Scale of Finance for Adaptation

advertisement

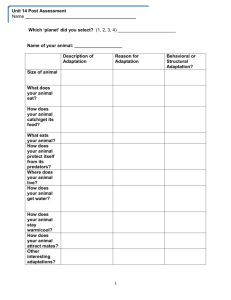

Catalyzing Adaptation Finance Enabling Adaptation Finance in Developing Countries Pradeep Kurukulasuriya, PhD Head- Climate Change Adaptation (Global) UNDP-GEF (HQ) Bonn, June 2014 Cambodia/LDCF Guatemala/SPA Vanuatu/SCCF Laos/SCCF Cambodia/LDCF Catalyzing Adaptation Finance Scale of Finance for Adaptation Copenhagen Accord- $100b/year additional finance by 2020 (50% of this for adaptation) “Additional” Funding Needs $2.129 b (Urgent and Immediate Priorities -NAPAs) $30-100 b/year for period 2010-2050 (WDR 2010) $290 b/year (Parry et all 2009) $326 - $355 b/year for financing adaptation options on natural ecosystems) (Source: Berry 2007) Mainly infrastructure Estimates are likely an underestimate! Present Level of Assistance Approx. USD $140-175b & $70-100 b/year for 2010-2050 (mainly for mitigation) Vertical Funds (for adaptation; LDCF/SCCF/AF): less than $1.0b to-date cumulatively Catalyzing Adaptation Finance Scale of Finance for Adaptation Catalyzing Adaptation Finance Scale of Damage in Thailand (2011) Estimated Losses: $15-20 billion (Swiss Re/Munich Re) $21 billion (prop. damage); $22 billion (opp. costs) (World Bank) Catalyzing Adaptation Finance Catalyzing Adaptation Finance: Key Drivers Public finance alone is not currently sufficient; Public finance alone is not going to be sufficient Most of the investment in adaptation expected by businesses and households (end-users) Ensuring that money is well spent, and hence maximizing its impact and The main drivers of private sector investment will be: – Preserving existing infrastructure, businesses and livelihoods – Developing new businesses – (No-regret investments (adaptation is an ancillary benefit) Ensuring that money is well spent, and hence maximizing its impact and effectiveness will be critical to maintaining support and realizing the transition to a low-carbon, climateresilient future. Catalyzing Adaptation Finance Catalyzing Climate Finance Catalyzing Adaptation Finance Key Barriers to Adaptation Finance Pay attention to lessons from energy… Need to get the enabling environment right! Integrated Model ‘Blended Finance’ International Sources Domestic Sources Collect Account For Blend Funding Sources Source: UN-MPTF, 2014 Capital Market Private Sector Catalyzing Adaptation Finance Key Barriers to Adaptation Finance Adaptation Finance is unlikely to be at the scale required without an effort to remove a few key barriers Need to create conditions that attract finance without compromising development goals and sharing cost burden on end-users. Multiple stakeholders (investors, end-users, policy makers, supply chains, etc) Broad spectrum of policies, incentives and support mechanisms to (a) reduce risks (i.e. lower cost of capital) (b) increase rewards (i.e. premium prices, credits, etc) Catalyzing Adaptation Finance Key Barriers to Adaptation Finance Climate Finance Readiness The capacities of countries to plan for, attract, access, deliver, and monitor and report on climate finance, both international and domestic, in ways that are catalytic and fully integrated with national development priorities. Catalyzing Adaptation Finance Financial Planning • Assess needs and priorities, and identify barriers to investment • Identify policy mix and sources of financing Key Barriers to Adaptation Finance Accessing Finance Delivering Finance Monitor, Report & Verify • Multiple access channels • Implement and execute project, programme, sector-wide approaches • Monitor, report, and verify flows of results and funding • Blend and combine finance • Formulate project, progamme, sector-wide approaches to access finance • Build local supply of expertise and skills • Coordinate implementation • Performancebased payments National Planning and Budgeting Cycle: Country X Entry points and Tools for Addressing Climate Risk Final Evaluation National Plan and medium term budget or expenditure framework Evaluation of economic and social benefits from additionality of adaptation Plan adjustments/course correction for Implementation Adjustments to sectoral plans and valuation estimates in adaptation priority sectors Climate risk assessment/ Valuation of costs and benefits – estimate of additional adaptation budget needs. Prioritization based on climate risk analysis Mid Term Review of National Plan/ Sectoral Plan Reviews Value added of adaptation programmes reviewed – Annual Monitoring (Sectors) Evidence based results on impact of adaptation expenditures Sectoral Plans Medium Term Annual sectoral budgets Annual Implementation (Priority sectors for Climate Adaptation) Catalyzing Adaptation Finance Key Barriers to Adaptation Finance NAPs - A Defining Framework for Medium and Long-Term Climate Change Challenge Catalyzing Adaptation Finance Strengthening Country Systems Lessons from Cambodia – Focus on the process – Inclusive national dialogue and strong ownership from multiple stakeholders – Establish institutional structures and mechanisms that are demand led and enable innovation, accountability and transparency – Strengthen capacities of national institutions to plan, budget, track and monitor climate finance – Build public capacity to design and implement national programmes and projects that are results (benefit) based and sustainable – Establish robust M&E systems to track and measure climate finance effectiveness – Share lessons and knowledge both nationally and internationally to build capacity and strengthen commitment to agreed climate responses. Catalyzing Some Early Insights Adaptation Finance • Country-driven processes subject to political changes/ sensitivities • Priority setting is lengthy & complex due to competing agendas among sectoral ministries • Technical capacities for iterative climate considerations in planning and budget required (to assess finance needs, first need to understand costs/benefits of adaptation over different time scales) • Elements are not one-size-fits-all - Different configurations of these four components can exist within institutions, between institutions, or across national or sectoral systems. • Not starting from scratch – Many countries have parts of these systems in place. The challenge is identifying them and organizing them to produce an effective system at the national level. • Readiness is an ongoing process – tools and guidebooks are available to support countries as the climate finance landscape evolves Catalyzing Adaptation Finance Key Barriers to Adaptation Finance What does it take to get the enabling environment right? Catalyzing Adaptation Finance Focus of UNDP’s Work on Climate Finance Readiness ACTION ON THE GROUND CAPACITY ENHANCEMENT BARRIER REMOVAL • Policy development: How is CC policy formulated? Are national CC strategies developed? • Provide a framework for sector-wide approaches & to incentivise private investments POLICY DIALOGUE NAP-GSP, LECB, CPEIR LDCF/SCCF/AF/Bilateral financed projects • Institutional structures: What are roles & responsibilities of institutions involved in managing CC response & their interaction? NAP-GSP, LECB, CPEIR, LDCF/SCCF/Bilateral financed projects • Public financial management: How to quantify & track CC-related expenditures in the budget? CPEIR • Developing bankable adaptation projects including training on the economics of adaptation Economics of Adaptation 20 Catalyzing Adaptation Finance Key Barriers to Adaptation Finance ACTION ON THE GROUND CAPACITY ENHANCEMENT BARRIER REMOVAL POLICY DIALOGUE LDCF/SCCF/AF/Bilateral financed projects NAP, Climate Readiness, Economics of Adaptation, Evidence Based Result Tracking 21 Niger/LDCF Samoa/SCCF Bangladesh/LDCF Laos/LDCF www.undp-alm.org