round table questions

advertisement

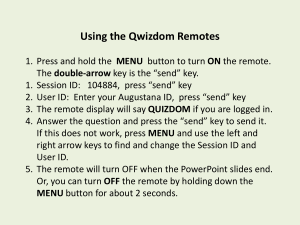

The ICTF Global Credit Management Round Table Discussion of Export Credit and Collection Challenges Moderator: Richard Clark, Director, Corporate Credit - Parker Hannifin Corp. Panelists: Nicole Harvey, Director of Credit & Collections - Parfums de Coeur Fernando Mesia, Senior Vice President - Mercantil Commercebank Tina Sorrels, Director of Credit - AJC International November 17, 2015 Latin America • After years of “strong currencies” in Latin America, the past 12 months have seen huge devaluations in Colombia, Mexico, Brazil and Chile – the four strongest economies in Latin America. Any comments from the attendees? How are you handling the situation? QWIZDOM Latin America cont… • How many members have increased their credit department staff handling Latin America (in the US or Latin America) in the past 12 months? Latin America cont… • There are a number of challenges having Distributors/Resellers pay on time per their signed contracts with us. Is anyone else experiencing the same credit/accounts receivable challenges, and how are you dealing with very slow payers in Latin America? Argentina • Is anyone having any difficulties obtaining payment from their customers in Argentina? QWIZDOM Brazil • Has the downgrade of Brazil below the Investment Grade Level reduced availability on the credit insurance side for Brazil? Has it made any company be more conservative when approving/increasing a credit line in Brazil? Brazil cont… • With the rapid devaluation of currency, recession and potential overthrow of top government officials in Brazil, what changes are being made to selling in the country? Cuba • We get a lot of questions about when we will start doing business in Cuba. Any insight into when Congress will lift the embargo? Are there any public sources of commercial data in Cuba? Ecuador • Ecuador – the country which cannot devalue but has all sorts of other issues – how many members are using more caution granting credit in this country? QWIZDOM Honduras • What are people seeing regarding the direction of the Honduran economy? Mexico • Question on exporting to a customer in Mexico utilizing a commercial Letter of Credit and using rail as the mode of transportation. We recently found it impossible to obtain a discrepantfree Letter of Credit to export from U.S. to Mexico utilizing a Railroad Company as transportation to the border in Texas with the customer taking ownership at the border to transport in Mexico to their place of business. The biggest issue is probably the inflexibility of our customer and the customer refusing to waive discrepancies in the Railroad Company waybill. Railroad Company refused to alter or change the railway bill. • Discrepancies included: • 1. Rail Destination on railway bill incorrect because we were delivering to the border in TX only and not to the final destination. • 2. Method of payment could not reflect “prepaid” because Railroad Company’s coding for the freight being split by us and our customer was “11” (AAR Accounting Rule 11). • 3. No indication of goods received for shipment on the railway bill. • 4. Product was listed on railway bill according to the Railroad Company’s coding system and it was not close to the type of product we were selling. • 5. No signature on the railway bill. • In conversations with the bank, they refused to accept a railway bill that was unsigned even though we provided the bank with a letter from a VP at the Railroad Company stating that the railway bills are never signed. • We attempted to use Certificate of Receipt instead of the railway bill, however, the bank and customer would not agree. • We attempted to use a warehouse bill of lading instead of the railway bill and it was not agreed to. • The note section of the railway bill was used to address the 5 discrepancies above by stating the destination, freight prepaid, etc. • Customer claimed they are unable to utilize a Standby L/C. • Any suggestions on how to make this work in the future? Suggestions on other secured ways to sell to such customers? Venezuela • Are you selling to any Venezuelan companies that are experiencing delays on payments released by CADIVI/CENCOEX? If so, have you been able to work with the company through a Collateral or Guarantee? What other options have you tried? China • How serious is the slowdown in the Chinese economy? Have we passed the worst of it? What are your observations from a credit extension and payment stand point? QWIZDOM / QWIZDOM Africa • I am very interested in anything concerning Africa - how to secure operations / credit in Africa; techniques that are specific there; pitfalls and opportunities, etc… General Questions • We are all aware of the downside of the drop in oil prices, as energy-related companies have cut back on purchases and Capital Expenditures. Who is in an industry that has benefitted from the price decreases, and where (country or industry) has your company benefitted? General Questions cont… • How do you take into account the appropriate risk for doing business overseas? Do companies account for the risk by enacting higher hurdle rates for projects or adding a risk premium to account for the sovereign/country risk? General Questions cont… • With international markets going through so much volatility, credit managers have to constantly monitor their international customers. In some countries, it’s not the customers themselves, but the country risk that concerns us. A couple of customers in high risk countries have trouble sending money outside of the country (Greece and Serbia). Occasionally, we are asked if they can wire us money from an account in another country. The account could be in their name or in another company’s name. What type of due diligence is required on our part? Are there any legal considerations that come into play? General Questions cont… • Can anyone report good or bad experiences they’ve had with supplychain finance programs? General Questions cont… • I would like to ask about the best practices for protecting your A/R department from fraudsters. Protection in this instance would be from those criminals that monitor email transmissions in an attempt to then send an email posing as your company advising your customer that wire instructions have changed. This would also work in reverse where they pose as your customer requesting a refund be sent to a new bank. General Questions cont… • We rely on credit insurance; however, there are some countries we do business in, like Pakistan, which insurers will not insure regardless of the strength of the buyer. L/C’s do not work in our world (Telecom). What are some alternatives? General Questions cont… • With the tightening of banking regulations around the world, are people finding it harder and/or more expensive to get letters of credit? QWIZDOM • Is anyone using Bank Payment Obligations (BPO) and, if so, did it work the way you thought it would? Was it an efficient and secure way to get paid? Do you need special software? General Questions cont… • What is best practice for foreign customers who do not withhold taxes from payments? For those that do withhold, what documentation do you require for the deduction to be valid? General Questions cont… • How are panelists and peers utilizing interest penalties for late payments? What basis is used to calculate the interest amount? Does the calculation differ in countries where the country’s internal interest rate is higher than in the US? THANK YOU FOR YOUR PARTICIPATION!!!