Finance and Accounting - University of Florida

PRESENTATION TO BUDGET REVIEW

COUNCIL

FEBRUARY 23, 2012

FINANCE & ACCOUNTING

Today’s Agenda

Finance and Accounting (F&A) Mission

Organizational Structure

F&A Staffing

Customer Service

Areas Under Review:

Controller’s Office and Operational Controls and Efficiencies

Payroll and Tax Services

Gator Business Administrators Services (GBAS)

Tigert Hall Shared Service Center (SSC)

Financial Reporting

General Accounting

Cost Analysis

Summary

Q&A At End

Mission of Finance & Accounting

Maintain public trust and confidence in the University of Florida by

safeguarding institutional resources and providing quality

financial, accounting, and operational support to vested stakeholders

Consistently advance the vision and core missions of the University.

“Keeper” of sound University business processes and good

internal control systems and is available to consult on these topics.

Maintain accounting records, collects and disburses University funds

Prepare various University-wide reports, including the Annual

Financial Report, IPEDS, BOT reports and the National Science

Foundation (NSF) annual report.

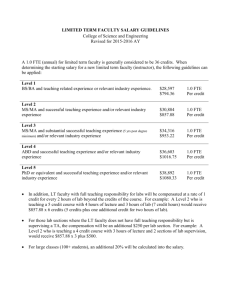

F&A Historical Staffing Level s

We have focused on identifying the mission-critical functions in F&A and have been able to reduce FTEs

2011-12

154.40

Total F&A

2010-11

156.20

2009-10

163.63

2008-09

173.50

# FTE Change from 2008-09 -19.10

-17.30

-9.87

% FTE Change from 2008-09 -11.01% -9.97% -5.69%

Makeup of F&A Staff

44.1 Degreed Accountants

13 Certified Public Accountants (CPAs)

Other Certified Professionals, CMA, CIA, CTP

13 Other Degreed Professionals

97.3 Other Fiscal Staff

Focus on Customer Service

Recognize our role as a support function for campus

Conduct customer surveys to assess areas in which we can improve or need to focus more efforts:

Sponsor quarterly CFO Roundtable (formerly F&A

Roundtable)

Quarterly CFO Newsletter

Remedy system to effectively manage calls and emails

Office Communicator

UFS Phone System

FI Users Group

Consistent with CFO, encourage our employees to bring forth ideas for improvement

Research Participant Payment process

Distribution of 2013 Budget by Area

Disb/Asset Mgt - 55 FTE

Univ Financial Svces 28.25 FTE

Controller 10.35 FTE

Treasury Mgt - 18 FTE

Payroll - 20 FTE

General Accounting - 9 FTE

Cost Analysis - 5 FTE

Shared Svces - 4 FTE

Financial Reporting - 4 FTE

GBAS - .8 FTE

Controller’s & Operational Controls

Major Programs and Services

Management of Finance and Accounting (F&A)

General management and support of F&A – 154.4 FTEs and over $10 million budget

Controller and 4.1 Sr. Associate Controllers

Ongoing meetings with all levels of F&A

Continual review of F&A business processes and organizational structure to achieve efficiencies

Controller’s & Operational Controls

Major Programs and Services

Accounting, Auditing, Reporting, Internal Control,

Business Process Guidance and Support to Customers

Represent users of the MyUFL system with Enterprise

Systems

Serve on Various University and DSO Boards and

Committees; Staff support to BOT Finance and Facilities

Committee and the Audit and Operations Committee

Prepare monthly and annual Scorecards

Departmental visits

Participate in ITN for Administrative Services Review

Controller’s & Operational Controls

Major Programs and Services

Bond Financing:

Clinical Translational Research Building $30 million

Hough MBA and Harn Asian Wing $18.5 million refinancing

Upcoming JWRU $50 million Expansion and Renovation

Teach Several Pro3 Classes:

Color of Money

Internal Controls

Departmental Reconciliations

Controller’s & Operational Controls

Major Programs and Services

Audit Liaison:

Auditor General Financial, Federal and Operational Audits

23 Numbered Memos 2010-11 Fiscal Year

Coordination of responses to audit findings

Coordination of Management Representation Letter s

Internal Revenue Service

18 month duration

Over 200 Information Data Requests (IDRs)

Review and negotiate audit closing process:

Negotiated to $77K

Office of Audit and Compliance Review (OACR) exit conferences

Others Including HHS, Kellogg Foundation, other grant specific reviews, etc.

Controller’s & Operational Controls

Accomplishments

Completed two bond financings during the 2011 FY; one currently planned for FY 2012

Along with F&A staff worked to negotiate a $77,000 payment for back taxes and interest to IRS for a five-year audit period.

This was substantially less than other peer institutions have been assessed and our process for monitoring Unrelated Business

Income Tax (UBIT) earned compliments from the IRS staff

18 month duration with approximately 200 requests for information

Earned commendations from IRS for our procedures

Negotiated new F&A rates with DHHS (see Cost Analysis)

Controller’s & Operational Controls

Accomplishments

Accumulated, prepared and sent out monthly and annual scorecards to 77

Departments/Centers/Institutes

Departmental Visits:

Vet Medicine

PURC (Public Utility Research Center)

JW Reitz Union

Various visits to assist with implementation of FI 9.1

Payroll and Tax Services

Major Programs and Services

Payroll Processing

Biweekly payroll and off-cycle – 653,230 employee payments for $1.2 billion per year

Time and Labor Reporting System corrections and support – 1800

Prepares Vouchers for Payroll Vendor Payments – approximately 1,500 payments totaling $60 million

Wage Refunds – 508 refunds for $465,000

Collections, Garnishments – 10,000 a year

Direct Deposits Authorizations – 22,000 entries/year

Payroll and Tax Services

Major Programs and Services

Monitors Departmental Payroll Distributions

(distributions allocate payroll charges to Cost Centers)

Teach PRO3 “Payroll Distributions” class

Prior and current year distribution changes

Payroll and Tax Services

Major Programs and Services

Tax Services

Monitor Employees for Correct FICA Status

W-2s – 35,193 W-2s provided

Social Security and Medicare tax monitoring

Unrelated Business Income Tax (UBIT)

Florida Sales and Use Tax – 292 departments reviewed with 12 consolidated returns filed

Payroll and Tax Services

Major Programs and Services

Payments to Foreign Nationals

1042-S

Nonresident Aliens (NRA) and tax treaties

Foreign research participants review

Payments to foreign organizations (IRS reg 1442)

Payroll and Tax Services

Major Programs and Services

Other Services

Campus Support

Payroll - Email (64,000) & phone calls (11,000)

Tax Services – Email (21,000) & phone calls (7,600)

Campus training programs

UBIT training and departmental visits

Florida sales tax

Audit support e.g. IRS

Payroll and Tax Services

Accomplishments

Online W-2s and End-of-Year Statements (EYES)

Payroll and Tax Services

Accomplishments

Substantial Decrease in Number of Printed Checks

Payroll and Tax Services

Accomplishments

Wireless Device Reimbursement

Change in IRS regulations allowed a change in the reimbursement process saved UF approximately

$500,000 a year

Self service direct deposit functionality

GBAS Mission

Gator Business Administrator Services, or GBAS, targets business

administrators on campus.

Define institutional expectations associated with the role of the business administrator

Provide ongoing professional development for existing business administrators

Identify and facilitate initial and on-going training in all areas of finance and administration

Ensure that Business Administrators and staff have a comprehensive

understanding of policies, directives and procedures, rules (State, Federal, university, other) and that they are applied fairly and consistently across units

Partner Business Administrators across campus with core office leaders on a regular, on-going basis to actively engage in discussing current issues,

providing input into new and existing policies and procedures, sharing information and best practices, and suggesting and implementing process improvements.

GBAS

Major Programs and Services

Orientation:

12 Online Modules to Introduce Newly-hired and those new-to-the position Business Administrators to the UF

Financial, HR and Administrative Environment

Mentoring

Foundation – Pro3 curriculum

GBAS Institutes

Ongoing professional development

GBAS Credential – End of 2012

GBAS Accomplishments

Held one Business Office Institute in Fall, 2011 with 40 participants; Next Institutes in April and November

2012

Held a reporting training class for Business

Administrators with 30+ participants – Yesterday,

February 22, 2012

Started a mentoring program in February 2012 with 10 participants

SSC Mission

To work in partnership with the academic and

administrative management of the University of

Florida to provide efficient and effective financial and

administrative services and solutions, focused on unit level needs and university-wide objectives.

SSC Major Programs and Service

Financial and Human Resources transaction processing.

Cross Coverage - Highly trained staff members are available to assist units during employee absences and peak periods of activity.

Training – Unit training support may be provided to insure compliance with internal and external regulations.

Assist units with analyzing FTE needs and opportunities to streamline administrative processes for better quality service, improved efficiencies and customer service.

SSC Accomplishments

Tigert Hall SSC go live date – October 26, 2010

Total units served – 16

Total AP transactions processed, October, 2010 to

January, 2012 – 2419

Total HR transactions processed, October, 2010 to

January, 2012 – 326

Support to CLAS – analysis of FTE and research administration support

Financial Reporting

Major Programs and Services

Annual Reports

UF Annual Financial Report

SUS Consolidated statements

IPEDS, UF Fact Book, US News and World Report, others

SACS

Credit rating agencies

Quarterly Financial Statements with a Variance

Analysis to the UF Board of Trustees

Financial Reporting

Major Programs and Services

Report Writing

nVision reports for Auxiliaries to use in creating financial statements

Assistance to other F&A departments

Assistance to Campus

Assist with journal entries for financial statements

Teach Departmental Reconciliation and Basic

Accounting Concepts classes – 8 times a year each

Financial Reporting

Accomplishments

Electronic Reporting

Implemented electronic (Excel) workbooks and eliminated 79, 3-ring binders. Saved paper, space and time.

Workshops are videotaped and available to remote locations and can be viewed when convenient to user.

In person visits to preparers with complex entries.

Financial Reporting

Accomplishments

Streamlined Documentation

Based on feedback from users, reduced the amount of documentation for each preparer by preparing journal entries for the following centrally:

Accounts Payable

Compensated Absences

Salaries Payable

Investment Allocations

Investment Interest and Fair Value Adjustments

Other Postemployment Benefits

Reversing Entries and Beginning Net Assets

General Accounting

Major Programs and Services

Maintain the Integrity of the University’s Accounting

Records

Create and Maintain all Chartfields and HR Account

Codes in PeopleSoft

Review and Post General Ledger and subsystem journals

Keep Subsystems/GL/KK In Sync

Close General Ledger and Sub-Systems at Month and

Year-End (which affects the timely release of reports to

Campus)

General Accounting

Major Programs and Services

Auxiliary/Educational Business Activity

New Requests and Ongoing Support

Auxiliary Enterprise Committee Meetings (3/year) and related reports

Quarterly Auxiliary Financial Statements Support and

Annual training

Annual Service Center Rate Review to Comply with

Circular A-21 Guidelines

General Accounting

Major Programs and Services

Reporting

Review Monthly Financial Reports and Data Warehouse

Negative Balances Reporting to Campus

Support to Campus

Financial Services (FI) User Group

Monitor the Fringe Benefit Pool Assessment

Accounting and Reporting Support to UF and 11 DSOs

Training via Human Resources Online courses and

Instruction Guides

General Accounting

Major Programs and Services

Other Services

myUFL Upgrade Testing Support

Agency Fund Requests

Unclaimed Property

Search & Claim UF’s property from the State

Prepare Annual Unclaimed Property Report to the State

General Accounting

Accomplishments

Started the Financial Services User Group

Changed the E2E & E2R process to be more streamlined for Campus – eliminated 3,000 checks

Streamlined process for creating Contracts & Grants

HR Account Codes and shortened timeline by as much as 3 days

Changed Cash Management Funding Process for COM

Resulting in Fewer COM FTEs Needed for the process

Cost Analysis

Major Programs and Services

Responsible for maintaining the Effort Reporting system required by Circular A-21:

Approximately 20,000 emails and inquiries from campus

New Effort Reporting System for Summer, 2011

Conducted 13 open labs and 30 training sessions

45,000 Effort submissions

Pulling old Effort reports for HHS Audit – over 7000

Prepares various reports for agencies such as the annual

NSF report

Prepares the annual Schedule of Expenditures of

Financial Awards (SEFA) report required under Circular

A-133.

Cost Analysis

Major Programs and Services

Assists campus and core offices on questions regarding grantor awards and compliance issues.

Coordinates Annual Campus Space Study

Over 40,000 campus rooms

Biggest driver of indirect cost recovery (FnA) calculation

Cost Analysis staff “walks” Organized Research space for

FnA base years

Cost Analysis

Major Programs and Services

Prepares the University-wide indirect cost (Facilities and Administrative (FnA)) study:

Results in approximately $70 million of reimbursements coming to the University annually

“Base Year” study is prepared every four to five years

“Off-Year” studies are conducted to look for unusual or expected trends

Very, Very Personnel Intensive

Cost Analysis

Accomplishments

Facilities and Administrative (FnA) rates approved (yet to be signed)

2010, 2011 and 2012 – 46.5%

2013 and 2014 – 49%

Results in an increase of approximately $1.7 million/year to UF compared to 2012

2015 – 50%

Results in an increase of approximately $2.4 million/year to

UF compared to 2012

Cost Analysis

Accomplishments

Implemented New Effort Reporting System (direct response to HHS audit)

Fringe Benefit Pool Analysis, Projection and Submission to

Federal Government

Summary

Reduced staffing 11% since 2009

Below shows additional FTE reductions for 2012-13 if 5% cut is implemented:

2012-13 with

5% Reduction 2011-12 2010-11 2009-10 2008-09

Total F&A

# FTE Change from 2008-09

149.70

154.40

156.20

163.63

173.50

-23.80

-19.10

-17.30

-9.87

% FTE Change from 2008-09 -13.72% -11.01% -9.97% -5.69%

Summary

Implications of 5% Cut

No emergency payroll checks – employees will paid on next pay date (2 weeks) – FY 2011 – 699 checks for $1.5m

No wage refund calculations – overpayments to employees will go uncollected – FY 2011 – 508 refunds for $465k

No time adjustments after 60 days – FY 2011 – 903 forms processed

Elimination of positions – reduces ability to continue service levels during vacancies and absences as well as provide for cross training

Unable to implement new departmental deposit process

May impact implementation of Research Participant Payment initiative

Summary

Implications of 5% Cut

Eliminate auditing travel reimbursements - overpayments will go uncollected leading to audit findings and public criticism

Reducing equipment replacements and maintenance – increases exposure to not being able to provide timely services to campus

Reducing training offered to employees – reduces employees’ knowledge of laws, rules and regulations as well as ability to identify more efficient processes

Reduce frequency of billing on amounts due the University including Housing, Transportation & Parking

Summary

We recognize and take seriously our commitment to serve our campus users and will strive to maintain our current level despite staff, equipment and technology reductions

We will continue to gauge our customer service through continual feedback and periodic surveys

We continue to look at strategic ways improve our products and services

We continue to evaluate staffing and program needs in

Finance and Accounting