PowerPoint Presentation - Priorities First Bookkeeping & Accounting

advertisement

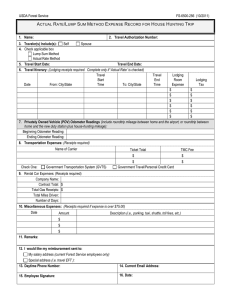

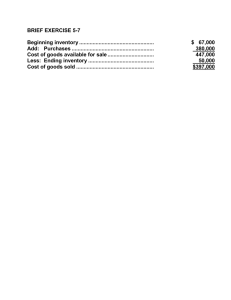

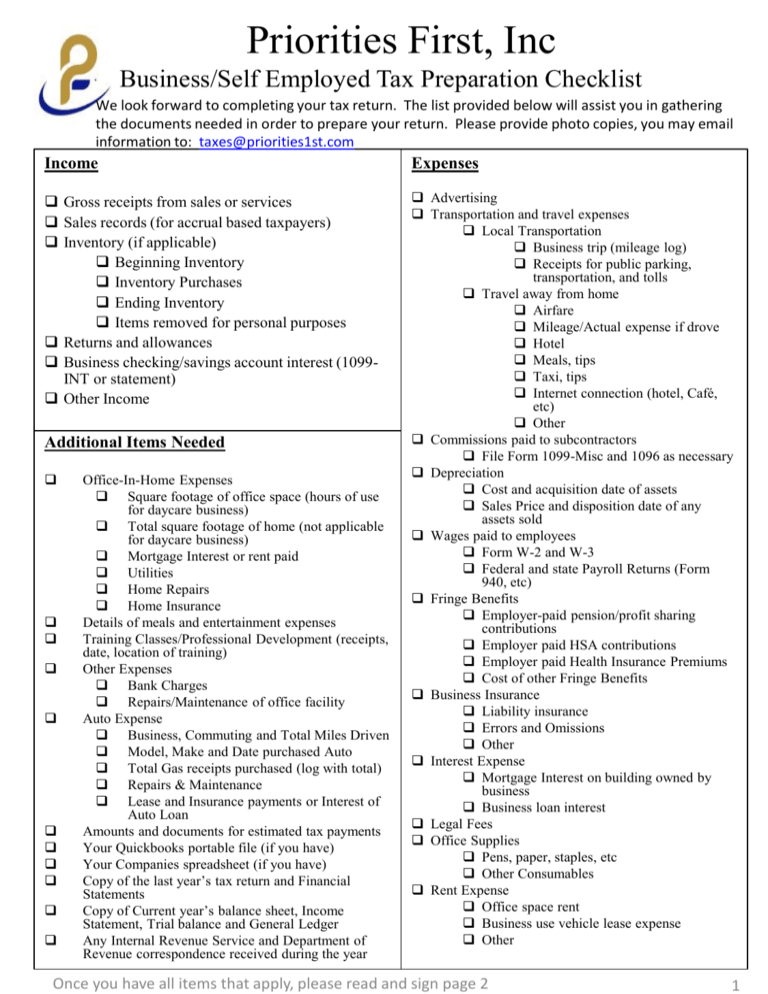

Priorities First, Inc Business/Self Employed Tax Preparation Checklist We look forward to completing your tax return. The list provided below will assist you in gathering the documents needed in order to prepare your return. Please provide photo copies, you may email information to: taxes@priorities1st.com Income Expenses Gross receipts from sales or services Sales records (for accrual based taxpayers) Inventory (if applicable) Beginning Inventory Inventory Purchases Ending Inventory Items removed for personal purposes Returns and allowances Business checking/savings account interest (1099INT or statement) Other Income Advertising Transportation and travel expenses Local Transportation Business trip (mileage log) Receipts for public parking, transportation, and tolls Travel away from home Airfare Mileage/Actual expense if drove Hotel Meals, tips Taxi, tips Internet connection (hotel, Café, etc) Other Commissions paid to subcontractors File Form 1099-Misc and 1096 as necessary Depreciation Cost and acquisition date of assets Sales Price and disposition date of any assets sold Wages paid to employees Form W-2 and W-3 Federal and state Payroll Returns (Form 940, etc) Fringe Benefits Employer-paid pension/profit sharing contributions Employer paid HSA contributions Employer paid Health Insurance Premiums Cost of other Fringe Benefits Business Insurance Liability insurance Errors and Omissions Other Interest Expense Mortgage Interest on building owned by business Business loan interest Legal Fees Office Supplies Pens, paper, staples, etc Other Consumables Rent Expense Office space rent Business use vehicle lease expense Other Additional Items Needed Office-In-Home Expenses Square footage of office space (hours of use for daycare business) Total square footage of home (not applicable for daycare business) Mortgage Interest or rent paid Utilities Home Repairs Home Insurance Details of meals and entertainment expenses Training Classes/Professional Development (receipts, date, location of training) Other Expenses Bank Charges Repairs/Maintenance of office facility Auto Expense Business, Commuting and Total Miles Driven Model, Make and Date purchased Auto Total Gas receipts purchased (log with total) Repairs & Maintenance Lease and Insurance payments or Interest of Auto Loan Amounts and documents for estimated tax payments Your Quickbooks portable file (if you have) Your Companies spreadsheet (if you have) Copy of the last year’s tax return and Financial Statements Copy of Current year’s balance sheet, Income Statement, Trial balance and General Ledger Any Internal Revenue Service and Department of Revenue correspondence received during the year Once you have all items that apply, please read and sign page 2 1