October 2012 Meetup PowerPoint Presentation

advertisement

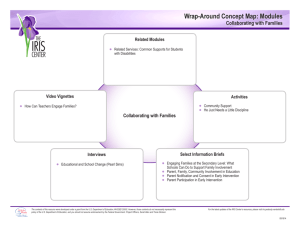

Iris Investopedia explains “Pairs Trade” It's the ultimate strategy for stock pickers, because stock picking is all that counts. What the actual market does won't matter (much). If the market or the sector moves in one direction or the other, the gain on the long stock is offset by a loss on the short. Wikipedia explains “Pairs trade” The pairs trade or pair trading is a market neutral trading strategy enabling traders to profit from virtually any market conditions: uptrend, downtrend, or sideways movement. This strategy is categorized as a statistical arbitrage and convergence trading strategy. The pair trading was pioneered by Gerry Bamberger and later led by Nunzio Tartaglia’s quantitative group at Morgan Stanley in the 1980s Definition of “Pairs Trade” The strategy of matching a long position with a short position in two stocks of the same sector. This creates a hedge against the sector and the overall market that the two stocks are in. The hedge created is essentially a bet that you are placing on the two stocks; the stock you are long in versus the stock you are short in. Wikipedia explains “Pairs trade” Market neutrality The pairs trade helps to hedge sector- and market-risk. For example, if the whole market crashes, and the two stocks plummet along with it, the trade should result in a gain on the short position and a negating loss on the long position, leaving the profit close to zero in spite of the large move. Benefits of Pairs Trading Wikipedia explains “Pairs trade” Today, pairs trading is often conducted using algorithmic trading strategies on an Execution Management System. These strategies are typically built around models that define the spread based on historical data mining and analysis. The algorithm monitors for deviations in price, automatically buying and selling to capitalize on market inefficiencies. The advantage in terms of reaction time allows traders to take advantage of tighter spreads. Iris Iris Iris is a pairs trading platform with 100% automation capability. Using advanced algorithms, Iris is able to manage an entire portfolio by deciphering patterns in correlated instruments based upon pre-defined quantitative factors. Iris has the capability of managing/monitoring thousands of pairs simultaneously, advanced execution technology, and an extremely customizable entry/exit system over 20 levels. Iris executes in the most cost effective manner using our smart routing algorithm, which reduces the total execution costs by up to 50% (from standard route out), yet still fills both sides of the pair immediately. Iris utilizes Takion Technologies’ robust execution engine for all order flow. Any time a pair triggers an entry or an exit it is executed in a matter of milliseconds. By having access to such technology, Iris users have a significant advantage over competition in capturing the most ideal fill prices. Even if a delay in data should arise, Iris continuously rechecks all prices before executing to validate every order. Iris uses a proprietary standard deviation calculation that measures the divergence from the mean price relationship between the two paired stocks, resulting in the standard deviation value. By using the standard deviation measurement the volatility for each pair is treated uniquely. It is extremely important to standardize each pair's volatility when using a black box algorithm such as Iris, because the system is executing each trade based on predefined standard deviation levels generalized for all pairs. Another benefit to using the standard deviation measurement is the time value effect. Over time the standard deviation will fall even if the stock prices have not converged due to such effect, which will force a non-profitable pair to close. The capital can then be redeployed to potentially more profitable opportunities. Dividend Adjustments Iris is aware of all dividends affecting any open or potential position and adjusts the stock price accordingly. If a user is in a pair overnight and one of the symbols pays a dividend, Iris will automatically recalculate the STD, so the correct and accurate value is used. Also, Iris automatically adjusts the PnL for dividends. Most trading platforms do not adjust for dividends in all markets – NYSE, Nasdaq, AMEX — Iris does. The Iris Process 1. User Inputs Entry & Exit Standard Deviation Criteria and Dollar Allocation % for Each Level. 2. All Pairs are Displayed and Monitored in Candidate Pairs Window for Potential Entries. 6. The Pair Exits All Levels Based on User-defined Exit Criteria and ReEnters Candidate Pair Window Based On Initial Criteria. 3. A Pair Reaches its User-defined Entry Standard Deviation Threshold and Either Auto Enters or Alerts the Trader to Enter. 5. The Pair Reaches it’s User-defined Exit Standard Deviation Threshold and Either Auto Exits or Alerts the Trader to Exit. Iris 4. The Entered Pair Moves to the Open Positions Window and is Tracked for Additional Level Entries and Exits. Iris Connect/Disconnect button By clicking connect you will connect to our servers. By clicking disconnect you will disconnect from the servers. Windows Here you can open Iris windows by clicking on the corresponding button. Layout Restore your previous layout, save your layout, or have the option of saving your layout on exit. Exit All Positions By clicking this you will liquidate all open positions immediately. Auto Enter / Auto Exit buttons When both Auto Enter and Auto Exit are unchecked you will be in “manual mode”. When one of the boxes is clicked, it will highlight and you will be in “graybox mode”. With both the boxes clicked and highlighted, you will be in “blackbox mode”. Rebalance Rebalance your entire portfolio as a % or a dollar value up or down with a click of a mouse. Specify the amount you would like to rebalance in the amount field. Audible Alerts If ON, when a trade enters or is ready to enter Iris will ‘ding’. Desktop Alerts If ON, a desktop alert will pop up when a new entry or exit level is available or when a level is automatically executed. Highlight Entries/Exits If ON, the order executed will highlight for the period of ‘Highlight Delay’ to catch your eye Highlight delay The number of seconds you want the order executed to highlight. Highlight RSI Highlights pairs with an RSI value > or < the set value Hide count rejects IF YES, Iris will not display potential pairs in the Candidate window if one of the symbols already has greater than the Max Pair per Symbol setting. Auto Exit pairs Here you will set the number of days to automatically exit pairs if the PnL is NEG or POS, as well as your maximum STD stop loss exit. Email on disconnect If Iris is not manually disconnected from the server by the user (usually due to a communication problem over the internet), an email will be sent to alert the user. Profit & Loss Summary window Marked PnL Open PnL Closed PnL Profit & Loss Summary window Intraday % Total exposure Long exposure Short exposure Profit & Loss Summary window Volume traded Open pairs Monitored pairs LIST WINDOW Favorite Pairs Enter the pairs you want to monitor in this field and click update. Both symbols must be on same line with white space (tab / one or more spaces) between them. Example: LOW HD Omit Symbols and/or Pairs Enter the symbol or pairs you with to omit from trading in this field and click update. You can also add notes here (such as “Earnings 2-24”), which will be ignored. Manual Mode Trading Enter Level and Enter Pair When you click on the single + it will enter 1 level of the pair, the +++ will enter you into all of the queued levels. Pair Column This shows the current pairs you are watching, the stock in red will be sold short and the green stock will be purchased long. STD This shows the current standard deviation of that pair. Current Level The level of standard deviation that this pair is currently at based on your entry curve Volatility The higher this number the lower the volatility of the pair. (Proprietary calculation). Cost to Enter The amount of capital needed to enter the next entry (may be multiple queued levels) Last Price Displays the last print of the stocks in that pair. Closing Price Displays yesterday’s closing price RSI Relative strength index for each stock Price Ratio Divides the lower priced stock by the higher priced stock and displays the value. Subsector Shows the sector that your stocks are in. Categorization is from ICB internationally recognized database. Stocks around the world are uniformly categorized into each category (this will be beneficial when we can trade international STD Lookback (Days) This is the amount of historical days used to calculate the spread for your pairs. Max Pairs per Symbol This limits the amount of pairs that you can have matched up to any one symbol. I.e., if you have 25 stocks matched up to SPY and you have this set to 5, then it will only enter positions in the first 5 pairs that meet the rest of your criteria. Max Value per Pair ($) This is the total dollar amount that is allocated per pair if that pair gets into all 20 levels. Est. Ticket Cost ($) Your commission cost per 1000 shares traded. Auto Enter Candidates Set this to YES and it will auto enter candidate pairs and open pairs. When set to NO, it will only automatically enter new levels in open pairs. Trading Method ‘Standard’ will enter your trades when the spread hits each STD level trigger. Aggregate will only enter the trade when the pair crosses your STD trigger and reaches your buffer level – then converges back that amount. You will always enter at your “trigger STD” or better and can queue up multiple levels for entry for further price improvement. Trigger buffers The pairs go past the level by the Buffer Entry amount and then when they come back to the level it will enter the trade. For exits, the pair needs to go past the Current Exit by the Buffer Exit amount, and then when it diverges back to the STD exit level trigger you will exit the level (and the queued levels). Entry STD Enter the starting value of your standard deviation in the Start box. In the increment box enter the amount you want each level to increase by. Exit STD This is the amount that the pairs will have to come together for the program to be set to take a profit. This amount is equal to the current entry level minus the amount you put in the Diff box. Allocation In the first box under the Allocation column, enter the amount in percent of the Max Value per Pair that you want the program to enter per level. For convenience, if you enter ‘5’ and click on Copy Level 1, it will enter 5% at each level. Pair Detail window By double clicking on any pair you can display it in the pair detail window Open levels The level breakdown of the pair current open levels of the pair Closed levels The level breakdown for the levels closed for the pair WITHIN THE WINDOWS By Right clicking on the pair you can: - View pair in detail window - Omit a pair - Omit only the long or short symbol - Look up long or short symbol in Yahoo finance WITHIN THE WINDOWS By right clicking on a column header you can: - Choose new columns / hide columns - Sort column by ascending or descending - Easy to view columns by using Best fit Iris Pairing Stocks It may be a good idea to start by pairing stocks within the same Sector Basic Materials Consumer Goods Financial Healthcare Industrial Goods Technology Utilities Defensive Transportation Energy Consumer Cyclical Communication Recommend not pairing Biotech’s Pharmaceuticals ADRs with non ADRs Volatile pairs American depositary receipt (ADR) a negotiable security that represents the underlying securities of a non-US company that trades in the US financial markets. Price Ratio Should have minimum price ratio of .10. It's probably not a good idea to pair a $5 stock with a $100 stock, resulting in .05 price ratio Picking stocks to pair up Avg volume should be 500k or more Picking stocks to pair up It’s a good idea to trade stocks that have positive EPS both historically and expected You may notice increased volatility during Options X Earnings season End of the quarter End of the year Pair Spread The percentage spread between the two stocks should not spread more than 20% Max on a 1, 3, 6 month chart “CB ACGL example below” CB ACGL Example of a good pair CB ACGL Example of a good pair UDR EQR Example of a good pair UDR EQR Example of a good pair TSLA F Example of a bad pair TSLA F Example of a bad pair SCHW ETFC Example of a bad pair SCHW ETFC Example of a bad pair Omitting Stocks Upgrades, Downgrades, Any Material News Stocks with upgrades, downgrades, and any other material news should probably be omitted for a few days allowing the news to subside. Omitting Stocks Takeovers/Buyouts These stocks should be permanently omitted. Omitting Stocks Earnings Approximately a week prior to a company's earnings release, it is suggested to omit the symbol and keep it omitted for several days after as earnings are statistically unreliable. Iris Proprietary Volatility Calculation The lower the volatility value the more volatile the pair is. It’s up to the user but we recommend omitting pairs with a volatility value less than 15 Iris Picking Pairs The Pair Matcher Methodology for picking pairs. Things to look for • Highly correlated and co-integrated. • Above 500k a day in volume. • In the same industry and sector/sub-sector. • Ratio less then 5 to 1. Things to stay away from • Speculative, i.e. biotech • Low volume. • ADR’s to US stocks. • Cross sector pairing. • Volatile sectors. The Pair Matcher How I picked the sectors 1. Average volume above 500k 2. Previous close between 10 and 250 The Pair Matcher Tools to find my pairs The Pair Matcher Yahoo Finance The Pair Matcher The Pair Matcher The Pair Matcher Reasons for the pair matcher • Building the spreadsheet, and using yahoo is very time consuming • I was spending over 40 hours a week picking my list and pairs • I found myself duplicating pairs when I would type them into yahoo • Keeping things organized was very tedious • So the idea of building a program that would save time came to me • I wanted to review a pairs list in a matter of minutes instead of hours • I wanted to see the 4 time frames in 1 window • I needed the ability to quickly look at all pair combinations • I also needed the ability to filter the results and sort them • The best thing though is the ability to constantly review my pairs list in a timely manner The Pair Matcher What a bad pair looks like. The Pair Matcher What a bad pair looks like. The Pair Matcher Example of a highly correlated pair that has a low probability of making money. The Pair Matcher Example of a highly correlated pair that has a low probability of making money. The Pair Matcher Example of a pair that crosses multiple times. The Pair Matcher Not 100% correlated but highly co-integrated. The Pair Matcher What a good pair looks like. The Pair Matcher What a good pair looks like. The Pair Matcher Summary • Pairs need to be correlated but not too correlated. • Co-integration is key. • Related, i.e. same sector. • Enough volume to support your trades. • Pairs fall in and out of favor, so you need to check them weekly/monthly. • No speculative stocks. The Pair Matcher Live Demonstration Sectors spreadsheet Finance.yahoo.com www.pairmatcher.com The Pair Matcher The Pair Matcher