Read Article Here

advertisement

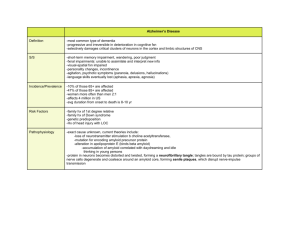

Start-up Alzheon Launches with Pure-Play Alzheimer’s Disease Strategy By Jennifer Boggs Managing Editor November 4, 2013 Back in 2007, an Alzheimer’s disease candidate called Alzhemed missed its endpoint in a large-scale pivotal study, just one of many late stage failures in the space, along withMyriad Genetics Inc.’s Flurizan, Medivation Inc.’s Dimebon, Eli Lilly and Co.’s semagacestat and bapineuzumab from Pfizer Inc. and Johnson & Johnson/Eland Corp. plc. (See BioWorld Today, Aug. 28, 2007.) But Alzhemed, also known as tramiprosate, offered a glimmer of hope. Despite falling short of the primary endpoint, which measured disease modification using magnetic resonance imaging and clinical efficacy using the Alzheimer’s Disease Assessment Scale, cognitive subpart and Dementia Rating scale, the drug displayed some positive trends, including data suggesting a pharmacological effect on spinal fluid levels of amyloid-beta and tau biomarkers, along with changes in hippocampal volume. Those trends were enough to convince developer Neurochem Inc., which later changed its name to Bellus Health Inc., to keep the program alive. Laval, Quebec-based Bellus started to develop a prodrug of tramiprosate to address some pharmacokinetic and tolerability issues. And the resulting candidate, ALZ-801, along with rights to a family of analogues and associated platform of chemotypes and clinical datasets, attracted a veteran biopharma team with expertise in Alzheimer’s disease. “In the intervening decade since the Alzhemed trial, we’ve learned so much more about the disease, about the course of the disease and when to intervene,” said Martin Tolar, founder, president and CEO of Alzheon Inc., a Lexington, Mass.-based start-up that launched in late October with plans to operate as a pure-play Alzheimer’s disease firm. “I’m very excited by the possibility,” said Tolar, who has worked in the Alzheimer’s space for 20 years. “I can’t believe for a decade there has been nothing.” Meanwhile, he added, health care costs associated with the disease continue to rise, threatening to “bankrupt the system.” Despite the string of high-profile failures, Alzheon managed to pull together a solid management team, plus a couple of dedicated investors for an undisclosed initial financing and license rights to the tramiprosate prodrug “all under two months,” Tolar said. “The whole deal came together very quickly.” Much of that is likely ascribed to the expertise of the executive team, which also includes John Hey, who previously worked with Tolar at Comentis Inc., a company that made headlines for its whopper of a deal with Astellas Pharma Inc. involving beta-secretase inhibitor CTS-21166. Tolar called beta-secretase the “Holy Grail for Alzheimer’s,” as it represents a potential disease-modifying therapy. (See BioWorld Today, April 28, 2008.) Alzheon’s plan is to start with the ALZ-801 prodrug, which is “better at getting to the brain [and] has better tolerability” than the parent compound, Alzhemed, Tolar explained. Based on subsequent analysis from the failed Alzhemed trial, researchers discovered that the drug appears to be most effective in the highrisk population of patients testing positive for APOE4. That subset represents the majority of all Alzheimer’s patients, Tolar said, so that’s the population Alzheon plans to target. ALZ-801 already has Phase I data, plus a surfeit of safety data for the parent molecule behind it, thanks to Neurochem’s “audacity” to conduct large studies in roughly 2,000 patients, he added. Alzheon plans to move into an efficacy study next year, armed with a new trial strategy. “We plan to enroll early stage, but not MCI [mild cognitive impairment] patients,” Tolar told BioWorld Today. “It will be a much more homogenous population with much more aggressive disease.” The compound’s mechanism focuses on preventing the aggregation of amyloid, a pathway for which researchers have gleaned new insights over the years. It’s not the amyloid plaques as once thought, he noted. “We want to intervene where the amyloid is generated, which is what beta-secretase does.” Work on ALZ-801 also has shown it may interfere with tau, too. Both pathways have been associated with Alzheimer’s, and research has led to an amyloid/tau debate, with zealots on each side. But, Tolar pointed out, it’s probably more complex than that. “At the end of the day, it will probably not be just one drug that cures Alzheimer’s; it will probably be a cocktail. “We’re agnostic,” he added. “We want what works.” The planned Phase II study will be designed similarly to registrational studies, and, if all goes well, Alzheon may even be able to use it as a registrational study. Data are expected in about two years, so sometime in 2016. With about a dozen employees, Alzheon plans to stay “lean and mean,” Tolar said. Alzheon has assembled two teams: one to focus on drug development and one to focus on transactions to in-license additional molecules, looking for other compounds that have been at least somewhat de-risked. “At some point we’ll partner,” he added, with no plans to try to build a commercial infrastructure for the large Alzheimer’s market. For now, though, “we plan to go very fast.” In addition to Tolar and Hey, Alzheon’s management team includes Mark Versavel, who previously worked on Alzheimer’s candidate metrifonate at Bayer AG, as chief medical officer. Under the terms of its licensing deal with Bellus, the Canadian firm will receive a portion of all future payments received by Alzheon related to ALZ-801 royalties on future net sales. Specific terms were not disclosed.