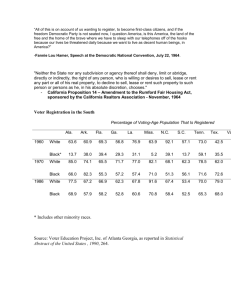

saltzman - Florida Charter School Conference

advertisement

Facility Financing for Charter Schools 101 Steve Saltzman The Charter School “Ecosystem” A successful charter school demands more than just stellar academics – it must be a sound business enterprise as well. Operations Facility Academics The Bicycle Analogy Back Wheel: FINANCIAL ENGINE Front Wheel: MISSION Who is Self-Help? • Non-profit CDFI founded in 1980 • Mission: Creating and protecting ownership and economic opportunity for people of color, women, rural residents and lowwealth families and communities. • Over $110 million lent to charter schools nationwide since 1997 Two Factors should drive your thinking about financial and facilities planning: 1. How many students you have 2. The amount of per pupil revenue you will receive • • Plan only with money you have either in hand or committed by law Too many schools get in trouble because they assume their enrollment will grow. If you play optimistically, even a modest shortfall can challenge your school’s ability to honor its obligations. How Much Can You Spend on Your Facility? • Every penny spent on facilities is a penny not spent on instruction or faculty development. • Overspending on real estate can be an enormous distraction from the most important challenge at hand – providing a quality education to young people. How Much $ Do You Have? Get out your “Charter School Budgeting Worksheet 1” and calculate along with me. • How many students do you expect to enroll in year 1? • How much per pupil revenue will you have? Calculate Problem #1: [# of students] x [per pupil revenue] = maximum gross revenue Use a Realistic Revenue Projection • Most new schools suffer 10% attrition from opening day. Calculate Problem #2: [Maximum gross revenue] x [0.9] = likely gross revenue How Much Should I Spend on my Building? Key Rule: Occupancy costs should be no more than 15% your revenue. (This includes maintenance, rent/mortgage payments, insurance and all other building related expenses) Calculate Problem #3: [0.15] x [likely gross revenue] = maximum facilities expense Caution on Facility Spending #1 • Caution: Realtors may encourage you to spend 20% of your maximum gross revenue on your lease or mortgage because this can increase their commissions by as much as 30%. • Spending such a high % of your revenues on facilities provides no margin for error should enrollment lapse. What Size Building Do I Need? Key Rule: You should plan at least 75 square feet per student (100 square feet per pupil is ideal) Calculate Problem #4: [# of students] x [75] = minimum usable space for building [Max facilities payment] / [Min square feet] = max rent/mortgage per square foot More Than Just Rent: Operating Costs • Though rent or mortgage will be most of your facilities expense, it won’t be all of it. • Here are some other items you’ll need to consider. These will not be included in a mortgage, and may or may not be included in a lease. Expense Item Typical Cost/ft2/Year Utilities $1 -$2 Repair/Maintenance $1.00 Roads and grounds $0 - $.50 Cleaning $.90 Security $0 - $.75 Administrative Total Operating Expenses Fixed Expenses Total Operating and Fixed Expenses $.75 - $1.55 $4.5 – 6.5 $1 - $2 $6-7 How Much Can I Spend on a Mortgage or Lease? • Remember to account for those operating costs we’ve discussed. Typically, they come to about $6/ft2. Calculate Problem #5: [Max cost per ft2] – [ $6 ] = Max mortgage or non-inclusive rent per ft2 [Max mortgage or noninclusive rent per ft2] x [building size in ft2] = Max mortgage or non-inclusive rent Mortgage or Lease Utilities CAM Repair/Maintenance Grounds Security Administration + Insurance = Total Facility Cost How Much Should I Spend on my Teaching Staff? Key Rule: Your spending on teachers should equal at least 55% of your likely gross revenue. (This includes salary and benefits.) Calculate Problem #6: #Classes x Avg # of teachers/class= # of teachers [0.55] x [likely gross revenue] = teacher staffing budget Caution on Facilities Spending #2: • Caution: Schools that spend less than 55% of their revenues on instruction and more than 15% on facilities have limited budget flexibility: • You can always hire additional teachers or parttime instructors to fill gaps, but you cannot easily eliminate 2,000 unused sq feet of a building. Calculate Problem #6 (part 2): [Minimum teacher staffing budget] / [# teachers] = average teacher salary and budget What’s Left? • After 55%+ for teacher pay, • 15% for occupancy costs, you have: 30% likely gross revenue for student services, administration, and any other costs. Calculate Problem #7: What do you have left? How do I get the Building I Need if my School Starts Small? • Caution: New school leaders face the choice: – Obtain a facility on day one that is big enough to accommodate their final, maximum ideal enrollment [OR] – Lease a temporary facility for the first few years • Either choice holds perils • Many landlords will allow you to create a “ladder-style” deal, where your rent increases as enrollment grows. Again, the peril of ladder-style deals is that schools seldom grow as quickly or smoothly as they wish. 5 Key Take-Aways 1. Facility budget = Max 15% of likely gross revenue 2. Teacher staffing budget = at least 55% of likely gross revenue 3. Minimum facility size = 75 ft2 per student. 100 ft2 per student is ideal. 4. Be aware of your realtor’s personal interests. 5. Do not sign any single-source agreements. Leases • Leases can be very long and technical but you still are responsible for understanding it completely before signing it • Have your own attorney examine the lease with you • Some leases contain “hidden” clauses that will force schools to pay more for their facilities • Learning to understand and negotiate a lease could save your school thousands of dollars! Types of Leases Flat or Fixed Leases • A single rent is set for a definite period of time. Gross Leases • The tenant pays a flat monthly amount. • The landlord pays for all operating costs for the building. • In some cases, the tenant pays for its electricity, heat, and air conditioning. • This type of lease often contains an escalation clause that allows the landlord to increase the rent annually to offset increased expenses. Step Leases (Ladder-Style) • The rent is increased at a set amount on an annual basis during the life of the agreement. • The increase is to cover the landlord's expected increases in expenses. • The increase is based on estimated rather than actual costs. Cost-of-Living Leases • The rent is tied to rises in the cost of living. • The rent goes up with general inflation. From FindLaw.com Types of Leases (con’t) Net Leases • The tenant pays a base monthly rent plus some of the expenses. • The increases are based on actual costs rather than on estimates. • The rent increases at the time that the landlord incurs an increase in costs. • In some cases, the tenant pays rent plus all of the real estate taxes. • If leasing only a portion of the building, the tenant will pay a proportionate share of the taxes. Net-Net Leases • The tenant pays the base rental amount, real estate taxes, and insurance premiums. • The insurance and real estate taxes are allocated among the tenants based on the proportion of space occupied. Net-Net-Net Leases (the most common lease) • The tenant pays the base rental amount plus the landlord's operating costs. • Included in this amount are real estate taxes, insurance, maintenance, and repairs. Percentage Leases • The tenant pays either a base amount and a percentage of gross income or, depending on which is higher, pays a base amount or a percentage of the business's gross income. From FindLaw.com Best Leases for Schools • Depends on age of school and the local real estate market -More negotiating room in depressed markets • Start-up schools will benefit from stable occupancy costs • More mature schools should consider buying their facility, if possible Terms • Escalation clauses – If the landlord’s expenses go up, s/he has the right to increase your rent – Typical for gross leases • CAM (Common Area Maintenance) – If your school is in a multi-tenant building, understand what you’re doing • Leasehold Improvements – Alterations to a leased property What’s in a Lease? It depends! Before you sign anything, understand: • Who pays for: Utilities, CAM, Maintenance, Improvements, Taxes (remember, you are tax exempt.) • If lease-to-purchase, how is the purchase price calculated? • What happens to improvements you make? Can you deduct them from the cost of purchase? • What constitutes “maintenance”? Usually not roof, HVAC, etc. • How can you exit the lease if need be? • Under what circumstances can the landlord kick you out? [Advice: Have an attorney—on your side— look at the lease. You may have to pay to hire someone, but it’s worth it.] Parts of a Lease • Name of parties involved (usually referred to as “Tenant” and “Landlord”) – Only the parties outlined as “tenant” and “landlord” are legally bound by the contract. Make sure board members and other supporters are not personally mentioned in the lease • Term – Length of lease – Start-up schools should look for relatively short leases with an option to renew at the end of the lease Parts of a Lease (cont’d) • Base Rent and Payment Details – Outlines the minimum amount of rent you will pay – Reveals any possible fees or elevations – Usually the type of lease (NNN, gross, etc) is not explicitly mentioned, but this section will outline which party is responsible for paying which expenses – Make sure the lease clearly explains how expenses and rent elevations will be calculated • Fees – Outlines when bills are due, what penalties will be assessed for late payments, etc Parts of a Lease (cont’d) • Utilities and Service/Conditions/Responsibilities – Should give exact information about paying for utilities, CAM, parking, janitorial, etc… • Repair and Maintenance – Who fixes what (and who pays for it) when something breaks • Alterations and Improvements – Outlines what type (if any) of leasehold improvement you can make • Landlord Liability and Rights – In what ways can the landlord waive responsibility and when are they allowed to terminate a lease How to read a lease • Skim first to identify the exact dimensions of the building (the premise) and the land (property) • Identify the exact date the lease will begin and end and look for any possible lease extensions – Paying rent months in advance of receiving revenues could put your school in a difficult position • Look for clauses about parking, equipment, restricted uses of property, ability to alter the premise, subletting, etc • After you understand the above, have your lawyer thoroughly review the lease Red Flags • Verbal agreements from landlord are not in written lease • Landlord takes no responsibility for repairs • Single-source contracts with realtors Thanks! And good luck! Questions? Steve Saltzman 919.956.4620 800.476.7428 steve.saltzman@self-help.org