Inflation is taxation without legislation

advertisement

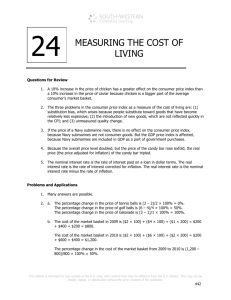

Inflation Introduction We have learned: Definition of GDP Components of GDP Stylized facts about GDP Real versus Nominal GDP Now you will learn: Consumer Price Index measures inflation Stylized facts about CPI Producer Price Index Measurement problems Problems with measurement GDP Deflator versus CPI Real versus nominal rates Deflation Inflation “Inflation is taxation without legislation” Milton Friedman The Consumer Price Index consumer price index (CPI): a measure of the overall cost of the goods and services bought by a typical consumer. How the Consumer Price Index Is Calculated o Fix the basket. The Bureau of Labor Statistics uses surveys to determine a representative bundle of goods and services purchased by a typical consumer. Example: 4 hot dogs and 2 hamburgers. o Find the prices. Prices for each of the goods and services in the basket must be determined for each time period. Example: Year 2010 2011 2012 Price of Hot Dogs $1 $2 $3 Price of Hamburgers $2 $3 $4 o Compute the basket’s cost. By keeping the basket the same, only prices are being allowed to change. This allows us to isolate the effects of price changes over time. Example: Cost in 2010 = ($1 × 4) + ($2 × 2) = $8. Cost in 2011 = ($2 × 4) + ($3 × 2) = $14. Cost in 2012 = ($3 × 4) + ($4 × 2) = $20. o Choose a base year and compute the index. The base year is the benchmark against which other years are compared. The formula for calculating the price index is: cost of basket in current year CPI 100 cost of basket in base year Example (using 2010 as the base year): CPI for 2010 = ($8)/($8) × 100 = 100. CPI for 2011 = ($14)/($8) × 100 = 175. CPI for 2012 = ($20)/($8) × 100 = 250. o Compute the inflation rate. inflation rate: the percentage change in the price index from the preceding period. The formula used to calculate the inflation rate is: CPI Year 2 CPI Year 1 inflation rate 100% CPI Year 1 Example: Inflation Rate for 2011 = (175 – 100)/100 × 100% = 75%. Inflation Rate for 2012 = (250 – 175)/175 × 100% = 43%. Inflation Rate (1947-2011) as measured by CPI, SA, All Urban Mean: 3.6% Median: 2.97% Sigma: 2.7% Stylized facts about CPI (from BLS) Price indexes are available for the U.S., the four Census regions, size of city, cross-classifications of regions and size-classes, and for 26 local areas. Indexes are available for major groups of consumer expenditures (food and beverages, housing, apparel, transportation, medical care, recreation, education and communications, and other goods and services), for items within each group, and for special categories, such as services. Monthly indexes are available for the U.S., the four Census regions, and some local areas. More detailed item indexes are available for the U.S. than for regions and local areas. Indexes are available for two population groups: a CPI for All Urban Consumers (CPI-U) which covers approximately 87 percent of the total population and a CPI for Urban Wage Earners and Clerical Workers (CPI-W) which covers 32 percent of the population. The CPI represents changes in prices of all goods and services purchased for consumption by urban households. User fees (such as water and sewer service) and sales and excise taxes paid by the consumer are also included. Income taxes and investment items (like stocks, bonds, and life insurance) are not included. The CPI-U includes expenditures by urban wage earners and clerical workers, professional, managerial, and technical workers, the self-employed, short-term workers, the unemployed, retirees and others not in the labor force. The CPI-W includes only expenditures by those in hourly wage earning or clerical jobs. Prices for the goods and services used to calculate the CPI are collected in 87 urban areas throughout the country and from about 23,000 retail and service establishments. Data on rents are collected from about 50,000 landlords or tenants. The Producer Price Index producer price index (PPI): a measure of the cost of a basket of goods and services bought by firms. Because firms eventually pass on higher costs to consumers in the form of higher prices on products, the producer price index is believed to be useful in predicting changes in the CPI. Problems in Measuring the Cost of Living Substitution Bias o When the price of one good changes, consumers often respond by substituting another good in its place. o The CPI does not allow for this substitution; it is calculated using a fixed basket of goods and services. o This implies that the CPI overstates the increase in the cost of living over time. Introduction of New Goods o When a new good is introduced, consumers have a wider variety of goods and services to choose from. o This makes every dollar more valuable, which lowers the cost of maintaining the same level of economic well-being. o Because the market basket is not revised often enough, these new goods are left out of the bundle of goods and services included in the basket. Unmeasured Quality Change o If the quality of a good falls from one year to the next, the value of a dollar falls; if quality rises, the value of the dollar rises. o Attempts are made to correct prices for changes in quality, but it is often difficult to do so because quality is hard to measure. The size of these problems is also difficult to measure. Most studies indicate that the CPI overstates the rate of inflation by approximately one percentage point per year. The issue is important because many government transfer programs (such as Social Security) are tied to increases in the CPI. The GDP Deflator versus the Consumer Price Index The GDP deflator reflects the prices of all goods produced domestically, while the CPI reflects the prices of all goods bought by consumers. The CPI compares the prices of a fixed basket of goods over time, while the GDP deflator compares the prices of the goods currently produced to the prices of the goods produced in the base year. This means that the group of goods and services used to compute the GDP deflator changes automatically over time as output changes. 3. Figure 2 shows the inflation rate as measured by both the CPI and the GDP deflator. Correcting Economic Variables for the Effects of Inflation Dollar Figures from Different Times o To change dollar values from one year to the next, we can use this formula: Price level in Year 2 Value in Year 2 dollars Value in Year 1 dollars Price level in Year 1 o Example: Babe Ruth’s 1931 salary in 2009 dollars: Salary in 2009 dollars = Salary in 1931 dollars × Price level in 2009 Salary in 2009 dollars = $80,000 × (214.5/15.2). Salary in 2009 dollars = $1,128,947. Price level in 1931 Indexation indexation: the automatic correction of a dollar amount for the effects of inflation by law or contract. Many government transfer programs use indexation for the benefits. The government also indexes the tax brackets used for federal income tax. There are uses of indexation in the private sector as well. Many labor contracts include cost-of-living allowances (COLAs). Real and Nominal Interest Rates Example: Sally Slackjaw deposits $1,000 into a bank account that pays an annual interest rate of 10%. A year later, she withdraws $1,100. What matters to Sally is the purchasing power of her money. o If there is zero inflation, her purchasing power has risen by 10%. o If there is 6% inflation, her purchasing power has risen by about 4%. o If there is 10% inflation, her purchasing power has remained the same. o If there is 12% inflation, her purchasing power has declined by about 2%. o If there is 2% deflation, her purchasing power has risen by about 12%. nominal interest rate: the interest rate as usually reported without a correction for the effects of inflation. real interest rate: the interest rate corrected for the effects of inflation. real interest rate nominal interest rate inflation rate Deflation 1930-1933 dollar deflated by 10% per year o Contributing factor to extant of Depression o Contraction of credit o Bankruptcies increased money demand o Federal Reserve contracted money supply by 30% o Banks toppled (thousands) Deflationary spiral o Price declines lead to decrease in production Firms would have to buy inputs at a high price and sell them at a low price o Less production leads to lower wages and hence lower demand o Decreased demand drives the price level down o Return to step one Are Deflations all that bad? Are deflation and depression empirically linked? No, concludes a broad historical study of inflation and real output growth rates. Deflation and depression do seem to have been linked during the 1930s. But in the rest of the data for 17 countries and more than 100 years, there is virtually no evidence of such a link. (Atkeson and Kehoe 2004) Debt Deflation, according to Irving Fisher Assuming, accordingly, that, at some point of time, a state of over-indebtedness exists, this will tend to lead to liquidation, through the alarm either of debtors or creditors or both. Then we may deduce the following chain of consequences in nine links: 1.Debt liquidation leads to distress selling and to 2.Contraction of deposit currency, as bank loans are paid off, and to a slowing down of velocity of circulation. This contraction of deposits and of their velocity, precipitated by distress selling, causes 3.A fall in the level of prices, in other words, a swelling of the dollar. Assuming, as above stated, that this fall of prices is not interfered with by reflation or otherwise, there must be 4.A still greater fall in the net worths of business, precipitating bankruptcies and 5.A like fall in profits, which in a "capitalistic," that is, a private-profit society, leads the concerns which are running at a loss to make 6.A reduction in output, in trade and in employment of labor. These losses, bankruptcies and unemployment, lead to 7.pessimism and loss of confidence, which in turn lead to 8.Hoarding and slowing down still more the velocity of circulation. The above eight changes cause 9.Complicated disturbances in the rates of interest, in particular, a fall in the nominal, or money, rates and a rise in the real, or commodity, rates of interest.—(Fisher 1933) Hyperinflation International Accounting Standards Board describes hyperinflation as "a cumulative inflation rate over three years approaching 100% (26% per annum compounded for three years in a row)" Some academics define hyperinflation as 50%/month or more The hyperinflation cycle o Money supply is increased without a corresponding increase in real output This increases price levels o A bunch of nasty stuff happens at the same time: Sellers hedge against inflation by increasing prices Population becomes unwilling to hold money, they will quickly spend it before it loses value This is an increase in the velocity of money, which increases prices Hyperinflation o wipes out value of public and private savings o results in capital flight o scares away FDI Why do governments allow hyperinflation to take root? o Hyperinflation allows the government to devalue past spending (and future spending perhaps) and avoid an overt tax increase o Hyperinflation is a covert tax increase, most people don’t understand economy Hyperinflation is often associated with: o Wars o Currency meltdowns o Political upheaval What to do? o Stop printing money, decrease the money supply o Sometimes it is necessary to abandon currency and start over Hyperinflation is a regressive tax on consumption Some Examples: Argentina: 1 (1992) peso = 100,000,000,000 pre-1983 pesos. Mexico: 10,000% inflation over the 80s and 90s, o Abandoned currency in 1993 Russia: o 1992: 2,520% o 1993: 840% o 1994: 224% Ukraine o 1993, 10,000% or more! Zimbabwe loves the hyperinflation train…choo, choo.