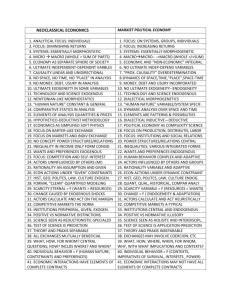

Modeling Firm Demand

advertisement

Modeling Demand

Module 7

Conceptual Structure of SIMQ Market Model

Firm Demand = Total Industry Demand * Share of Market

Firm Demand = Average Firm Demand * n * Share of Market

Firm Demand = Average Firm Demand * Normalized Share of Market

Macro-economic

Influences

Seasonal Patterns

Exogenous

Demand

Stage of Life Cycle

Industry Activity

Pricing, Promotion,

Endogenous

AFD

Demand

FD

Quality

Competitive Profile

Relative Pricing, Promotion,

Quality, and Loyalty

Relative

Demand

NSOM

Normalised Share of Market

NSOM = Firm Demand / Avg Firm Demand

Relative Price

(current)

Relative Advertising

(current, t-1, t-2 )

Pricing

NSOM

Promotion

Relative R&D

(t-1, t-2)

Loyalty

NSOM (t-1)

Quality

NSOM is firm specific and a measure of relative demand, the predictor

variables should also be relative to industry averages.

For example, relative price of the firm is

PREL = Firm’s Price / Industry Avg. Price

Calculating NSOM

11) Use a multiple regression to estimate NSOM.

Average Firm Demand

How many units will any firm sell on the average.

D

n

Df

f 1

Error

n

Endog

Exog

AFD = Exogenous demand + Endogenous demand

Exogenous demand = “Base demand” X Seasonal effects

Endogenous demand = Influence of aggregate industry behavior

Average Firm Demand

AFD

Exogenous

Demand

Macro-Economic

Influences

Endogenous

Demand

Industry Behavior

- Pricing (Avg Price)

- Seasonality

- Promotion (Avg. Advertising)

- Stage of Life Cycle

- Product Quality (Avg. R&D)

Estimate Trend and

Seasonality using

Time Series Analysis

Estimate weights of these factors

using Regression Analysis

AFD = {(T*S) + (B0+B1*Avg P+..)}

AFD: Exogenous Demand

Base demand

Population, Income, Tastes, Product life cycle,

Substitutes and complements (Macro-economic

influences)

Seasonal demand

Weather, Customs, Holidays

Not all products are affected

Estimation is done using:

Time Series Decomposition

Calculating Exogenous AFD

1) Use Statpro to generate Seasonal Indices

Calculating Exogenous AFD

2) Use Seasonal Indices to De-seasonalize observations.

1438 / .895 = 1607

Calculating AFD

3) Fit a simple regression line to the de-seasonalized

observations.

Calculating AFD

4) Use the regression line to create a

‘de-seasonalized’ forecast.

11 * 65.213 + 1237.9 = 1955.2

Calculating AFD

5) Re-seasonalize the predicted forecast. This is the

exogenous portion of demand.

1.093 * 2150.9 = 2350.3

Calculating AFD

6) Calculate the residual error from the forecast.

This is the endogenous portion of demand.

2839 – 2350.3 = 488.7

Calculating AFD

7) Fit a multiple regression with the residuals as the

dependent variable and the firm data as the

independent variables.

Calculating AFD

8) Use the new regression equation to forecast

residuals. These are estimated of endogenous

demand.

15688.25 + (-43.885) * 371.9 + (.0032) * 97960 + (.0127) * 25610 = 4.2

Calculating AFD

9) Add the exogenous forecast to the endogenous

forecast to create a composite forecast.

2350.3 + 204.2 = 2554.6

Calculating AFD

10) Subtract the composite forecast from the

observations to find a total error.

2839 – 2554.6 = 284.4

Calculating AFD

11) Calculate the standard deviation of

the residuals.

Because there may be more explanation

that can be squeezed out of the trend

and attributed to the dependent

variables, repeat the process.

For subsequent iterations,

Raw AFD – Estimated Endogenous as

starting data for time series.

Continue till error stops decreasing.

Conceptual Structure of SIMQ Market Model

With Average Firm Demand and Normalized Share of Market

modeled, we can now create a decision support system for any

individual firm.

Exogenous

Demand

Endogenous

AFD

Demand

Relative

Demand

FD

NSOM

Example DSS