Where Did My Loan Go?

advertisement

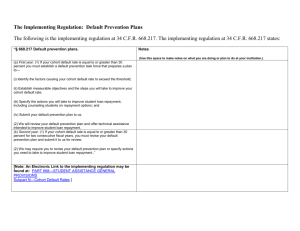

Mapping Your Future® and Meteor™ Where is my student loan? Presented by: Cathy Mueller Mapping Your Future Tim Cameron Meteor Mapping Your Future A valuable resource • Provides services to schools for ultimate benefit of student • Loan counseling meets regulatory requirements and does not limit student choice of lenders, guarantors A valuable resource • Provides variety of resources for students and families – – – – Career exploration College preparation Paying for college Money management • Provides neutral content and encourages students to look at all sources of free funding Help students track debt in this new landscape Split servicing • Student changed lender/guarantor to take advantage of benefits • Student consolidated while in-school to lock in a low fixed interest rate • Student transferred to a new school • School switched from FDLP to FFELP or vice versa • Lenders suspended student loans Legislative changes • Ensuring Continued Access to Student Loans Act (ECASLA) – Loan Participation Purchase Program – Loan Purchase Commitment Program • Term Asset-Backed Securities Loan Facility (TALF) • Higher Education Opportunity Act (Servicemembers Civil Relief Act) Impact to student Communication overload! • Multiple servicers to single student • Status change notifications, privacy notice, 1098-E • Delinquency letters, phone calls, emails • Single student to multiple servicers • Changes in address or phone number • Payments • Requests for deferment, forbearance Impact to student • Payment schedule complications – Multiple payment due dates – Multiple payment methods – Potential loss of extended repayment options • Deferment and forbearance complications – Inconsistent deferment documentation standards – Inconsistent forbearance period maximums Solution Each of these “hurdles” is easily addressed so long as the borrower knows who their lenders/servicers are and how to get in touch with them. So, WHERE is my loan? The Meteor project The Meteor project • Non-proprietary, open- source software that brings together data from distributed databases across the higher education financing community • Anyone can participate! – – – – – – Lenders Guarantors Servicers Schools U.S. Department of Education Others Approval FSA approval for use of real-time data • Collaborative effort to bring about change to the requirements for schools to solely rely on NSLDS data • Allows schools to resolve discrepancies by using real-time data that comes directly from loan holders' databases Features • Access real-time, student-specific financial aid information from multiple sources with intuitive user interface and navigation • Currently provides real-time, detailed information on FFELP and alternative loans (capability exists to include Direct and Perkins Loans) How Meteor works Participant types • • • • Access Providers (AP) Authentication Agents (AA) Data Providers (DP) Index Providers (IP) Meteor process Users Authentication (by AP or AA) Access Provider One Student/Borrower or Financial Aid Professional or Access Provider Representative or Lender Data Providers Two Index Provider Three Data available through Meteor Meteor and the National Student Clearinghouse: campus-based authentication Authentication model • Schools that have entered into electronic services agreement with Clearinghouse act as Authentication Agents • Students' campus-issued credentials utilized to access Meteor and other Clearinghouse services via Student Self-Service website Student Self-Service • Meteor is integrated into Clearinghouse’s Student Self-Service application • For schools that wish to provide students with Meteor access, Meteor loan detail is incorporated into LoanLocator display Online award letter pilot • Will serve as debt management tool (borrowing history presented BEFORE new award is accepted) • Ensures borrower is aware of potential impact of increasing aggregate loan amount – Total current outstanding – New total outstanding with addition of new loan – Repayment scenarios based on aggregates Help your students Remind students how successful repayment can be accomplished • Keeping good records • Staying in touch with loan holders • Maintaining strategy for repayment Get more information • Interactive website www.MeteorNetwork.org – Audio presentation – Interactive demonstration version of software – Link to Meteor project site • Project documentation www.NCHELP.org/Meteor.htm – Implementation information – Provider list – User Guide and other documentation Online Student Loan Counseling Features Neutral Instructions Loan types Limits Borrow conservatively Debt/salary wizard Budget calculator Customization Counseling sessions 1. Stafford entrance 2. Stafford exit 3. Stafford entrance (Spanish) 4. Stafford exit (Spanish) 5. Perkins entrance 6. Perkins exit 7. Stafford and Perkins combined entrance 8. Stafford and Perkins combined exit 9. Nursing Student Loan entrance Counseling sessions 10. Nursing Student Loan exit 11. Health Professions entrance 12. Health Professions exit 13. Grad PLUS entrance 14. Grad PLUS exit 15. Stafford and Grad PLUS combined entrance 16. Stafford and Grad PLUS combined exit 17. TEACH Grant initial and subsequent 18. TEACH Grant exit Meet regulatory requirements Requirements Maintain documentation Sample repayment information Respond to questions Stafford exit data to guaranty agency Written repayment information to Perkins borrowers • Provide contact information • Definition of half-time enrollment • Appropriate offices if withdraw • • • • • Requirements • Prevent borrowers from circumventing or exiting counseling before complete • OSLC team and staff continue to monitor regulations Documentation • Paper records – Daily records – Reports tab • Export • Automated method Archive policy • Mapping Your Future isn’t record keeper • Archive policy – One year of data online – Two prior years available by customer service request – Prior data is unavailable Sample repayment • Stafford entrance – Range of indebtedness or – Average indebtedness of borrowers who obtained Stafford Loans for attendance at school or in program of study – If student borrows Stafford AND Grad PLUS loans, sample repayment amount based on average indebtedness must include both Stafford and Grad PLUS indebtedness Sample repayment • Grad PLUS entrance – Range of debt levels or – average indebtedness of Grad PLUS borrowers at school or in program of study – If student borrows Stafford AND Grad PLUS loans, sample repayment amount based on average indebtedness must include both Stafford and Grad PLUS indebtedness Sample repayment • Stafford exit – Borrower's actual indebtedness or – Average indebtedness of borrowers who obtained Federal Stafford or SLS loans at school or in program of study – If student borrows Stafford AND Grad PLUS loans, sample repayment amount based on average indebtedness must include both Stafford and Grad PLUS indebtedness Sample repayment • Display information with monthly payment amount at maximum interest rate – – – – With instructions to borrower On your website On customized counseling start page Use indebtedness customization Example Indebtedness Mapping Your Future with Meteor First step Guaranty Agencies Schools Lenders The student chooses an Access Provider site Servicers Secure connection Guaranty Agencies Schools Lenders Servicers Borrower options • Enhanced exit counseling integrates borrower's loan information in real time into exit counseling session. Option requires that student has a PIN from the service provider (NYSHESC) • Allows borrower to continue process without PIN and complete exit interview without benefit of seeing real-time loan data Authentication User authenticated and sent to Mapping Your Future to complete counseling AUTH Guaranty Agencies NSC Schools Lenders / Servicers Detail screen displays Counseling steps • Reads content and answers questions • Read and acknowledge Meteor disclaimer • Views Meteor data (customized screen) • Views calculator (debt/salary wizard) • Completes form, providing required data • Views, prints confirmation page • Chooses to view complete Meteor data Benefits • Default prevention • Value-added service for schools and students • Cost-benefit calculation for organization • Effective process to meet regulatory requirements Process • Requirements for guarantors – Have authentication process in place – Be Meteor Access Provider – IT resources for development • Requirements for schools – Participate in Online Student Loan Counseling – Determine if primary service providers are Meteor participants – Must be Meteor Access Provider or have relationship with Meteor Access Provider Customize Customization School logo Questions Money management content Average indebtedness Budget Start page Student form End URL Counseling start page • School-specific information – – – – – – – Dates Disbursement procedures Refund policies Sample repayment* Contact information* Withdrawal contacts* Half-time definition* • Template • One per session Counseling start page • Options – Wizard—create a new page – Edit—edit existing page – Submit—Submit page for approval • • • • School logo (insert URL in image box) Type text directly into Pagemaster Save changes every 15 minutes Link to page Counseling start page Future of OSLC • Reengineering database • PESC Online Loan Counseling standard • Financial literacy counseling • Future releases Get more information feedback@mappingyourfuture.org (573) 796-3730 Cathy Mueller Mapping Your Future (940) 497-0741 cathy@mappingyourfuture.org