5 - GEOCITIES.ws

advertisement

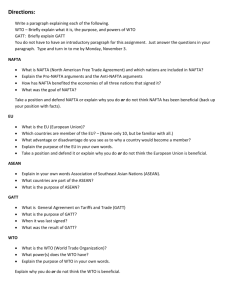

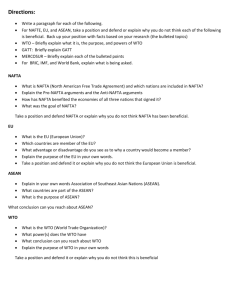

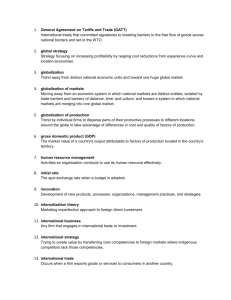

The Free Trade Movement: Part 1: Trade Theory THE THEORY OF INTERNATIONAL TRADE: EVOLUTION OF A CONCEPT • • • • • • • Theorists: Adam Smith (1776) David Ricardo (1817) Eli Heckscher (1919) / Bertil Ohlin (1933) Wassily Leontif (1953) Raymond Vernon (1966) Paul Krugman and others (1980s & 1990s) Michael Porter (1990) • pre-18th century: mercantilism 2 An Overview of Trade Theory • Free Trade policy prevails when a government does not attempt to influence (eg, through quotas or duties) what its citizens can buy from another country or what they can produce and sell to another country. • The Benefits of Trade allow a country to specialize in the production and export of products that can be made most efficiently in that country. • South Korea is often cited an exemplary case study of the benefits of trade. --Balassa et. al. found continuous lowering of import barriers since late 1950s. » But these studies are controversial. --Created incentives to export. Nationalized banks and directed large firms (chaebols) how to invest. (HOWEVER, THIS REPRESENTS NOT FREE TRADE POLICY, BUT “STRATEGIC TRADE POLICY” …AS WILL BE ARGUED LATER.) The Benefits of Trade in S. Korea • 1950s: 77% of employment in agriculture. 2001: 10%. • Percentage of GNP in manufacturing went from 10% to over 30%. • 1970 GNP/per capita: 2002 GNP/per capita: $ 260 $10,013 » GNP Growth/year until Crisis: 9% • Shift from non-productive uses (agriculture) to comparative advantage uses (labor-intensive manufacturing). 5 Mercantilism: mid-16th century • Mercantilism: The theory and system of political economy prevailing in Europe after the decline of feudalism, based on national policies of accumulating bullion, establishing colonies and a merchant marine, and developing industry and mining to attain a favorable balance of trade. – Excerpted from American Heritage Dictionary. 6 Is the Mercantilist Theory Still Valid? • Pursuit of national economic interests seems to indicate: Yes. • It equates international status (political power) with economic power and economic power with a trade surplus. • The classic case of neomercantilism: Japan (?) 7 Fallacy of Mercantilist theory identified by David Hume - 1752 • Increased exports by Country A lead to increased money supply, hence inflation and higher prices. • Increased imports by Country B lead to lower prices. • Result: Country A sells less because of high prices and Country B sells more because of lower prices. • In the long run, no country can keep a trade surplus. 8 “Classic” theory justified free trade, discredited mercantilism. ABSOLUTE ADVANTAGE - ADAM SMITH Two countries - Two products Each country can produce one product more efficiently than the other. They should specialize and trade. COMPARATIVE ADVANTAGE - RICARDO Two countries - Two products One country can produce both products more efficiently than the other country. Each should specialize in the product in which it has a comparative advantage and trade for the other product.9 Comparative Trade Advantage Product X Point “B” shows the benefits from free trade. China Germany A B exports imports imports B exports A Product Y 10 Factor Proportions Theory • Hecksher and Ohlin argued that comparative advantage arises from differences in national factor endowments. – Factors can now be seen as including: • RESOURCES, LABOR, CAPITAL; ENTREPRENEURSHIP & TECHNOLOGY • The empirical test of H-O “Leontif paradox” – Leontif’s study found that US imports capital-intensive goods and exports labor-intensive goods; yet has relatively more abundant capital and expensive labor. – An explanation: • US has special advantage in new product innovations. • These may be less capital intensive until mass-production state; in fact this is labor-intensive production. • It was clear that factor endowments were complex (basic, advanced). • Focus still is on comparative advantage. 11 INTERNATIONAL PRODUCT-LIFE CYCLE (IPLC) - RAYMOND VERNON PRINCIPLE Original innovation of a particular product generally occurs in a country with favorable demand conditions. Both location of sales (trade) and location of production will shift depending on the stage of the PLC. 12 International Product Life Cycle sales time InvestDC InvestLDC PLC for innovator country 13 …..progress report on the evolution of the concept of free trade over 2 centuries: • From Adam Smith Wassily Leontif, the original concept was refined and expanded, and it supported Free Trade Policy. • Most theories had attempted to answer the question, “Why do countries trade?” However, the real question is: “Why do companies trade?” • THEORIES ORIENTED ON FIRMS/INDUSTRIES: – New Trade Theory – National Competitive Advantage 14 NEW TRADE THEORY - PAUL KRUGMAN and others PRINCIPLE • First Mover Advantages will create Barriers to Entry. Productive efficiency may not be the result of initial factor endowments or stage of development, but instead be a result of a firm's first mover advantages that create a “barrier to entry” against competitors due to progressing along the Experience Curve. (Experience curve: scale economies and learning curve) Rationale for governments to pursue Strategic Trade Policy: (i.e. Some firms in specific industries are favored, nurtured, promoted and protected from free trade so they can catch up with the First Movers.) Experience curve Unit costs B A Accumulated output 16 Application of New Trade Theory to national economic policy • Lack of “free trade” began to be recognized in the 1970s, as Japan and other countries were seen to use highly successful export promotion strategies. • Typically, NTT applies to industries with high, fixed costs, where world demand will support few competitors. High returns from specialization where substantial economies of scale are present. • Competitors may dominate markets because “they got there first”. first-mover advantage. • Thus: government intervention (strategic trade policy) is motivated to create this advantage. 17 A CASE STUDY OF FIRST MOVER ADVANTAGE • Founded 1915 by William Boeing • Largest commercial airplane manufacturer – Economies of scale may preclude new entrants. • 9,000 commercial jetliners in service. © McGraw Hill Companies, Inc.,2000 18 • Established 1967 by governments of France, Germany, Great Britain • By 2001, Airbus had achieved parity with Boeing in commercial airplane orders. » There was an important role for governments. © McGraw Hill Companies, Inc.,2000 19 What determines first mover advantage? “Luck”... first mover may be simply lucky. “Strategic Trade Policy”, or industrial policy (i.e., Some firms in specific industries are favored, nurtured, promoted and protected from domestic and international competition. - eg. Korean government. – Chaebols) 20 The role of industrial policy in Asia • What is it? It refers to domestic policies to create new industry to compete internationally. (Strategic Trade Policy) INDUSTRIAL AND TRADE POLICY AIMS TO BENEFIT THE HOME ECONOMY THROUGH ADVANTAGEOUS TRADING PRACTICES OR CREATING NEW INDUSTRY WITHOUT RUNNING FOUL OF EXISTING BI-LATERAL AND MULTI-LATERAL TRADE AGREEMENTS 21 A case of strategic trade policy: Japan’s position in the world semiconductor industry 60 50 40 Japan USA 30 20 10 0 1974 76 78 80 82 84 86 88 22 McGraw Hill Companies,2000 The concept of comparative advantage today: Porter’s Diamond • The Competitive Advantage of Nations, Michael Porter, 1990 • Looked at 100 industries in 10 nations. – The Diamond incorporates and extends the logic of existing theories. – Question: “Why does a nation achieve international success in a particular industry?” 23 Determinants of national competitive advantage: Porter’s “Diamond” Chance Firm Strategy, Structure and Rivalry Factor Endowments Government Demand Conditions Related and Supporting Industries 24 Factor Endowments • Basic factors: – natural resources, – climate, – location •Advanced factors: –infrastructure, –skilled labor, –technology Relationship of Basic to Advanced Factors • Basic can provide an initial advantage. • Must be supported by advanced factors to maintain success. • No basics, then must invest in advanced factors. 25 Demand Conditions • Demand was seen as likely to create the capabilities of firms to satisfy the market with new products. • Countries with more sophisticated and demanding consumers start the product life cycle. 26 Firm Strategy, Structure and Rivalry • Management ‘ideology’ can either help or hurt you. Japanese firms stressed market share, and competition based on cost. Related and Supporting Industries • Creates clusters of supporting industries that are internationally competitive. 27 Determinants of National Competitive Advantage • Factor endowments:The factors of production must be considered in full complexity. ADVANCED factors result from investment by government, companies, and people, and are more likely to lead to competitive advantage. • Firm strategy, structure and rivalry:The conditions in the nation governing how companies are created, organized, managed, and the nature of domestic rivalry –all effect competitive vitality of the firms. • Demand conditions:The nature of demand --concentrated, sophisticated, demanding home customers push firms to be globally competitive. • Related and supporting industries:The presence or absence in a nation of supplier industries or related industries can create “clusters” with strong spillover effects, which makes firms internationally competitive. • Other determinants: Government, chance 28 29 30 Some implications of trade theory for practical business decisions • Company strategy: Managers can exploit national competitive advantages in their global strategy. • Location implications:It makes sense to establish a global web of production activities to countries where they can be performed most efficiently. • First-mover implications:It may pay to invest substantial financial resources in building a firstmover, or early-mover, advantage. PART 2: THE POLITICAL ECONOMY OF TRADE History of the free trade movement origins: end of “mercantilism” in Europe post WWII: under the auspices of GATT GATT (GENERAL AGREEMENT ON TARIFFS AND TRADE) created in 1948 one of the 3 major institutions created to guide the “free” economies purpose: multilateral negotiating forum to achieve free trade GATT championed TRADE LIBERALIZATION and a 16-fold increase in world trade in 50 years. 32 GATT PRINCIPLES 1. Non-discrimination – MFN (“normal” trade status) MFN - If country A gives country B "most-favored nation” concessions, must give the same to all member countries. 2. Reciprocity -- Countries should engage in mutual exchange of concessions on the principle of membership-wide participation. If free trade is undermined by one country then another country(s) may be entitled to RETALIATE. 3. Exceptions to GATT rules: Regional Blocs and bilateral deals EU, NAFTA, etc. - exempt from giving regional concessions to non-member countries. Less-developed countries (LDCs) generally did not participate and were not expected to reciprocate for concessions offered by developed countries. This policy is being abandoned now, under WTO. 33 Retaliation: US Trade Sanctions Partial List 25 20 15 New Sanctions 10 0 1993 95 97 98 5 Afghanistan Italy Burma Libya Canada Nigeria China N. Korea Cuba Pakistan India Saudi Arabia Iran Sudan Iraq Syria Yugoslavia 34 McGraw-Hill Companies,2000 GATT NEGOTIATION ROUNDS • Date name outcome • • • • • • 1947 1949 1950-1 1955-6 1960-1 1964-7 Geneva Annecy Torquay Geneva Dillon Kennedy tariffs (45000 tariff concessions) tariffs tariffs tariffs tariffs 35% tariff reduction; anti-dumping Tokyo Uruguay Doha 34% tariff reduction; NTB* codes • 1973-9 • 1986-94 • 2001-05 complex international business package ? * NTB: non-tariff barrier, i.e. everything else. 35 e.g. subsidies, quotas, administrative policies WORLD TRADE ORGANIZATION – WTO WTO inaugurated on 1/1/1995 Currently, 148 members (@ 2004) • Initiated a new “round” in Doha on 15/11/2001, scheduled to finish by the end of 2004 decision-making based on consensus; highly politicized unfinished business from Uruguay Round~ • agriculture • tariffs on industrial goods • other possible issues 36 complex agenda now being negotiated: • agriculture is most important, to help poor countries • tariffs on industrial goods gradually reduced to zero and include goods exported by the poor countries • “Singapore issues”: (mostly non-trade issues) – – – – foreign investment (national treatment) transparency in government purchasing trade facilitation (efficient customs clearance) competition policies (monopoly; price fixing) • other possible issues: – protect intellectual property rights from abuse • From pirates • From patent-holders – regional and bilateral negotiations – e-commerce – labor standards, human rights, environment 37 Impact of GATT / WTO 154 Rue de Lausanne, Geneva • Tariff reduction in advanced countries from 40% to 4%. • Uruguay Round opened new frontiers for liberalization; the final round under GATT. • Created the World Trade Organization. – 90% of disputes satisfactorily settled. • 104 disputes brought to WTO in first three years. • 196 handled by GATT during its entire history. 38 Average Tariff Rates on Manufactures France Germany Italy Japan Holland Sweden Britain USA 1950 18 26 25 -11 9 23 18 1990 5.9 5.9 5.9 5.3 5.9 4.4 5.9 5.9 2000 3.9 3.9 3.9 3.9 3.9 3.9 3.9 3.9 39 Instruments of Trade Policy (1) • Tariff - oldest form of trade policy • Subsidy - payment to domestic producer • e.g.: cash grants, low-interest loans, tax breaks, government equity participation in the company • Local content requirement • Import Quota: • Restriction on quantity of some good imported into a country • Voluntary Export Restraint (VER): • Quota on trade imposed by exporting country, typically at the request of the importing country 40 Instruments of Trade Policy(2) • Antidumping policies – Defined variously as: • Selling goods in a foreign market below production costs. • Selling goods in a foreign market below fair market value. – Result of: • Unloading excess production. • Predatory behavior. – Remedy: seek imposition of tariffs. • Administrative policies – Japanese are accused • Tulip bulbs • Federal Express 41 Instruments of Trade Policy (3) • Local content requirement – Requires some specific fraction of a good to be produced domestically. – Percent of component parts or of the value of the good – Initially used by developing countries to help shift from assembly to production of goods. Developed countries (US) beginning to implement. – For component part manufacturer, LCR acts the same as an import quota. 42 Results of Japanese VERs • “Voluntary” Export Restraints limit exports – Japan limited to 1.85 mm vehicle exports/year. Restraints finally dropped by US in early 1990s. – Cost to US consumers: $1B/year 1981-85. – Money went to Japanese producers in the form of higher prices. – Today US auto manufacturers losing market share to Japanese cars made in USA. – See http://internationalecon.com/v1.0/ch10/10c071.html • VERs for semiconductors – (see: “The Rise … of the Japanese Semiconductor Industry”) – In 1986, Japan agreed to VERs and promote US market share in Japan. The agreement for 19962001 changed from enforcement to monitoring. – The intended results were indeed achieved, but probably due to market forces. 43 Political and economic factors affecting national trade and industrial policy Justification: (generally rejected by classical economists) • protecting jobs and industries • infant industry (emerging industries) • Oldest argument - Alexander Hamilton, 1792 • Protected under the GATT / WTO. • • • • national security retaliation protecting consumers enhance national competitive advantage – strategic trade policy (also called “industrial policy”) 44 INSTRUMENTS OF NATIONAL TRADE POLICY – examples PROMOTING EXPORTS Fiscal incentives to export producers Export credits & export guarantees Operation of overseas export promotion agencies (JETRO -Japanese External Trade Organization) Export Processing Zones and Free Trade Zones 45 • Japan – The industrial policy of MITI (and other ministries): – Indicative planning (and vision) – Directed lending – Targeting new industries – Phasing out old industries The purpose of government: to promote national competitiveness (not politics). 46 The traditional government-business relationship in Japan Bureaucrats Politicians Business world 47 Disturbing Trends • US current account deficit sustained since 1970s; today 5-6% of GDP – Trade deficit has been mirrored by Japan’s surplus, famously in cars. – now, China’s trade surplus bigger! – US deficit grew even with weaker $. • GATT/WTO encounters resistance; countries now increasingly resort to regional and bilateral agreements. 48 THE POLITICAL ECONOMY OF REGIONAL TRADE A key issue: Does integration result in “trade creation” or “trade diversion” and create a “fortress” or otherwise impair global free trade? 49 • Regional economic integration – Agreements among countries in a geographic region to reduce, and ultimately remove, tariff and nontariff barriers to the free flow of goods, services and factors of production among each other – Additional gains from free trade beyond international agreements such as GATT / WTO • Political case for regional integration – Economic interdependence creates incentives for political cooperation and reduces potential for violent confrontation. – Together, the countries have more political and economic clout to enhance trade and other negotiations with other countries or regional blocs. – A key issue: Does integration result in a “fortress” or otherwise impair global free trade? 50 51 Stages of Regional Integration Political Economic Union NAFTA Common Union Free Customs Market Union Trade Area EU 1992 52 McGraw-Hill Companies,2000 Stages of Regional Integration No barriers to goods and services ASEAN (only a Preferential Trade Area) Free Trade Area (FTA) ? Common external trade policy EFTA, NAFTA, AFTA (prospective) APEC – free and open trade and investment by 2010 ASEAN: Association of Southeast Asian Nations Customs Union AFTA: ASEAN Free Trade Area EC – Treaty of Rome Free factor movements Common Market APEC: Asia-Pacific Economic Co-operation EU – Single European Act EC: European Community EU: European Union Harmonization of EFTA: European Free Trade Area Economic Union macro-economic policies; EU – Maastricht Treaty NAFTA: North American Free Trade Area Common currency EU – Maastricht Treaty Common administration Political Union 53 Bilateral and regional trade agreements additional gains from free trade beyond GATT / WTO WTO EU NAFTA ASEAN+3 MERCOSUR Definition - agreement among countries in a geographic region to reduce, and ultimately remove, tariff and nontariff barriers to the free flow of goods, services and 54 factors of production among each other It is being pursued very actively today, especially after the setback to the Doha Round in Cancun in September 2003. Number of Regional and Bilateral Agreements 280 125 GATT 1948~1994 WTO 1995~2003 55 56 EU 57 NAFTA McGraw-Hill Companies,2000 58 APEC McGraw-Hill Companies,2000 59 ASEAN McGraw-Hill Companies,2000 Major Asia-Pacific Regional Groupings • APEC (1989) – 21 countries including Asia-Pacific, North America, others – $18 trillion GDP; 47% of global trade (2000) – The policy concept of “open regionalism” implies nondiscrimination with the rest of the world. • ASEAN (1967) / AFTA (1992) – 10 Southeast Asian countries • Sub-regional economic zones (SREZs), for example: – ASEAN-China FTA – Hong Kong – Macau – Taiwan – Guangdong – Fujian – Singapore – Johor (Malaysia) – Riau (Indonesia) – Japan Sea and Yellow Sea coastal areas • Other less formal subregional and bilateral arrangements 60 APEC since the Bogor Declaration • The new model of “open regionalism” – To be distinguished from “Fortress Europe” or “Fortress North America” • Liberalization supplemented by “facilitation” and economic and technical cooperation – Reflects member differences in stages of development • Unilateral rather than reciprocal concessions – Philosophy of consensus and voluntarism 61 Association of Southeast Asian Nations GDP Growth (%) US Export to ASEAN ($billion) 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 45 40 35 30 25 20 15 10 5 0 62 McGraw-Hill Companies,2000 Who are the trading nations of East Asia? TRADE % OF GDP = ((Exports + Imports) / GDP (x100) Indicates a country’s dependence on trade SINGAPORE MALAYSIA HONG KONG TAIWAN THAILAND S. KOREA INDONESIA PHILIPPINES CHINA JAPAN 350 320 198 80 78 54 50 46 36 16 63 Asian Trade Flows ASEAN NAFTA EU Japan Chinese economies Destination of Exports South Korea Aus/NZ Source of Imports Rest of World 0 5 10 15 20 25 % 64 McGraw-Hill Companies,2000 INTER-REGIONAL TRADE DIRECTION OF EXPORTS BY PERCENTAGE TO YEAR FROM N. America 1980 N. America 33.5 1990 41.9 2001 39.5 1980 EU 1990 2001 EU Europe E. Asia 1 L. America Africa M. East S. Asia TOTAL 25.2 27.4 15.8 8.9 3.3 4.2 1.0 94.1 22.3 23.4 20.4 5.0 1.7 2.6 0.8 95.8 19.0 19.7 20.9 16.5 1.3 2.1 na 100.0 6.7 8.3 10.3 67.1 71.0 67.5 71.9 74.4 73.4 2.9 5.3 7.8 2.4 1.1 2.3 7.2 3.3 2.5 5.5 3.3 2.6 na 0.7 0.7 97.3 96.4 98.9 1980 Europe 1990 2001 6.3 8.2 4.2 63.7 70.6 55.2 72.7 74.5 81.8 2.7 5.2 6.6 2.3 1.1 2.1 6.9 3.3 1.0 5.5 3.3 2.8 na 0.7 0.7 97.1 96.3 98.5 1980 E. Asia 1990 2001 (Asia) 26.0 31.9 25.1 16.8 19.8 16.8 18.9 20.7 17.9 29.9 32.3 48.2 4.1 1.9 2.7 4.4 1.6 1.6 7.4 3.0 3.0 na 1.8 1.5 92.5 92.9 98.5 1980 L. America 1990 2001 27.9 22.9 60.8 26.5 25.3 12.1 35.1 27.6 13.0 5.4 10.3 6.3 16.6 14.0 17.0 2.7 2.1 1.2 1.9 2.4 1.2 na 0.5 0.4 90.1 79.7 99.5 1980 Africa 1990 2001 27.4 3.0 17.7 43.6 66.0 51.8 46.1 68.0 52.5 4.3 4.6 14.9 3.2 0.6 3.5 1.8 12.8 7.8 1.7 4.4 2.1 na 0.3 3.6 84.8 97.0 98.5 1980 M. East 11.5 40.3 41.5 28.7 5.0 1.5 4.1 2.5 Source: UN Comtrade and WTO 65 94.8