3 1 A2 HL Comparative Advantage N

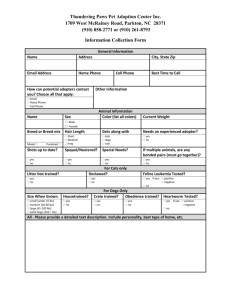

advertisement

3.2 HL Comparative Advantage B & D, pages 261-265 3.2 Learning Objectives 1. 2. 3. 4. Describe the differences between countries in in terms of factor endowments and the levels of technology. Explain the theories of absolute and comparative advantage and illustrate each by a sketch diagram. Calculate opportunity costs from a set of data in order to identify comparative advantage and illustrate on a diagram. Discuss the real-world relevance and limitations of the theory of comparative advantage, considering factors including the assumptions on which it rests, and the costs and benefits of specialization (a full discussion must take into account arguments in favour and against free trade and protection— see below). 1. Describe the differences between countries in in terms of factor endowments and the levels of technology. Costs of production varies between countries because of “factor endowments” – types of factors of production a country is “gifted” with. For example, New Zealand has a large land mass with volcanic soil, undulating landscapes with moderate temperatures and much rainfall – very conducive to growing fruits and vegetables. This also gives rise to lots of green grass when the trees got cleared; hence this allows for plenty of sheep and cattle raising – making for huge wool, meat and dairy industries. 2. Explain the theories of absolute and comparative advantage and illustrate each by a sketch PPC diagram. Meat (pounds) Potatoes (pounds) 3. Calculate opportunity costs from a set of data in order to identify comparative advantage and illustrate on a diagram. Imagine . . . only two goods: potatoes and meat only two people: Mr. Jones and Mrs. Choi Will they be better off if they trade? Who is most efficient at each product? Would you think there’s a good reason to trade? Jones Choi Hours Needed to Make 1 lb. of: Meat Potatoes 20 hours/lb 10 hours/lb 10 hours/lb 8 hours/lb. Amount Produced in 40 Hours Meat Potatoes 2 lbs. 4 lbs. 4 lbs. 5 lbs. The producer that requires a smaller quantity of inputs (in this case, hours of labour) to produce a good is said to have an absolute advantage in producing that good. Does that mean Mrs. Choi has no reason to trade? Consider Mr. Jones’ Production – and consumption – Possibilities Frontier Meat (pounds) 2 1 0 A 2 4 Potatoes (pounds) Mrs. Choi’s Production – and consumption – Possibilities Frontier Meat (pounds) 4 B 2 0 2.5 5 Potatoes (pounds) Compare the Opportunity Cost for each person producing Meat and Potatoes 1 lb. of Meat 1lb. Of Potatoes Mr. Jones 2 lb. potatoes 0.5 lb. meat Mrs. Choi 1.25 lb. potatoes 0.8 lb. meat The producer who has the smaller opportunity cost of producing a good is said to have a comparative advantage in producing that good. Who has the comparative advantage for a) meat b) potatoes? The Gains from Trade: Suppose the “terms of trade” is 0.66 Lbs. of meat = 1 Lbs. of Potatoes [see the table for how much each person has gained] Can you show the new “consumption frontier” for each person? That’s why it’s good to trade even for Mrs. Choi! The Outcome With Trade: What They What They Trade Produce What They Consume 1.3 lbs meat (A*) 2 lbs potatoes Jones 0 lbs meat 4 lbs potatoes Gets 1.3 lbs meat for 2 lb potatoes Choi 4 lbs meat 0 lbs potatoes Gives 1.3 lbs meat 2.7 lbs meat (B*) 2 lbs potatoes for 2 lb potatoes 4. The Limitations of the Theory 1. 2. 3. 4. Transport costs and tariffs will change the relative prices of goods and may therefore 'blur' the impact of comparative advantage. Exchange rates do not always relate exactly to what comparative advantage theory suggests as they have many other determinants - this may also negate the theory. Imperfect competition may lead to prices being different to opportunity cost ratios. Imperfect competition may also lead to the exploitation of economies of scale which may adjust to what comparative advantage theory suggests should happen. Comparative advantage theory is a static theory and does not take account of some of the more dynamic elements determining world trade. In particular, the factor of production capital is not a natural resource, and so may come outside the scope of the theory.