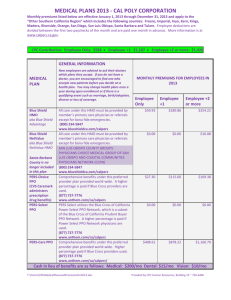

Product Portfolio 1 - Blue Cross and Blue Shield of Illinois

advertisement

Product Portfolio 1: HMO and PPO Product Portfolio 1: HMO and PPO Product Portfolio 1 Overview This presentation provides a general overview of our HMO and PPO products. Objectives After viewing this presentation, you should be able to: • Describe the basic features of core HMO and PPO products. • Describe the products we offer to employer groups and individuals. Disclaimer: All individually identifiable health information contained within this lesson is fictitious and should be kept highly confidential. Any association to any person, living or dead, is purely coincidental. The information contained within this lesson is not for use/disclosure outside of Health Care Service Corporation and its affiliated companies. Product Portfolio 1: HMO and PPO Introduction to the Product Portfolio Lessons Over the past few decades, health care insurance has evolved, moving from traditional coverage options to more cost-effective managed care plans. Twenty years ago most people had indemnity plans, also known as traditional or fee-for-service insurance. A person with an indemnity plan could see any provider, and both the insurance company and the individual shared the cost of service. These days most people are opting for managed care plans such as HMOs, PPOs and Consumer-Driven Health Plans. These plans provide a more organized system of delivering and paying for health care. In light of this shift in health insurance, HCSC has continued to evolve in its sophisticated product offerings. At HCSC our mission is to promote accessible, cost-effective and quality health care. To do this, we must offer a wide variety of product options. And that’s exactly what we do. Our product portfolio is diverse to meet the diverse needs of our employer groups and individual members. It’s no surprise that 1 in 3 Americans are Blues members, and 97% of Americans recognize our brand! To complement our comprehensive portfolio, we approach health care insurance with a unique customer service strategy. Let’s take a closer look… 1 in 3 Americans are with the Blues! Product Portfolio 1: HMO and PPO Introduction to the Product Portfolio Lessons Simply put, our goal is to provide our members with an unmatched health care experience. We achieve this by: • empowering them to become better, more proactive health care consumers. • engaging them at every stage of their health care continuum. • creating a seamless, hassle-free product experience with easy-to-access benefit and claims information, nationwide coverage and excellent customer service. • We empower members to be • We engage members at more accountable and proactive about their health care. every stage of their health care experience. • We create a seamless, hassle-free health care experience. Keep this strategy in mind as we discuss our product portfolio. You’ll see how these three goals play an essential part in defining the products we offer. In the next section you’ll learn about HMOs. It provides a general overview of HMOs, followed by information about our specific HMO products. Product Portfolio 1: HMO and PPO HMO Products Product Portfolio 1: HMO and PPO HMO Overview An HMO or health maintenance organization is a managed care plan created to help lower health care costs for both members and providers. In this type of plan, members choose from an HMO network of IPAs and primary care physicians. Members must first select a Primary Care Physician (PCP) who is in the approved HMO network. The PCP facilitates all medical care for the member and provides referrals to any necessary specialists. By acting as an initial “gatekeeper,” the PCP helps to reduce medical costs and unnecessary procedures. After treatment, the member does not have to submit a claim form, and covered services are usually paid after the member pays any required copayment. However, the member is responsible for any services done outside of the approved network, except in emergencies. HMOs are offered to both small and large groups; depending on the size of the group, customized plans may be offered. *Underlined terms are listed in the Glossary of Terms at the end of the presentation Product Portfolio 1: HMO and PPO HMO Overview Our HMO program provides comprehensive benefits, superior service, financial stability and reliability – all at an affordable price. We focus on our members’ total well-being by providing coverage designed to help them stay well, while at the same time controlling costs. The HMO covers routine office visits, preventive services such as periodic physical examinations, immunizations and maternity care. Here are some other key features of our HMO products: HMOs are generally available to groups of 2 or more employees. Members have a limited selection of available providers. HMOs provide lower out-of-pocket costs for members. Members pay coinsurance, but not a deductible. HMOs focus on prevention and wellness. Targeted members receive care and wellness reminders in the mail. Members select their PCP from an Independent Physician Association (IPA). The BlueCard® Program provides services when traveling or living in another Plan's service area. For members who are away from home for at least 90 days, the Away from Home Care Program provides nationwide access to providers at a participating BCBS HMO. Generally, HMOs are customizable for Large Groups (151+), whereas products for small and mid-size groups are usually standardized. Members receive "BluePrints for Health," a quarterly newsletter containing useful wellness articles and benefit updates. *Underlined terms are listed in the Glossary of Terms at the end of the presentation Product Portfolio 1: HMO and PPO Illinois HMO Plans • HMO Illinois is the basic HMO. It is one of the largest contracting networks of doctors and hospitals in Illinois. Many people don't need to change doctors when they join. • BlueAdvantage HMO is a subset of the HMO Illinois network, offering a smaller contracting provider network. Tailored for those who prefer a more affordable health care premium, BlueAdvantage HMO employee costs are typically less than HMO Illinois‘ rates. Key Points Product Portfolio 1: HMO and PPO • An HMO is a managed care plan in which members must first select a Primary Care Physician (PCP) who is in the approved HMO network. • The PCP facilitates all medical care for the member and provides referrals to any necessary specialists. By acting as an initial “gatekeeper,” the PCP helps to reduce medical costs and unnecessary procedures. • HMOs focus on prevention and wellness. Targeted members receive care and wellness reminders in the mail. • The member is responsible for any services done outside of the approved network, except in emergencies. • Generally, HMOs are customizable for Large Groups (151+), whereas products for small and mid-size groups are usually standardized. Product Portfolio 1: HMO and PPO PPO Products Product Portfolio 1: HMO and PPO PPO Overview A PPO or preferred provider organization is a network of contracting providers who agree to provide services to members at discounted rates. This type of plan is mutually beneficial to both the insuring group and the provider since the insurer receives substantial discounts, while the provider sees an increase in patients. The overwhelming majority of our members select one of our PPO products. In a PPO members typically make their own decisions about their health care rather than using a PCP as with an HMO. Members may choose to see any physician, including specialists, within the network, without a referral. In most PPO plans the member must meet a deductible (a specific dollar amount which must be paid toward eligible medical expenses before benefits will be paid). PPO members receive a list of doctors who participate in their plan’s network. They also have web access to provider directories. When a member chooses an in-network provider, expenses are covered at the full benefit level. When a member goes outside of the network, services are paid at a reduced benefit level, and members are responsible for paying any additional out-of-pocket expenses. Product Portfolio 1: HMO and PPO PPO Overview 100% HMO Product Membership 90% POS 80% 70% 60% 50% 40% PPO Includes small % of CDHP products 30% 20% 10% 0% Trad. Illinois As you can see, our PPOs are by far the most popular options across the four Divisions. Keep in mind that the PPO numbers also include a small percentage of CDHP products. Product Portfolio 1: HMO and PPO PPO Overview How we set up our networks. How BCBS sets up its PPO networks BCBS actually pioneered the concept of close relationships with providers back in the 1920’s. Instead of simply administering and paying benefits, we formed partnerships with hospitals and physicians to create coordinated accountable health plans. We’ve been contracting with providers for almost 80 years – longer than competitors who didn’t start contracting until the concept of PPO networks evolved in the 1970’s. We have the largest PPO network in the industry with networks in 49 states. In developing our networks, we focus on including physicians who represent a full range of specialties and who deliver cost-effective care. We consider the following factors: • Geographic Access: Our network ensures the availability of an extensive, full range of services throughout the member’s state. • Utilization Guidelines: Each provider agrees to follow our total integrated health management programs, to hold members free of charges exceeding our contracted allowance and to refer members to other PPO networks when appropriate. • Controlling Costs: Network hospitals contract with BCBS to provide care for our PPO members in accordance with negotiated fee schedules. Product Portfolio 1: HMO and PPO PPO Overview The benefits included with our products. Additional PPO benefits In addition to health care services, PPO products come with our integrated health care management tools, collectively known as Blue Care Connection. This suite of resources and support services provides personalized attention, health advocacy and condition-specific information. Here are some examples of what’s included in Blue Care Connection: • Personal Health Manager • Blue PointsSM • Blue Care Advisor • 24/7 Nurseline Product Portfolio 1: HMO and PPO PPO Overview Another PPO benefit is the PPO BlueCard® Program, in which members have access to PPO providers throughout the United States. Members can take advantage of the negotiated discounts available from PPO providers while traveling or residing outside of their service area. Look for the BlueCard® PPO Suitcase Logo on the Membership Card This logo indicates that members from any BCBS Plan have PPO benefits that are delivered through the BlueCard® Program. PPO Overview BlueCard® Program Blue Cross and Blue Shield Plans administer national PPO benefits through BlueCard®, a program that provides easy access to providers across the country, including 835,700 physicians and 5,570 hospitals. The BlueCard® membership card is recognized and accepted by Blue Cross and Blue Shield contracted hospitals and physicians — allowing multi-state employers to offer the same benefit plan to their employees in almost every national location. Benefits remain consistent while traveling or living in another Blue Cross and Blue Shield Plan’s network service area. There is no balance billing to the patient above the Blue Cross and Blue Shield approved charge; the patient is responsible only for any applicable deductible and/or copayments. Additionally, members must comply with the preauthorization and referral requirements stated in their benefits program Product Portfolio 1: HMO and PPO Illinois-specific PPOs As with our HMOs, we offer a wide variety of PPO products to meet market and customer demands. BAE PPO/PPO Value Choice BlueAdvantage Entrepreneur is a triple option product designed and priced for employer groups with 2 – 50 employees. BlueAdvantage Entrepreneur lets groups design the health benefits plan that best suits their company's needs and budget. The portfolio includes PPO plans with a wide range of deductible, coinsurance and out-of-pocket maximum options. Special Features • PPO and PPO Value Choice Plans • Access to the PPO network of physicians and hospitals • No referrals necessary • Full coverage throughout the United States and many foreign countries with the Blue Care Program • Coverage also includes preventive care benefits for well-child and adult care, including: physical exams, diagnostic tests and immunizations • Pharmacy benefits including retail and home delivery services Product Portfolio 1: HMO and PPO Illinois-specific PPOs CPO/CPO Value Choice The CPO and CPO Value Choice plans are a three-tiered PPO plan. When a member receives care from their chosen CPO provider, benefits are paid at the highest level. When a network PPO provider is used, benefits are still paid at an in-network level, but lower than services from a CPO provider. The option of receiving care from outside the network is always available and benefits will be paid at the lower level. These community-based health care plans offer the convenience and security of local contracting physicians and hospitals. CPO plans support local employer, doctors and medical facilities in many communities. Each CPO is designed around specific local or regional health care systems in the communities throughout the state of Illinois. Special Features •Employer groups have the choice of deductible amounts and annual out of pocket maximum amounts •No referrals necessary •Members choose their own provider – in or out of network •Full coverage throughout the United States and many foreign countries with the BlueCard Program •Vision discount program •Pharmacy benefits including retail and home delivery services Product Portfolio 1: HMO and PPO Illinois-specific PPOs BlueChoice Select The BlueChoice Select plans are available for employer groups with 2+ employees and offers access to a focused hospital and physician network The hospital network is based on geographic accessibility, the number of board certified doctors on staff, status with the Joint Commission on Accreditation of Healthcare Organizations and clinical care indicators developed by the Agency for Healthcare Research and Quality, an agency of the U.S. Department of Health and Human Services. Clinical care indicator scores of hospitals in the network for the BlueChoice Select product are comparable to the scores of those in the broad network for the Point of Service product Special Features •Employer groups have the choice of deductible amounts and annual out of pocket maximum amounts •Access to a value-based network of contracting doctors and hospitals in Illinois •No primary care physician required •No referrals necessary Product Portfolio 1: HMO and PPO Illinois-specific PPOs BluePrint PPO BluePrint (BP) is a triple option product designed and priced for employer groups with 51+ employees. BluePrint lets groups design the health benefits plan that best suits their company's needs and budget. The portfolio includes PPO plans with a wide range of deductible, coinsurance and out-of-pocket maximum options, HMO plans with several copayment options and other low cost plan options. Special Features PPO and PPO Value Choice Plans •Access to the PPO network of physicians and hospitals •No referrals necessary •Full coverage throughout the United States and many foreign countries with the Blue Care Program •Coverage also includes preventive care benefits for well-child and adult care, including: physical exams, diagnostic tests and immunizations •Pharmacy benefits including retail and home delivery services Product Portfolio 1: HMO and PPO Products for Individuals Under 65 We've given you a general overview of our PPOs. Now let’s discuss some of the products specifically aimed towards individuals. Most of our members are covered by group plans. A group is defined as two or more employees enrolled through an employer, association or other organization. We also have plans for individuals, who aren’t part of a group. In these plans, the individual is responsible for the entire premium. Another key difference between a group and individual policy is individual policies are always underwritten and usually include a preexisting condition exclusion. Underwriting refers to the process of identifying and classifying an applicant’s degree of risk. This determines whether the individual should be insured, and if so, how much the premium will be. Group policies are also underwritten, but it’s the actual group rather than the group’s individual employees that is underwritten. Most individual health plans include a preexisting condition exclusion. This means that applicants who have a medical condition before the policy begins may have to wait a certain period of time before the plan will cover that condition. Product Portfolio 1: HMO and PPO Products for Individuals Under 65 Each Division has various products for individuals under the age of 65. Here’s an overview of the product types: High Performance Network PPO These plans typically offer a smaller network with fewer providers. They have more limited accessibility, but come with lower premiums. Examples: BlueChoice Select, BlueChoice Value Traditional PPO These plans are standard PPOs. Catastrophic or Hospital Only PPO These plans provide inpatient coverage only. Examples: BlueValue, SelectBlue Example: BasicBlue HSA (Health Savings Account) An HSA is a savings account that a member can use to help pay a high deductible, as well as any other eligible medical expenses that may not be covered after meeting the deductible. Example: BlueEdge HSA Short-term PPO These plans provide temporary health insurance for up to 6 months. Example: SelecTEMP PPO Product Portfolio 1: HMO and PPO Medicare Advantage and Medicare Supplement Plans For those over 65, we provide Medicare Advantage and Individual Medicare Supplement plans. Medicare Advantage Plans Congress created the Medicare Advantage program to offer Medicare beneficiaries more choices, and in many cases, more benefits than those in the traditional Parts A and B program. Individual Medicare Supplemental Plans Medicare Supplement plans are designed to augment the benefits of Medicare Parts A and B. They’re not part of the Medicare Advantage program, and only individuals without group insurance are eligible for supplemental coverage. For those covered by group insurance, the group coverage acts as the primary insurance with Medicare providing secondary coverage. Federally-mandated “Standardization” requires that insurers selling supplemental coverage sell the same types of plans. Depending on which plan is chosen, we pay a portion or all copays, deductibles and coinsurance. In Illinois we also have Medicare Select plans, which provide the same benefits as the standardized plans, but come with a reduced premium for using a PPO network. Medicare Prescription Plans We also offer Medicare Prescription plans (Part D) which supplement Medicare coverage with drug benefits. Product Portfolio 1: HMO and PPO Transparency Now that we’ve introduced you to our HMOs and PPOs, it’s time to discuss an important feature that goes hand in hand with our products. especially CDHP members, have choices when they make health care decisions. More and more expect “transparency.” They want easy access to relevant and accurate provider information to help them make cost-efficient Our PPO members, decisions. We are responding to this need by giving members access to online health information such as costs of procedures and hospital comparisons. Product Portfolio 1: HMO and PPO Transparency Members have access to various online health tools through our self-service website—Blue Access® for Members. Through BAM, members can better manage their health care and access important information to help them make more cost-effective decisions. They can review their claims activity, use a health care cost calculator, compare hospitals and find prescription drug information. Through the Personal Health Manager, members can seek personalized information from nurses, trainers, dietitians and life coaches. They can also complete the online Health Risk Assessment. Personal Health Manager Health Risk Assessment Product Portfolio 1: HMO and PPO Transparency Members have access to various online health tools through our self-service website—Blue Access® for Members. Through BAM, members can better manage their health care and access important information to help them make more cost-effective decisions. They can review their claims activity, use a health care cost calculator, compare hospitals and find prescription drug information. Hospital Comparison Tool Treatment Cost Advisor BAM also provides several online transparency tools to help members calculate their out-of-pocket costs BEFORE a hospital admission or surgery. Our members enrolled in high-deductible health plans such as Health Savings Accounts or Health Care Accounts find these tools to be especially helpful. Key Points • In a PPO plan members may choose to see any physician within the network, without a referral. In most plans the member must meet a deductible. • PPOs are by far our most popular product. • We have the largest PPO network in the industry with networks in 49 states. • When setting up networks, we consider geographic access, utilization guidelines and controlling costs. • Blue Care Connection is a suite of resources and support services that provides personalized attention, health advocacy and condition-specific information. (Examples: Personal Health Manager, Blue PointsSM, Blue Care Advisor and the 24/7 Nurseline) • The PPO BlueCard® Program gives members access to PPO providers throughout the U.S. • In individual plans, the individual is responsible for the entire premium. Also the policies are always underwritten and usually include a preexisting condition exclusion. • Our PPO members, especially CDHP members, expect transparency, meaning they want easy access to relevant and accurate provider information to help them make cost-efficient decisions. Product Portfolio 1: HMO and PPO Summary This concludes the Product Portfolio 1: HMO and PPO lesson. You should now be able to: • Describe the basic features of key HMO Illinois and BlueAdvantage HMO • Describe the basic features of PPO Plans. • Describe the basic features of the BlueCard Program Glossary of Terms Managed Care A health care system that delivers care through a contracting network of providers. These providers agree to comply with the care approaches established by a care-management process. Providers may receive a “capitated” payment (prepayment made on a per subscriber or family basis) for providing care, or they may be paid on a discounted fee-for-service basis. Network A group of physicians, hospitals and other medical care professionals that a managed care plan has contracted with to deliver medical services to its members. HCSC’s networks are broad, offering widespread access to the continuum of care, including PCPs, specialists, behavioral health care providers, hospitals and pharmacies. Networks also include several different types of ancillary providers such as imaging centers, laboratories, home health care, durable medical equipment, home infusion therapy, hospice, skilled nursing facilities and radiation therapy centers. We pride ourselves on the fact that more than 85% of all doctors and hospitals throughout the U.S. contract with a BCBS Plan. Primary Care Physician (PCP) With HMO coverage, members select a PCP from a network family of practitioners, internists and pediatricians. Female members have direct access to network OB/GYNs for annual well-woman exams, pregnancy and gynecological issues. To help members select PCPs, we provide user-friendly paper and online directories and toll-free customer service assistance. Eligible family members may choose different PCPs, or the entire family may select the same PCP. Copayment The flat dollar amount or a percentage that a member pays out of pocket at the time of receiving a service. Coinsurance A method of cost-sharing that requires a member to pay a set percentage or set dollar amount towards eligible medical expenses. Independent Physician Association (IPA) An organization comprised of individual physicians or physicians in small group practices.