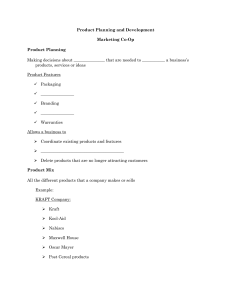

HASIL, BELANJA, LABA DAN RUGI

advertisement

NAMA NO MATRIKS NORHAIRIZAM BIN ABDUL MANAP GA00685 AHMAD YUS SHAHRIL FEEZRIE BIN YAACOB GA00447 SAHRA BINTI SANUSI GA00647 YULINDA BINTI YUSNEL GA00487 OUTLINE INTRODUCTION EXTERNAL ANALYSIS INTERNAL ANALYSIS STRATEGY ANALYSIS AND CHOICE STRATEGY IMPLEMENTATION CONCLUSION INTRODUCTION HISTORY COMPANY BACKGROUND MAIN ISSUE’S HISTORY 1903: James Kraft founder – sell cheese in chicago 1914: available in town at US 1920: export product to Canada & Europe 1916: known as processed cheese COMPANY BACKGROUND Largest food & beverage company in North America Well positioned in deliver steady, reliable growth Mission : to be the best food & company in North America Product : beverage, cheese, refrigerated meals & grocery categories MAIN ISSUE’S KNAC sales were flat Revenue declined 5.9% International segment, net revenue in EU decreased 17.4% Expected earning of at least $1.93 per share Financial – High Goodwill and LTD EXTERNAL ANALYSIS PESTDEL ANALYSIS PORTER’S FIVE FORCES ANALYSIS COMPETITIVE PROFILE MATRIX EFE MATRIX PESTDEL ANALYSIS Political, Government, and Legal Forces • Food safety programs • Global warming Economy Forces • Raising cost of petroleum • Consumer prices for baked food increased by 10.7% • Input cost of bakers have declined • US Market for packaged and processed food has seen large profit in retail sales • Food cost climbing PESTDEL ANALYSIS – cont. Social, Cultural, Demographic, and Natural Environment Forces • More people are dining out and food • Development of health food • Childhood obesity Technological Forces • Web site / Portal has undergone facelift Competitors • Competes with numbers of companies • Many consumer switching to store brand products PORTER’S FIVE FORCES ANALYSIS 1. Barries to entry •Spending more researching consumer •Development of health food •Large profit in retail sales – U.S market 2. Threat of substitutes •More people are dining out •Food safety program 3. Buyers •Available in 150 countries •Jan 2009: consumer price for baked goods increased 10.7% due to rising costs of petroleum. •Demand in world wide increase due to lifestyle PORTER’S FIVE FORCES ANALYSIS-cont 4. Bargaining power of suppliers •Dec 2007 & 2008: workers at one’s Kraft manufactures in Illinois turned up a batch fruits and nuts that were contaminated with salmonella •The tainted nuts came from a California based supplier, more specifically from Setton Pitachio of Terra Bella,Inc 5. Rivalry among the existing players •2nd largest food processing company behind Nestle (health , beauty and pet care products behind food) •Kraft itself competing with generic product & retailer brands, wholesalers and cooperatives. •Competitor : ConArga Food largest publicly in U.S •Significant in commercial food products & nation’s leading specialty potato providers. COMPETITORS PROFILE MATRIX Kraft Foods Inc. ConAgra Foods 1. 2nd largest food processing company 1. Largest publicly held firm that Kraft Foods competes in the U.S. market. 2. Vision Statement “Helping people around the world eat and live better”. 2. Vision statement “ One company growing by nourishing lives and finding a better way today one bite at a time”. 3.Competing with generic products and retailer brands, wholesalers and cooperatives instead of packaged food companies. 3. Leading branded foods company and trusted name behind many leading brands such as Healthy Choice, Chef Boyardee etc. 4. Kraft Foods products more expensive due to U.S. dollar gains stregth overseas. 4.Their consumer brands are found in 97% of U.S. households and 26 ranked first or 2nd in their category. COMPETITIVE PROFILE MATRIX – cont. Critical Success Factor Weight Kraft ConAgra Rating Score Rating Score 1. Advertising 0.25 3 0.75 2 0.5 2. Financial Position 0.1 3 0.3 2 0.2 3. Global Expansion 0.25 3 0.75 2 0.5 4. Market Share 0.1 3 0.3 2 0.2 5. Product Diversity 0.15 4 0.6 3 0.45 6. Consumer Demands 0.15 4 0.6 3 0.45 Total 1 3.3 2.3 KEY EXTERNAL FACTOR – EFE MATRIX Key External Threats Weight Rating Weighted Score 0.08 3 0.24 0.10 4 0.40 0.06 4 0.24 0.06 3 0.18 0.13 4 0.52 0.06 2 0.12 Opportunities 1. US Market for packaged and processed food has seen large profit in retail sales 2. More people are dining out and food producers are devoting more attention to product designed for restaurants, vending machines and other foodservice provider 3. Development of health food 4. Web site / Portal as marketing medium 5. Input cost of bakers have declined 6. Food safety programs have been adopted recently as issues of chemical and bacterial contamination and new food-borne pathogens remain a public health concern Total Opportunities 0.49 1.70 KEY EXTERNAL FACTOR – EFE MATRIX – cont. Key External Threats Threats 1. Competes with numbers of companies Weight Rating Weighted Score 0.13 4 0.52 0.09 3 0.27 0.07 3 0.21 4. Many consumer switching to store brand products 0.04 3 0.12 5. Consumer prices for baked food increased by 10.7% 0.05 2 0.10 6. Food cost climbing 7. Childhood obesity 0.06 2 0.12 0.05 2 0.10 Total Threats Total 0.51 1 2. Global warming 3. Raising cost of petroleum 1.44 3.14 4 = the response is superior, 3 = the response is above average, 2 = the response is average, 1 = the response is poor INTERNAL ANALYSIS MISSION ANALYSIS FUNCTIONAL ANALYSIS IFE MATRIX MISSION ANALYSIS Vision Statement Helping people around the world eat and live better Mission Statement Make Today Delicious In order to fulfill this mission Kraft Foods Inc. focuses on consumers in everything that they do. The company also understands that actions speak louder than words, so at Kraft Foods: We inspire trust. We act like owners. We keep it simple. We are open and inclusive. We tell it like it is. We lead from the head and the heart. We discuss. We decide. We deliver. MISSION ANALYSIS – cont. Mission Statement Make Today Delicious In order to fulfill this mission Kraft Foods Inc. focuses on consumers in everything that they do(1). The company also understands that actions speak louder than words, so at Kraft Foods(2): We inspire trust(3). We keep it simple(3). We lead from the head and the heart(3). We are open and inclusive(4). We tell it like it is(4). We act like owners(5). We discuss. We decide. We deliver(6). Components of a Mission Statement: 1.Customer 2.Product of Service 3.Philosophy 4.Concern for Public Image 5.Concern for Employees 6.Concern of Survival, Growth & Profitability FUNCTIONAL ANALYSIS 1. 2. 3. 4. Organizational Structure Operating Segments Financials Current Strategies FUNCTIONAL ANALYSIS – cont. 1. Organisational Structure David Brearton Exec. VP of Operations & Business Services Marc Firestone Exec. VP of Corp. & Legal Affairs Michael Clarke Exec. VP and President Kraft Europe Irene Rosenfeld Chaiman and CEO Karen May Exec. VP of Global Human Resources Sanjay Khosla Exec. VP of Global Human Resources Richard Searer Exec. VP and President North America Jean Spence Exec. VP of Research, Development & quality Michael Osanloc Exec. VP of Strategy Mary Best West Exec. VP and Chief Marketing Officer FUNCTIONAL ANALYSIS – cont. 2. Operating Segments Biscuits, salted snacks and chocolate confectionery Coffee, packaged juice drinks, and powdered beverages Natural, process, and cream cheeses Spoon able and pourable dressings, condiments, and desserts Frozen pizza, packaged dinners, lunch combinations, and processed meats FUNCTIONAL ANALYSIS – cont. Kraft Foods Inc. and Subsidiaries Summary of Financial Analysis Financial Ratio 2008 2007 2006 Comment Current Ratio 1.03 0.63 0.79 Satisfied Quick Ratio 0.69 0.39 0.45 Satisfied Cash Ratio 0.11 0.03 0.02 Satisfied Debt Ratio 0.97 1.59 1.27 Satisfied Inventory Turnover Ratio 7.56 5.87 6.09 Unsatisfied Day's Sales in Inventory 40.69 52.50 42.46 Satisfied Total Asset Turnover (x) 0.67 0.53 0.60 Satisfied Fixed Asset Turnover (x) 4.26 3.35 3.43 Satisfied Profit Margin (%) 6.87 7.17 9.20 Unsatisfied Return on asset (ROA) (%) 4.60 3.81 5.51 Satisfied Return on equity (ROE) (%) 13.07 9.49 10.72 Satisfied 1.95 1.64 1.86 Satisfied Basic Earning per share (EPS) FUNCTIONAL ANALYSIS – cont. 4. Current Strategies Had saved a total of $1.1 billion through streamlined manufacturing and a simplified organizational structure 36 plants The elimination of 19,000 positions KEY INTERNAL FACTOR – IFE MATRIX Key Internal Threats Strength 1. Organic revenue increased 2.3 percent 2. North American sales growth 2.9% - higher demand for its cereal 3. Commitment to develop new products (R&D) 4. Innovative advertising method 5. Kraft Foods Inc. manages over 100 different brand-name food products and tracks operating income to five specific consumer segments. 6. Company’s revenue increased to $42.2 billion 2008, while earnings increased to $2.9 billion Total Strength 4 = major strength, 3 = minor strength Weight Rating Weighted Score 0.07 3 0.21 0.07 3 0.21 0.08 4 0.32 0.09 4 0.36 0.13 4 0.52 0.13 4 0.52 0.62 2.14 KEY INTERNAL FACTOR – IFE MATRIX – cont. Key Internal Threats Weakness 1. Risk of contamination in source products 2. High amounts of goodwill ($27.5 billion) 3. $18.5 billion in long term debt (increased by 50% during 2009) 4. Margins depend on commodity prices 5. Drop in sales in Quarter 2 in 2009 (5.9%) Total Weakness Total 2 = minor weakness, 1 = major weakness Weight Rating Weighted Score 0.03 2 0.06 0.08 1 0.08 0.07 2 0.14 0.04 2 0.08 0.09 1 0.09 0.38 1 0.43 2.57 STRATEGY ANALYSIS AND CHOICE SWOT MATRIX BCG MATRIX SPACE MATRIX GRAND STRATEGY MATRIX IE MATRIX TABLE SWOT MATRIX OPPORTUNITIES 1 US Market for packaged and processed food has large profit in retail sales 2 More people are dining out and product designed for restaurants, and other foodservice provider increasing 3 Development of health food 4 Web site / Portal as marketing medium 5 Input cost of bakers have declined 6 Food safety programs 1 2 3 4 5 6 S1 O3 S3 O2 STRENGTH Organic revenue increased 2.3 percent North American sales growth 2.9% higher demand for its cereal Commitment to develop new products (R&D) Innovative advertising method Kraft Foods Inc. manages over 100 different brand-name food products and tracks operating income to five specific consumer segments. Company’s revenue increased to $42.2 billion 2008, while earnings increased to $2.9 billion SO STRATEGIES Create new organic food products to accommodate the trend of healthy food. (Product Development) R & D to be focus on product design for restaurants, vending machines and other food service provider. (Product Development) WEAKNESS 1 Risk of contamination in source products 2 High amounts of goodwill ($27.5 billion) 3 $18.5 billion in long term debt (increased by 50% during 2009) 4 Margins depend on commodity prices 5 Drop in sales in Quarter 2 in 2009 (5.9%) W1 O1 W5 O1 WO STRATEGIES Use quality organic ingredients to reduce risk of contamination. (Product Development & Related Diversification) Focusing on retails sales. (Market Penetration) W4 Renegotiated current contract for S3 Using interactive method in portal to O5 commodity. (Related diversification) O4 promote ideas from customer for new products. (Product Development) S4 Using games or any interactive method O4 to promote about products. (Market Penetration) S4 Using more interactive method such as O3 application for smartphone to promote about healthy food. (Market Penetration) S5 Promoted in convenient meals segment O1 in Retail (Market Penetration) TABLE SWOT MATRIX 1 2 – cont. 6 3 4 5 STRENGTH Organic revenue increased 2.3 percent North American sales growth 2.9% - higher demand for its cereal Commitment to develop new products (R&D) Innovative advertising method Kraft Foods Inc. manages over 100 different brand-name food products and tracks operating income to five specific consumer segments. Company’s revenue increased to $42.2 billion 2008, while earnings increased to $2.9 billion WEAKNESS Risk of contamination in source products 1 2 High amounts of goodwill ($27.5 billion) 3 $18.5 billion in long term debt (increased by 50% during 2009) 4 Margins depend on commodity prices 5 Drop in sales in Quarter 2 in 2009 (5.9%) THREAT ST STRATEGIES 1 Competes with numbers S4 Using interactive advertising to promote of companies T1 brand. (Market Penetration) WT STRATEGIES W4 Agreement with supplier to reduce price and T1 got competitive pricing 2 Global warming W1 T2 W2 T3 3 Raising cost of petroleum 4 Many consumer switching to store brand products 5 Consumer prices for baked food increased by 10.7% 6 Food cost climbing 7 Childhood obesity S5 Coleberate with store to supply products. T4 S1 Use R&D capabilities to develop new T7 healthier food options due to increasing obesity rates. ( Product Development) Promote organic food that healthy and environmental friendly Using Fleet Management System to control cost of petrol GRAND STRATEGY MATRIX Rapid Market Growth Quadrant II Quadrant I 1.Market Development 2.Market Penetration 3.Product Development 4.Forward Integration 5.Backward Integration 6.Horizontal Integration 7.Related Diversification Weak Competitive Position Quadrant III Quadrant IV Slow Market Growth Strong Competitive Position BCG MATRIX BCG MATRIX – cont. BCG Matrix 100 90 Market Growth 80 70 60 50 40 30 20 10 0 120 100 80 60 40 20 0 Relative Market Share Division Revenue (millions) Percent Revenues Profit (millions) Percent Profit Company $42,201 100% $2,901 100% Relative Market Share - Industry Growth Rate (%) - SPACE MATRIX – Factors & Conclusions FINANCIAL POSITION (FP) Factors Revenues increased 16.8% to $42.2 billion Earnings increased 12% to 2.9 billion Total L+SE+ Assets decreased 7.5% to $6.3 billion Gross profit margin of 33.2 compared to the industry average of 33.7 Current ratio of 1.1 TOTALS INDUSTRY POSITION (IP) Factors Growth potential Ease of market entry Profit potential Financial stability Resource utilization TOTALS Rating 4 3 3 4 2 16 Rating 5 4 4 3 3 19 SPACE MATRIX – Factors & Conclusions – cont. STABILITY POSITION (SP) Factors Competitive pressure Barriers to entry Unemployment Technology changes Price range of competitors products TOTALS COMPETETIVE POSITION (CP) Factors Customer loyalty Product quality Market share Technological knowledge Competition TOTALS Conclusions SP Average: -19/5= -3.8 CP Average: -17/5= -3.4 IP Average: 19/5= 3.8 FP Average: 16/5= 3.2 Directional Vector Coordinates: X-axis: -3.4 + (3.8) = .4 Y-axis: -3.8 + (3.2) = -.6 Rating -4 -4 -5 -2 -4 -19 Rating -3 -3 -2 -4 -5 -17 SPACE MATRIX – cont. Internal-External (I/E) Matrix IFE Total Weighted Scores 4.0 Strong 3.0 to 4.0 I Average 2.0 to 2.99 2.0 1.0 II High 3.0 to 4.0 EFE Total Weighted Scores Weak 1.0 to 1.99 3.0 III Grow and Build •Forward, Backward, or Horizontal Integration •Market Penetration •Market Development •Product Development 2.57, 3.14 3.0 IV V VI VII VIII IX Medium 2.0 to 2.99 2.0 Low 1.0 to 1.99 1.0 Division Revenues (millions) Percent Revenues Profit (millions) Percent Profit IFE Scores EFE Scores Company $42,201 100% $2,901 100% 2.57 3.14 STRATEGY IMPLEMENTATION QSPM MATRIX STRATEGY RECOMMAND ATION POLICY SUGGESTION ACTION EXECUTED QUANTITATIVE STRATEGIC PLANING (QSPM) QUANTITATIVE STRATEGIC PLANNING MATRIX (QSPM) 1 2 3 4 5 6 1 2 3 4 5 6 7 Key Factors Opportunities US Market for packaged and processed food has seen large profit in retail sales More people are dining out and food producers are devoting more attention to product designed for restaurants, vending machines and other foodservice provider Development of health food Web site / Portal as marketing medium Input cost of bakers have declined Food safety programs have been adopted recently as issues of chemical and bacterial contamination and new food-borne pathogens remain a public health concern Threats Competes with numbers of companies Global warming Raising cost of petroleum Many consumer switching to store brand products Consumer prices for baked food increased by 10.7% Food cost climbing Childhood obesity Weight STRATEGIC ALTERNATIVES 1 2 Market Product Development Penetration Promoted in Create new organic convenient food products to meals segment accommodate the in Retail trend of healthy food AS TAS AS TAS 0.08 4 0.10 - 0.06 0.06 0.13 0.06 2 2 2 0.12 0.13 0.09 0.07 0.04 0.05 0.06 0.05 1 1 3 2 3 2 0.13 0.09 0.21 0.32 1 0.08 - 0.26 0.12 0.1 0.18 0.1 4 2 3 0.24 1 3 2 2 3 4 0.13 0.27 0.14 0.26 0.18 0.1 0.18 0.2 QUANTITATIVE STRATEGIC PLANING (QSPM) – cont. QUANTITATIVE STRATEGIC PLANNING MATRIX (QSPM) 1 2 3 4 5 6 1 2 3 4 5 Key Factors Strengths Organic revenue increased 2.3 percent North American sales growth 2.9% - higher demand for its cereal Commitment to develop new products (R&D) Innovative advertising method Kraft Foods Inc. manages over 100 different brand-name food products and tracks operating income to five specific consumer segments. Company’s revenue increased to $42.2 billion 2008, while earnings increased to $2.9 billion Weaknesses Risk of contamination in source products High amounts of goodwill ($27.5 billion) $18.5 billion in long term debt (increased by 50% during 2009) Margins depend on commodity prices Drop in sales in Quarter 2 in 2009 (5.9%) Weight STRATEGIC ALTERNATIVES 1 2 Market Penetration Product Development Promoted in Create new organic convenient meals food products to segment in Retail accommodate the trend of healthy food AS TAS AS TAS 0.07 0.07 1 1 0.07 0.07 4 1 0.28 0.07 0.08 0.09 0.13 1 3 0.08 2 3 0.16 0.13 - 0.03 2 0.08 0.07 - 0.04 0.09 3 - 0.39 0.39 - 0.06 4 0.12 0.12 2.42 3 - 0.12 2.92 STRATEGY RECOMMENDATION Create new organic food products to accommodate the trend of healthy food KRAFT Organic commitment to Development revenue of Health Food develop new increase by product (Opportunities) 2.3% (Strength) (Strength) Obesity (Threats) POLICY SUGGESTION Company Strategy • Create new organic food products to accommodate the trend of healthy food. Supporting Policies • Each product segment will be “oriented” by organic foods • Marketing and R & D focus on new organic products. • Sales strategy - US focus in retail and in International, establish brand as organic producer. ACTION EXECUTED EPS Organic Revenue • Expected to increase $ 1.93 / unit (increase by 2.66%) • Increase from 2.3% to at least 2.66%. • Sales expected to increase 30% • COGS increase 25% • Marketing costs increase 15% Financial Policy • Goodwill policy will be revised. • R&D will be amortized up to 5 years. ACTION EXECUTED – cont. Kraft Foods Inc. and Subsidiaries Consolidated Statements of Earnings For the Year Ended 31st December (in million of dollars, except per share data) 2009 (expected) 2008 Net Revenues 54,861 100.0% 42,201 100.0% Cost of Goods Sold 35,233 64.2% 28,186 66.8% Gross Profit 19,629 35.8% 14,015 33.2% Marketing, admin and research costs 10,418 19.0% 9,059 16.5% Asset Impairment and exit costs 2007 36,134 100.0% 24,057 57.0% 12,077 43.0% 7,673 18.2% 1,024 1.9% 1,024 1.9% 440 1.0% - 0.0% - 0.0% - 0.0% Loses / (gains) on divestitures, net 92 0.2% 92 0.2% (15) 0.0% Amortization of Intangibles 23 0.0% 23 0.0% 13 0.0% 8,072 14.7% 3,817 14.6% 3,966 23.8% Interest Expenses 1,240 2.3% 1,240 2.3% 604 1.4% EBT Provision for Income Taxes 6,832 728 12.5% 1.3% 2,577 728 12.4% 1.7% 3,362 1,002 22.3% 2.4% 6,104 13.4% 1,849 12.9% 2,360 21.4% Earnings and gain from discontinued operations, net of 1,052 1.9% 1,052 2.5% 230 0.5% Net Earnings Per share data: 7,156 15.3% 2,901 15.4% 2,590 21.9% Gain on redemption of United Biscuits investment Operating Income Earnings from continuing operations Basic EPS * Unit share - 6.72 millions 1.93 1.95 1.64 CONCLUSION New organic products Expected EPS $1.93 Organic revenue increase to 2.66% Commitment to R&D Raising awareness of healthy food TQ 44