CSCPA 2014 Accounting Faculty Symposium Sorensen

advertisement

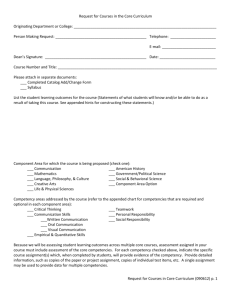

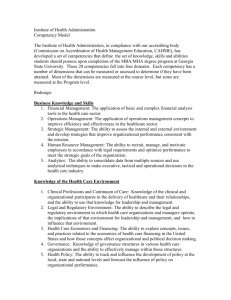

The Future of Accounting Education: Assessing the Competency Crisis James E. Sorensen, Ph.D., CPA, CGMAS School of Accountancy, University of Denver Colorado Society of CPAs Accounting Faculty Symposium October 18, 2014 Development & Vetting of Proposed Framework • Development: – First meeting of Task Force on September 10, 2010 – Have had virtual meetings nearly every other week since then – Numerous “side” meetings to focus on specific aspects of the framework • Conference Presentations: – 2011, 2012 and 2013 AAA annual meetings – 2012 and 2013 IMA Annual Conference & Exhibition – 2012 and 2013 AAA Management Accounting Section mid-year meeting • Input from numerous colleagues and members of the Pathways Commission’s Common Body of Knowledge task force .2 Publications and Manuscripts Under Review • Lawson, et al. 2014. “Focusing Accounting Curricula on Students’ Long-Run Careers: Recommendations for an Integrated Competency-Based Framework for Accounting Education.” Issues in Accounting Education, 29 (2): 295-317. • Lawson, et al. (2015) “Thoughts on Competency Integration in Accounting Education,” Issues in Accounting Education, 30 (3): 149-171. • P. Brewer, J.E. Sorensen, D.E. Stout. (2014). “The Future of Accounting Education: Addressing the Competency Crisis.” Strategic Finance, XCVI (2): 28-37. 3 Motivation for Development of Framework Accountants’ responsibilities are expanding… But, our extensive review of the literature shows that these responsibilities are not being met… 4 Pathways Commission Report • On the education of accountants and the need for change: – “Accounting education is challenged to keep pace with opportunities and expectations that students learn to think in new ways and develop the necessary skills and knowledge to maintain the profession’s ability to meet…evolving opportunities. Without innovation and change, the discipline and profession risk becoming supplanted by technology or possibly rendered irrelevant because of mechanical rules and artificial contrivances.” (p. 22) 5 Pathways Commission Report • On developing curriculum models… – “…accounting curricula have evolved with limited commitment or agreement about core learning objectives in recent years. Vital accounting programs, courses, and learning environments need systematic attention to foundations for curriculum and pedagogy and opportunities for renewal for accounting educators. … Accounting educators must bring together the broad accounting community to develop a shared vision for a body of knowledge that can serve as the foundation for varied curriculum models, allowing flexibility across varied educational institutions and missions.” (p. 36) 6 Pathways Commission Report • “If the accounting community continues to concentrate on the financial accounting system and not understanding the technology and dynamic business processes that run companies of the 21st century, the accounting profession has the potential to become obsolete.” (p. 68) (emphasis added) 7 The TASK FORCE RECOMMENDATIONS 8 TF Recommendation #1 • The perspective of accounting education should be reoriented to a greater focus on curricular requirement for long-term career demands. – Demski (2007): "... a vast amount of the curriculum is arguably aimed at preparing the student for the initial job ... important, but so are the ones that follow." – Academic and practitioner sources have cited the academic need to start building competencies required for the long-run. 9 TF Recommendation #2 The focus of accounting education should be broadened to move beyond a narrow focus on public accounting. – over 80% of accounting graduates ultimately choose careers outside of public accounting – accounting curricula should establish the base of knowledge and skills needed for career requirements across a variety of organizations. 10 TF Recommendation #3 • The educational objectives of accounting curricula today should reflect how accountants add organizational value – The way accountants add value within organizations has evolved and continues to evolve. – Numerous surveys of financial executives confirm that accountants today are being asked increasingly to complement traditional accounting competencies with broad management competencies that enable them to collaborate with other managers to improve organizational performance. 11 Workplace Reality Underlying Expected Competencies Overarching responsibility of ALL professional accountants is to ADD values to clients and organizations by all accounting disciplines: – Audit – Tax – Financial accounting – Management accounting – Accounting information systems – Others Ways to Add Value – Have evolved – Continue to evolve 12 TF Recommendation #4 • The competencies (KSAs) of an accounting education should emerge and be developed within the curriculum as integrated competencies. – There are many ways to deliver the content; competencies go beyond traditional "silos." – The challenge is achieving integration within and among competencies; we have work to do. 13 Conceptual Framework of Accounting Education • These collective recommendations lead to a plausible proposed conceptual framework that identifies the integrated professional competencies necessary to create value in the long-run careers for all accountants. 14 Competency Integration Framework 15 Integration: How Accountants Add Value Foundational Broad Management Accounting 16 Continuum of Entry-Level and Long-Term Competency Development and Integration Examples of Competency Areas Preparation for Initial Job Undergraduate Education Further Development of Life-Long Competencies Early Career and/or Additional Education Long-Term Career Integration of Formal Coursework and Professional Development Grounding in accounting and business knowledge and foundational skills Deeper expertise in area of chosen career path; increasing integration across subject matters and focus on organizational value Deeper integration across subject matters; greater focus on ability to gain new knowledge and skills over time to enhance organizational value Integration of Accounting and Broad Business Knowledge Limited integration across accounting and broad business knowledge Considerable integration of accounting and broad business knowledge Integrate accounting and broad business knowledge in highly uncertain and evolving situations; develop new ways to apply business knowledge as an accounting professional Integration of Foundational Competencies Develop foundational competencies for a business major Use foundational competencies to enhance cross-functional work Use foundational competencies effectively to anticipate and adapt to more complex business situations 17 Levels of Competency Must Be Achieved Sequentially Knowing Deeper Knowledge and More Contextual Complexity Demonstrate knowledge in unambiguous situations Identifying Analyzing Prioritizing Anticipating Identify ambiguous problems and relevant information Analyze relevant information, viewpoints, and alternatives Establish and apply priorities for reaching conclusions Anticipate and adapt to changing conditions Achieve First Achieve Second Achieve Third Achieve Last 18 Level of Competency Integration (partial representation of Accounting Competencies) Accounting Competencies Accounting Competency 3 Foundational Accounting Competency 2 Competencies Accounting Competency 1 Topic A Topic C Topic E Topic F Topic D Topic B Broad Management Competencies 19 Capital Investment Decision-Analysis Example Accounting Competencies Foundational Competencies Assurance & Internal Control: Internal and external audit implications Planning, Analysis & Control Communication Quantitative Methods External Reporting & Analysis: Financial statement preparation & analysis Screening and preference decisions Behavioral issues Taxation: Compliance and Planning: Tax implications Analytical Thinking & Problem Solving Broad Management Competencies Interpersonal Technology Leadership: Organizational change management Ethics & Social Responsibility: Corporate social responsibilities Governance, Risk & Compliance: Risk assessment Additional Core Management Competencies: Cost of capital, Capital structure, Real-options analysis 20 Inventory Management Example Accounting Competencies Foundational Competencies Communication Communication Quantitative Methods Quantitative Methods External Reporting & Analysis: Inventory accounting methods Ratio analysis Planning, Analysis & Control: Strategic performance measurement Analytical Thinking & ProblemThinking Solving Analytical & Problem Solving Interpersonal Interpersonal Technology Technology Assurance & Internal Control: Internal and external audit implications Information Systems: Documents and data Flows for inventories Broad Management Competencies Ethics & Social Responsibility: Global sourcing decisions Process Management & Improvement: Lean Production Governance, Risk & Compliance: Managing inventory risks Additional Core Management Competencies: Collaborative supply chain management 21 Framework for Including Integrated Competency-Based Learning Objectives with Accounting Curricula Enterprise Performance Management (EPM) (Strategy Formulation and Analysis, Planning, and Execution) A Life -Cycle Management Approach A Value Chain Management Approach A Stakeholder Management Approach A Resource Management Approach A Technology Management Approach Inventory Management External Reporting & Analysis LO1 LO2 Other Accounting Competencies LO3 LO4 Broad Management Competencies LO5 LO6 22 What Can Practitioners Do? • Practice Partner Action List: How Can I Help as a Practitioner? – Obtain and maintain professional credentials – Utilize IMA resources – Participate in IMA activities – Integrate EPM into your company 23 What Can Practitioners Do? • Academic Partner Action List: How Can I Help as an Academic Partner? – Obtain and maintain professional credentials – Involvement in and use of IMA resources – Develop a CMA focus on campus – Participate in national activities 24 Moving Forward What do you think? Comments or suggestions are welcome now. If you like, please drop a line to: James Sorensen jsorense@du.edu or to Raef Lawson, Chair of the Task Force IMA VP-Research & Professor-in-Residence Rlawson@imanet.org 25