MORTGAGE-DOCUMENTATION_handout

advertisement

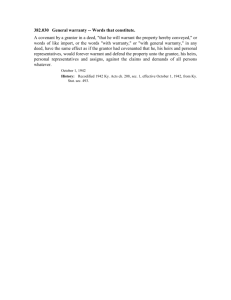

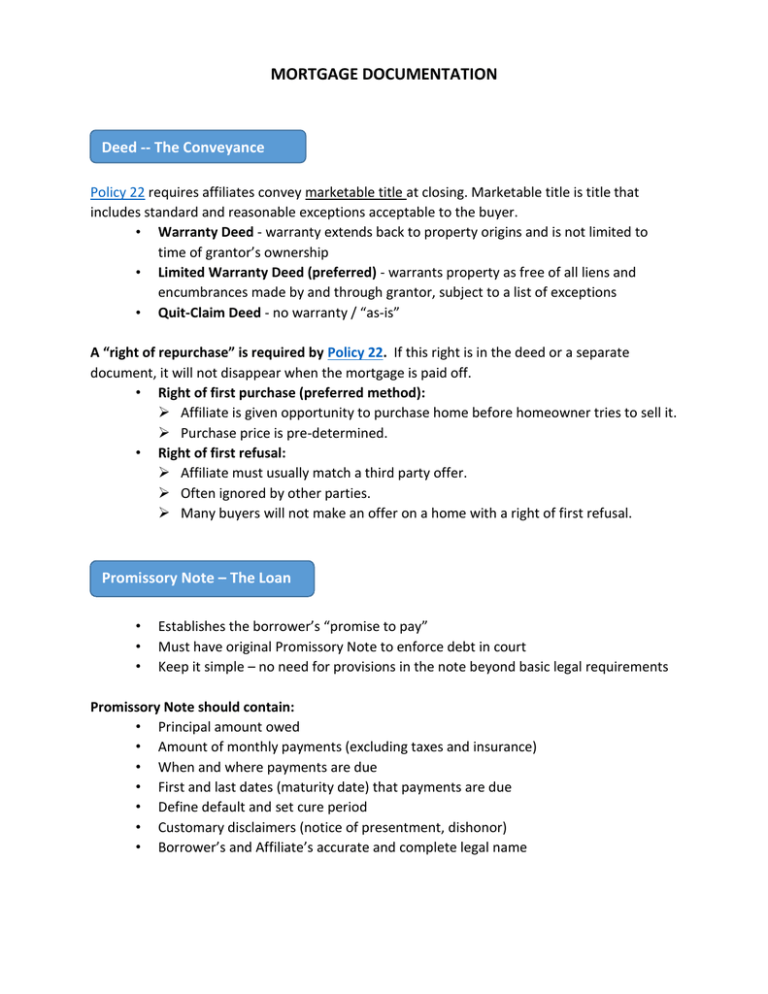

MORTGAGE DOCUMENTATION Deed -- The Conveyance Policy 22 requires affiliates convey marketable title at closing. Marketable title is title that includes standard and reasonable exceptions acceptable to the buyer. • Warranty Deed - warranty extends back to property origins and is not limited to time of grantor’s ownership • Limited Warranty Deed (preferred) - warrants property as free of all liens and encumbrances made by and through grantor, subject to a list of exceptions • Quit-Claim Deed - no warranty / “as-is” A “right of repurchase” is required by Policy 22. If this right is in the deed or a separate document, it will not disappear when the mortgage is paid off. • Right of first purchase (preferred method): Affiliate is given opportunity to purchase home before homeowner tries to sell it. Purchase price is pre-determined. • Right of first refusal: Affiliate must usually match a third party offer. Often ignored by other parties. Many buyers will not make an offer on a home with a right of first refusal. Promissory Note – The Loan • • • Establishes the borrower’s “promise to pay” Must have original Promissory Note to enforce debt in court Keep it simple – no need for provisions in the note beyond basic legal requirements Promissory Note should contain: • Principal amount owed • Amount of monthly payments (excluding taxes and insurance) • When and where payments are due • First and last dates (maturity date) that payments are due • Define default and set cure period • Customary disclaimers (notice of presentment, dishonor) • Borrower’s and Affiliate’s accurate and complete legal name Deed of Trust – The Security • • • • • • • Secures the payment; provides remedies for default, including affiliate’s right to foreclose Must refer to an existing Promissory Note dated on or before the date of the Deed of Trust. Must be recorded with proper governmental entity (usually county) Should accurately state: Borrower’s name Principal amount of Promissory Note Date of Promissory Note Some states may require more terms –watch for changing laws! Must have a legally sufficient description of the property Must include express foreclosure or power of sale provision (to proceed with nonjudicial foreclosure) Include requirement that Habitat home must be homeowner’s primary residence Most Common Errors with Mortgage Documents: • • Amounts, names or dates do not match on Promissory Note and Mortgage Affiliate or homebuyer name is not correct • • • • • • • Omitting monthly payment amount Failing to provide for adjustment of escrow amounts Incomplete or otherwise insufficient legal description Not including “power of sale” – precludes non-judicial foreclosure Improper execution (state specific), including proper witness and notary acknowledgment Omitting requirement that the home will be the homebuyer’s primary residence Not performing full due diligence review when acquiring the property • Title defects, environmental or zoning issues impact ability to convey good title Not recording the mortgage immediately, or in wrong order (after the deed) • • • • Not maintaining original mortgage documents in safe location (and keep copies if outsource servicing) Allowing homebuyer to move into the home before the mortgage is executed and delivered (limited exceptions require occupancy agreement and specific date for title transfer) For Mortgage Loans for Repair Products: not providing required 3 day right of Rescission