drop in home prices has apparently ended, while delinquency rates on mortgages have seemed to be leveling off, and mortgage interest rates have seemed to decrease. Business investment in fixed investment has risen, however, investment on nonresidential structures has continued to decline. Inventory has also seen a sharp increase as firms start restocking inventory. Overall corporate profits have seen an increase. Although, delinquency rates on commercial real estate loans has continued to remain high, and small businesses are finding it difficult to receive loans. As for the government its deficit has seems to be relaxing even if it is still high, recently it has been falling as the stimulus runs down. The Federal debt corresponding to the public is expected to go up to 65% of nominal GDP, and state and local governments have continued to lessen expenditures. Exports have risen since 2009, but current account deficit has widened as imports have increased more than exports. National savings has remained low. Over all real GDP has seemed to be recovering since 2009, however, worries have started to strain sentiment on recovery due to fiscal situations in Europe. 4. a. Show a demand and supply diagram for the 10-year U.S. Treasury bond market. Bond Market Interest Low Prices of Bonds High Quantiy of Bonds b. Use the bond market diagram to show graphically and to discuss how an increase of bond demand from China (for example) would affect bond prices and interest rates. Bond Market Interest Low Prices of Bonds High Quantiy of Bonds So an increase demand from China would shift the demand for bonds up or to the right. That means that bond prices increase, and since bond prices are inversely related to interest rates, interest rates will decrease. c. Use the bond market diagram to show graphically and to discuss how an increase in the borrowing of the U.S. government driven by larger budget deficits affects bond prices and interest rates. Bond Market Interest Low Prices of Bonds High Quantiy of Bonds If the government is driven by large budget deficits it needs to issue more bonds to finance the deficit or the fall in its revenue. Therefore the supply curve will shift down or to the right. This means that prices fall, and again since bond prices are inversely related to interest rates, interest rates will rise. d. Use the bond market diagram to show graphically and to discuss how an open-market purchase of the Fed affects bond prices and interest rates. Bond Market Interest Low Prices of Bonds High Quantiy of Bonds If the Fed purchases bonds their main objective is to lower interest rates. When they purchase bonds they move the demand curve up or to the right. This means that that bond prices are now higher and therefore interest rates decrease. 5. Based on the class discussion of what caused the 2007/08 recession, which business cycle theory best describes the 2007/08 recession. For an overview of different business cycle theories go to the assigned readings from the Economist magazine (cite the reading). The Economist states 5 main theories these include: exogenous shocks, Keynesian theory, real business-cycle theory, policy mistakes, and Austrian business cycle theory (The Economist, 2002). In accordance the recession was caused by the consumer. Therefore, it seems that the Keynesian theory seems to apply because the recession was in affect caused by a lack of demand as housing peaked and then started to lower and delinquency started to rise. Of course there were more things tied to the disaster such as the government and banks but mostly it was a consumer produced recession. Consumers were tied down to subprime mortgages which lowered consumption. The government decided that it would take part in influencing the recession. After which the government started to create a stimulus package. The stimulus package is typical of the Keynesian theory which believes in government intervention to stimulate the economy. The stimulus package was supposed to help settle the recession by increasing government output. b. Look at Dismalscientist.com to find out about the current Risk of Recession (see indicator listing for U.S.). Cut and paste the most recent release. Explain which variable is responsible for the most pronounced change in the probability of recession within the next 6 months? What is the rationale of linking this variable to forecasts for real GDP. Probability of recession within six-months, % 10-Aug 10- 10-Jun Jul United States 33 29 27 New England 35.9 29.2 25.6 Middle Atlantic 31.8 36.1 23 West North Central 29.6 23.7 23.3 South Atlantic 33.9 24.3 27.2 East North Central 35.3 23.6 26.5 East South Central 38.8 27 28.4 West South Central 28.1 25.8 26.2 Mountain 36.7 24.2 25.5 Pacific 32 38.7 33.4 10-May 10-Apr 10-Mar 10-Feb 23 23.8 25.9 18.1 23.3 17.9 22.9 20.8 20.6 28.3 23 21.8 26.9 14.4 21 18 18.7 22 21.9 31.7 26 27.3 31.1 20.7 28.9 20.6 23.8 27.3 26.6 23.7 32 27.9 39.8 24.6 31.9 25.7 29.9 31.8 31.5 35.3 The variables that most seem to be a hindrance to recovery are the lack of hiring and weak residential construction. They hinder GDP because jobs are synonymous with increased consumption if there is a lack of hiring this means that consumption is small. On the other hand, if there is weak residential construction due to the lack of demand less jobs will obviously be created and thus consumption remains weak. However, a weak residential construction also creates a weakness GDP because it is tied with investment. Residential construction is a part of investment. Since the recession is consumer based recession anything that increases in consumption (like job creation) will most likely do a greater good for the economy than increasing the investment. Both consumption and investment play a great part in GDP but in this case consumption would help GDP the most. c. Calculate the spread of the three-month Treasury bill and and ten-year Treasury note (the yield curve) and interpret this data in light of the article 'The Yield Curve as a Predictor of U.S. Recessions'. What does an inverted yield curve tell us about expected short-term interest rates (if the expectations theory of the yield curve is valid)? The yield curve is important in predicting recessions the spread is great way to predict the probability of a recession. Since Dismal Scientist calculates the probability of recession to be 33% (which includes the yield curve and other indicators) this means that the spread must be around -0.27 percentage points. According to the article on ‘The Yield Curve as a Predictor of U.S. Recessions,’ at a recession probability of 30% the spread is equal to -0.17 percentage points, and at 40% probability of recession it’s -0.50 percentage points. So taking the difference of -0.17 and -0.50 equates to 0.33 and dividing this by 10 for the change in recession probability equals 0.033 and multiplying by 3 to get the extra probability of an increase in 3% from 30% is 0.099. Then you subtract 0.099 from -0.17 which results in the spread -0.27 percentage points. However, if I just take the difference from just the 3 month Treasury bill at a 0.10 yield and the 10 year Treasury note with a yield of 2.47, I get 2.37 which is the spread. This means that the probability of recession is less than 5% at least for today. An inverted yield curve means that short term investments yield more than long term investments in the long run. Therefore, the short term interest rates will be higher now and interest rates will decrease in the future. d. Compare the current yield curve information with the data from the Index of Leading Indictors (The Conference Board Leading Indicators) as listed in the Dismal Scientist. The Conference Board Leading Indicators seems to have a good record in predicting economic recessions like the yield curve. According to this Leading Indicator curve in Dismal Scientist for August of 2010 the Leading Indicator was 0.3. Therefore by looking at the chart in the article ‘The Yield Curve as a Predictor of U.S. Recessions’ the probability of a recession is 15% to 20%. This is considerably higher than what was calculated with respect to the yield curve at less than 5%. However, with respect to Dismal Scientist own probability of recession both seem to have a fairly high probability of recession. Works Cited Banco Central de Venezuela. (2010, October 1). Banco Central de Venezuela. Retrieved October 1, 2010, from Banco Central de Venezuela: http://www.bcv.org.ve/EnglishVersion/c2/index.asp?secc=statistinf The Economist. (2002, September 28). Survey: Of shocks and horrors. The Economist, 364(8292), 7.