Moffatt & Nichol Background

advertisement

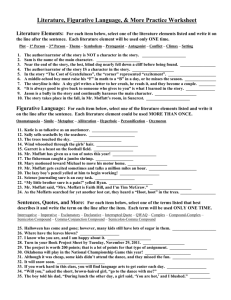

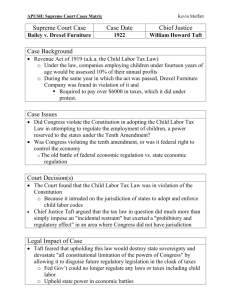

Lots of Moving Parts Dan Solomon and Walter Kemmsies Moffatt & Nichol Advisory Group Moffatt & Nichol Background • Established in 1945 in Long Beach, California, currently: • Offices in the Americas, Europe, Middle East and Pacific Rim • Practices: Goods Movement, Energy, Ports, Coastal, Urban Waterfronts & Marinas, Inspection & Rehabilitation • Planning and design of marine and freight transportation • • • • • • • • • • Terminal design for all types of freight and passenger movement Freight planning and market analysis Investment/privatization analysis Strategic development plans Port selection/network analysis Coastal engineering Port and waterside construction (marinas) Railroads and capacity expansion Environment issues/emission modeling Port security Commentary and presentation materials on this occasion are based on the personal views of the speakers and may not coincide with opinions held by Moffatt & Nichol or its employees. 3 Major Trends • State of the World • • • • • US economy has been the main driver of global economic growth since 2011 US economy at long term average activity levels but below potential output levels, the residential real estate market remains restrained due to contractionary financial regulations Europe is past its worst point but faces a long recovery period depending on the ECB’s success in implementing Quantitative Easing and fiscal stimulus, Grexit and Brexit not withstanding Asian manufactured goods exporters have low domestic demand growth Commodity export-driven economies will languish until Asian manufactured goods exporters regain growth momentum • Key Uncertainties in 2015 • • • Deflation is driven by excess commodity production capacity and automation as well as aging developed economy consumers and insufficient demand in emerging markets Federal Reserve is slated to start raising interest rates which may have a larger impact globally than domestically and is likely to further increase the foreign exchange value of the US dollar Commodity prices, oil in particular, will be weighed down by a strengthening US dollar but could get a boost from a surge in global infrastructure investment • Long Term Scenario Differentiators • US trade deficit is unsustainable and a major risk to global growth • China and other emerging market economies, as well as the US, need to maintain “Fordism” policies No Fordism in China China Emphasizes Fordism US Infrastructure Investment Medium growth, deflation risk High growth, low inflation No US Infrastructure Investment Low growth, deflation risk Medium growth, high inflation 4 US has led global growth CONTRIBUTIONS TO CHANGES IN GLOBAL REAL GDP GROWTH: 2014 COMPARED TO 2013 After pulling the world economy into a severe recession, the US has been driving global economic recovery, more so in the last few years. Europe and Asia should be stepping up soon and eventually commodity-exporting economies. Source: Bloomberg, IMF, Moffatt & Nichol 5 US Economic Scorecard is positive for 2015-2016 The most significant factor is the degree to which the Fed feels it needs to preempt inflation. This is a Recovery Period score card, once the Fed starts hiking a different score card will be used. Real GDP growth is forecasted to be 2.9% in 2015 and 2016. Indicator Score Considerations Monetary Policy Neutral The Fed is withdrawing the punchbowl soon but very gently and politely Inflation Positive A bit low, but little inflation risk. Fiscal Policy Neutral Shifting towards deficit and debt reduction. Financial Sector Neutral FDIC’s watch list declining, consumer credit increasing, regulatory stance has been contractionary, corporate bond market may present bubble risk Causes of Last Recession Positive Residential real estate sector is in the long process of recovery Leading Industries Neutral Industries likely to lead growth in this cycle have been investing but energy got ahead of consumption trends Production Costs Positive Low interest rates, wages, commodity prices Labor Markets Positive Employment rising in expected industries, energy sector is shedding employees Neutral Central banks are cutting interest rates and increasing liquidity, but Emerging Markets could be impacted by rising US interest rates and weak commodity prices, and Europe is still dealing with the legacy of austerity. Stronger US$ means weaker export and therefore economic growth Global Economy 6 US economy in a virtuous cycle until the Fed decides it isn’t EMPLOYMENT AND RETAIL SALES VOLUMES As of May 2014, employment in the US exceeded the previous peak level in December 2007. Monetary and fiscal policy supported increased spending by employed consumers which eventually reached levels where the private sector needed to hire more labor. This in turn helped consumer spending, resulting in more employment… a virtuous cycle. Source: Bureau of Labor Statistics, National Bureau for Economic Research, Moffatt & Nichol 7 Full-time US employment still short of pre-recession levels US EMPLOYMENT IN NONAGRICULTURAL INDUSTRIES (Not Seasonally Adjusted) Although the total US work force is larger today than it was just before the recession, full-time employment is yet to make a full comeback. However, March 2015 numbers put us just 262,000 full-times jobs shy of record highs. Source: Bureau of Labor Statistics, Moffatt & Nichol 8 Overcoming the bubbles Consumer Credit & Home Mortgage Loans Consumer Credit (Revolving) Mortgage Debt 1,200 12,000 RIP: Consumer Credit Wart 2005 - 2011 1,000 600 6,000 400 4,000 200 2,000 0 1990 2005 - 2011 8,000 $ Billion $ Biilion 800 10,000 0 1995 2000 2005 2010 2015 1990 1995 2000 2005 2010 2015 The fact that the US has come this far during the recovery is impressive given the levels of consumer credit and mortgage debt that the US consumer sector had in 2008 Source: US Federal Reserve, Moffatt & Nichol 9 Inflation risk is less than growth risk CORE CONSUMER PRICE INFLATION TRENDS 4.0% 3.0% Japan 2.0% US 1.0% Euro Area Sep-15 May-15 Jan-15 Sep-14 May-14 Jan-14 Sep-13 May-13 Jan-13 Sep-12 May-12 Jan-12 Sep-11 May-11 Jan-11 Sep-10 May-10 Jan-10 Sep-09 May-09 -1.0% Jan-09 0.0% China -2.0% -3.0% -4.0% Core inflation (excluding volatile food and energy prices) provides a better indication of consumer price trends. The Federal Reserve is not under pressure from inflation to raise interest rates. Japan finally broke out of deflation but economic growth remains stalled. The Euro Area is struggling to increase inflation. China is actually experiencing deflation. Source: Trading Economics, Moffatt & Nichol 10 Strengthening US Dollar may help imports and hurt exports DOLLAR-EURO EXCHANGE RATE AND THE SPREAD BETWEEN US AND GERMAN GOVERNMENT BONDS With the US economy leading global growth and inflation, US interest rates are likely to rise ahead of interest rates in other currencies. As long as an economy is relatively strong and this is reflected in rising (real) interest rates, its currency tends to strengthen. However, correlation between US Dollar strength and import/export growth is only mildly positive/negative. Strong growth in export destination countries can overcome the effect of a strengthening US dollar. Investments in infrastructure can also make exports more competitive. Source: Trading Economics, Moffatt & Nichol 11 Import volumes led US TEU growth in 2014 MONTHLY AND ANNUAL VOLUMES AT MAJOR US PORTS Total Total Loaded Import Load Export Load Empty 2006 36,872,549 26,902,788 17,297,240 9,605,548 9,969,762 2007 37,263,101 28,331,823 17,342,377 10,989,446 8,931,278 2008 35,382,311 27,641,905 16,060,599 11,581,306 7,740,407 2009 30,368,529 23,920,945 13,444,526 10,476,419 6,447,584 2010 35,120,125 26,877,744 15,620,245 11,257,500 8,242,381 2011 35,650,253 27,722,873 15,780,519 11,942,354 7,927,380 2012 36,295,886 28,194,242 16,266,504 11,927,738 8,101,644 2013 37,227,612 29,053,063 16,645,540 12,407,523 8,174,549 2014 38,973,674 30,127,816 17,783,189 12,344,626 8,845,858 2015 Q1 9,186,063 7,004,802 4,273,205 2,731,598 2,181,261 2014 Growth 4.7% 3.7% 6.8% -0.5% 8.2% 2006-14 CAGR 0.7% 1.4% 0.3% 3.2% -1.5% Imports drove volume growth in 2014, this shows how the US has been supporting global growth. But looking back to the years before the recession of 2008-2009, exports have performed a lot better. It is worth noting that there are some months when loaded export TEUs almost exceed loaded import volumes, which seems to have happened in November 2013. Peak season import growth is expected to be in the 6% to 8% range. Exports are expected to decline. Source: AAPA, Moffatt & Nichol 12 US Trade deficit remains high but declining US TRADE DEFICIT The US has helped the world economy develop, particularly emerging market economies, by allowing its trade balance to be in deficit. This isn’t sustainable in the long run. Reducing the trade deficit is important for employment and therefore economic growth. The decreasing US oil trade deficit has directly helped strengthen our goods balance and in the process helped US employment recover from the deep 2007-2009 recession. But more, a further reduction in the deficit, is needed. The US trade deficit skyrocketed by 43.1% in March 2015, led by a 7.7% increase in imports. Although the oil trade deficit continued to decrease in March, the total goods deficit today stands at $70.56 billion. Who are people blaming? US West Coast Ports and a strong dollar alongside weak global growth. Source: US Census Bureau, Moffatt & Nichol 13 Wage differentials drove offshoring, now near and on-shoring MANUFACTURING WAGE COMPARISONS IN US$ IN 2008 AND 2014E $55,000 44% of World Population 9% of World Population $50,000 $45,000 $40,000 $35,000 $30,000 $25,000 $20,000 Developed Market sourcing is shifting from China to Central America and South Asia $15,000 $10,000 $5,000 $0 It is unlikely that manufactured goods, which are labor intensive, will be produced in the US. In addition to lower production costs, emerging markets also have faster growing demand for manufactured goods. It is not surprising that many factories moved to China and other emerging Asian economies. Now, with wages rising, Chinese households could eventually be able to afford the goods they produce. This deliberate effort at “Fordism” sets China apart. Source: UN ILO, Moffatt & Nichol 14 The World’s Population is Aging PROPORTION OF POPULATION ABOVE 55 YEARS OF AGE 60% Japan 50% Europe China 40% Canada US 30% Brazil Mexico 20% India 10% 0% 1990 2000 2010 2020 2030 2040 2050 15 The ultimate global logistics challenge WORLD POPULATION AND OECD GLOBAL MIDDLE CLASS PROJECTIONS Emerging markets are more than just large economies growing quickly, they are developing significant middle classes too. For the developed economies to sustain higher growth in the long term, they must focus on this market segment. Developed economies need growth in order to support their retirees. Need more infrastructure and less waste if these forecasts are correct. This is the ultimate global logistics challenge. Source: OECD, US Census Bureau 16 Increasingly Urbanized, Increasingly Congested PERCENTAGE OF URBAN POPULATION AND AGGLOMERATIONS BY SIZE CLASS: 1980 AND 2011 2008 2011 Three major migration trends in the US are to the south, to the coasts and to urban areas. Rest of the world is urbanizing too. Substitution of capital for labor in rural areas and higher income offered by manufacturing and services in urban areas drive urbanization trends. Better service supply in urban areas also attracts retirees. In major port cities it is likely that congestion could worsen. Source: UN Department of Economic and Social Affairs 17 Ecommerce continues to gain share of US retail sale ECOMMERCE VS BRICK AND MORTAR RETAIL SALES Ecommerce is gaining share of consumer spending in many countries, with the US among the countries leading the trend. Growing concentrations of populations in metropolitan regions and growing Internet subscriptions are main driver. Source: US Census Bureau, Moffatt & Nichol 18 Supply chain/final delivery evolving, impacting retail strategy ECOMMERCE SERVICE SUPPLIERS There are many new entrants in the ecommerce market and even more will join. Significant evolution is the only discernible trend. Source: UPS presentation at Port of Long Beach Pulse of the Port event 19 In China, watch consumers not producers INVESTMENT CONTRIBUTIONS TO GDP IN SELECT ECONOMIES: 1990 – 2020E Investment in real estate, factories and infrastructure reached very high levels both in absolute terms and relative to GDP. Since 2011 China has tried to develop domestic consumer spending to reduce dependency on exports and infrastructure programs to drive growth. Slowing GDP growth in China is not indicative of a recession there but a transition to a more sustainable pattern of economic activity. Source: IMF WEO, Moffatt & Nichol 20 Ships continue to get larger EVOLUTION OF CONTAINERSHIP SIZE FLEET CAPACITY BREAKDOWN BY TEU SIZE RANGE As of November 1, 2012 12% > 10K As of April 1, 2015 20% > 10K Source: Alphaliner, Moffatt & Nichol 21 Ocean carriers: An industry in transition SHIPPING ALLIANCES, EAST-WEST G6 CKYHE O3 2M APL Cosco Container Lines CMA GGM Maersk Hapag-Lloyd K Line China Shipping Container Lines MSC Hyundai Merchant Marine Yangming Marine Transport Co. UASC Mitsui OSK Lines Hanjin Shipping Co. And Hamburg-Sud? NYK Line Evergreen OOCL Ocean carriers are purchasing bigger and bigger ships in an attempt to lower slot costs. Ocean carriers have also been getting rid of chassis, terminal assets, and other asset holding to cut costs. As a result of these gigantic vessels, the following is true: • Fewer ports of call • New Mega Alliances have formed to fill the ships and offer weekly schedules • Automation of terminals to increase productivity is necessary • There is a mismatch between ship infrastructure and landside infrastructure Shipper demands: • As fast as possible • As reliable as possible • As cheap as possible 22 More freight in fewer gateways US INTERNATIONAL CONTAINER VOLUMES AND PORT SHARES: 1974-2014 100% 40 95% 35 30 90% 25 85% 20 15 Share of Total Millions of Twenty Foot Equivalent Units (TEU) 45 80% 10 75% 5 Top 10 Share (right) All Ports 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 70% 1974 0 Top 10 As volumes concentrate in fewer ships to reduce average fixed costs per slot, they concentrate in fewer ports to increase revenuegenerating time. Source: AAPA, Moffatt & Nichol 23 Congestion is a global problem that needs local solutions TRUCK TRAFFIC IN ROTTERDAM TRUCK LINES AT THE PORT OF PARANAGUA, BRAZIL PORT TRAFFIC IN SOUTHERN CALIFORNIA PORT OF SHANGHAI, CHINA 24 Battleground for North Asia container imports mainly in South SHARES OF IMPORTS (TONS) ARRIVING ON VESSELS CARRYING CONTAINERS FROM ASIA TOTAL NORTH AMERICAN CONTAINER VOLUME TRENDS 30 25 Million TEUs 20 15 10 5 Pacific Atlantic Gulf 2014 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 0 n West Coast Share >60% n East Coast Share >60% n No share >60% The Freight Analysis Framework database shows the economic zones that are dominated by West and Gulf/East Coast ports, and where neither has a dominated share. Source: US Department of Transportation – Freight Analysis Framework 25 LA/LB vs NY/NJ import composition LOS ANGELES/LONG BEACH TOP IMPORT COMMODITIES: 2007 VS 2013 Commodity 2013 Rank 2007 Rank Change 2013 Tonnage 2007 Tonnage CAGR Cont. Rate 2007 Cont. Rate 2013 Change Textiles/leather 1 1 - 5,169,112 4,805,260 1.22% 97.49% 95.21% -2.28% Machinery 2 6 4 4,421,391 3,926,672 2.00% 96.01% 90.81% -5.20% Plastics/rubber 3 4 1 4,380,449 4,536,329 -0.58% 98.40% 97.46% -0.94% Electronics 4 5 1 4,060,202 4,179,234 -0.48% 97.02% 94.51% -2.52% Furniture 5 2 (3) 3,695,839 4,603,383 -3.59% 99.39% 99.05% -0.34% Articles-base metal 6 3 (3) 3,671,083 4,550,034 -3.51% 92.18% 89.03% -3.15% Nonmetal min. prods. 7 7 - 2,736,062 3,784,259 -5.26% 98.77% 67.23% -31.54% NEW YORK/NEW JERSEY TOP IMPORT COMMODITIES: 2007 VS 2013 Commodity 2013 Rank 2007 Rank Change 2013 Tonnage 2007 Tonnage CAGR Cont. Rate 2007 Cont. Rate 2013 Change Other foodstuffs 1 1 - 3,328,963 2,858,415 2.57% 87.15% 89.53% 2.39% Plastics/rubber 2 5 3 1,811,616 1,531,998 2.83% 98.49% 97.54% -0.95% Nonmetal min. prods. 3 2 (1) 1,743,109 2,043,613 -2.62% 82.24% 68.96% -13.28% Textiles/leather 4 3 (1) 1,683,341 1,699,453 -0.16% 97.72% 95.71% -2.01% Alcoholic beverages 5 4 (1) 1,544,785 1,604,170 -0.63% 96.64% 85.50% -11.14% Coal-n.e.c. 6 26 20 1,341,952 78,605 60.47% 9.61% 0.79% -8.82% Gasoline 7 28 21 1,293,845 53,282 70.17% 9.30% 0.71% -8.60% Import and export drivers vary from port to port. 26 Dimensions of Panama Canal locks and ships Super Session Source: Panama Canal Authority 27 Existing market share Super Session LA/LB % OF TRADE NY/NJ % OF TRADE Despite being further away (landside), LALB generally maintains a higher level of market share within the Midwest. The US Midwest is an extension of LALB’s expansive hinterland • These port’s maintain on average a 20-30% share within this market • Volumes are predominantly North and Southeast Asian (Trans-Pacific) and would not “naturally” transit the Panama Canal NYNJ is the gateway for lower TransAtlantic volumes LA/LB IMPORTS • 7% 12% North Asia • Southeast Asia All Other • North Asia accounts for the majority of volume in NYNJ (41% of imports, 32% exports) which suggests that this trade lane is currently being extensively served but is predominantly associated with the local Northeast market Europe, the Mediterranean and South Asia combined account for a similar share of throughput Expansion of the Panama Canal is not likely to have an impact on these volumes NY/NJ IMPORTS 10% 41% 8% North Asia Europe Mediterranean 9% South Asia Southeast Asia 12% All Other 81% 20% Source: US Census Bureau, FHWA, Moffatt & Nichol 28 So. California ports are the low-cost logistics path to Chicago Super Session SHIPPING COSTS* TO CHICAGO BY GATEWAY (FROM NORTH ASIA) SHIPPING COSTS* TO CHICAGO BY GATEWAY POST CANAL EXPANSION (FROM NORTH ASIA) Post Expansion Scenarios • California ports remain the “lowcost” gateways • Larger vessels to the East Coast are estimated to narrow the competitive gap • Panama Canal route is estimated to be only marginally cheaper than the Suez route ASSUMED VESSEL SIZES (TEU) Scenario California PNW EC via Panama EC via Suez Base (Today) 13,000 9,500 4,500 9,500 Scenario 1 (Post PC Expansion) 13,000 9,500 13,000 13,000 Scenario 2 (Post PC Expansion) 15,000 19,500 13,000 13,000 As larger vessels call East Coast ports after the Panama Canal expansion is complete, the estimated advantage should narrow, but not overcome, the competitive gap with West Coast ports. Source: Moffatt & Nichol 29 Asia to US transit times Super Session Representative Time (Median) in Days Shanghai to Chicago Days Water Route TransPacific Suez Panama Port Region Ocean Dwell Rail Total S. California 14 2 2.8 19 N. California 15 2 3.0 18 PNW 13 2 3.0 18 BC-Prince Rupert 12 2 3.5 17 BC- Vancouver 13 2 3.5 18 N. Atlantic 31 2 1.3 34 M. Atlantic 34 2 1.5 37 S. Atlantic 36 2 1.5 40 N. Atlantic 26 2 1.3 29 M. Atlantic 25 2 1.5 28 S. Atlantic 25 2 1.5 29 Prince Rupert & the PNW ports potentially offer the shortest transit periods from Asia to Chicago when compared to all-water services. However, time is not the only factor impacting beneficial cargo owner route choices. Source: Moffatt & Nichol 30 Competition from Canada Super Session Aggressive pricing by the Canadian railroads have yielded strong growth in inbound rail cars into the Midwest. Prince Rupert in British Colombia (BC) along with Canadian National (CN) pose a risk to US West Coast and Panama Canal-bound traffic • The inflection point in inbound rail traffic at International Falls, MN in 2008/2009 coincides with the aggressive pricing (as estimated be revenue per ton) of the rail operations originating in BC. Broke from trend with USbased services. • These BC operations have targeted the US Midwest markets INBOUND RAIL CARS AT INTERNATIONAL FALLS, MN CN SYSTEM MAP AVERAGE REVENUE PER TON INDEX BY RAIL ORIGIN International Falls, MN Source: BTS, Public Waybill Samples, Moffatt & Nichol 31 Potential impact of near-sourcing to Mexico Super Session APPAREL AND FOOTWEAR ARTICLES OF IRON & STEEL Source: BTS, US Census Bureau, Moffatt & Nichol FURNITURE Mexico has captured share in some consumer and industrialrelated commodities, a continuation of these trends could reduce the growth of maritime trade between the US and China. It is unlikely that all industries would migrate to the same location as China becomes less of a primary offshoring destination. • Relative to Mexico, China continues to dominate total trade in most commodities (based on tonnage) • A sharp increase in market capture by Mexico is unlikely, given the substantial manufacturing-related investments made in Asia over the past two decades, however, continued trend growth gains in certain commodities could be expected 32 What can the US competitively export? TOP 10 HIGH POTENTIAL US NET EXPORTS* Containerized Score Bulk/Breakbulk Score Wood Pulp Scrap and Waste 9.4 Oil Seeds (Soy 32.7 Oil Seeds (Soy) 1.1 Meat and Other Edible Animal Parts 28.7 Raw Hides and Leather 0.8 Cereal Grains 3.9 Cotton – Untreated, Yarn and Woven Fabric 0.7 Animal Feed 3.4 Animal Feed 0.7 Wood and Charcoal 0.4 Meat and Other Edible Animal Parts 0.3 Crude Oil and Refined Petroleum/Natural Gas Products 0.3 Plastic Feedstock and Manufactured Goods 0.2 Live Animals 0.2 Iron and Steel 0.1 Wood Pulp Scrap and Waste 0.2 Paper and Paperboard 0.1 Fish and Crustaceans 0.1 Chemical Products 0.1 Dairy Products, including Eggs and Honey 0.1 Cereals 0.1 Organic Chemicals 0.1 Organic Chemicals 0.1 Plastics Feedstock and Manufactured Goods 0.1 *Based on relative comparative advantage as defined by Bela Belassi Agriculture, Capital Goods, Energy Labor is more expensive and capital is cheaper in the US compared to fast growing emerging market economies such as China. The US has comparative advantage (and competitive) advantages in the production of goods that use little labor. This is shown in the list of goods that the US has been prone to export. Source: US Census Bureau, Moffatt &Nichol 33 Asia is the dominant destination of US capital goods exports US CAPITAL GOODS EXPORTS (MILLION METRIC TONS) BY DESTINATION Asia China South/Central America Europe Africa Australia and Oceania North America 2003 34% 7% 26% 27% 6% 6% 1% 100% 2004 34% 8% 26% 25% 7% 7% 1% 100% Source: US Census Bureau, Moffatt & Nichol 2005 32% 7% 27% 25% 7% 7% 2% 100% 2006 32% 7% 28% 25% 8% 6% 1% 100% 2007 31% 6% 29% 26% 7% 6% 1% 100% 2008 31% 7% 30% 24% 8% 5% 1% 100% 2009 34% 7% 31% 20% 9% 5% 2% 100% 2010 35% 7% 32% 19% 7% 6% 1% 100% 2011 33% 7% 32% 20% 6% 7% 1% 100% 2012 34% 7% 31% 20% 7% 7% 2% 100% 2013 34% 7% 32% 19% 7% 6% 3% 100% 2014 34% 8% 30% 20% 8% 5% 3% 100% +/- Share -0.4% 1.0% 4.4% -6.9% 1.7% -0.7% 1.9% 34 Asia is the dominant destination of US grains and oilseeds US GRAIN AND OILSEED EXPORTS (MILLION METRIC TONS) BY DESTINATION Asia - East & Southeast China South & Central America Africa Europe North America Middle East Asia - South 2003 52% 11% 14% 13% 9% 9% 4% 0% 100% Source: US Census Bureau, Moffatt & Nichol 2005 53% 10% 15% 14% 5% 7% 5% 0% 100% 2007 50% 10% 15% 14% 7% 6% 7% 1% 100% 2009 63% 21% 13% 9% 4% 7% 4% 0% 100% 2011 60% 21% 11% 11% 4% 7% 6% 0% 100% 2013 62% 34% 15% 7% 6% 7% 3% 0% 100% 2014 62% 30% 17% 6% 6% 6% 3% 0% 100% +/- Share 10% 19% 3% -6% -3% -3% -1% 0% 35 Empty container availability is very poor in less urban areas CONTAINER SHORTAGE INCIDENCE BY CITY West South Central North-Central East Dry Reefer 20ft 40ft 40ft High Average 40ft 20ft Average New York 0% 0% 0% 0% 0% 0% 0% Norfolk 0% 0% 0% 0% 0% 2% 1% Charleston 0% 0% 0% 0% 13% 0% 7% Savannah 0% 0% 0% 0% 8% 0% 4% Minneapolis 45% 68% 25% 46% 100% 100% 100% Chicago 0% 51% 13% 21% 2% 4% 3% Cincinnati 0% 0% 0% 0% 4% 49% 26% Columbus 0% 6% 0% 2% 8% 32% 20% Kansas City 2% 51% 4% 19% 0% 42% 21% Memphis 0% 2% 0% 1% 13% 100% 57% New Orleans 11% 15% 19% 15% 11% 28% 20% Dallas 0% 0% 0% 0% 2% 98% 50% Houston 26% 49% 2% 26% 0% 8% 4% Denver 0% 0% 0% 0% 55% 70% 62% LALB 0% 0% 0% 0% 0% 0% 0% Oakland 9% 0% 0% 3% 8% 4% 6% Seattle 4% 0% 21% 8% 0% 8% 4% Tacoma 0% 11% 25% 12% 51% 2% 26% Average 5% 14% 6% 8% 15% 30% 23% Exporters in areas of the Midwest that are not very urban have the least amounts of containers available. This hampers agricultural exports that are best suited for containerization. Source: US Department of Agriculture, Moffatt & Nichol 36 Small vessels also matter to trade and economic growth TRIPS OF VESSELS WITH LESS THAN 13’ DRAFT – GULF INTRACOASTAL WATERWAY AVERAGE MONTHLY OILSEED AND GRAIN SHIPMENTS FROM THE NEW ORLEANS CUSTOM DISTRICT BY DESTINATION REGION Agricultural goods exported by ports in the New Orleans custom district go to destinations all over the globe. The average monthly number of tons of dry bulk agricultural goods shipped to countries in various regions of the world are shown in the map below. The average Caribbean country receives 17,000 tons of cereals, oilseeds and/or DDGs per month. Central American and Caribbean countries receive shipments in a range that is best served through smaller capacity vessels. Source: USACOE, USTO, Moffatt & Nichol 37 Major Trends • State of the World • • • • • US economy has been the main driver of global economic growth since 2011 US economy at long term average activity levels but below potential output levels, the residential real estate market remains restrained due to contractionary financial regulations Europe is past its worst point but faces a long recovery period depending on the ECB’s success in implementing Quantitative Easing and fiscal stimulus Asian manufactured goods exporters have low domestic demand growth Commodity export-driven economies will languish until Asian manufactured goods exporters regain growth momentum • Key Uncertainties in 2015 • • • Deflation is driven by excess commodity production capacity and automation as well as aging developed economy consumers and insufficient demand in emerging markets Federal Reserve is slated to start raising interest rates which may have a larger impact globally than domestically and is likely to further increase the foreign exchange value of the US dollar Commodity prices, oil in particular, will be weighed down by a strengthening US dollar but could get a boost from a surge in global infrastructure investment • Long Term Scenario Differentiators • US trade deficit is unsustainable and a major risk to global growth • China and other emerging market economies, as well as the US, need to maintain “Fordism” policies No Fordism in China China Emphasizes Fordism US Infrastructure Investment Medium growth, deflation risk High growth, low inflation No US Infrastructure Investment Low growth, deflation risk Medium growth, high inflation 38 Containerization Trends EXPORT NON-ENERGY IMPORT NON-ENERGY Export and import tonnages have grown at CAGRs of 3.7% and 1.4%, respectively, since 2003. Containerization rates have increased 5% for both exports and imports. Export tonnage has generally been higher than import tonnage. What would happen to containerized export volumes if the value of exports increased and container rates did not increase as much? Source: US Census Bureau, Moffatt & Nichol 40 Divergent port quality trends WORLD BANK PORT QUALITY INDEXES BESIDES LARGER CRANES 7 6 US Port quality Index 5 China 4 Brazil 3 2 1 0 2007 2008 2009 2010 2011 2012 2013 The World Bank Quality of Port Infrastructure measures business executives' perception of their country's port facilities. Data are from the World Economic Forum's Executive Opinion Survey. Scores range from 1 (port infrastructure considered extremely underdeveloped) to 7 (port infrastructure considered efficient by international standards). China, the US and Brazil have been investing in port infrastructure but the composition of the global vessel fleet may be changing faster than the port infrastructure is being upgraded. Source: World Bank 41 Bigger ships require just-in-time terminal optimization Simulation KPI Measurements Scenario 1 3D Virtual Terminal Real-World Terminal FlexTerm Snapshot of Current Configuration Simulation KPI Measurements Scenario N Historical Terminal Operations Data • Analysis of dynamic processes taking place in real time and space • Experiments involving individual process or complex combinations of processes to verify productivities or compare alternatives. • Confidence in investment to stakeholders / investors. • Visualization of processes through animations 42 Deteriorating US inland infrastructure a serious problem CHANGES IN SHARE OF CROP PRODUCTION: 1997 VS 2012 Hours of Lock Outages by Year and by Type of Outage SHARES OF US GRAIN AND OIL SEED EXPORTS New Orleans Columbia-Snake Seattle, WA Los Angeles, CA Norfolk, VA Other 2003 2005 2007 2009 2011 2013 2014 +/- Share 61% 14% 8% 1% 1% 15% 100% 52% 16% 13% 2% 1% 16% 100% 51% 16% 11% 4% 2% 17% 100% 52% 15% 12% 3% 2% 15% 100% 48% 18% 12% 4% 2% 17% 100% 49% 20% 8% 4% 3% 16% 100% 52% 19% 8% 3% 2% 14% 100% -8.7% 5.2% 0.2% 2.1% 1.9% -0.6% Soybean Transportation Coalition studied US inland waterways. Key points: 54% of the Inland Marine Transportation System’s (IMTS) structures are more than 50 years old and 36% are more than 70 years old. Along with water issues probably, this has impacted where grain is produced and exported. Grain increasingly moves on steel rivers (railways). 43