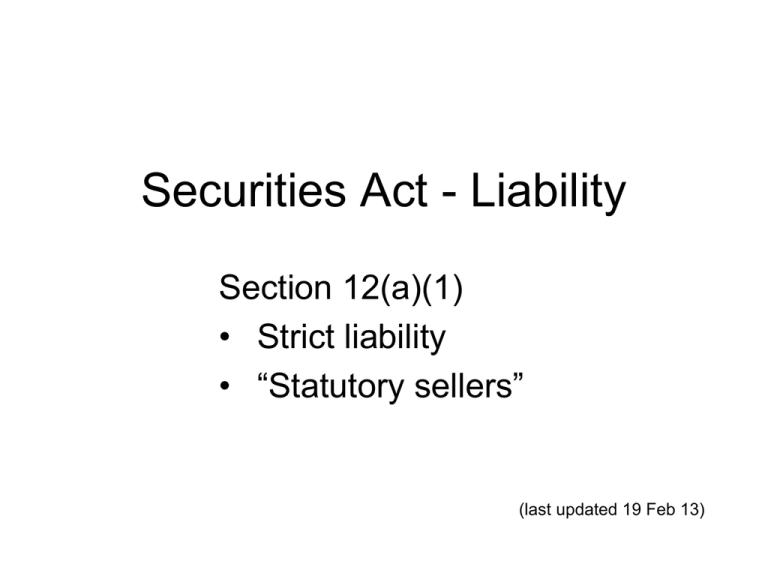

Securities Act - Liability

Section 12(a)(1)

• Strict liability

• “Statutory sellers”

(last updated 19 Feb 13)

Liability for selling

“unregistered, non-exempt”

securities?

§ 12 Civil liabilities arising in

connection with prospectuses

and communications

(a) In general

Any person who-(1) offers or sells a security in

violation of section 5 of this act,

....

shall be liable, subject to

subsection (b) of this section, to

the person purchasing such

security from him, who may sue

either at law or in equity in any

court of competent jurisdiction,

to recover the consideration paid

for such security with interest

thereon, less the amount of any

income received thereon, upon

the tender of such security, or

for damages if he no longer

owns the security.

Compare this to 10b-5 and

§11 liability …

Rule 10b-5

§11

“icw” purch/ sale

security

Part of RS

Purchaser or

seller

Purchaser

(tracing)

Purchaser

Defendant

Primary violator

List (I, Ds, Os,

UWs, expert)

“statutory

seller”

(1) Material

misrepresentation

Pl BOP (or duty

to speak)

Pl BOP (or

omission)

n/a

(2) Scienter

Pl BOP (facts /

strong E)

Def BOP (“due

diligence”)

n/a

(3) Reliance

Pl BOP (unless

FOM)

Def BOP (Pl

“knew”) *

n/a !!!

(4) Causation

Pl BOP (prox

cause)

Def BOP

(“other than”)

n/a

(5) Damages

Pl BOP (O/P or

rescission)

Rescission (up

to offering $)

Rescission

Federal

Federal or

state

Federal or

state

2 yrs + 5yrs

1 yr + 3 yrs

1 yr

Transactional

nexus

Plaintiff

Court

Limitations

§12(a)(1)

Violation of

§5

§12(a)(2)

Pinter v. Dahl (US 1988)

Pinter v. Dahl (sung to the tune of “The Ballad of the Beverly Hillbillies”)

Come and listen to my story bout that guy Maurice,

California boy just a-waitin’ to be fleeced.

Then one day put some money in with Bill

Out in Oklahoma where the wildcatters drill.

Oil, that is, black gold. Texas tea.

Well, the next thing you know Maurice is on the dole,

Askin’ lots of friends he knows to throw cash down the hole

Said Beej Pinter is the guy you wanna see

And they each put some money in without an SEC

Filing, that is. Form S-1.

Well, now it’s time to figure out if anyone can claim

That someone not the issuer can bear part of the blame

For selling shares unregistered with no gratuity,

To share a heapin’ helpin’ of some liability.

Section 12(a)(1) that is. 33 Act. Write a check.

Y’all invest now, hear?

© Jeffrey Lipshaw 2007. All rights reserved.

Pinter v. Dahl (US 1988)

Black Gold Oil Company

(what a name) is in the oil

and gas business. One

B.J. Pinter runs the

business and is the

principal

shareholder. Pinter looks

for more investors and

finds Maurice Dahl, a

California real estate

developer. Dahl looks at

Pinter's drilling logs and

exclaims: "This can't

lose!" Dahl tell his friends,

who invest in Black Gold

Oil.

Investors

Dahl

sue

Pinter

counterclaim

Is Pinter liable,

though he never

passed title?

§ 12 Civil liabilities arising in

connection with

prospectuses

and communications

(a) In general

Any person who-(1) offers or sells a security in

violation of section 5 of this act,

....

shall be liable, subject to

subsection (b) of this section, to

the person purchasing such

security from him, who may sue

either at law or in equity in any

court of competent jurisdiction,

to recover the consideration

paid for such security with

interest thereon, less the

amount of any income received

thereon, upon the tender of

such security, or for damages if

he no longer owns the security.

§ 15 Liability of controlling persons

Every person who, by or

through stock ownership,

agency, or otherwise, or who,

pursuant to or in connection

with an agreement or

understanding with one or more

other persons by or through

stock ownership, agency, or

otherwise, controls any person

liable under section 11 or 12,

shall also be liable jointly and

severally with and to the same

extent as such controlled

person to any person to whom

such controlled person is liable,

unless the controlling person

had no knowledge of or

reasonable ground to believe in

the existence of the facts by

reason of which the liability of

the controlled person is alleged

to exist.

Pinter v. Dahl (US 1988)

Black Gold Oil Company

(what a name) is in the oil

and gas business. One

B.J. Pinter runs the

business and is the

principal

shareholder. Pinter looks

for more investors and

finds Maurice Dahl, a

California real estate

developer. Dahl looks at

Pinter's drilling logs and

exclaims: "This can't

lose!" Dahl tell his friends,

who invest in Black Gold

Oil.

Investors

Dahl

sue

Pinter

counterclaim

Is Dahl liable to the

investors, though

he never passed title?

§ 12 Civil liabilities arising in

connection with

prospectuses

and communications

(a) In general

Any person who-(1) offers or sells a security in

violation of section 5 of this act,

....

shall be liable, subject to

subsection (b) of this section, to

the person purchasing such

security from him, who may sue

either at law or in equity in any

court of competent jurisdiction,

to recover the consideration

paid for such security with

interest thereon, less the

amount of any income received

thereon, upon the tender of

such security, or for damages if

he no longer owns the security.

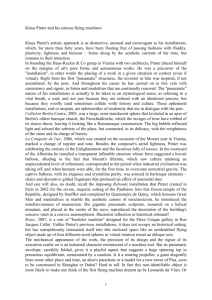

Pinter v. Dahl (US 1988)

“The language and purpose of §

12(1) suggest that liability extends

only to the person who

successfully solicits the purchase,

motivated at least in part by a

desire to serve his own financial

interests or those of the

securities owner.”

Justice Harry

Blackmun

§2(a) Definitions

(3) The term "sale" or "sell" shall

include every contract of sale or

disposition of a security or

interest in a security, for value.

The term "offer to sell," "offer for

sale," or "offer" shall include

every attempt or offer to dispose

of, or solicitation of an offer to

buy, a security or interest in a

security, for value.

And now let’s apply this

Court-made law …

Hypothetical #1

Your law firm represents Saintine

Drilling & Exploration, which raised

money in a private placement.

Your firm prepared the private

placement memo and, at the client’s

request, you sent a cover letter and

copies of the memo to certain

investors -- along with the drilling

logs (see side panel).

Your firm was paid handsomely for

its work, a fact disclosed in the

offering memo.

Pinter v. Dahl (US 1988)

“Indeed, [the substantial-factor

test] might expose securities

professionals, such as

accountants and lawyers, whose

involvement is only the

performance of their professional

services, to § 12(1) strict liability

for rescission. The buyer does

not, in any meaningful sense,

"purchas[e] the security from"

such a person.”

Justice Harry

Blackmun

Hypothetical #2

Oil & Gas Ltd. sells

unregistered common shares

at $15 per share to 45

purchasers in violation of § 5.

Alice is one of the

purchasers. Two months after

the Oil & Gas offering, Alice

sells her 1,000 shares to Bob

for $10/share. The value of the

shares declines further to $7.

Alice

Bob

Oil & Gas

The end