Productionive - University of Michigan

advertisement

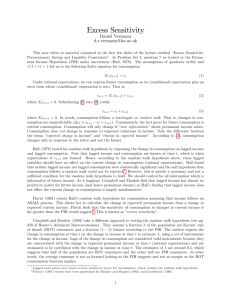

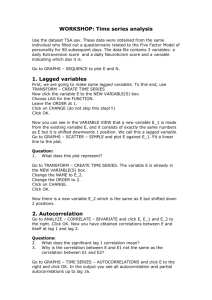

The Microeconomic Implications of Labor Regulations: Cross-Country Evidence from Within the Firm Francine Lafontaine Jagadeesh Sivadasan Ross School of Business, University of Michigan AEA Meetings, Jan 2007 (Updated Jan 2009) Introduction Goal: Assess the effects of regulations that create rigidities in the labor market Important and controversial question: a number of papers have considered the effects of such regulations at the macro level (e.g. Botero et al (2004), Lazear (1990)) We focus on the very micro level, using data from a single fast-food chain with operations in more than 40 countries around the world: most importantly, we quantify the effect of the regulations on firm labor adjustment decisions also examine effect on extent of operations 2 Introduction Important advantages of our empirical setting: Fundamentally same production technology Same output (as close as can get) Labor intensive - labor issues really matter We have very detailed data: weekly revenues and costs information for each outlet outside the US (more than 2500 of them, over 4 years, in 43 countries) 3 Introduction Important advantages of our empirical setting: The high frequency of our data has two main advantages: Gets around problems with annual data, which can hide a lot of within year turnover (Hamermesh and Pfann (1996)) Allows us to adopt estimation strategies with lots of controls (i.e. fixed effects at the outlet, outlet-year, or outlet-year-season) 4 Introduction We focus on questions that are particularly suited to our data paper – addresses the effect of regulation on productivity and labor demand In some sense, more direct place to look for effects But in reality, theory ambiguous on these effects, whereas clear predictions on hysteresis and effect on responsiveness to output changes And our data – labor costs, not labor levels => potential biases due to “poor” measure of wages Companion 5 Introduction – Preview of Results We find strong evidence that in countries with more rigid labor laws: Outlets’ choices of labor levels are less responsive, from period to period, to changes in revenues, and there is more hysteresis in labor levels, that is labor in one period is more related to previous period labor We also find some evidence that in such countries: the Company enters later and operates fewer outlets - and uses “local” franchising more as well 6 Organization of this Talk Basic Model and Predictions A Note on Dynamics Data and Definition of Variables Results for Labor Adjustment – Botero & GCS Key Identification Issues Contrasting IV with Materials Adjustment Results Results Results on Company’s Extent of Operations Conclusions 7 Basic Model Draws on Heckman and Pagés (2003), who drew on Holt, Modigliani, Muth and Simon (1960) Given our weekly data, we take capital as given (or contributing to the Hicks neutral productivity term), and write a 2 input Cobb-Douglas production process with labor and materials Yt t Lt M t where Yt is the quantity of output produced by the firm in period t, Lt is labor, and Mt represents materials used 8 Basic Model Assume iso-elastic demand curve: Pt Qt1/ where Pt is the price per unit output in period t, represents demand shifters and is the price elasticity of demand The firm’s profit to be maximized is t Pt Qt Wt Lt St M t where Wt is the wage rate faced by the firm in period t, and St is the per unit cost of materials 9 Basic Model Each week, manager chooses labor and materials so FOCs for these are binding Assume horizontal labor and materials supply in each local market (each outlet buys little, and even as a group they are a tiny part of the market) => obtain optimal labor and materials demand function in terms of the primitives (prices, demand & production function parameters) => can write total labor and material cost equations conditional on output 10 Basic Model These input demand equations are b log ' rt * f t log ' rt * t where we use bt to denote log(WtLt) and ft to mean log(StMt), and 1 1 ' 1 and ' 1 . These equations then describe equilibrium input costs in the absence of adjustment costs 11 Basic Model Now suppose that there are costs to adjusting labor. First, let the cost of being off the static optimum be quadratic in log labor cto o (bt* bt )2 where o > 0. Second, suppose that the cost of changing labor levels from one period to the next are given by cta a (bt bt 1 ) 2 where we expect a to be positive and increasing in the rigidity of labor regulations 12 Basic Model Each outlet minimizes the sum of these costs. This yields optimal labor choice bit (1 - )b bi ,t 1 j * it j where outlet i is in country j, and j aj o j a . The optimal labor cost equation above can be rewritten as j j j bit (1 - )rit bi ,t 1 (1 - )log ' 13 Basic Model Taking, as a first approximation, j a0 a1 j we get the following econometric specification for the labor costs of outlet i in country j at time t: bit (1 a0 a1 )rit (a0 a1 )bi ,t 1 (1 a0 a1 )log ' j j j rit bi ,t 1 r rit b bi ,t 1 is it j j where τ j is the index of labor regulation, and is stands for store, store-year, or store-season-year fixed effects. 14 Basic Model In this regression, we expect r to be negative and b to be positive. In other words, our simple model yields two principal implications that we bring to data: Labor costs should be less responsive to changes in revenues in countries where regulations are more stringent Labor costs at time t should be more dependent on labor costs at time t-1 in countries with more stringent laws (hysteresis) These predictions are intuitive, and the latter has been tested in a number of studies of the effect of regulation on labor demand (see survey in Heckman and Pagés, 2004). 15 Note on Dynamics Our two testable implications are derived from a very simple model Heckman and Pagés (2004) express concern that the labor hysteresis prediction may not arise in a more general dynamic model We solved a more general dynamic stochastic programming model: Two state variables are current productivity and last period labor. We solve numerically for four scenarios: with both symmetric (quadratic) and asymmetric (i.e. severance pay only) adjustment costs. and for iid as well as persistent demand /productivity shocks processes 16 Note on Dynamics To approximate our actual data, using optimal policy functions, we ran regressions on simulated behavior of 75 outlets for 104 periods across 45 regimes Zero adjustment costs Log (Lagged labor cost) Log (Revenue) Adj. cost X Log (Lagged labor cost) Adj. cost X Log (Revenue) Constant Fixed Effects Observations Adjusted R-squared Number of clusters IID shocks Persistent shocks Symmetric quadratic adjustment costs IID Persistent shocks shocks 0.0000 [0.0001] 0.984*** [0.0001] 0.0006*** [0.0001] 0.984*** [0.0002] 0.657*** [0.039] 0.198*** [0.022] 0.574*** [0.015] 0.264*** [0.018] 0.874*** [0.043] 0.190*** [0.030] 0.251*** [0.017] 0.288*** [0.020] 0.117*** [0.008] 0.398*** [0.026] 0.146*** [0.008] 0.677*** [0.023] 0.0001 [0.0002] -0.0001 [0.0004] -0.0004 [0.0003] 0.0001 [0.0006] 1.130*** [0.151] -0.540*** [0.111] 0.690*** [0.090] -0.602*** [0.089] 1.856*** [0.104] -0.885*** [0.118] 0.398*** [0.032] -1.083*** [0.073] 0.253*** [0.020] -1.344*** [0.067] 0.421*** [0.031] -0.971*** [0.089] -1.529*** [0.0001] -1.528*** [0.0002] -0.555*** [0.072] -0.688*** [0.022] -0.181** [0.072] -1.267*** [0.023] -1.470*** [0.021] -1.337*** [0.005] Outlet-year- Outlet-yearseason season 351000 0.999 45 351000 0.999 45 Asymmetric linear adjustment costs IID Persistent shocks shocks Outlet-year- Outlet-year- Outlet-year- Outlet-yearseason season season season 351000 0.801 45 351000 0.932 45 351000 0.782 45 351000 0.929 45 Fixed (lump-sum) adjustment costs IID Persistent shocks shocks Outlet-year- Outlet-yearseason season 351000 0.852 45 351000 0.90 45 17 The Data Mostly from internal firm records Cover over 2500 outlets in more than 40 countries worldwide, weekly from 2000 to 2003 Data on Revenues per week Total labor costs per week Total materials costs per week Number of items (standardized notion of output) 18 The Data We measure the rigidity of the labor regulations in each country using the Botero et al (2004) index (see appendix in paper for details) advantage – computed similarly across countries Main disadvantage – laws may not be enforced as strongly everywhere Main We verify our results using an index of hiring and firing flexibility from the Global Competitiveness Survey (2002) of business executives 19 Index of labor regulation (Botero, et al) 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 RUS KAZ FRA NLD NOR UKR POL DOM VNM BEL HRV LKA KOR THA BOL AUS IRL SGP UGY USA HKG ZMB 0 20 .8 Russian Federation Tunisia Portugal Germany Zimbabwe 0 .2 .4 .6 Spain France Sweden Slovenia Netherlands Latvia Finland Jordan Norway Indonesia Ukraine Slovakia Venezuela Italy Poland Panama Lithuania Dominican Republic Mexico DenmarkBrazil Vietnam Czech Republic Bulgaria Greece AustriaCroatiaBelgium Chile Philippines Sri Lanka Peru Taiwan Switzerland South Korea India China Thailand Turkey Ecuador Hungary Bolivia Australia Colombia Argentina Ireland South Africa Singapore Israel Great Britain Canada Morocco United States Malaysia Hong Kong Jamaica New ZealandJapan .2 .4 .6 .8 1 Hiring/firing inflexibility (2002, Global Competitiveness Report) Fitted (OLS) Fitted (GLS, Root-N weight) 21 Panel Characteristics (baseline sample) Year 2000 2001 2002 2003 Total Number of observations 80,429 85,113 74,201 82,305 322,048 Number of outlets 1,721 1,828 2,147 1,938 2,526 Number of countries 39 37 38 37 43 22 Descriptive Statistics Panel B: Summary statistics (variables in logs) Variable N Log (Labor cost) 322,048 Log (Revenue) 322,048 Log (Material cost) 318,749 Mean SD P25 Median P75 Min Max 7.19 8.84 7.72 0.85 0.69 0.66 6.71 8.46 7.37 7.27 8.90 7.78 7.78 9.32 8.16 -5.05 2.85 -4.87 10.25 11.50 10.94 Panel C: Summary statistics (variables in levels) Variable N Mean SD P25 Median P75 Min Max 1,391.21 5,329.17 1,626.86 0.16 819.84 4,730.58 1,590.36 -0.15 1,434.39 7,332.80 2,394.45 0.03 2,390.97 11,156.53 3,481.43 0.16 0.01 17.30 0.01 -0.25 28,219 98,668 56,580 0.42 Labor cost Revenue Material cost Index of labor regulation 322,048 322,048 318,749 322,048 1,798.57 8,485.44 2,706.78 0.00 23 1 .8 .6 .4 .2 0 0 .2 .4 .6 .8 1 Correlation between changes in input costs and revenue .2 .4 .6 .8 Index of labor regulation (Botero, et al) .2 .4 .6 .8 1 Hiring/firing inflexibility (2002, Global Competitiveness Report) Correlation between changes in labor cost and revenue Correlation between changes in labor cost and revenue Fitted (GLS, Root-N weight) Fitted (GLS, Root-N weight) Correlation between changes in material cost and revenue Correlation between changes in material cost and revenue Fitted (GLS, Root-N weight) Fitted (GLS, Root-N weight) 24 Table 4: Baseline Results (4) (5) (6) 0.501*** [0.049] 0.341*** [0.040] 1.013*** [0.291] -0.570*** [0.144] 0.623*** [0.227] 0.348*** [0.036] 0.360*** [0.035] 0.909*** [0.223] -0.488*** [0.101] 1.550*** [0.310] 0.203*** [0.033] 0.391*** [0.036] 0.687*** [0.203] -0.414*** [0.106] 2.305*** [0.358] Fixed Effects Outlet Outlet-year Outlet-yearseason Observations Adjusted R-squared Number of clusters 322,048 0.945 43 322,048 0.952 43 322,048 0.959 43 Log (Lagged labor cost) Log (Revenue) Regulation X Log (Lagged labor cost) Regulation X Log (Revenue) Constant 25 Table 4: Baseline Results Effect of a one standard deviation (0.85) increase in Log (Lagged Labor) in percentage terms At Regulation = mean (0.00) 42.59 29.58 17.26 At Regulation = mean + sd (= 0.16) 56.36 41.94 26.60 Impact of increase in Regulation 13.78 12.36 9.34 Effect of a one standard deviation (0.69) increase in Log (Revenue) in percentage terms At Regulation = mean (0.00) 23.53 24.84 26.98 At Regulation = mean + sd (= 0.16) 17.24 19.45 22.41 Impact of increase in Regulation -6.29 -5.39 -4.57 26 Table 5: GCS Index Results (1) (2) (3) 0.530*** [0.053] 0.355*** [0.041] 0.988*** [0.332] -0.734*** [0.221] 0.244 [0.240] 0.371*** [0.041] 0.383*** [0.036] 0.914*** [0.291] -0.714*** [0.217] 1.136*** [0.316] 0.220*** [0.034] 0.418*** [0.038] 0.710*** [0.235] -0.629** [0.262] 1.909*** [0.363] Fixed Effects Outlet Outlet-year Outletyear-season Observations Adjusted R-squared Number of clusters 338,660 0.948 48 338,660 0.955 48 338,660 0.961 48 Log (Lagged labor cost) Log (Revenue) Inflexibility X Log (Lagged labor cost) Inflexibility X Log (Revenue) Constant 27 Table 5: GCS Index Results Effect of a one standard deviation (0.85) increase in Log (Lagged Labor) in percentage terms At Inflexibility = mean (0.00) 45.05 31.53 18.70 At Inflexibility = mean + sd (= 0.13) 55.97 41.63 26.55 Impact of increase in Inflexibility 10.92 10.10 7.85 Effect of a one standard deviation (0.69) increase in Log (Revenue) in percentage terms At Inflexibility = mean (0.00) 24.50 26.43 28.84 At Inflexibility = mean + sd (= 0.13) 17.91 20.02 23.20 Impact of increase in Inflexibility -6.58 -6.40 -5.64 28 Key Identification Issues As per our model above, the error term is: 1 eit (1 a0 a1 )log it 1 it Thus the error term includes omitted supply-side parameter it (output elasticity with respect to labor) and demand side parameter it (elasticity of demand) Our store or store-year-season fixed effects control implicitly for the differences in τ j across countries, and for these supply and demand parameters insofar as they are fixed within a store or store-year or store-year-season j 29 Key Identification Issues Unanticipated demand and productivity shocks can also add to the error term if labor is set early, then a high (low) demand shock shows up as too little (much) labor conditional on output Since we are interested in the coefficient on lagged labor or revenue interacted with regulation, a bias arises only when: the omitted demand and supply parameters vary within storeyear-seasons, and are correlated with lagged labor/revenue in a different way across different regulation regimes prediction errors (with regard to demand and productivity shocks) are correlated with levels of regulation 30 Key Identification Issues We address these potential identification issues in two different ways: using the material demand equation as a control with instrumental variables The material demand equation is a good control because: omitted demand and supply parameters are the same for the material as for the labor demand equation prediction error also would bias the material demand specification in a similar way IV approach draws from traditional approaches in the literature (Blundell and Bond 1998) uses lagged endogenous variables that are uncorrelated with unpredicted component of current demand and productivity shocks we have more instruments than endogenous variables, so we can perform an overidentification test – good results! 31 Table 6: Material Costs Results (Botero et al. Index) (4) (5) (6) 0.159*** [0.038] 0.852*** [0.027] -0.211 [0.201] -0.020 [0.138] -1.032*** [0.084] 0.112*** [0.036] 0.901*** [0.020] -0.168 [0.197] -0.004 [0.093] -1.102*** [0.127] 0.033* [0.019] 0.942*** [0.008] -0.089 [0.125] -0.075* [0.043] -0.856*** [0.132] Fixed Effects Outlet Outlet-year Outletyear-season Observations Adjusted R-squared Number of clusters 362,711 0.947 43 362,711 0.953 43 362,711 0.960 43 Log (Lagged materials cost) Log (Revenue) Regulation X Log (Lagged materials cost) Regulation X Log (Revenue) Constant 32 Table 6: Material Costs Results (Botero et al. Index) Effect of a one standard deviation (0.66) increase in Log (Lagged Materials cost) At Regulation = mean (0.00) At Regulation = mean + sd (=0.16) Impact of increase in Regulation 10.49 7.39 2.18 8.27 5.62 1.24 -2.23 -1.77 -0.94 Effect of a one standard deviation (0.69) increase in Log (Revenue) At Regulation = mean (0.00) 58.79 62.17 65.00 At Regulation = mean + sd (=0.16) 58.57 62.12 64.17 Impact of increase in Regulation -0.22 -0.04 -0.83 33 Table 7: Robustness check: OECD Sample and Interaction Terms (1) OECD Log (Lagged labor cost) Log (Revenue) Regulation X Log (Lagged labor cost) Regulation X Log (Revenue) (2) (3) (4) (5) 0.174*** [0.030] 0.461*** [0.036] 1.709*** [0.325] -1.085*** [0.276] -0.052 [0.063] 0.639*** [0.065] 0.204 [0.333] 0.726*** [0.205] 0.165 [0.176] 0.645*** [0.171] 0.428*** 0.331** 0.380* 0.687** 0.700*** [0.141] [0.161] [0.200] [0.299] [0.238] -0.354* -0.069 -0.225 -0.584*** -0.543*** [0.183] [0.108] -0.158*** [0.152] [0.152] [0.141] GDP X Log (Lagged labor cost) [0.033] GDP X Log (Revenue) 0.156*** [0.030] Entry barriers X Log (Lagged labor cost) 0.081*** [0.021] Entry barriers X Log (Revenue) -0.078*** [0.025] Wage flexibility X Log (Lagged labor cost) -0.0002 [0.064] Wage flexibility X Log (Revenue) -0.063 [0.038] Labor relations X Log (Lagged labor cost) 0.008 [0.040] Labor relations X Log (Revenue) -0.053 [0.032] Fixed effects Constant Observations Outletyearseason 1.996*** [0.314] 236,291 Outletyearseason Outletyearseason Outletyearseason Outletyearseason 2.197*** [0.321] 322,048 2.273*** [0.296] 265,842 2.238*** [0.344] 321,569 2.291*** [0.321] 321,569 34 Table 8: Robustness check: DID comparison of top and bottom decile of change in Index of Inflexibility between 2002 and 2004 LABOR (1) Log (Lagged input cost) Log (Revenue) Year 2003 Year 2003 X Log (Lagged input cost) Year 2003 X Log (Revenue) DInf_p90 X Year 2003 DInf_p90 X Log (Lagged input cost) DInf_p90 X Log (Revenue) DInf_p90 X Year 2003 X Log (Lagged input cost) DInf_p90 X Year 2003 X Log (Revenue) DGDPGR X Year 2003 DGDPGR X Log (Lagged input cost) DGDPGR X Log (Revenue) DGDPGR X Year 2003 X Log (Lagged input cost) DGDPGR X Year 2003 X Log (Revenue) Constant Fixed effects (2) 0.570*** [0.032] 0.152*** [0.038] -0.474* [0.280] -0.328*** [0.040] 0.321*** [0.037] 1.435*** [0.494] -0.143 [0.112] 0.196 [0.171] 0.519*** [0.127] -0.634*** [0.105] 15.56** [6.029] -1.970*** [0.660] 1.403 [1.378] 1.881** [0.857] -3.569*** [0.823] 1.233*** [0.288] 0.358*** [0.057] 0.198*** [0.053] -0.179 [0.191] 0.083 [0.202] 0.432** [0.198] -0.722*** [0.211] Outlet MATERIALS (3) (4) -0.480 [1.073] 0.341 [1.654] 0.647 [1.101] -4.088** [1.780] 1.968*** [0.252] 0.157*** [0.022] 0.897*** [0.023] -0.138 [0.122] -0.034 [0.023] 0.048* [0.025] 1.107*** [0.164] 0.104*** [0.037] -0.091** [0.045] 0.001 [0.053] -0.125** [0.057] 9.037*** [1.803] 1.555*** [0.303] -1.110*** [0.350] -2.257*** [0.360] 0.806** [0.362] -1.250*** [0.132] 1.061*** [0.256] -0.135 [0.320] -2.088*** [0.304] 0.181 [0.375] -0.941*** [0.086] Outlet- Outlet Outlet- -0.233*** [0.059] 0.328*** [0.067] 0.055*** [0.016] 0.918*** [0.021] 0.008 [0.018] 0.032 [0.022] 0.103*** [0.033] 0.009 [0.044] -0.077* [0.044] -0.078 [0.060] 35 Table 8: Robustness check: Case study of labor reform in South Korea (1996-98) Log (Lagged input cost) Log (Revenue) POST_REFORM X Log (Lagged input cost) POST_REFORM X Log (Revenue) BEFORE-AFTER LABOR MATERIALS (1) (2) (3) (4) 0.765*** 0.270*** 0.332*** 0.122*** [0.049] [0.058] [0.039] [0.024] 0.206*** 0.160*** 0.717*** 0.822*** [0.034] [0.041] [0.034] [0.026] -0.404*** -0.129** -0.024 -0.018 [0.053] [0.064] [0.044] [0.029] 0.335*** 0.574*** 0.033 0.040 [0.043] [0.049] [0.037] [0.035] Constant -0.127 [0.096] -1.242*** [0.100] Fixed Effects Outlet Observations Adjusted R-squared Number of clusters 15,071 0.854 152 0.515*** [0.145] Outletyearseason 15,071 0.894 152 -0.710*** [0.137] Outletyearseason 15,099 0.963 152 D_KOREA X Log (Lagged input cost) D_KOREA X Log (Revenue) D_KOREA X POST_REFORM X Log (Lagged input cost) D_KOREA X POST_REFORM X Log (Revenue) Outlet 15,099 0.944 152 36 Table 8: Robustness check: Case study of labor reform in South Korea (1996-98) Log (Lagged input cost) Log (Revenue) POST_REFORM X Log (Lagged input cost) DIFFERENCE-IN-DIFFERENCES LABOR MATERIALS (5) (6) (7) (8) 0.272*** 0.084*** 0.074*** 0.023*** [0.021] [0.016] [0.009] [0.007] 0.460*** 0.549*** 0.958*** 0.965*** [0.013] [0.013] [0.009] [0.010] 0.190*** 0.090*** 0.054*** 0.018 [0.015] [0.021] [0.014] [0.012] -0.167*** -0.152*** -0.043*** 0.005 [0.013] 0.493*** [0.054] -0.254*** [0.036] [0.014] 0.186*** [0.060] -0.389*** [0.043] [0.012] 0.257*** [0.040] -0.241*** [0.035] [0.013] 0.099*** [0.024] -0.143*** [0.028] -0.594*** -0.219*** -0.078* -0.036 [0.055] [0.067] [0.046] [0.031] D_KOREA X POST_REFORM X Log (Revenue) 0.502*** 0.726*** 0.075* 0.035 Constant [0.045] 1.156*** [0.105] [0.050] 2.158*** [0.085] [0.038] -1.453*** [0.053] [0.038] -1.153*** [0.053] Fixed Effects Outlet Outletyearseason Outlet Outletyearseason Observations Adjusted R-squared Number of clusters 71,273 0.977 592 71,273 0.984 592 71,200 0.971 592 71,200 0.980 592 POST_REFORM X Log (Revenue) D_KOREA X Log (Lagged input cost) D_KOREA X Log (Revenue) D_KOREA X POST_REFORM X Log (Lagged input cost) 37 Impulse response functions based on VAR analysis 38 Implied Rigidity Estimates The underlying structural parameters o and a are not simultaneously identified. However j a0 a1 j is identified Model implies following relationship between optimal adjustment and actual adjustment of labor More regulation => higher j => greater dampening of adjustment 39 Table 11: Estimates of Dampening Factor (change in labor costs in the absence of adjustment costs / actual change in labor costs) Estimate of a0 Estimate of a1 Dampening factor estimate Regulation P25 P75 Change (percent) Panel 1: Using results from Column 6 of Table 4 Coefficient on Log (Lagged labor cost): 0.203 Coefficient on Regulation X Lagged labor cost: 0.687 0.900 0.687 23.7 1 - Coefficient on Log (Revenue): 0.609 - (Coefficient on Regulation X Revenue): 0.414 0.453 0.325 28.3 Average of above: 0.406 Average of above: 0.550 0.677 0.506 25.2 Panel 2: Using results from Column 1 of Table 7 – OECD only Coefficient on Log (Lagged labor cost): 0.174 Coefficient on Regulation X Lagged labor cost: 0.428 0.890 0.749 15.9 1 - Coefficient on Log (Revenue): 0.539 - (Coefficient on Regulation X Revenue): 0.354 0.514 0.397 22.7 Average of above: 0.356 Average of above: 0.391 0.702 0.573 18.4 40 A Look at the Firm’s Expansion If more rigid labor regulations imply that individual outlets cannot adjust labor as much as they otherwise would, then all else the same, outlets in these markets will be less profitable. This suggests the firm should Enter later Expand less rapidly Franchise more ? in highly regulated markets 41 Labor Regulation and International Expansion: Time to Entry Whole Sample Log(GDP/capita in USD) Log(Population) Log(Distance to USA in kms) Regulation (Botero et al) -0.31** [0.07] -0.19** [0.07] 0.28 [0.19] 1.10* [0.44] Regulation (GCS) Constant Observations R-squared Number of Clusters 5.09* [2.01] 6906 0.42 37 -0.22** [0.08] -0.11 [0.06] 0.26 [0.18] -0.45 [0.65] 3.80* [1.61] 8111 0.23 43 Country = Observation (end of 2001) -0.32** -0.22** [0.07] [0.08] -0.18* -0.10 [0.07] [0.07] 0.24 0.23 [0.21] [0.19] 1.14* [0.45] -0.44 [0.70] 5.36* 3.95* [2.14] [1.72] 34 40 0.45 0.24 42 Labor Regulation and International Expansion: Number of Outlets Whole Sample Log(GDP in USD) Log(Population) Log(Distance to USA in kms) Regulation (Botero et al) 0.59** [0.13] 0.63** [0.17] -0.45+ [0.26] -2.02* [0.83] Regulation (GCS) Constant Observations R-squared Number of clusters -8.25* [3.56] 7423 0.41 41 0.57** [0.12] 0.54** [0.15] -0.40 [0.27] -0.37 [1.47] -7.54** [2.81] 8628 0.38 47 Country = Observation (end of 2001) 0.51** 0.50** [0.18] [0.16] 0.58** 0.53** [0.20] [0.18] -0.38 -0.30 [0.32] [0.32] -2.60* [1.07] -1.99 [2.01] -7.10 -6.83+ [4.64] [3.51] 38 44 0.34 0.30 43 Labor Regulation and International Expansion: Use of Franchising Whole Sample Log(GDP in USD) Log(Population) Log(Distance to USA in kms) Regulation (Botero) 0.15 [0.06]* -0.001 [0.06] -0.19 [0.06]** 0.12 [0.37] Regulation (GCS) Constant Observations R-squared Number of clusters 0.59 [1.53] 2852 0.35 30 0.12 [0.05]* -0.01 [0.04] -0.28 [0.07]** 0.82 [0.40]+ 1.43 [1.12] 3372 0.29 36 Country = Observation (end of 2002) 0.18 0.14 [0.06]* [0.05]** 0.03 0.01 [0.06] [0.04] -0.17 -0.27 [0.08]* [0.08]** 0.37 [0.38] 0.91 [0.40]* -0.35 0.76 [1.68] [1.30] 29 33 0.38 0.34 29 33 44 Conclusion Using weekly data from outlets of a multinational fast-food chain, we have shown evidence of a statistically and economically important effect of labor regulations on labor decisions at the micro level To our knowledge this is the first time that effects of such policies are documented in a crosscountry context at such a micro level 45 Conclusion Specifically, using our most conservative estimates, we find that an increase of one standard deviation in the labor regulation rigidity index reduces the response of labor cost to a one standard deviation increase in output (revenue) by about 4.4 percentage points (from 26.4 per cent to 22.0 percent) increases the response of labor cost to a one standard deviation increase in lagged labor cost by about 9.6 percentage points (from 17.0 per cent to 26.6 per cent) 46 Conclusion We have also shown that results are similar whether we use the Botero et al. index, or an alternative measure of labor regulation from the Global Competitiveness Survey The effects do not hold for material costs, confirming that they are not spurious – the increased rigidity in labor is not driven by omitted variables that are also likely to affect other variable costs The effects are even stronger when we estimate using an IV approach 47 Conclusion Consistent with the impact on adjustment behavior, we also find that the Company delayed entry, and operates fewer outlets and its partners rely on franchising more in countries with more rigid labor laws 48 Conclusion So we have shown that labor levels are more persistent in countries that enact more rigid labor laws, an effect these policies are meant to achieve However, increases (responses to positive shocks) as well as decreases in labor levels are affected Consistent with our earlier findings that outlet level labor demand was lower in more heavily regulated markets, our results on timing of entry and level of operations of the Company across markets suggest that easing these laws would increase employment and output in this industry 49 Other paper (Lafontaine and Sivadasan, “Within-firm Labor Productivity across Countries: A case study): Quantifying the Labor Demand effect We find coefficients for regulation of about -0.4 => an increase in labor regulation (Botero Index) from its 25th percentile to its 75th percentile value reduces labor per outlet by 0. 4 * 0.31 = 12% Alternatively, a one standard deviation increase in the labor regulation rigidity index leads to a reduction in conditional labor demand of 6.4 per cent 50 Interpreting the Expansion Effects From column 1 (part a): an increase in labor regulation by one standard deviation increases the time to entry by 1.7 years on a mean of 8.9 years (so not quite 20% increase) From column 1 (part b): a one standard deviation increase in the index of labor regulation reduces the number of stores by about 3.2 relative to a mean of 12.06 outlets (a >25% reduction) 51 Interpreting the Expansion Effects We also find some evidence that the franchisor and its partners rely on franchising more the more highly regulated the labor market is Our analyses here are based on more limited information, however, and we have yet to verify robustness 52