AdamicTimeSeriesNetS.. - University of Michigan

advertisement

Co-evolution of network

structure and content

Lada Adamic

School of Information & Center for the Study of Complex Systems

University of Michigan

Outline

Co-evolution of network structure and content

Can the structure of Twitter and virtual world interactions

reveal something about their content?

http://arxiv.org/abs/1107.5543

Can the structure of a commodity futures trading network

reveal something about information flowing into the market?

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=136

1184

What is the relationship between network

structure and information diffusion?

3

Is information flowing over the

network?

Or is information shaping the

network?

Can the shape of the network reveal

properties of information

Big news! Giant microbes!

Can the shape of the network reveal

properties of information

Little news. How’s the weather?

Related work on time evolving graphs

Densification over time (Leskovec et al. 2005)

Community structure over time (Leicht et al. 2007, Mucha et al.

2010)

Change in structure (ability to “compress” network) signals

events (Graphscope by Sun et al. 2007)

Disease propagation & timing (Moody 2002, Liljeros 2010)

Enron email (B. Aven, 2011)

What’s different here

We look at network dynamics at relatively short time

scales and construct time series

A range of network metrics, instead of just community

structure

Information novelty and diversity as opposed to tracking

single events / pieces of information

Can the network reveal…

If everyone is talking about the same thing, or if there is just

background chatter.

If what they are talking about is novel?

1st context: virtual worlds

Networks: asset transfers (gestures, landmarks) and

transactions (e.g. rent, object purchases)

Content: assets being transferred

10

Study transfers in the context of 100

groups with highest numbers of

transfers

11

Second context: Twitter Network

microblogging : < 140 characters / tweet

Network links read from tweets

Reply or mention: by putting the @ in front of

the username

Retweet: repeat something someone else wrote on twitter,

preceded by the letters RT and @ in front of their username

Selecting Twitter communities to track

http://wefollow.com/twitter/researcher

For each “researcher” gather tweets of accounts they

follow

Highly dynamic networks

repeated

of edges

0.10

0.15

0.20

SecondLife

Twitter

Segmentation:

Twitter: every 800

tweets

%

0.05

1

2

3

4

5

6

7

Segments

# of segment elapsed

8

median segment

duration 1.5 days

SecondLife: every

50 asset transfers

0.00

percentage

0.25

median segment

duration 8.4 days

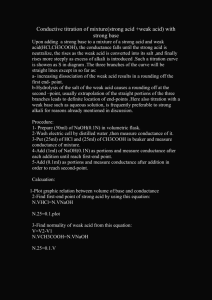

Conductance:

capturing potential for information flow

A

A

B

low

conductance

A

B

B

medium

conductance

high

conductance

wkl

Cij = å

Õ deg(k)

paths _i _ j edges _ k _ l _ on _ path

Temporal conductance (summed over all pairs):

High if pairs of nodes share edges, or many short,

indirect paths

Koren, North, Volinsky, KDD, 2006

Network expectedness

Define expectedness:

Average conductance of all neighbor pairs at time t,

based on conductance of pair at time t-1

1

Xt =

Et

å

edges(i, j )

C i,t-1j

expected

unexpected

16

network

configuratio

n at

t=0

conductance = 4

possible

configuratio

ns at

t=1

conductance = 4

expectedness = 1.5

edge jaccard = 1

Conductan

ce and

expectedn

ess as a toy

network

evolves

d

conductance = 4.5

conductance = 6

expectedness = 1.3333 expectedness = 0.5

edge jaccard = 0.6667 edge jaccard = 0.25

SecondLife: network structure and

content

standard

network

metrics are

not indicative

of information

properties

overlapoverlapD diversity D diversity

t-1,t

t,t+1 t-1, t

t, (t+1)

conductance

and

expectedness

are

Conductance & diversity of

information

High conductance brings higher

content diversity

Repeat network patterns bring less

diversity and less novelty

but… similarity and novelty are

positively correlated (r = 0.19)

Social and transaction

network of top sellers in

SL

Twitter: textual diversity and novelty

Semantic metrics

Metric Type

Computation Methods

between connected node pairs in

the graph

Contemporary Metrics

(average cosine

similarity of words in

Tweets)

between indirectly-connected node

pairs, i.e., non-neighbors with an

undirected path of length > 1

between them

between isolated pairs (in different

components)

Novelty Metric

(Language Model

distance)

between two sets of tweets

associated with Twitter networks

captured at different times

network structure

Twitter: network structure and

information diversity

# nodes(T)

-0.584 ! ! !

-0.632

0.305 ! ! !

0.030 ! ! !

# edges(T)

-0.537 ! ! !

-0.601

0.348 ! ! !

0.058 ! ! !

0.6

0.4

reciprocity(T)

-0.160 !

-0.179 !

0.176 ! !

0.128 !

clustering coef.(T)

-0.198 ! !

-0.240

0.181 ! !

0.030 ! ! !

centralization(T)

-0.121 !

-0.176

0.158 ! !

0.062 ! !

edge deg cor.(T)

0.027

-0.155 ! !

0.113

0.054 ! !

av. degree(T)

-0.287 ! ! !

-0.353

0.323 ! ! !

0.093 ! ! !

sd. degree(T)

-0.212 ! !

-0.277

0.251 ! ! !

0.048 ! !

WCC size(T)

0.317 ! ! !

0.303

-0.126 ! !

0.038 ! ! !

conductance(T)

-0.444 ! ! !

-0.506

0.369 ! ! !

0.121 ! ! !

expectedness(T)

-0.145 ! !

-0.161 !

0.234 ! ! !

0.092 ! ! !

all-pairs

unconnected indirectly-connected connected

content similarity

0.2

0.0

-0.2

-0.4

-0.6

Inferring Network Semantic

Information

Question: Does the network structural information help to

improve the prediction performance of the

characteristics of information exchanged?

Semantic

variables

Topological

variables

Kernel

Regression

Prediction

Model

Semantic

variables

Example: Inferring the average

similarity score between isolated pairs

0.8

0.6

0.4

2

R in predicting the

ASS between isolated nodes

1

0.2

Q

c :X ={connected}

1

1

c2:X2={indireclty−connected}

c :X ={# nodes}

3

3

c :X ={# edges}

4

4

0

.

.

s

s

s

y

ted cted ode dge ocit coef ation cor Deg Deg Size ance nes

c

v

d

r

g

t

e ne n

r

d

t

C

e

t

a

c

p

g

n

e

s C u cte

n

n

#

# eci rin cen e d

W o n d pe

r te n

co −co

g

s

o

d

c ex

y

l

u

c

e

t

l

c

ec

r

i

ind

The input variables of curve ci start from Xi

and increase each time by adding the

variable labeled on x-axis.

Don’t need to use

other textual variables

(e.g. similarity between

indirectly connected

pairs) when sufficient

topological information

available

Reason: topological

variables account for

much of the pattern in

the text!

Network structure and information

novelty

Greater novelty in

edges

# nodes(T-1,T)

corresponds to

# edges(T-1,T)

greater novelty in reciprocity(T-1,T)

content shared clustering coef.(T-1,T)

centralization(T-1,T))

For nodes that are edge deg cor.(T-1,T)

interacting (citing av. degree(T-1,T))

or being cited):

sd. degree(T-1,T))

WCC size(T-1,T))

Higher

edge jaccard(T-1,T)

conductance

and

conductance(T-1,T)

expectedness

expectedness(T-1)

correlates with less expectedness(T)

information

novelty

0.3

0.124 !

-0.050 ! !

0.171 !

-0.117 ! ! !

0.042

-0.004

0.149 !

-0.197 ! ! !

-0.018

0.038

-0.111 ! !

0.101 !

0.066

-0.044 !

0.083

-0.119 ! !

0.085

-0.101 !

-0.233 ! !

-0.230 ! ! !

0.202 !

-0.225 ! ! !

0.171 ! !

-0.143 ! !

0.093 !

-0.273 ! ! !

0.2

0.1

0.0

-0.1

-0.2

-0.3

LMdist_allNodes(T-1,T)

LMdist_NodesWithNeighbors(T-1,T)

Information in trading networks

CFTC = Commodity futures trading commission

stated mission: protect market users and the public from

fraud, manipulation, and abusive practices

futures contracts started out as contracts for agricultural

products, but expanded to more exotic contracts,

including index futures

Collaboration with Celso Brunetti, Jeff Harris, and Andrei

Kirilenko

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=

25

Data

6.3 million transactions in Aug. 2008 in the Sept. E-mini S&P

futures contract

price discovery for the index occurs mostly in this contract

(Hasbrouck (2003))

data includes: date & time, executing broker, opposite broker,

buy or sell, price, quantity

sample

in broker

transaction windows of 240 transactions

executing

opposite broker

quantity: 10

price: $171.25

matching algorithm

sell 10 contracts at $171.25

buy 20

30 contracts at $171.50

$171.25

sell 5 contracts at $171.75

buy 30

20 contracts at $171.25

$171.50

sell 20 contracts at $172.00

buy 50 contracts at $171.00

limit order book

27

not social, not intentional, not

persistent

28

Financial variables

Rate of return:

Last price to first price in logs (close-to-open)

Volatility:

Range – log difference between max and min price

Duration:

start

Total period duration - time in seconds between the

and end of each sampling period

Proxy for arrival of new information

Volume:

Trading volume – number of contracts traded

What can we learn from network

structure?

e.g. centralization?

low in-centralization

high in-centralization

low outdegree

low indegree

high outdegree

high indegree

30

overview of network variables

# nodes, # edges

clustering coefficient, LSCC, reciprocity

CEN = giniin-degree – giniout-degree

INOUT = r(indegree of node, outdegree of same

node)

AI (asymmetric information)

31

Correlations between network

and financial variables

High Centralization: market dominance - a dominant trader buys

from many small sellers – low duration, low volume

Correlations between network

and financial variables

Negative assortativity: large sellers sell to small buyers and vice

versa

– low duration, higher volume

Correlations between network

and financial variables

High av. degree & largest strongly connected component:

no news - many buyers and sellers – high duration, high volume

Correlations between network

and financial variables

Rate of return:

positive correlation with centralization

Volatility & duration:

Volume:

correlated with standard deviation of degree, average

deg. and the total number of edges (E).

Correlated with a few network variables, sign varies.

Conclusion

Network structure alone is revealing of the diversity and

novelty information content being transmitted

Results depend on the scope and relative position of the

activity in the network

Future work

Sensitivity to inclusion of non-interactive or across-community

interactions

Applying novelty & conductance metrics to financial time series

Continuous formulation of novelty and other network metrics

(because segmentation is problematic)

Roles of individual nodes

Thanks:

Edwin Teng

Liuling Gong

Avishay Livne

Information network academic research center

Questions?