Chapter 10

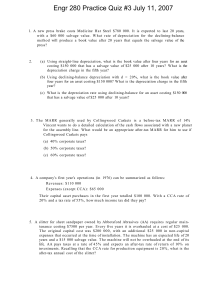

advertisement

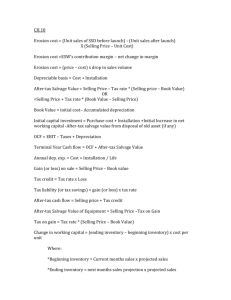

Chapter 10 MAKING CAPITAL INVESTMENT DECISIONS Relevant Cash Flows A change in the firm’s overall future cash flow that comes about as a direct consequence of the decision to take that project. These cash flows are called incremental cash flows Incremental cash flows: the difference between a firm’s future cash flows with a project and those without the project Irrelevant cash flows The stand-alone principle The stand-alone principle allows us to analyze each project in isolation from the firm simply by focusing on incremental cash flows Asking the Right Question You should always ask yourself “Will this cash flow occur ONLY if we accept the project?” If the answer is “yes,” it should be included in the analysis because it is incremental If the answer is “no,” it should not be included in the analysis because it will occur anyway If the answer is “part of it,” then we should include the part that occurs because of the project Common Types of Cash Flows Sunk cost: a cost that has already been incurred and can’t be removed. Opportunity cost: the cost of giving up a valuable alternative if a particular investment is undertaken. Side effects: a) negative impact on the cash flows of an existing product from the introduction of a new product (erosion) b) Positive impact Common Types of Cash Flows Net working capital: Financing costs: Notes Financial manager is interested in: 1. Cash flows 2. When these cash flows actually occurs 3. After-tax cash flows Note that Incremental cash flows are after-tax cash flows Differentiate between: after-tax cash flows, accounting profit and net income Pro Forma Statements and Cash Flow Financial statements projecting future years’ operations Capital budgeting relies heavily on pro forma accounting statements, particularly income statements Computing cash flows – refresher Operating Cash Flow (OCF) = EBIT + depreciation – taxes OCF = Net income + depreciation (when there is no interest expense) Cash Flow From Assets (CFFA) = OCF – net capital spending (NCS) – changes in NWC Example If Pepsi can sell 50,000 cans per year of a new product line for 4$ per can. It costs 2.5$ per can, this product line has three- year life with a required rate of return of 20%. There will be 12,000$ fixed costs per year, Pepsi will need to invest a total of 90,000$ in manufacturing equipment which will be 100 percent depreciated. In addition the project will require an initial 20,000$ investment in networking capital, and the tax rate is 34 percent Prepare a pro forma income statement Calculate the total investment for each year Calculate the total project cash flows Calculate the NPV Ex 1 Page 327 Parker & stone Inc., is looking at setting up a new manufacturing plant in south park to produce garden tools. The company bought some land six years ago for 6$ million in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent these facilities from a competitor instead. If the land were sold today, the company would net 6.4$ million. The company wants to build its manufacturing plant on this land; the plant will cost 14.2$ million to build, and the site requires 890,000$ worth of grading before its suitable for construction. What is the proper cash flow amount to use as the initial investment in fixed assets when evaluating the project? Why? Ex 3 Page 328 A proposed new investment has projected sales of 830,000$. Variable costs are 60 percent of sales, and fixed costs are 181,000$; depreciation is 77,000$. Prepare a pro forma income statement assuming a tax rate of 35 percent. What is the projected net income? Ex 4 Page 328 Consider the following income statement: sales 824,500 costs 538,900 Depreciation 126,500 EBIT ? Taxes(34%) ? Net income ? Fill in the missing numbers and then calculate the OCF. What is the depreciation tax shield? Ex 9,10 Page 328 Summer Tyme, Inc., is considering a new three-year expansion project that requires an initial fixed asst investment of 3.9$ million. That fixed asset will be depreciated straight-line to zero over the three-year tax life. After which time it will be worthless. the project is estimated to generate 2,650,000$ in annual sales, with the cost of 840,000$. If the tax rate is 35 percent, what is the OCF for this project? Suppose that the required rate of return is 12 percent, what is the NPV? More on NWC Why do we have to consider changes in NWC separately? GAAP requires that sales be recorded on the income statement when made, not when cash is received GAAP also requires that we record cost of goods sold when the GAAP also requires that we record cost of goods sold when the corresponding sales are made, regardless of when we actually pay our suppliers Finally, we have to buy inventory to support sales, although we haven’t collected cash yet Example Suppose that during a particular year of a project we have the following simplified income statement Sales 500 Costs 310 Net income 190 Depreciation and taxes are zero, no fixed assets are purchased during the year. Also assume that the only components of networking capital are account receivables and payable. The beginning and ending amount for these accounts are as follows Beginning of year Ending of year change AR 880 910 30 AP 550 605 55 NWC 330 305 -25 Depreciation Depreciation itself is a non-cash expense; consequently, it is only relevant because it affects taxes Depreciation tax shield = DT D = depreciation expense T = marginal tax rate Computing Depreciation Straight-line depreciation D = (Initial cost – salvage) / number of years Very few assets are depreciated straight-line for tax purposes MACRS Need to know which asset class is appropriate for tax purposes Multiply percentage given in table by the initial cost Example Consider an automobile costing 12,000$. What is the depreciation using the MACRS method? class examples Three-year Equipments used in research Five-year Autos, computers Seven-year Most industrial industries Property class year Three-year Five-year Seven-year 1 33.33% 20.00% 14.29% 2 44.45 32 24.49 3 14.81 19.20 17.49 4 7.41 11.52 12.49 5 11.52 8.93 6 5.76 8.92 7 8.93 8 4.46 After-tax Salvage If the salvage value is different from the book value of the asset, then there is a tax effect Book value = initial cost – accumulated depreciation After-tax salvage = salvage – T(salvage – book value) MARCS Book values Year Beginning book value depreciation Ending book value 1 12,000 2,400 9,600 2 3 4 5 6 Example: Depreciation and After-tax Salvage You purchase equipment for $100,000, and it costs $10,000 to have it delivered and installed. Based on past information, you believe that you can sell the equipment for $17,000 when you are done with it in 6 years. The company’s marginal tax rate is 40%. What is the depreciation expense each year and the after-tax salvage in year 6 for each of the following situations? Suppose the appropriate depreciation schedule is straight-line What is the depreciation using the MACRS method (three years)? What is the end-year book value? What is the after-tax salvage? What is the depreciation using the MACRS method (seven years)? What is the end-year book value? What is the after-tax salvage? Ex 6 Page 328 A piece of newly purchased industrial equipment costs 1,080,000$ and its classified as seven-year property under MARCS. Calculate the annual depreciation allowance and end-of-the year book values for this equipment Book value versus Market value The book value of an asset can differ substantially from its actual market value The difference between book and market value will affect taxes The Majestic Mulch and Compost Company (Example) the company is investigating the feasibility of a new line of power mulching tools. MMCC projects unit sales as follows: year Unit sales 1 3,000 2 5,000 3 6,000 4 6,500 5 6,000 6 5,000 7 4,000 8 3,000 The Majestic Mulch and Compost Company (Example) The new Mulcher will sell for 120$ per unit to start. After three years MMCC anticipates that the price will drop to 110$ due to competition. The company will require 20,000$ networking capital at the start. After that the networking capital will be about 15 percent of sales for that year. The variable cost per unit is 60$, and the total fixed costs are 25,000$ per year. It will cost about 800,000$ to buy the equipment and it will be worth about 20 percent of its cost in eight years. The relevant tax rate is 34 percent ant the required return is 15 percent. Based on this information, should MMCC proceed? The Majestic Mulch and Compost Company (Example) Calculation of sales = unit price * number of units year Unit price Unit sales Revenues 1 120$ 3,000 360,000$ 2 120 5,000 600,000 3 120 6,000 720,000 4 110 6,500 715,000 5 110 6,000 660,000 6 110 5,000 550,000 7 110 4,000 440,000 8 110 3,000 330,000 The Majestic Mulch and Compost Company (Example) Calculation of depreciation= MARCS percentage * initial cost year MARCS percentage depreciation Ending book value 1 14.29% 114,320 685,680 2 24.49 195,920 489,760 3 17.49 139,920 349,840 4 12.49 99,920 249,920 5 8.93 71,440 178,480 6 8.92 71,360 107,120 7 8.93 71,440 35,680 8 4.46 35,680 0 The Majestic Mulch and Compost Company (Example) year 1 2 3 4 5 6 7 8 revenues 36,000 600,000 720,000 715,000 660,000 550,000 440,000 330,000 VC 180,000 300,000 360,000 390,000 360,000 300,000 240,000 180,000 FC 25,000 25,000 25,000 25,000 25,000 25,000 25,000 25,000 Dep 114,320 195,920 139,920 99,920 71,440 71,360 71,440 35,680 EBIT 40,680 79,080 195,080 200,080 203,560 153,640 103,560 89,320 Tax(34%) 13,831 26,887 66,327 68,027 69,210 52,238 35,210 30,369 NI 26,849 52,193 128,753 132,053 134,350 101,402 68,350 58,951 The Majestic Mulch and Compost Company (Example) Calculation of OCF = EBIT + Dep - Tax year 1 2 3 4 5 6 7 8 EBIT 40,680 79,080 195,080 200,080 203,560 153,640 103,560 89,320 Dep 114,320 195,920 139,920 99,920 71,440 71,360 71,440 35,680 Tax(34%) 13,831 26,887 66,327 68,027 69,210 52,238 35,210 30,369 OCF 141,169 248,113 268,673 231,973 205,790 172,762 139,790 94,631 The Majestic Mulch and Compost Company (Example) Calculation of NWC for each year= sales * 0.15 Change in NWC= ending NWC – Beg NWC year Revenues 0 NWC 20,000 1 360,000$ 2 600,000 3 720,000 4 715,000 5 660,000 6 550,000 7 440,000 8 330,000 Cash flow The Majestic Mulch and Compost Company (Example) year 0 Initial NWC Change in NWC NWC recovery Total change in NWC -20,000 1 2 3 4 5 6 7 8 The Majestic Mulch and Compost Company (Example) Calculation of salvage = 0.2 * initial cost After-tax salvage = salvage – T (salvage – BV) year 0 Initial cost After-tax salvage Capital spending 800,000 1 2 3 4 5 6 7 8 The Majestic Mulch and Compost Company (Example) Calculation of total CF= OCF – change in NWC- NCS year 0 OCF Change in NWC NCS Total CF Cumulat ive CF Pv of CF 1 2 3 4 5 6 7 8 Other Methods for Computing OCF If you have the following information: Sales = 1,500$ Costs = 700$ Depreciation = 600$ Tax rate = 34% No interest Calculate the OCF Other Methods for Computing OCF Bottom-Up Approach Works only when there is no interest expense OCF = NI + depreciation Top-Down Approach OCF = Sales – Costs – Taxes Don’t subtract non-cash deductions Tax Shield Approach OCF = (Sales – Costs)(1 – T) + Depreciation*T Depreciation tax shield The tax saving that results from the depreciation deduction Depreciation * tax rate Ex 8 Page 328 An asset used in a four-year project falls in the five-year MARCS class for tax purpose. The asset has an acquisition cost of 7,900,000$ and will be sold for 1,400,000$ at the end of the project. If the tax rate is 35 percent. What is the after tax salvage value of the asset? Ex 32 Page 332 Aguilera Acoustics, Inc. (AAI), projects unit sales for a new seven-octave voice emulation implant as follows year Unit sales 1 93,000 2 105,000 3 128,000 4 134,000 5 87,000 Ex 32 Page 332 Production of the implants will require 1,800,000$ in networking capital to start and additional networking capital investments each year equal to 15 percent of the projected sales increase for the following year. Total fixed costs are 1,200,000$ per year, variable production costs are 265$ per unit, and the units priced at 380$ each. The equipment needed to begin production has an installed cost of 24,000,000$.becasue the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualified as seven-year MARCS property. In five years, this equipment can be sold about 20 percent of its acquisition cost.AAI is in the 35 percent marginal tax and has a required return on all its projects of 18 percent. Based on these estimates, what is the NPV?