Johns Hopkins University Financial Accounting

advertisement

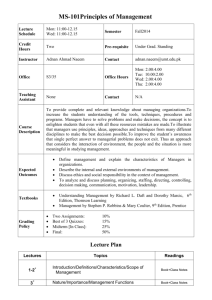

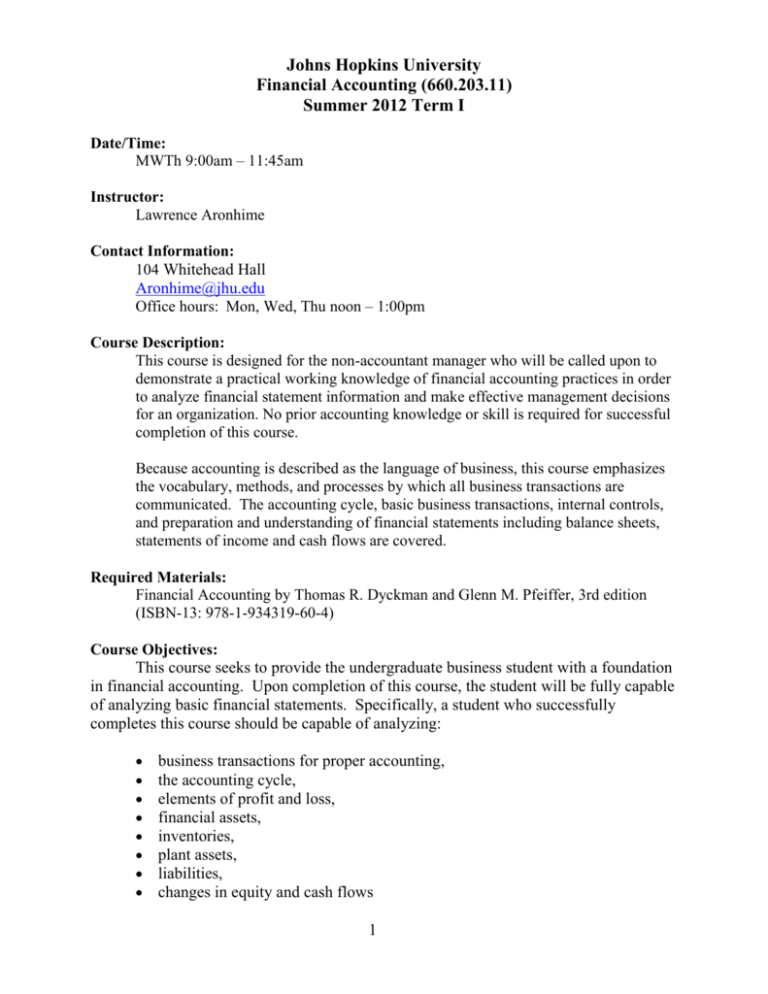

Johns Hopkins University Financial Accounting (660.203.11) Summer 2012 Term I Date/Time: MWTh 9:00am – 11:45am Instructor: Lawrence Aronhime Contact Information: 104 Whitehead Hall Aronhime@jhu.edu Office hours: Mon, Wed, Thu noon – 1:00pm Course Description: This course is designed for the non-accountant manager who will be called upon to demonstrate a practical working knowledge of financial accounting practices in order to analyze financial statement information and make effective management decisions for an organization. No prior accounting knowledge or skill is required for successful completion of this course. Because accounting is described as the language of business, this course emphasizes the vocabulary, methods, and processes by which all business transactions are communicated. The accounting cycle, basic business transactions, internal controls, and preparation and understanding of financial statements including balance sheets, statements of income and cash flows are covered. Required Materials: Financial Accounting by Thomas R. Dyckman and Glenn M. Pfeiffer, 3rd edition (ISBN-13: 978-1-934319-60-4) Course Objectives: This course seeks to provide the undergraduate business student with a foundation in financial accounting. Upon completion of this course, the student will be fully capable of analyzing basic financial statements. Specifically, a student who successfully completes this course should be capable of analyzing: business transactions for proper accounting, the accounting cycle, elements of profit and loss, financial assets, inventories, plant assets, liabilities, changes in equity and cash flows 1 Johns Hopkins University Financial Accounting (660.203.11) Summer 2012 Term I Student Responsibilities: This is a rigorous course. At a minimum, prior to each class session, students are expected to have read the assigned chapters and attempt the exercises and issues for discussion. It is imperative that all assignments and readings by completed prior to class. Students are expected to take all examinations and to complete all assignments on the required dates. Make-up exams may be arranged only at the discretion of the instructor and the Department. It is the responsibility of the student to obtain notes and assignments from colleagues for any classes that were missed. Group size cannot exceed two without permission of the instructor. No Senior Options will be offered. Evaluations: A 90-100 B 80-89 C 70-79 Plusses and minuses will be used at the discretion of the instructor. Assignments: Midterm Examination 1 Midterm Examination 2 Final Examination Cases/ Homework/ Quizzes 20% 20% 40% 20% All exams are cumulative. One sheet of paper hand-written is allowed for each exam. Cases are assigned according to the attached schedule. Cases must be submitted in hard copy on time, without exception. 2 Johns Hopkins University Financial Accounting (660.203.11) Summer 2012 Term I Cases: During a case course, you may find it hard to measure how much you are learning from the cases. This contrasts with lecture and/or problem courses where experience has given you an intuitive feeling for how well you are acquiring substantive knowledge of theoretical concepts, problem-solving techniques and institutional practices. But in a case course where analytical ability and the skill of making sound judgments are less apparent, you may lack a sense of solid accomplishment, at least at first. Admittedly, additions to one’s managerial skills and powers of diagnosis are not as noticeable or as tangible as a binder full of lecture notes. But this does not mean they are any less real or that you are making any less progress in learning how to be a manager. In the process of searching for solutions, very likely you will find that you have acquired a considerable knowledge about types of organizations, the nature of various businesses and the range of management practices. Moreover, you will be gaining a better grasp of how to evaluate risk and cope with the uncertainties of enterprise. Likewise, you will develop a sharper appreciation of the common and the unique aspects of managerial encounters. Such is the essence of management, and learning through the case method is no less an achievement. If throughout the course you can remain open to the diverse views found in your community of students while developing your own skills of critical reasoning and decision making, your learning will climb to heights accessible to a select few. Excerpted from "Case Preparation for the Beginner: A Nudge Toward an Open Door", written by Associate Professor William F. Crittenden of Northeastern University, Jan. 1998, p. 41 . 3 Johns Hopkins University Financial Accounting (660.203.11) Summer 2012 Term I Day Date Subject Ch. 5/30 Wed Introduction to Financial Statements 1, 2 Exercises Problems P1: 35, 41 C1: 45 5/31 Thu Constructing Financial Statements Adjusting Accounts 6/4 Mon Cash Flows 6/6 Wed Review 6/7 Thu Midterm 1 6/11 Mon Interpreting Financial Statements 5 M5: 14, 15, 22 E5: 26 P5: 36, 41 Revenue and Receivables 6 P6: 40, 43 C6: 48 7 M6: 13, 14, 15, 18, 20, 23, 24 E6: 26-34 M7: 17, 18, 19 E7: 26, 28, 29, 30 M8: 12, 13, 14, 19 E8: 22, 23, 24, 30, 31, 32, 35 M9: 17, 18, 19, 20, 23, 24 E9: 36, 37, 39, 41 M10: 12, 13, 15, 16 E10: 23, 24, 25, 28 M11: 19, 20, 21, 22, 23, 24 E11: 39, 42, 47, 50, 51 P9: 51, 52, 55, 59 3 4 6/13 Wed 6/14 Thu Cost of Goods Sold and Inventory Fixed Assets 6/18 Mon Midterm 2 6/20 Wed Liabilities 9 6/21 Thu 10 6/25 Mon Leases, Pensions, and Income Taxes Stockholders’ Equity 6/27 Wed Review Session 6/28 Thu Final Exam 8 11 M2: 18, 22, 25 E2: 38, 42, 44 M3: 21, 24 E3: 32, 35 M4: 22, 26, 28 E4: 34, 35, 39 P2: 55, 56, 61, 65 C2: 69 P3: 40, 41, 43, 54 C3: 56 P4: 46, 48 C4: 57 P7: 33, 34 C7: 38 P8: 36, 37, 39 C8; 40, 42 P10: 33, 34, 35, 36, 37, 40, 41, 42 P11: 55, 59 The instructor reserves the right to change topics, readings, cases, and assignments in order to further appropriate course outcomes. 4