Governing the Global Economy

advertisement

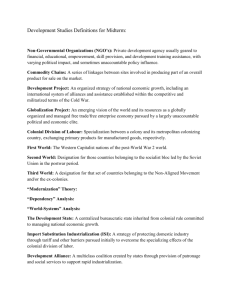

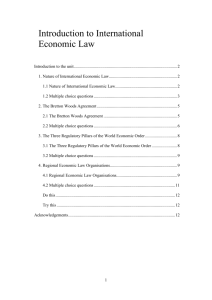

Governing the Global Economy The Future of Multilateral Economic Institutions Chapter 4; Richard Higgott in Beeson and Bisley Global Governance • Global governance is a model of global politics where there is no supranational authority in terms of sovereignty and decision-making body apart from ‘state’ but there are certain binding norms and rules. • It is a broad and dynamic process of interactive decision-making at the global level. Competing models of global politics No Supranational Authority Supranational Authority No binding norms and rules International Anarchy Global Hegemony Binding norms and rules Global Governance World Government Bretton Woods Institutions • Multilateralism is a form of a global governance • One of the best example to multilateralism is Bretton Woods Institutions. • They were established to reconstruct the international economic and financial systems after the 2nd World War. Result IMF Problems of the post –war period : financial instability due to two world wars. Objective: laying down the foundations of a liberal multilateral trading system; preventing economic crisis, reaching a more stable and equitable international economy. World Bank(International Bank for Reconstruction and Development, IBRD) World Trade Organization(initially General Agreement on Tarrifs and Trade) Multilalteralism and the Limits of Global Governance • Global governance (GG) is an over-used and under-specified concept. • The search for meaningful use is a reflection of the growing despair over the mismatch between the overdevelopment of the global economy and the under-development of a comparable global polity. Multilalteralism and the Limits of Global Governance The economic multilateralism of the 20th century Bretton Woods Institutions (IMF and WB), the WTO—will become unsustainable. It will do so for at least three reasons. • (1) The nature of what constitute ‘public goods’ in the 21st century global economy is strongly contested. • (2) Both the ability and political will of the US to play the role of self-binding hegemon, under-writing multilateralism, is problematic to say the least. • (3) Resistance amongst the world’s ‘rule takers’ to a hegemonic global order is growing. Liberal Multilateral Trading System Open and competitive international economy Form of collective action, recognition of common interests Main problematic of this chapter; (today’s discussion topic) Are those international economic institutions still operating their tasks? Do we still need them in a globalized world of the 21st century? • The character of the 21st century’s globalized world; High level of economic interdependence "dependent on others for some needs." In other words, you can't produce everything you need. A characteristics of a society or macroeconomy with a high degree of division of labor, where people depend on other people to produce most of the goods and services required to sustain life and living. Principles of Multilateralism (1) All participant countries must be treated alike; Principle of nondiscrimination (2) They have to behave as if they were a single entity; Principle of indivisibility (3)Obligations among countries must have a general and enduring character; Principle of diffuse reciprocity equal or identical advantages or disadvantages resulted from the rules and norms • Multilateralism is a process that coordinates behaviour among three or more countries on the basis of generalized norms and rules within a world of high level of economic interdependence. History of the Bretton Woods Institutions • Bretton Woods agreement is a clear example of the multilateralism. • They became prominent in the post-1945 period. • IMF, World Bank and GATT were under influence of USA and this dominance has an historical explanation. • USA emerged from the World War II as the world’s predominant military and economic power. • Conference initiated by USA and took place on US soil in Bretton Woods, New Hampshire. • USA was the leading force in the negotiation, effectively dictated some key outcomes which shaped the world politics in the post war period. What were the US priorities in relation to Bretton Woods • Re-establishing full employment , thus need to ensure that domestic growth levels could be sustained in the post war period. So, the international economic system should be OPEN and STABLE. • Need to contain the spread of communism. Threat of the Soviet Union. Thus, USA seek ways promoting recovery and reconstruction of post-war Europe(especially Germany). The idea behind the Bretton Woods System • Those institutions reflected a faith in classical political economy and doctrine of laissez-faire literally means leave to, principle of non-intervention in economic affairs, the idea that economy works best when left alone by governments There was one more factor which shaped Bretton Woods; There was one more factor which shaped Breeton Woods; Great Depression demonstrated that unregulated international economy was unstable. In line with the ideas of Keynes markets had to be “managed”. All industrialized states in the post war period adopted Keynesian techniques of economic management • Keynesian techniques of economic managment; fiscal policy( government spending and taxation) used to deliver growth and keep unemployment low. • Bretton Woods attempt to establish a Keynesian style regulative framework for the post-war international economy. • This was a mixture of free trade, free capital movement and stable currencies. The fate of the Bretton Woods System(I) • For at least two decades until 1970s, it achieved its goal of sustained economic development. We name 50s and 60s as “Golden Age”. • But there are different views on how far Bretton Woods era of multilateral governance contributed to the economic boom. • Some radical theorists argue that the principal motor for growth was high and sustained military expenditure legitimized by the Cold War. The fate of the Bretton Woods System(II) • In 1970s there came an economic stagnation period with rising unemployment which was linked to high inflation. • G7(Group of Seven) as a group consisting of the finance ministers of seven developed nations: the U.S., U.K., France, Germany, Italy, Canada and Japan is a product of this crisis where the leaders and finance ministers of those countries started to meet on a regular basis to discuss monetary issues. (good example of multilateralism) The fate of the Bretton Woods System(III) • During 1980s, the institutions of global economic governance started to change around the ideas of “Washington Consensus”. • The term coined by John Williamson(1990-1993) to describe the policies that the international institutions based in Washington, namely IMF, The World Bank and US Treasury Department had come to favour for a reconstruction. • More neoliberal policies; tax reform(cutting personal and corporate taxes), trade liberalization(e.g trade of goods without taxes) and privatization. Evolving roles of Bretton Woods Institutions • In 1980s and 1990s, IMF mainly tried to enforce ‘neoliberal’ agenda of economic liberalization( through its loan programme ‘Structural Adjustment Facility’) But there were conditionalities, in order to receive loans, countries in economic crisis were required to adopt neoliberal policies (e.g. privatize public assets, cut government spending, reduce regulation and liberalize capital accounts) • These conditionalities were problematic for the way they involved the IMF in the domestic affairs of some of its members. • World Bank started as a facilitator of European reconstruction. Its mission today is to reduce poverty and support development. • It had supported neo-liberal reforms in the developing world. Why developing countries are opposing the development model of IMF • Is the IMF imposing a limited and a bad development model? • Unlike the path historically followed by the industrialized countries, the IMF forces countries from the Global South to prioritize export production over the development of diversified domestic economies. • Nearly 80 percent of all malnourished children in the developing world live in countries where farmers have been forced to shift from food production for local consumption to the production of export crops destined for wealthy countries. • The IMF also requires countries to eliminate assistance to domestic industries while providing benefits for multinational corporations -- such as forcibly lowering labor costs. • Small businesses and farmers can't compete. Sweatshop workers in free trade zones set up by the IMF and World Bank earn starvation wages, live in deplorable conditions, and are unable to provide for their families. • The cycle of poverty is perpetuated, not eliminated, as governments' debt to the IMF grows. Future of Multilateral Economic Governance • Crisis have occurred on a regular basis; 30s 60s 80s 1997-98 Asian Crisis 2007-09 • This raises the question do those institutions highlight, in advance, key instabilities and crisis tendencies. Do we really need them? WHY? It was deeper, most severe downturn since 1930s.( Global GDP fell in 2009 by 1.7 per cent. Volume of world trade dropped by 6.1 per cent). It effected every country in the world. It originated within the heart of the finance. Thus 2007-09 crisis led to calls for urgent reforms in the architecture of global economic governance. Global Financial Crisis of 200709 pose a considerable challenge for those institutions Do we really need them? Some believes that some form of regulation are so specialized that only a handful of experts, practitioners or other insiders can claim to understand them. They are not democratically elected bodies. So their legitimacy is drawn indirectly from the legitimacy of their member states. The legitimacy of multilateralism, is embedded in shared norms(usually elites, rather than wider national publics) and is underwritten by judicial instruments( such as the International Criminal Court or the Dispute Settlement Mechanism of the WTO. Next Class Discussion Paper R Higgott, Multilalteralism and the Limits of Global Governance, CSGR Working Paper No. 134/04, May 2004