Electronic Payment

Instructor: Jerry Gao Ph.D.

San Jose State University

email: jerrygao@email.sjsu.edu

URL: http://www.engr.sjsu.edu/gaojerry

Oct., 2002

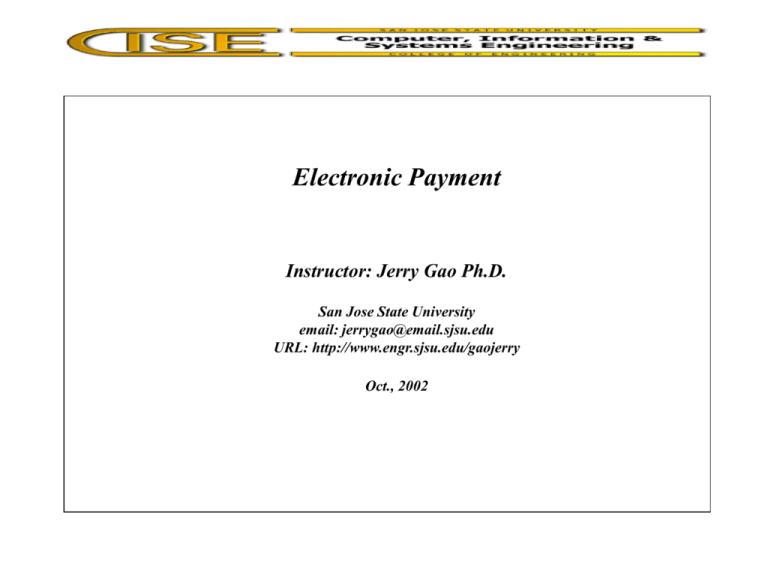

Topic: Electronic Payment Systems

Presentation Outline

- History of payment systems

- Overview of current payment systems

- Introduction to electronic payment systems

- Requirements of electronic payment

- Classification of electronic payment systems and protocols

- Account-Based Payment and Example

- Electronic Check Payment and Example

- Micro-Payment and Example

Jerry Gao Ph.D. 10/20020

All Rights Reserved

Topic: Electronic Payment Systems

History of Payment Systems

(1) The most primitive form of payment is: barter

--> the direct exchange of goods and services for other

goods and services.

The major problem of this payment approach is:

--> double coincidence of wants

(2) The earliest money was called commodity money, where physical

commodities (such as corn, salt, or gold) whose values were well known were

used to effect payment. Since 1980s, gold and silver coins became the most

commonly used commodity money.

(3) The next step in the progression of money was the use of tokens, such as

paper notes, which were backed by deposits of gold and silver held by the note

issuers. This is referred to as adopting a commodity standard.

Jerry Gao Ph.D. 10/2002

Topic: Electronic Payment Systems

The Current Payment Systems

(1) Cash Payment:

(2) Payment by Credit Card Transfer or giro

(3) Credit Card Payment:

(3) Check Payment:

(4) Automated

(5) Wire Transfer Services

Jerry Gao Ph.D. 10/2002

Topic: Online Payment Protocols and Systems

Introduction to Electronic Payment and Systems

What is a payment system?

E-commerce application systems must provide payment processing and

transaction service to buyers and sellers.

A payment system, as a part of E-commerce application system, is a

such system which support secured payment processes by providing

reliable, secured, and efficient transaction services between sellers and

buyers.

The basic requirements of a payment system:

- Provide secured and confidential transaction processes.

- Conduct authentication and authorization for all involved parties.

- Ensure the integrity of payment instructions for goods and services.

- Availability, cost-effective, efficiency and reliability.

- Global access and international useful

Jerry Gao Ph.D. 10/2002

Topic: Online Payment Protocols and Systems

Introduction to Electronic Payment Systems

Electronic payment is implemented by a flow of money from the payer via the

issuer and acquirer to the payee.

Advantages:

- Fast transaction processing

- Flexible of use (24 hours available)

- Low cost transactions

- Global accessible to customers and businesses

Disadvantages:

High risks and security challenges due to:

- Unlike paper, digital “documents” can be copied perfectly and arbitrarily often.

- Digital signatures can be produced by anybody who knows the secret

cryptographic key.

- A buyer’s name can be associated with every payment.

Jerry Gao Ph.D. 10/2002

Topic: Online Payment Protocols and Systems

Introduction to Electronic Payment Systems

Electronic Payment Models:(N. Asokan. Et al, [1])

Direct-payment systems:--> require an interaction between payer and payee.

- Cash-like payment systems

- A certain amount of money is taken away from the payer

before purchases are made.

Example: Smart card-based electronic purses,

electronic cash, and bank checks

- Check-like payment systems

- pay-now systems (like credit card-based payment systems)

- pay-later systems (like ATM card-based payment systems)

Indirect payment systems:--> the payer or the payee initiates payment without

the other party involved online. (Example, electronic funds transfer)

Jerry Gao Ph.D. 10/2002

Topic: Online Payment Protocols and Systems

Figure 1. Money flow in a cash-like payment system [1]

Jerry Gao Ph.D. 10/2002

Topic: Online Payment Protocols and Systems

Figure 2. Money flow in a check-like payment system [1]

Jerry Gao Ph.D. 10/2002

Topic: Online Payment Protocols and Systems

Introduction to Electronic Payment Systems

Classification of electronic payment systems:

- Card-based payment systems:

Examples: CyberCash, First Virtual (FV), VISA and MasterCard, CARI

- Electronic checking systems:

Examples: FSTC, NetBill

- Electronic cash payment systems:

Examples: Ecash (DgiCash), NetCash, CyberCoin, Mondex

- Micro-payment systems:

Examples: Millicent, SubScrip, PayWord, MicroMint, IKP micropayment.

Jerry Gao Ph.D. 10/2002

Topic: Online Payment Protocols and Systems

Requirements of Electronic Payment

To build secure and low overhead electronic transaction systems, different

electronic payment protocols are generated and proposed.

A payment protocol is a communication protocol which defines message formats,

transaction rules, and sequences between involved parties in payment processing

for e-commerce application systems.

The major properties of the payment protocols are:

- Atomicity: This states whether the transaction must occur completely or not.

Two sub cases of atomicity:

a) money transfer atomicity, where funds are transferred atomically.

b) good-transfer atomicity, where the money and the goods are

atomically transferred.

- Consistency: All the involved parties must agree on the facts of exchange.

- Durability: It must always be possible to recover the last consistent state.

- Transaction independent: All the transactions must be independent to each other

Jerry Gao Ph.D. 10/2002

Topic: Online Payment Protocols and Systems

Requirements of Electronic Payment

Some additional properties of payment protocols:

- Cost Factor:

- Divisibility: All the involved parties must agree on the facts of exchange.

- Scalability: It must support concurrent transactions.

- Interoperability: It must be able to move value back and forth between systems.

- Conservation: This is composed of temporal consistency, where holds its value

over time, and supports different currency.

- Online: It gives whether the transaction can be performed online.

- Identified: It gives whether the identity of the person performed transaction is

maintained.

Jerry Gao Ph.D. 10/2002

Topic: Online Payment Protocols and Systems

Classification of Electronic Payment Protocols

Classification of electronic payment protocols:

- Account-based payment systems based on macro-payment protocols, where

value is stored and exchanged via accounts in the existing systems.

Examples: iKP, SET,

- Electronic check payment systems based on electronic check payment scheme.

Examples: NetBill

- Digital cash payment systems based on digital cash payment protocols, where

the medium of exchange is a maker representing value.

Examples: Digicash, NetCash

- Micro-payment protocols on the Internet:

Examples: Millicent,

Jerry Gao Ph.D. 10/2002

Topic: Online Payment Protocols and Systems

Classification of Electronic Payment Protocols

E-Commerce Payment Protocols

Macro-Payment Protocols

SET

Electronic Check Payment Protocols

CyberCash

iKP

SEPP

FV

Digital Cash Payment Protocols

NetBill

FSTC

Micro-Payment Protocols

DigiCash

NetCash

Mondax

CyberCoin

Cafe

Jerry Gao Ph.D. 10/2002

Millicent

PayWord

SubScrip

Topic: Account-Based Electronic Payment Systems

Overview of Account-Based Payment

Credit Card payment schemes have been in use as a payment method since 1960s.

There are two major international brands: VISA and MasterCard

About VISA:

- The VISA brand grew from a scheme launched by the Bank of America, which

was subsequently licensed by Barclaycard in the United Kingdom in 1966.

- By the middle of 1995, VISA owned by its 180,000 member financial institutions,

had issued more than 420 million cards and is accepted by more than 12 million

merchants in 247 countries.

About MasterCard:

- MasterCard is of comparable size with 13 million merchants in 220 countries

and 22,000 member organizations.

- More than 800 million cards issued and nearly $1,300 billion of sales each year.

Jerry Gao Ph.D. 10/2002

Topic: Account-Based Electronic Payment

Overview of Account-Based Payment

Different types of payment card schemes:

(A) Credit cards, where payments are set against a special-purpose account

associated with some form of installment-based repayment scheme or a revolving

line of credit.

- pay later with limit and interest rate.

(B) Debit cards (paperless checks) are linked to a checking/saving account.

- pay now with balance checking.

(C)Charge cards: work in a similar way to credit cards in that payments are set

against a special-purpose account.

- payment must be made at the end of billing period without limit.

(D) Travel and entertainment cards are charge cards whose usage is linked to

airlines, hotels, restaurants, car rental companies, or particular retail outlets.

Jerry Gao Ph.D. 10/2002

Topic: Account-Based Electronic Payment Systems

Overview of Credit Card-Based Payment

Payment Model:

Card Issuer’s Bank

CardHolder

Jerry Gao Ph.D. 10/2002

Card Association

Card Acquirer’s Bank

Merchant

Topic: Account-Based Electronic Payment Systems

Overview of Account-Based Payment

VISA (total $1248.4B sales)

MasterCard (763.4 million cards)

------------------------------------------------------------------------------------------Sales Volume

No. of

Sales Volume

No. of

Region

billions of $(U.S.) Cards (millions) billions of $(U.S.) Cards (millions)

-------------------------------------------------------------------------------------------------------U.S.

358.4

228.1

202.4

174

Europe

262.4

81.2

not available

53.5

Asia-Pacific 91.6

73

116.2

72.5

Canada

18.6

not available

not available

Middle East 5.6

Africa

2.3

5.5

2

Latin America 23.6

21.4

19.1

21.2

Totals

424.7

470

338.7

36.8

778.4

Jerry Gao Ph.D. 10/2002

Topic: Electronic Cash Payment Protocols and Systems

Special Features of Account-Based Electronic Payment

- Online Transaction.

- Anonymity:

This ensure that no detailed cash transactions for customer

are traceable. Even sellers do not know the identity of

customers involved in the purchases

- Security:

High security and low risk due to the use of traditional

banking system and user accounts.

- Standardization:

Use of the existing standardized payment model

- Flexibility:

consumers can have multiple cards used in different

countries and concurrency

- All transactions can be easily traced by banking system and merchants.

Jerry Gao Ph.D. 10/2002

Topic: Electronic Check Payment Protocols and Systems

Special Features of Account-Based Electronic Payment

Limitations:

- Dependency:

dependent on existing banking systems.

- Transaction cost:

high transaction cost compared with other approaches

- Performance:

slower performance due to the authentication and

account validation using the existing banking systems

- Privacy:

consumer loss of the privacy of their transactions

Jerry Gao Ph.D. 10/2002

Topic: Account-based Electronic Payment Systems

Credit Card-Based Electronic Payment System: CyberCash

About CyberCash:

- CyberCash is a secure Internet payment system developed by CyberCash, Inc., which

is located at Reston, VA, USA, and it was found in August 1994 to provide software

and service solutions for secure financial transactions over the Internet.

- CyberCash uses special wallet software, enable consumers to make secure purchases

using major credit cards from CyberCash-affiliated merchants.

- the CyberCash payment system was launched in April 1995. It had over half a million

copies in circulation.

- CyberCash has other payment systems, such as CyberCoin (electronic cash system)

and PayNow (electronic check system).

Jerry Gao Ph.D. 10/2002

Topic: Account-based Electronic Payment Systems

Credit Card-Based Electronic Payment System: CyberCash

Features of CyberCash:

- Use the existing credit card infrastructure for settlement payments.

- Use cryptographic techniques to protect the transaction data during a purchase.

- Authenticate the identifies of both parties to the transaction.

- Provide online transaction and online authentication.

- Broker the transaction between merchant’s bank and cardholder’s bank.

Jerry Gao Ph.D. 10/2002

Topic: Account-Based Payment Protocols and Systems

Credit Card-Based Electronic Payment System: CyberCash

Banking

Network

CyberCash

Server

Registration

Card binding

Customer

Wallet

Internet

Purchase messages

Purchase

Shopping

Web Browser

Web Server

CyberCash Payment Model

Jerry Gao Ph.D. 10/2002

Merchant

Software

Topic: Account-Based Payment Protocols and Systems

Credit Card-Based Electronic Payment System: CyberCash

Consumer

Finish

shopping

Click “PAY”

Payment-req

Choose

CC, addr

Cybercash

Server (CS)

Merchant

Credit-card pay

order

form

forward

details

auth-capture

charge-action-res

Charge-card-res

issue

receipt

log

transaction

Payment Steps in a CyberCash Purchase

Jerry Gao Ph.D. 10/2002

authorize

+ clear

with bank

Topic: Account-Based Payment Protocols and Systems

Credit Card-Based Electronic Payment System: CyberCash

CyberCash Messages:

Header

Header:

Transport

Opaque

Trailer

It indicates the start of a CyberCash message.

Transport: It contains the order information in a purchase, transaction ID, date,

and the key ID to the encrypt the opaque part.

Opaque:

The encrypted part of a message.

Trailer:

the end of a CyberCash message.

Topic:Elect ronic Check Payment Protocols and Systems

Electronic Check Payment System: NetBill

Overview of NetBill:

- NetBill is a dependable, secure and economical payment method for purchasing

digital goods and services through the Internet.

- NetBill protocol is developed by Carnegie Mellon University.

- In partnership with Visa International and Mellon Bank, the first trial of the system

was installed in early 1996.

Major goals of NetBill:

- Support high transaction volumes at low cost

- Provide authentication, privacy, and security for transactions

- Provide account management and administration for consumers and merchants

Jerry Gao Ph.D. 10/2002

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Process: NetBill

Merchant

Customer

Network

Bank

Jerry Gao Ph.D. 10/2002

NetBill

Server

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment System: NetBill

Merchant

1

2

NetBill

Server

Customer

6

3

4

5

7

8

1. Consumer’s application send a price quote request to the merchant’s application

through a checkbook library.

2. Merchant’s application sends back the price quote the consumer’s application.

3. Consumer accepts the price quote, and then sends a purchase request through the

Checkbook library.

4. Merchant’s application sends to the consumer’s Checkbook encrypted in a onetime key.

5.Consumer sends a electronic payment order (EPO) to merchant’s application.

6. The merchant’s application sends the endorsed EPO to the NetBill server.

7. NetBill server verifies that the consumer and merchant signatures are valid. Then,

return the merchant a digitally signed receipt with a decryption key.

8. The merchant’s application forward the NetBill server’s receipt to the Check book.

Jerry Gao Ph.D. 10/2002

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment System: NetBill

NetBill Archecture: (Source: NetBill 1994 Prototype)

Consumer

Application

Merchant

Application

Checkbook

Till

Security

Server

Transaction

Server

User Admin.

Server

Payment &

Collection Server

System Admin.

Server

DB

Jerry Gao Ph.D. 10/2002

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment System: NetBill

Major features of NetBill:

- Certified delivery: delivering encrypted information goods and then charging

against the consumer’s NetBill account. Then, decryption key registration are used at

both the merchant’s application and the NetBill server.

- Scalability: the bottleneck in the NetBill model is the NetBill Server which supports

many different merchants.

- Support for flexible pricing: by including the steps of offer and acceptance. The

merchant can calculate a customized quote for individual consumer.

- Protection of consumer accounts against unscrupulous merchants in a conventional

credit card transaction.

Jerry Gao Ph.D. 10/2002

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment System: NetBill

Security Mechanisms of NetBill:

- Create a NetBill account for each consumer by using a unique user ID and the RSA

public key.

- the key pair is certified by NetBill and is used for signatures and authentication in

the system.

-These signatures are used to check the elements of NetBill transactions (the price

quote, the acceptance, etc) really came from the right parties.

- NetBill uses symmetric cryptogrphy method for message authentication and

encryption and decryption.

Jerry Gao Ph.D. 10/2002

Topic: Micro-Payment Protocols and Systems

Micro-Payment Systems

- Objectives: ---> Micro-payment situations:

Although micro-payment systems share the similar requirements of other

payment systems, they focus on special markets, where:

- Low-value transactions involved less than the value of smallest coin.

- Non-tangible and network-deliverable merchandise

examples: archived magazines, journals, CD, software,…

- Special requirements:

- Fast and low cost payment transactions.

- Very small amount of value

- Reduced the number of involved parties

- High scalable

The issues of other payment systems:

- Account-based systems have high transaction costs.

- Transaction speed in electronic checking systems is slow.

- Electronic money systems involve more parties, have low transaction

speed, and cause poor scalability.

Jerry Gao Ph.D. 10/2002

Topic: Micro-Payment Protocols and Systems

Micro-Payment Protocols

- Objectives: ---> Micro-payment situations:

Although micro-payment systems share the similar requirements of other

payment systems, they focus on special markets, where:

- Low-value transactions involved less than the value of smallest coin.

- Non-tangible and network-deliverable merchandise

examples: archived magazines, journals, CD, software,…

- Special requirements:

- Fast and low cost payment transactions.

- Very small amount of value

- Reduced the number of involved parties

- High scalable

The issues of other payment systems:

- Account-based systems have high transaction costs.

- Transaction speed in electronic checking systems is slow.

- Electronic money systems involve more parties, have low transaction

speed, and cause poor scalability.

Jerry Gao Ph.D. 10/2002

Topic: Micro-Payment Protocols and Systems

Micro-Payment Protocols and Systems

Micro-payment Protocols:

- Millicent, developed by Digital Equipment Corp. in 1995.

- SubScrip, developed at the University of Newcastle, Australia.

- PayWord, developed by Ron Rivest (MIT) and Adi Shamir.

- MicroMint, developed by Ron Rivest and Adi Shamir.

- iKP micropayment protocol

Micro-payment systems do not available in conventional commerce.

They open many new areas of business.

Examples:

- Millicent payment system

- Micro Payment Transfer Protocol (MPTP) based on PayWord.

Jerry Gao Ph.D. 10/2002

Topic: Micro-Payment Protocols and Systems

Micro-Payment Systems

- Important features of Micro-payment protocols and systems:

- Simplified verification

- Simple security mechanisms

- Very low cost transactions

- Very fast speed

- Simplified architecture

- Major factors on transaction costs:

- Payment methods

- Complexity of security mechanisms

- The number of involved parties

- Transaction model (on-line/off-line)

Jerry Gao Ph.D. 10/2002

Topic: Micro-Payment Protocols and Systems

Micro-Payment Protocol: Millicent

Overview of Millicent:

Millicent payment protocol is designed for low-amount transactions over the Internet.

It is developed by Digital

- Support low-cost, secured transactions (less than one cent)

- Use non-expensive symmetric crytographic algorithms

- Use scrip as digital cash for customers to make purchases from vendors

- Provide decentralized validation of electronic cash at the vendor’s server

- Provide no additional communications, off-line processing.

Business market: electronic publishing, software and game industries.

Performance: 14,000 pieces of Scrip can be produced per second.

8,000 payments can be validated per second, with change Scrip being

produced.

A public trial of the Millicent system was scheduled for the summer of 1997.

Jerry Gao Ph.D. 10/2002

Topic: Micro-Payment Protocols and Systems

Micro-Payment Protocol: MilliCent

MilliCent model:

MilliCent protocols use a form of electronic currency called Scrip to connect three

involved parties:

- vendors, customers, and brokers.

Scrip is vendor specific.

A Millicent broker:

--> medicate between vendors and customers to simplify the tasks they perform.

--> aggregate micro-payments

--> sell vendor Scrip to customers

--> handle the real money in the Millicent system.

--> maintain customer accounts and vendors (subScripion services)

--> buy and produce large chunks of vendor Scrips (for licensed vendors)

Vendors: --> are merchants selling low-value services or information to customers

Customers: --> buy broker Scrip with real money from selected brokers.

--> use the vendor Scrips to make purchases.

Jerry Gao Ph.D. 10/2002

Topic: Micro-Payment Protocols and Systems

Micro-Payment Protocol: MilliCent

Customer

Dealer

3

Internet

1

2

1. Customer sends broker-scripts.

2. Customer gets dealer-script.

3. Customer send dealer-scripts.

Broker

Jerry Gao Ph.D. 10/2002