Implementing A Managerial Accounting System Using QuickBooks Pro

advertisement

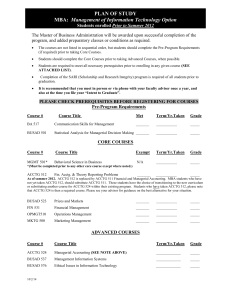

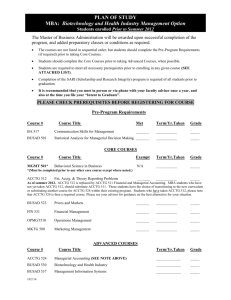

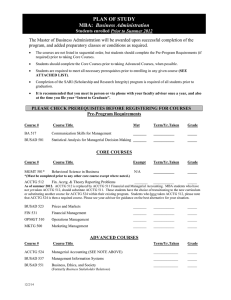

Implementing A Managerial Accounting System Using ® QuickBooks Pro Lessons Learned From the Tomorrow’s Top Agricultural Producer (TTAP) Program Texas Cooperative Extension Management Accounting Team Texas Cooperative Extension James McGrann Doug Richardson Francisco Abello Brenda Duckworth Rob Borchardt Stan Bevers Christy Waggoner Jay Yates Karen Wilhelm Management Accounting Overview What is Management Accounting? Accumulation of consistent, conservative information by which a business is managed End user prescribes information needs Management Acctg end users = manager, creditors, stock holders Tax Acctg end user = IRS Management Accounting Overview Tax accounting vs. Management accounting Tax Acctg = cash basis acctg, calendar year, depreciation is accelerated, results in a line item expense Income = bad; Expense = good Management Acctg = accrual-adjusted basis of acctg in order to analyze the production cycle and to “match” income with expenses incurred, economic depreciation, consistent, conservative Income = good; Expense = bad Management Accounting Overview Why is management accounting important? End-use of accounting information = management Decisions are made Conservative & Consistent (comparison & pro forma) Cannot manage from Schedule F (tax return) Income = bad; Expense = good Risk is better managed when cost of production is known All costs are absorbed by product being sold Costs are matched with corresponding income TCE Management Accounting System The “System” Uses QuickBooks Pro® Interfaces with Excel Double-entry accounting package Relatively inexpensive Standardized chart of accounts (to be imported) Excel reports Schedule F Instruction guide with examples Farm Financial Standards Council methodology TCE Management Accounting System Classes “centers” Profit, cost, and support centers Step-up cost transfer accounting - Enterprise analysis - Full absorption - Production phase analysis TCE Management Accounting System Centers (3 levels) - Profit centers: phases of production where commodity is to be sold (PC: Corn) - Cost centers: phases of production where value is added, but no product is sold (CC: Irrigation) - Support centers: accumulation of general overhead (indirect) costs are accumulated (SC: G&A) TCE Management Accounting System Through transfer accounts (below NOI line), costs are fully absorbed by the Profit Centers and matched to corresponding income (via journal entries) Incomplete cost centers (production cycle not complete) are held on B/S in “Investment in growing crops” asset accounts All Support Centers & Cost Centers are allocated/transferred and, therefore, go to zero Cash based tax information is intact (above NOI line) P&L by Center Corn HWht Irrig (PC) (PC) (CC) Income 5,000 4,000 Expense 1,000 NOI 4,000 3,500 500 PWht G&A (CC) (SC) 00 00 2,000 1,000 00 Total 9,000 3,000 7,500 -2,000 -1,000 -3,000 1,500 Other Income Other Expense Transfer SC 1,000 500 500 Transfer CC 2,500 00 -2,500 00 00 00 00 2,500 00 -2,000 00 500 Total Other Exp 3,500 3,000 00 00 00 00 Net Income 00 00 00 1,000 Transfer B/S 500 500 1,000 -3,000 00 TCE Management Accounting System What sets this particular system apart? Information from QBP is easily entered into pre-designed Excel worksheets by which reports are generated Support materials and examples are included System is a financial management tool Management Accounting Teaching Modules Set-up Bridging the gap Allocation/ Transfers Management Accounting Teaching Modules Set-up & daily transactions - Import chart of accounts Center description & allocation criteria Daily transactions & common mistakes Basic accounting instruction Time requirements: Producer: high Instructor: medium Management Accounting Teaching Modules Bridging the Gap Balance Sheet - Beginning balance sheet (usually a challenge) Getting it right - Medium level of accounting instruction - How transactions affect financial statements Time requirements: Producer: medium Instructor: high Management Accounting Teaching Modules Allocation, transfers, reporting/analysis - In-depth accounting instruction - Journal entries (allocations & transfers) - Reports P&L by Class (QBP) FinAnalysis (Excel) Total Unit Cost Report (Excel) Commodity Cycle Reports (Excel) Time requirements: Producer: low Instructor: low Management Accounting Lessons Learned - TTAP Good management requires some accounting knowledge QBP is not a monster… Rigidity leads to consistency & makes the learning curve less steep Requires commitment On-site visits are a must Tax accountant buyoff is important = teamwork Management Accounting Pitfalls Lack of willing CPAs Mind-set = tax accounting Business structure (cash transfers between entities) Balance sheet - Incomplete - Based on FMV (vs. historical cost) Implementing A Managerial Accounting System Using ® QuickBooks Pro Questions & Comments