ECON5335 - International Economics

advertisement

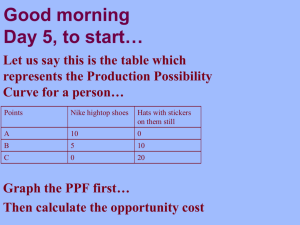

ECON5335 - International Economics Chapter 4 Trade Flows in Theory Trade models - usually question being asked: “why do we trade what we trade?” - 3 very simple theoretical models - autarky initial position - permit trade to occur - other question asked is “who do we trade with?” - empirical model based on econometrics 3/19/2016 2 Only two goods Meat Potatoes Only two people Rancher Farmer 3 If rancher (R) produces only meat and farmer (F) produces only potatoes then both have potential to gain from trade If both R and F produce both meat and potatoes Both can potentially gain from specialization and trade Production possibilities frontier (PPF) Various mixes of output that economy can produce if all resources used to capacity 4 The Production Possibilities Frontier (a) Panel (a) shows the production opportunities available to the farmer and the rancher. 5 (b) The farmer’s production possibilities frontier Meat (oz) If there is no trade, the farmer chooses this production and consumption. (c) The rancher’s production possibilities frontier Meat (oz) 24 8 12 4 0 If there is no trade, the rancher chooses this production and consumption. B A 16 32 Potatoes (oz) 0 24 48 Potatoes (oz) Panel (b) shows the combinations of meat and potatoes that the farmer can produce. Panel (c) shows the combinations of meat and potatoes that the rancher can produce. Both production possibilities frontiers are derived assuming that the farmer and rancher each work 8 hours per day. If there is no trade, each person’s production possibilities frontier is also his or her consumption possibilities frontier. 6 Specialization and trade Farmer – specialize in growing potatoes More time growing potatoes Less time raising cattle Rancher – specialize in raising cattle More time raising cattle Less time growing potatoes Trade: 5 oz of meat for 15 oz of potatoes Both gain from specialization and trade 7 (a) The farmer’s production and consumption Meat (oz) Meat (oz) Farmer's production and consumption without trade 8 A* 5 4 0 (b) The rancher’s production and consumption A 16 17 24 Farmer's consumption with trade Rancher’s production with trade 18 B* 13 12 B Farmer's production with trade 32 Potatoes (oz) 0 12 24 27 Rancher’s production and consumption without trade Rancher’s consumption with trade 48 Potatoes (oz) The proposed trade between the farmer and the rancher offers each of them a combination of meat and potatoes that would be impossible in the absence of trade. In panel (a), the farmer gets to consume at point A* rather than point A. In panel (b), the rancher gets to consume at point B* rather than point B. Trade allows each to consume more meat and more potatoes. 8 The proposed trade between the farmer and the rancher offers each of them a combination of meat and potatoes that would be impossible in the absence of trade. In panel (a), the farmer gets to consume at point A* rather than point A. In panel (b), the rancher gets to consume at point B* rather than point B. Trade allows each to consume more meat and more potatoes. 9 Absolute advantage Produce a good using fewer inputs than another producer 10 The Opportunity Cost of Meat and Potatoes Opportunity cost • Whatever must be given up to obtain some item • What you give up to get something else • Measures the trade-off between the two goods that each producer faces 11 Comparative advantage Produce a good at a lower opportunity cost than another producer Reflects the relative opportunity cost Principle of comparative advantage Each good - produced by the individual that has the smaller opportunity cost of producing that good Developed by David Ricardo 12 One person Can have absolute advantage in both goods By definition, cannot have comparative advantage in both goods For different opportunity costs One person - comparative advantage in one good The other person - comparative advantage in the other good 13 Gains from specialization and trade Based on comparative advantage Total production in economy rises Increase in the size of the economic pie Everyone – better off Can apply to individuals, firms, and countries 14 Trade can benefit everyone in society Allows people to specialize The price of trade Must lie between the two opportunity costs Principle of comparative advantage explains: Interdependence – reliance on other individuals, firms or countries Gains from trade – applies to individuals, firms and countries 15 Should the U.S. trade with other countries? U.S and Japan Each produces food and cars One American worker, one month One car, or Two tons of food One Japanese worker, one month One car One ton of food 16 Principle of comparative advantage Each good – produced by the country with the smaller opportunity cost of producing that good Specialization and trade All countries have more food and more cars 17 In theory Clear that there are gains from specialization and trade that arise from differences in productivity of labor and capital in each sector So in Ricardian model if we assume labor is the only factor of production then labor productivity would drive comparative advantage and determine who trades what aLFQF + aLMQM = L Labor required for each unit of food production = productivity Total units of food production Labor required for each unit of meat production Total amount of labor resources Total units of meat production 18 If the domestic country wants to consume both meat and food (in autarky), relative prices must adjust so that wages are equal in the wine and cheese industries. If PF /aLF = PM /aLM workers will have no incentive to flock to either the food or the meat industry, thereby maintaining a positive amount of production of both goods. PF /PM = aLF /aLM Production (and consumption) of both goods occurs when relative price of a good equals the opportunity cost of producing that good. Suppose that the domestic country has a comparative advantage in food production: its opportunity cost of producing cheese is lower than it is in the foreign country. aLF /aLM < a*LF /a*LM where “*” notates foreign country variables Note here that this is the relative productivity which therefore determines comparative advantage Heckscher Ohlin Model (1919) Problem with Ricardian model was that it only had one factor of production So here a 2 good, 2 FoP model Different rule emerges for comparative advantage Krugman economies of scale model Differentiated products Economies of scale Different results for comparative advantage Look at abundance of FoP or resources Country with relatively abundant amount of FoP will export good or service which is intensive in that factor Therefore comparative advantage is in the relative abundance of the FoP K/L ratio indicates factor abundance If US has K/L = 0.5 and China has K/L = 0.02 then US has relatively more K and China relatively more L So China should export good which uses L intensively, and US should export good which uses K intensively So price of K rises in US and price of L falls Opposite happens in China: price of L rises and price of K falls But before in autarky L was paid much less in China than in the US as so much L in China. Implication is that there is convergence in factor prices across countries – known as “factor price equalization” In Ricardian model no distributional consequences – here they are possible If US exports more K intensive goods, then income earned by K goes up (conversely income earned by L goes down) Vice versa for China Therefore owners of K in US better off compared with L and v-v for China Known as the “Stolper Samuelson Theory” Need to test H-O theory to see if it is true Wassily Leontief collected data for US and if H-O correct US exports should have higher K/L ratio than imports (1947) Results: US X = $14K/L US M = $18K/L Was H-O wrong? Leontief called it a “paradox”. Resolution came from widening defn of K By looking at average years of education (“human capital”) Baldwin found that greater factor intensity in exports. Paul Krugman developed a model of trade with differentiated products. Why? Here by trading we can expand our market and lower our costs But depends on the size and type of economies of scale Economies of scale – internal? Economies of scale – external? Linder’s theory of overlapping demands Paul Krugman developed a model of trade with differentiated products. Why? Here by trading we can expand our market and lower our costs But depends on the size and type of economies of scale Economies of scale – internal? Economies of scale – external? Linder’s theory of overlapping demands Given trade begins between 2 countries with similar industries We would expect Total # of firms to fall Price to fall as costs fall Variety in each country to increase Average size of firms to increase Ricardian and H-O models explain “interindustry” trade Krugman explains “intra-industry” trade 3 of the top 10 trading partners with the US in 2011 were also the 3 largest European economies: Germany, UK and France. These countries have the largest gross domestic product (GDP) in Europe. Why does the US trade most with these European countries and not other European countries? 2-30 In fact, the size of an economy is directly related to the volume of imports and exports. Larger economies produce more goods and services, so they have more to sell in the export market. Larger economies generate more income from the goods and services sold, so people are able to buy more imports. 2-31 2-32 Other things besides size matter for trade: 1. Distance between markets influences transportation costs and therefore the cost of imports and exports. Distance may also influence personal contact and communication, which may influence trade. 2. Cultural affinity: if two countries have cultural ties, it is likely that they also have strong economic ties. 3. Geography: ocean harbors and a lack of mountain barriers make transportation and trade easier. 2-33 4. Multinational corporations: corporations spread across different nations import and export many goods between their divisions. 5. Borders: crossing borders involves formalities that take time and perhaps monetary costs like tariffs. These implicit and explicit costs reduce trade. The existence of borders may also indicate the existence of different languages (see 2) or different currencies, either of which may impede trade more. 2-34 In its basic form, the gravity model assumes that only size and distance are important for trade in the following way: Tij = A * (Yi * Yj)/Dij where Tij is the value of trade between country i and country j A is a constant Yi the GDP of country i Yj is the GDP of country j Dij is the distance between country i and country j 2-35 In a slightly more general form, the gravity model that is commonly estimated is Tij = A x Yia x Yjb /Dijc where a, b, and c are allowed to differ from 1. Perhaps surprisingly, the gravity model works fairly well in predicting actual trade flows, as the figure above representing US–EU trade flows suggested. 2-36 Estimates of the effect of distance from the gravity model predict that a 1% increase in the distance between countries is associated with a decrease in the volume of trade of 0.7% to 1%. Besides distance, borders increase the cost and time needed to trade. 2-37 Trade agreements between countries are intended to reduce the formalities and tariffs needed to cross borders, and therefore to increase trade. The gravity model can assess the effect of trade agreements on trade: does a trade agreement lead to significantly more trade among its partners than one would otherwise predict given their GDPs and distances from one another? 2-38 The US has signed a free trade agreement with Mexico and Canada in 1994, the North American Free Trade Agreement (NAFTA). Because of NAFTA and because Mexico and Canada are close to the US, the amount of trade between the US and its northern and southern neighbors as a fraction of GDP is larger than between the US and European countries. 2-39 2-40 Yet even with a free trade agreement between the US and Canada, which use a common language, the border between these countries still seems to be associated with a reduction in trade. So Canadian provinces trade more with each other, than with US states, ceteris paribus 2-41 2-42 2-43 Shows that still more likely to trade if no borders But also shows that size and geography also matter Gravity model tested extensively in economics literature Shows that US’s natural trade partner is Canada and to a lesser extent Mexico