PUBLIC SERVICE COMMISSION

advertisement

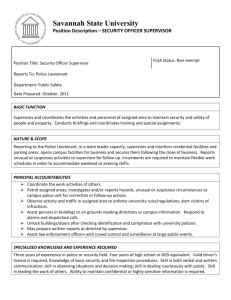

PUBLIC SERVICE COMMISSION Constitution of the Public Service Commission Role and function of the Commission. Composition of the Public Service Commission Under the Constitution of the Cooperative Republic of Guyana (Article 200-202) the Public Service Commission (PSC) shall consist of six members, who shall be appointed as follows: - Three members appointed by the President acting after meaningful consultation with the leader of the opposition. - Two members appointed by the President upon nomination by the National Assembly after it has consulted such bodies as appear to represent public officers or classes of public officers - And if the President thinks fit, one other member appointed by his Excellency the President , acting in accordance with his own deliberate judgment. Electing of the Chairman and Deputy Chairman. The Chairman and the Deputy Chairman of the Commission shall be elected by and from the members of the Commission using such consensual mechanisms as the Commission deems fit. Members of the Commission. Chairman Mr. Carvil Duncan AA. Member: - Mr. Cecil Seepersaud - Mr. Desmond Hope - Ms. Vidyawattie Looknauth - Ms. Vera Naughton Secretary Mr. Jaigobin Jaisingh THE OBJECTIVE OF PUBLIC SERVICE COMMISSION The Objective of the Public Service Commission is to make Appointments to Public Offices and to remove and exercise disciplinary control over persons holding or acting in such Offices. Roles and Functions of the Commission Recruitment Promotions Dismissals Resignations Secondment Reclassifications Transfers Acting Appointments. Disciplinary Matters Extension of Sick Leave Superannuation Benefits Vacancy Circulars CURRENT RULES Public Service Rules (1987) Public Service Commission Rules (1998) Table of Offences and Penalties.(6th Nov, 1987) Draft Revised Rules Public Service Rules (2004) Public Service Commission Rules.(2010) Table of Offences and Penalties.(2010) TRAINING N.B. TRAINING FOR PUBLIC SERVENTS IS THE RESPONSIBILITY OF THE PUBLIC SERVICE MINISTRY In house training conducted by PSC in the year 2012 to 2013. Superannuation Benefits and Advance of Gratuity. Time Management Enhancing effectiveness in the office Customers care and services. Developing of a modern public sector. Preparation of Records of Service. Leave Disciplinary Office etiquette Occupational Health and Safety (Guyana Fire Service) Sensitization on Vat (Guyana Revenue Authority) External Training. Public Service Ministry Training Programs: - Certificate in Supervisory Management. (3) - Certificate in Human Resource Management. (3) Personnel Practice and Policies.(5) Induction orientation. (5) Government Accounting Procedure (2) Office Assistant (2) Customer Care/Promoting the Right Imagine. (5) Self Management and Leadership Training. (3) ORGANISATIONAL CHART - SECRETARIAT POLICE/PUBLIC SERVICE COMMISSION STAFFING PUBLIC SERVICE COMMISSION Chairman, Public Service Commission Chairman, Police Service Commission Secretary, Public Service Commission Chief Accountant Senior Registry Supervisor Administrative Assistant System Development Officer One (1) Personal Assistant One (1) Confidential Secretary One (1) Confidential Secretary One (1) Confidential Secretary One (1) Principal Personnel Officer One (1) Senior Personnel Officer Two (2) Personnel Officer II One (1) Personnel Officer I Six (6) Clerks One (1) Assistant Accountant One (1) Accounts Clerk One (1) Registry Supervisor Three (3) Typist Clerks One (1) Driver One (1) Senior Office Assistant One (1) Office Assistant Two (2) Cleaners One (1)System Support Officer BUDGETARY REGIME The Public/Police Service Commission is listed as a budgetary agencies with the Ministry of Finance and separately approved by the National Assembly. Details as it relates to the Public/Police Service Commission Current Estimates Agency #: 09 Agency Name: Public/Police Service Commission Programme Name:Public/Police Service Commission Sub programmes 1) General Administration – is responsible for providing effective administrative and accounting service within the agency and supports human development. This is accomplished through four (4) activities which are: Administration Accounts Confidential Registry Registry 2) Human Resource Management- is responsible for an effective and efficient service in management of activities and other administrative related support. Details as it relates to the Public/Police Service Commission Capital Estimates Agency # Agency Name Project Code Project Title 09 Public/police Service Commission 2500400 Public and Police Service Commission Breakdown of the Commission’s Current Allocation for the years 2007 – 2013 Years 2007 2008 2009 2010 2011 2012 2013 TOTAL Budgetary Allocation/ Voted Provision 43,394,000 47,990,000 52,255,000 56,219,000 63,634,000 65,459,000 64,982,000 393,933,000 % Received From National Assembly 0.08% 0.08% 0.08% 0.08% 0.08% 0.07% 0.06% 0.53% Revised Voted Provision/Expenditure (Actual) 38,341,000 48,403,000 52,140,000 53,306,000 60,392,000 61,977,000 64,982,000 379,541,000 Breakdown of the Commission’s Capital Allocation for the years 2007 – 2013 Years 2007 2008 2009 2010 2011 2012 2013 TOTAL Budgetary Allocation/ Voted Provision 963,000 1,500,000 2,000,000 1,221,000 1,300,000 4,000,000 2,400,000 13,357,000 % Received From National Assembly 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.07% Revised Voted Provision/Expendit ure (Actual) 931,000 1,375,000 1,998,000 1,221,000 1,298,000 3,975,000 2,400,000 13,198,000 Some internal Control Mechanisms Cash flow and justification are prepared by the Accounts Department, submitted to the Accounting Office for approval before same are submitted to Ministry of Finance. On receipt of Allotment, entries are imputed into Integrated Financial Management System (IFMAS) and reports are submitted to the Accounting Officer. All invoices, bills etc. must be approved by the Accounting Officer before preparation of payment voucher. All payment vouchers must be approved by the Accounting Officer before they are entered into IFMAS. Upon receipt of cheques from Ministry of Finance with respect to payment vouchers submitted, the cheque number and date are recorded into the ‘Payment Voucher Number Book’ along with its particulars. Payments All cheques given out are signed for in the ‘Cheque Dispatch Register’. Upon return of payment voucher, receipt must be attached with equivalent revenue stamps, company stamp and signature of payee. Stores Upon receipt of goods collected after payment is made, same are entered into the ‘Goods Received’ and ‘Receipt and Issue Registers’ by the Accounts Clerk and enter on Bin Cards by the Clerk 11 (G) The stock is then checked to verify the balances of both the ‘Receipt and Issue Registers’ and Bin Cards. Forms for requisition of stock are prepared by each Department and approved by the Accounting Officer before distribution. After distribution the ‘Receipt and Issue Registers’ and Bin Cards are updated and a physical stock count is carried out to verify all balances. Imprest ($200,000) The Commission’s petty cash transactions are the responsibility of the Assistant Accountant. On a daily basis all petty cash transactions are recorded into the Imprest Cash Book. After all transactions are entered, the Cash Book is then balanced to show cash on hand and cash at bank. The cash is then checked to ensure it corresponds with the cash balance. The book is then signed off by the supervisor with other registers such as the Advance Register, Used and Unused Cheque and Receipt Registers. The registers are updated daily. ACCOUNTABILITY MACHANISMS Telephone Register- is updated monthly, giving details of charges on all telephone numbers. The register is signed off by the supervisor. Guyana Power & Light Register- is updated monthly giving details of charges etc pertaining to bills received and payments made, the information is then signed off by the Supervisor. Fuel Register- all payments made to Guyoil is entered and balance by clerk, the supervisor, then signs off the entries. All requisition for fuel is approved by the Accounting Officer, charged bill is entered by the Clerk and signed off by the supervisor NIS Register- is updated monthly showing information of each employee in respect of employee amounts and employers amounts deducted. Particulars of the cheque and receipt receive upon payment are also entered into the register and signed off by the supervisor. Salaries Register- is updated monthly showing gross salary, deductions, net salary and any remarks to suffice changes made to individuals salary, and is signed off by the supervisor. Bank reconciliation statement is prepared monthly by the Assistant Accountant to reconcile the Imprest Bank Account with the Imprest Cash Book and is signed off by the supervisor. Audit The accounts of the Commission are being audited by the Auditor General’s Department on a yearly basis. During the audit the Commission is presented with the appropriation Statement to verify all amounts with respect to allotment received, virements, actual expenditure and balances. Finding of the audit is reported in the Auditor’s General Report. Any recommendations given by the Auditor General Department for enhancing procedures are readily implemented. Disciplinary Proceeding. The disciplinary procedures are outline in the Commission Rules. (chapter vii) CONFLICT OF INTEREST Every Member of the Commission before taking up office are required to take an oath to affirm that he/she will, without fear, favour, affection or ill-will truly perform the duty as ……… No Members are allowed to hold any Public Office. No Members can be appointed if they are currently holding a Public Office. All staff members of the Commission are also required to sign an oath of office. PSC Rules 90 to 98 also outline the conducts for Members and Officers of the Commission.