Unit 2 - Economics and the Consumer

advertisement

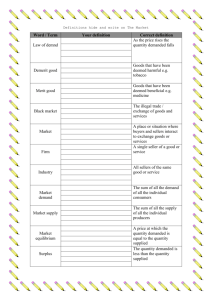

Economics & The Consumer Economics is the study of choices about using resources – Economist Macroeconomics – global impacts (government decisions) Microeconomics – Decisions by individuals and businesses The Basic Economic Problem is Scarcity Limited resources with unlimited wants & needs Opportunity Cost Chapter 1 The value of the next best alternative foregone as the result of making a decision Each decision made has an opportunity cost & opportunity benefit Is the reward worth the cost? Analyze the costs & benefits of getting a job right out of high school vs. attending college Slide 3 1. 2. 3. A society’s economic system is the combination of social and individual decision making it uses to answer the three basic economic questions What to Produce? Country’s priorities / needs / resources / etc. How to Produce? Resources of the country – labor / capital / information / etc. For Whom to Produce? Consumers have choices or is there equality Traditional Economy – production decisions passed to generations (Tribes in remote areas) Command Economy - the government owns resources and makes most economic decisions in the “BEST INTERESTS” of society (North Korea) Market Economy - people own the resources and run the businesses – Entrepreneurship & risk (Competition and Profit drive this system) Mixed Economy – Combination of Market and Command economies (United States) Market Economic System Command Economic System Mixed Economic System Traditional Economic System What to produce? Consumers & Producers based on selfinterests Government decides – What is “best” for society Combination of consumer and government decision making Based on customs How things have always been done How to produce? Consumers & Producers based on selfinterests Government decides – What is “best” for society Combination of consumer and government decision making Based on customs How things have always been done What needs & wants to satisfy? Consumers & Producers based on selfinterests Government decides – What is “best” for society Combination of consumer and government decision making Based on customs How things have always been done Chapter 1 Slide 7 Individuals in the marketplace based on their own best interests – selfish motivations Consumers “vote” with their dollars – price & quality is directly affected by these “votes” Competition forces businesses to provide high quality & low prices to attain market share & maintain profitability Profit drives how they answer the 3 basic economic questions In a market economic system, the choices individuals make determine how society’s scarce resources will be used Prices are determined by the natural forces of supply and demand Adam Smith – THE INVISIBLE HAND Competition and “selfishness” are crucial to its effectiveness “It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our own necessities but of their advantages.” The invisible hand is a metaphor coined by the economist Adam Smith. Once in The Wealth of Nations and other writings, Smith demonstrated that, in a free market, an individual pursuing his own self-interest tends to also promote the good of his community as a whole through a principle that he called “the invisible hand”. He argued that each individual maximizing revenue for himself maximizes the total revenue of society as a whole, as this is identical with the sum total of individual revenues. Create a poem / story / song / etc. representing your understanding of Adam Smith’s Invisible Hand Theory. Groups will present their “creation” – The best group will receive extra credit Chapter 1 Private Property - Individuals in the marketplace based on their own best interests – selfish motivations Freedom of Choice - Consumers “vote” with their dollars – price & quality is directly affected by these “votes” Competition - Businesses provide high quality & low prices to attain market share & maintain profitability Profit - Ultimately drives how the the 3 basic economic questions are answered Slide 13 Land Labor Human factors - workers Capital Any “Natural” resource – raw materials Previously produced goods used in production (machinery / tools / factories / etc.) Entrepreneurship Ownership – organization Small Business Administration Technology Recently added “factor” The production output in relation to a unit of input (a worker) - efficiency Wages vs. Productivity As wages ↑, productivity must improve Productivity can be improved through: Improvements in technology Better equipment Training / management techniques Chapter 2 Slide 15 Individual (Sole) Proprietorship (1 owner) Partnership (2 or more owners) Negative = Unlimited Liability Positive = Tax advantages Negative = Unlimited Liability Positive = Tax advantages Corporation Owned by 1 or multiple individuals – considered a separate entity from owners (Limited Liability) Private vs. Public Corporation (Stock – shareholders) Negative = Double Taxation DEMAND – SCHEDULES & CURVES • Quantities of a good consumers are willing and able to purchase at various prices during a given time period Demand Schedule: Price $1 $2 $3 $4 $5 Quantity Demanded 1000 800 600 400 200 DEMAND CURVE Price $1 $2 $3 $4 $5 Quantity Demanded 1000 800 600 400 200 SUPPLY – SCHEDULES & CURVES • The quantities firms are willing and able to make available for sale at various prices Supply Schedule: Price $1 $2 $3 $4 $5 Quantity Supplied 200 400 600 800 1000 SUPPLY CURVE Price $1 $2 $3 $4 $5 Quantity Supplied 200 400 600 800 1000 Market Price - Equilibrium • Equilibrium Price - the price at which quantity supplied equals quantity demanded • GRAPH: SHORTAGE IN THE MARKET • If price is set below equilibrium a SHORTAGE will occur – Prices should rise (Forced up) • (quantity demanded > quantity supplied) • GRAPH: SURPLUS IN THE MARKET • If price is set above equilibrium a SURPLUS will occur – Prices should fall (Forced Down) • (quantity demanded < quantity supplied) • GRAPH: 1. 2. 3. 4. Provide Public Goods Redistribute Income Regulating Business Activity Ensuring Economic Stability National Defense Police & Fire Protection Courts Parks Highways & Roads Public Education Public Transportation Social Security Retirement Benefits Survivor Benefits Disability Benefits Medicare Benefits Unemployment Insurance Public Assistance Welfare (TANF, SSI, Food Stamps, Housing, etc.) Protecting the Environment (EPA) Protecting Consumers – safety (CPSC) Protecting Workers – safety & fairness Promoting Competition (FTC) Anti-Trust Laws to maintain fairness & competition to ensure quality & fair prices Fiscal Policy Policies regarding Taxes and Government Spending Stimulus Plan / Bailouts of Banks Monetary Policy Interest Rates (Fed Fund Rate) Public Goods and Services Redistribution of Income Wealthy individuals pay taxes at higher levels for public assistance programs (welfare / etc.) To influence behavior Education / Law Enforcement / Roads / etc. “Sin Tax” – Alcohol & Tobacco taxed at higher rates To stabilize the economy “Fed Fund” rate is adjusted accordingly Progressive Taxes (Income Tax): The more you earn – the higher amount of tax comes out of your pocket (Tax Brackets) Regressive Taxes (SALES TAX): Smaller share of income is collected as income grows – SALES TAX is regressive – straight % for sales tax Proportional Taxes (PROPERTY TAX): FLAT TAX – all members of a community pay the same amount regardless of earnings or value Income Tax Social Security Tax (FICA) Certain goods (alcohol, tobacco, firearms, air travel) Property Tax Estate & Gift Tax Mandatory retirement savings program Sales Tax Excise Tax Wages / Interest income / etc. Based on property values after death Business (License) Tax Customs Duties / Tariffs Imported goods may have additional taxes Benefits principle Ability-to-pay principle The benefits principle is the idea that people should pay taxes based on the benefits they receive from government services. An example is a gasoline tax: Tax revenues from a gasoline tax are used to finance our highway system. People who drive the most also pay the most toward maintaining roads. The ability-to-pay principle is the idea that taxes should be levied according to an individual’s ability to shoulder the tax burden. Voluntary Compliance Federal Income Tax Rates: Schedule X – Single Person If taxable income is over-- But not over-- The tax is: $0 $7,825 10% of the amount over $0 $7,825 $31,850 $782.50 plus 15% of the amount over 7,825 $31,850 $77,100 $4,386.25 plus 25% of the amount over 31,850 $77,100 $160,850 $15,698.75 plus 28% of the amount over 77,100 $160,850 $349,700 $39,148.75 plus 33% of the amount over 160,850 $349,700 no limit $101,469.25 plus 35% of the amount over 349,700 Milton Friedman Supported a laissez-faire approach to government involvement in economics Government attempts to protect consumers usually creates higher prices or lower product quality John Kenneth Galbraith Supports strong government involvement for government in economic issues Large corporations have too much influence on modern society inhibiting the natural forces of supply & demand (ex. advertising creates wants & needs) Research issues pertaining to strong governmental involvement vs. less intrusive policies & formulate an argument in favor of the philosophy you feel is a more effective for economic stability for a country.