IFI_Ch11

advertisement

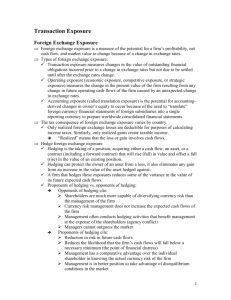

Chapter 11 Transaction Exposure The Goals of Chapter 11 • Introduce three types of foreign exchange exposure: transaction, operating, and translation exposure • Discuss the pros and cons of hedging foreign exchange risk by MNEs • Analyze the source of transaction exposure, which corresponds to the risk that the values of foreigncurrency-denominated receipts or payments could be influenced by the exchange rate changes • Focus on the introduction of how to manage (or hedge) the transaction exposure 11-2 Types of Foreign Exchange Exposure 11-3 Types of Foreign Exchange Exposure • Foreign exchange exposure is a measure of the potential change for a firm’s profitability, net cash flow, and market value because of a change in exchange rates • An important task for the financial manager is to measure foreign exchange exposure and to manage it so as to maximize or stabilize the profitability, net cash flow, and market value of the firm • The impact on a firm when foreign exchange rates change can be classified into three kinds of exposure: transaction, operating, and translation exposure 11-4 Types of Foreign Exchange Exposure • Transaction exposure measures changes in the value of existing foreign-currency-denominated obligations, which incurred prior to an exchange rate change but are not due to be settled until after the exchange rate change – According to the above definition, the exchange rate changes cause the transaction exposure for existing obligations, which start in the past and end in the future • In general, this type of exposure can be defined as changes in cash flows of current existing contractual obligations due to the movement of the exchange rates 11-5 Types of Foreign Exchange Exposure • Operating exposure, also called economic exposure, competitive exposure, or strategic exposure, measures the change in the present value of the firm resulting from any change in future operating cash flows of the firm caused by an unexpected change in exchange rates • More specifically, the change in firms’ value depends on the impact of the exchange rate change on future sales volume, product prices, and costs in the following years 11-6 Types of Foreign Exchange Exposure • Translation exposure, also called accounting exposure, is the potential for accounting-derived changes in owner’s equity to occur because of the need to “translate” foreign currency financial statements of foreign subsidiaries into a single reporting currency to prepare worldwide consolidated financial statements • This risk arises from that the exchange rates for acquiring assets, liabilities, and equities are different from that for generating consolidated financial statements • So, comparing to time points of acquiring assets, liabilities, and equities, changes of the exchange rate at later time points cause the translation exposure 11-7 Exhibit 11.1 Comparison of Occurrence Time of the Three Foreign Exchange Exposures on the Time Line Time point when the exchange rate changes Translation exposure Changes in reported owners’ equity in consolidated financial statements caused by a change in exchange rates Operating exposure Change in expected future cash flows for following years arising from an unexpected change in exchange rates Transaction exposure Impact of settling existing obligations, which entered into before changes in exchange rates but to be settled after changes in exchange rates Time 11-8 Types of Foreign Exchange Exposure • Transaction exposure vs. Operating exposure – Both transaction exposure and operating exposure exist because of unexpected changes in future cash flows – The difference between them: • Transaction exposure is concerned with the uncertainty of future cash flows which are already contracted • Operating exposure focuses on expected future cash flows (not yet contracted) that might change because a change in exchange rates could altered international competitiveness 11-9 Types of Foreign Exchange Exposure • Tax consequence of foreign exchange exposures – As a general rule, only realized foreign exchange losses are deductible for calculating income taxes; Similarly, only realized foreign exchange gains create taxable income – Losses from transaction exposure usually reduce taxable income in that year, but losses from operating exposure may maintain for several years and thus reduce taxable income over a series of future years – Note that translation exposure could affect the parent company’s net worth or net income, but it will not generate cash losses in practice, i.e., both the parent company and subsidiaries will not lose any money physically during the translation of financial statements – Since losses from translation exposure are only “paper” losses, involving no cash flows, they are not deductible from pretax income 11-10 Reasons for Hedging Foreign Exchange Risk 11-11 Why Hedge? • MNEs possess a multitude of cash flows that are sensitive to changes in exchange rates, interest rates, and commodity prices – These three financial price risks are the subject of the growing field of financial risk management – This chapter focuses only on the sensitivity of the individual firm’s future cash flows to exchange rates • Many firms attempt to manage their currency (foreign exchange) exposures through hedging – Hedging is the taking of a position, acquiring either a cash flow, an asset, or a contract (e.g., a forward contract) that will rise (fall) in value and offset a fall (rise) in the value of an existing position – While hedging can protect the owner of an asset from a loss, it also eliminates any gains from an increase in the value of 11-12 that asset Why Hedge? • What is to be gained by the firm from hedging? – The major motive for firms to hedge is to increase the present value of firms – The value of a firm, according to financial theories, is the present value of all expected future cash flows in the future – For expected cash flows with higher uncertainty (or risk), a higher discount rate should be applied to calculating the present value and thus a lower present value for these cash flows is generated – A firm that hedges these foreign exchange exposures reduces the variance (or risk) in the value of future expected cash flows (see Exhibit 11.2 on the next slide) – Thus, a lower discount rate is employed to calculate the present value of expected future cash flows, which implies the increase of the present value of the firm 11-13 Exhibit 11.2 Impact of Hedging on the Expected Cash Flows of the Firm ※ Hedging will not increase the expected value for a cash flow. Actually, if taking the hedging cost into account, hedge transactions will decrease the expected cash flow ※ Hedging reduces the variability of future cash flows about the expected value of the distribution. This reduction of distribution variance is a reduction of risk 11-14 Why Hedge? • However, is a reduction in the variability of future cash flows to be a sufficient reason for currency risk management? Opponents of currency hedging commonly make the following arguments – Shareholders are much more capable of diversifying currency risk according to their individual preferences and risk tolerance than the management of the firm – Although currency risk management can reduce the variance, it reduces the expected cash flow due to hedging costs. • So, the net benefit of hedge depends on the trade-off between these two effects – Hedging activities are sometimes conducted to benefit the management at the expense of the shareholders • For instance, the true goal of hedging the variance of the company’s income is to ensure the bonus of the management 11-15 Why Hedge? – Management may overuse the expensive hedge • Management may believe that it will be criticized more severely for incurring foreign exchange losses than for incurring similar or even higher hedge costs in avoiding the foreign exchange loss • Possibly due to the accounting rules: because the foreign exchange losses appear in the income statements as a highly visible item or as a footnote, but the hedging costs are buried in operating or interest expenses – Efficient market theorists believe that investors can see through the “accounting veil” and therefore have already factored the foreign exchange effect into a firm’s market valuation • Although the translation exposure are only “paper” losses, there are still some firms to hedge this risk • However, the above argument implies that it is not necessary to hedge the translation (accounting) exposure 11-16 Why Hedge? • Proponents of hedging cite the following arguments: – Hedge can reduce the variance of future cash flows and thus may increase the firm’s present value by reducing the discount rate – Firms should focus on the main business they are in and take activities to minimize risks arising from interest rates, exchange rates, and other market variables – Management is in better position than shareholders to recognize disequilibrium conditions quickly and to undertake the hedging activities immediately – Management has a comparative advantage over individual shareholders in estimating the actual currency risk of the firm and taking the correct hedging strategy 11-17 Why Hedge? – Reduction in risk in future cash flows improves the planning capability of the firm. Therefore, the firm can undertake more investment projects that it might not consider before – Since a firm must generate sufficient cash flows to make debt-service payments, reduction of risk in future cash flows reduces the likelihood that the firm’s cash flows will fall below a necessary minimum (This minimum level of cash flows is also terms as the point of financial distress) 11-18 Sources of Transaction Exposure 11-19 Sources of Transaction Exposure • Transaction exposure measures gains or losses that arise from the settlement of existing financial obligations whose terms are stated in a foreign currency • The sources of transaction exposure include – Purchasing or selling goods and services in foreign currencies through credit accounts (to form the A/P or A/R on the balance sheet) – Borrowing or lending funds in foreign currencies – Entering into foreign exchange or foreign currency derivative contracts 11-20 Purchasing or Selling through Credit Account • The most common example of transaction exposure arises when a firm has a receivable or payable denominated in foreign currencies • For each trade of goods and services, the total transaction exposure consists of quotation, backlog, and billing exposures (see Exhibit 11.3) • Suppose that a U.S. firm sells merchandise on credit account to a Belgian buyer for €1,000,000 to be made in 60 days. The current exchange rate is $1.12/€, so the seller expects to receive $1,120,000 – For the exchange rate to become $1.08/€ ($1.15/€), the seller will receive $1,080,000 ($1,150,000) – Thus exposure (or risk) means not only the probability of some losses but also the probability of some gains 11-21 Exhibit 11.3 The Life Span of the Transaction Exposure for Trades of Goods and Services Time and Events t1 t2 Seller quotes a price in foreign currency to buyer (in verbal or written form) t3 Buyer places firm order with seller at price offered at time t1 t4 Seller ships products and bills buyer (becomes A/R) Buyer settles A/R with cash in foreign currency quoted at time t1 Time between quoting a price and reaching a contractual sale Time it takes to fill the order after contract is signed Time it takes to get paid in cash after A/R is issued Quotation Exposure Backlog Exposure Billing Exposure ※After the price is quoted at t1, if the exchange rate changes against the seller at t2, the seller may earn less or even suffer losses. So the transaction exposure starts from t1 ※At t3, the seller books foreign-currency-denominated receivables at the exchange rate of that time point, but changes in exchange rate between t3 and t4 will affect the received cash flow in domestic dollars at t4, that is the billing exposure ※The transaction exposure on credit account is actually the billing exposure 11-22 Borrowing or Lending Foreign Currencies • A true case for the transaction exposure over foreign debt is about the Grupo Embotellador de Mexico (Gemex) • Gemex, the largest bottler of PepsiCo outside the U.S., had U.S. dollar debt of $264 million in 1994 • The Mexico’s new peso was pegged at Ps3.45/$ since Jan. 1, 1993, but the peso was forced to float in Dec. 1994 because of economic and political events and the exchange rate stabilized near Ps5.5/$ • So, the debt in pesos is from Ps910 million to Ps1452 million, which increases by 59% 11-23 Entering into Foreign Exchange or Foreign Currency Derivative Contracts • Suppose a U.S. firm purchases ¥100 million through a foreign exchange forward contract at the forward exchange rate ¥100/$ after 90 days – When a firm enters into a foreign exchange derivatives contract, it deliberately creates a transaction exposure – The motive to create transaction exposure could be the need for hedge the account payable of ¥100 million after 90 days – If the spot exchange rate becomes ¥110/$ (¥90/$) after 90 days, the U.S. firm will have a transaction loss (gain) through this foreign exchange forward contract – On the other hand, if the spot exchange rate is ¥110/$ (¥90/$) after 90 days, the account payable of ¥100 million after 90 days have a transaction gain (loss) 11-24 Sources of Transaction Exposure ※ Note that cash balances in foreign currency (外幣 現金部位) DO NOT create transaction exposure, even though their domestic currency value changes immediately with a change in exchange rates – Since the firm does not have the obligation to transfer cash in foreign currency into cash in domestic currency, there is no transaction exposure for the cash in foreign currency – This kind of risk is reflected in the consolidated statement and thus classified as the translation exposure 11-25 Management of Transaction Exposure 11-26 Management of Transaction Exposure • Transaction exposure can be managed by operating, financial, and contractual hedges • The term operating hedge refers to an off-setting operating cash flow arising form the conduct of business – For example, the payments in a foreign currency could be offset by the foreign currency cash inflow generated from operating activities, e.g., from sales. This kind of hedge for the transaction exposure is also termed natural hedge – Operating hedge could also employ the use of risk-sharing agreements, leads and lags in payment terms, and other strategies (discussed in detail in Ch 12) 11-27 Management of Transaction Exposure • A financial hedge refers to either an off-setting debt obligation (such as a loan) or some type of financial derivative such as an interest rate swap – To eliminate the transaction exposure, firms can borrow foreign currencies today to prepare for the settlement of A/Rs in foreign currencies in the future – Due to the borrowing activities, this kind of hedge is classified as financial hedge • Contractual hedges employ the forward, futures, and options contracts to hedge transaction exposures • The Trident case as follows illustrates how contractual and financial hedging techniques may be used to protect against transaction exposure 11-28 Trident’s Transaction Exposure • Trident company just concludes negotiations for the sale of telecommunication equipments to Regency, a British firm, for £1,000,000 – The sale is made in March with payment due three months later in June – The financial and market information is as follows ‧Spot exchange rate: $1.7640/£ ‧Three-month forward rate: $1.7540/£ ‧Cost of capital for Trident company: 12% ‧U.K. three-month deposit (borrowing) interest rate: 8% (10%) ‧U.S. three-month deposit (borrowing) interest rate: 6% (8%) ‧Put option expired in June for £1,000,000 with the strike price $1.75/£ ($1.71/£) is quoted as 1.5% (1.0%) premium ‧Trident’s foreign exchange advisory service forecasts that the spot rate after three months will be $1.76/£ 11-29 Trident’s Transaction Exposure • Trident’s minimum acceptable margin is at a sales price of $1,700,000, which implies the budget rate, the lowest acceptable dollar per pound exchange rate, is at $1.70/£ • Trident company has four alternatives to deal with the transaction exposure: – – – – Remain unhedged Hedge in the forward market Hedge in the money market Hedge in the options market • These choices can be applied to both an account receivable (in this case) and an account payable 11-30 Trident’s Transaction Exposure • Unhedged position • Forward Market Hedge – A forward hedge involves a forward (or futures) contract and a source of funds to fulfill the contract in the future – If funds to fulfill the forward contract are on hand or are due because of a business operation, the hedge is considered “covered,” since no residual foreign exchange risk exists 11-31 Trident’s Transaction Exposure – It would be recorded on Trident’s income statement as a foreign exchange loss of $10,000 ($1,764,000 as booked, $1,754,000 as settled) – Different from the above case, if funds to fulfill the forward exchange contract are not already available or due to be received later, funds to fulfill the forward contract must be purchased in the spot market at some future time points – This type of hedge is “open” or “uncovered” and involves considerable risk because of the uncertain future spot rate to obtain funds to fulfill the forward contract – In this chapter, only the covered hedge is considered 11-32 Trident’s Transaction Exposure • Money Market Hedge – A money market hedge also involves a contract and a source of funds to fulfill that contract – In this instance, the contract is a loan agreement, so the money market hedge is a kind of financial hedge – The firm seeking the money market hedge borrows in one currency and exchanges the proceeds for another currency – Funds to fulfill the contract–to repay the loan–may be generated from business operations, in which case the money market hedge is covered ※ £975,610 =£1,000,000 / (1+10%×90/360) 11-33 Trident’s Transaction Exposure – The money-market hedge actually creates a pounddenominated liability (the pound loan) to offset the pounddenominated asset (the account receivable) – So, the money-market hedge is also a kind of balance sheet hedge – Money market hedge vs. forward market hedge Received today Invested in Rate (annual) FV after 3 months $1,720,976 Deposit 6% $1,746,791 $1,720,976 Dollar loans 8% $1,755,396 $1,720,976 Operations of the firm 12% $1,772,605 ※ A break-even investment rate can be calculated that would make Trident indifferent between the forward market hedge and the money market hedge $1, 720,976 (1 r ) $1, 754, 000 r 1.92% (7.68% annually) ※ If Trident can invest the loan proceeds at a rate higher than 7.68% per annum, it would prefer the money market hedge 11-34 Trident’s Transaction Exposure • Option Market Hedge – Trident could also cover £1,000,000 exposure by purchasing a put option to acquire the right to sell British pounds forward at the strike price – Hedging with purchasing options allows for participation in any upside potential associated with the position while limiting downside risk – The choice of option strike prices is an important aspect of utilizing options for hedging because option premiums and payoff patterns will differ accordingly – Trident consider (1) a nearly ATM put with the strike price of $1.75/£ and the premium of 1.5%, or (2) an OTM put with the strike price of $1.71/£ and the premium of 1% 11-35 Trident’s Transaction Exposure – For the ATM put, the cost of put is £1,000,000 × 1.5% = £15,000 = $26,460 (= £15,000 × $1.7640/£) – The minimal dollar receipts in June is $1,750,000 – $26,460×(1 + 12%×90/360) = $1,750,000 – $27,254 = $1,722,746 when the spot exchange rate is below $1.75/£ (The opportunity cost of $26,460 is the cost of capital of Trident, i.e., 12%) – The maximal dollar receipts in June is unlimited and increasing with the appreciation of the pounds 11-36 Trident’s Transaction Exposure – Compare the ATM put and the OTM put Put option with strike price Option cost (FV in June) ATM put at $1.75/£ OTM put at $1.71/£ $27,254 $18,169 Proceeds if exercised $1,750,000 $1,710,000 Minimum net proceeds $1,722,746 $1,691,831 Maximum net proceeds Unlimited Unlimited ※ The option premium for the OTM put is £1,000,000 × 1% = £10,000 = $17,640 (= £10,000 × $1.7640/£) ※ The minimal dollar receipts in June is $1,710,000 – $17,640×(1 + 12%×90/360) = $1,710,000 – $18,169 = $1,691,831 when the spot exchange rate is below $1.71/£ ※ The OTM put is much cheaper today, but the minimum net proceeds of the OTM put is smaller than those of the ATM put, i.e., the OTM put provides a lower level of protection ※ In the Trident’s case, the OTM put cannot meet its budgeted exchange rate of $1.70/£ after taking the premium expenses into consideration 11-37 Trident’s Transaction Exposure • Comparison of alternative hedging strategies for Trident Unhedged position Wait three months then sell the received £1,000,000 for dollars in the spot market Result Receipt in US$ in June 1. An unlimited maximum 2. An expected $1,760,000 3. A zero minimum Forward market hedge Sell £1,000,000 forward for dollars Result Certain receipts of $1,754,000 in June Money market hedge 1. Borrow £975,610 at the interest rate of 10% 2. Exchange for $1,720,976 at the spot exchange rate 3. Invest $1,720,976 in US markets for three months Result 1. The received £1,000,000 is for the repayment of the interest and principal of the borrowed amount of £975,610 2. The FV of $1,720,976 in June depends on the US$ investment rate (The break-even rate of 7.68% generates the same payment as the forward contract, i.e., $1,754,000) Options market hedge Purchase a three-month put option of £1,000,000 with the strike price of $1.75/£ and premium cost of $27,254 (FV after 3 months) Result Receipt in US$ in June 1. An unlimited maximum less $27,254 2. An expected $1,760,000 less $27,254 3. A minimum of $1,750,000 less $27,254 11-38 Exhibit 11.5 Valuation of Cash Flows Under Hedging Alternatives for Trident Value of Trident’s £1,000,000 A/R (in million US dollars) Uncovered Put option strike price of $1.75/£ 1.84 OTM put option hedge Put option strike price of $1.71/£ 1.82 ATM put option hedge 1.80 1.78 Money market hedge 1.76 1.74 Forward contract hedge 1.72 1.70 1.68 1.68 1.70 1.72 1.74 1.76 1.78 1.80 1.82 1.84 1.86 Ending spot exchange rate (US$/£) 11-39 Trident’s Transaction Exposure • The final choice among hedges depends on the firm’s risk tolerance, its view of the future exchange rate, and its confidence in its view – Thus, transaction exposure management with contractual or financial hedges requires managerial judgment • For an account payable, where the firm would be required to make a foreign currency payment at a future date, it is possible to apply similar techniques to hedging this transaction exposure • Suppose that Trident had a £1,000,000 account payable which will be settled in 90 days, the possible hedge alternative are summarized in the table on the next slide 11-40 Trident’s Transaction Exposure Unhedged position Wait 90 days, exchange dollars for £1,000,000 at that time, and make its payment Result Total payment for £1,000,000 in June 1. Unlimited US$ 2. Expected amount of $1,760,000 3. Minimal zero US$ payment Forward market hedge Buy £1,000,000 forward for dollars Result Certain payments of $1,754,000 in June Money market hedge 1. Borrow $1,729,411.77 at the interest rate of 8% 2. Exchange for £980,392.16 at the spot exchange rate of $1.764/£ 3. Deposit £980,392.16 in the British pound money market at the interest rate of 8% for 90 days Result 1. The interest and principal of £980,392.16 is £1,000,000, which is just enough for the payment after 90 days 2. The repayment amount of $1,729,411.77 in 90 days is $1,764,000 (This cost is higher than the forward hedge and therefore unattractive) Options market hedge Purchase a three-month call option of £1,000,000 with a nearly at-the-money strike price of $1.75/£ and premium is assumed to be 1.5%, which implies a cost of $27,254 (FV after 3 months) Result Total payment for £1,000,000 in June 1. A limited maximum of $1,750,000 + $27,254 = $1,777,254 2. A minimum of $0 plus $27,254 11-41 Exhibit 11.6 Valuation of Hedging Alternatives for an Account Payable Value of Trident’s £1,000,000 A/P in million US dollars -1.68 1.68 1.70 Ending spot exchange rate (US$/£) 1.72 1.74 1.76 1.78 1.80 1.82 1.84 1.86 -1.70 Forward contract hedge locks in a payment of $1,754,000 -1.72 -1.74 -1.76 -1.78 -1.80 Call option hedge Money market hedge locks in a payment of $1,764,000 -1.82 -1.84 Call option strike price of $1.75/£ Uncovered payment whatever the ending spot rate is in 90 days 11-42 Risk Management in Practice 11-43 Risk Management in Practice • The following paragraphs summarized the results of many surveys of corporate risk management practices in recent years 1. Treasury function: – The treasury function of most private firms, which is the group typically responsible for transaction exposure management, is usually considered a cost center – It is not suited to treat the treasury as a profit center. Since assets with higher risk will provide higher expected returns, if the treasury operates as a profit center, it might tolerate more risks that should be hedged 11-44 Risk Management in Practice 2. Currency risk managers are expected to err on the conservative side when managing the firm’s money – Although transaction exposures exist before they are actually booked as foreign-currency-denominated receivables or payables, many firms do not allow the hedging of quotation exposure or backlog exposure as a matter of policy • Many firms feel that until the transaction exists on the accounting books of the firm, the probability of the exposure actually occurring is considered to be less than 100% – These conservative policies dictate that contractual or financial hedges should be placed only on existing exposures – An increasing number of firms, however, are actively hedging not only backlog exposures, but also selectively hedging quotation and anticipated exposures • Anticipated exposures are transactions for which there are–at present–no contracts or agreements between parties, but that are anticipated on the basis of historical trends and continuing business relationships 11-45 Risk Management in Practice 3. Which contracts are used for hedge? – In practice, transaction exposure management programs are generally divided along an “option-line”; those that use options and those that do not – Those firms that do use currency options are generally more aggressive in their tolerance of currency risk – Firms that do not use currency options rely almost exclusively on forward contracts and money market hedge – For extremely conservative and risk-intolerant firms, they hedge all existing exposures with forwards and hedge a variety of backlog and anticipated exposures with options 11-46 Risk Management in Practice 4. Proportional hedges – Many MNEs have established rather rigid transaction exposure risk management policies that mandate proportional hedging – These policies generally require the use of forward contract hedges on a percentage (e.g., 50%, 60%, or 70%) of existing transaction exposures – The remaining portion of the exposure is then selectively hedged on the basis of the firm’s risk tolerance, the view of exchange rate movements, and the confidence level about the view 11-47 Risk Management in Practice 5. Full hedge only at favorable forward exchange rates – Many firms require that when there is a favorable forward exchange rate, full forward-cover is put in place; Otherwise, they may adopt the proportional hedges – More specifically, for the account receivables (payables) of Trident case, the full forward-cover strategy is adopted when the forward exchange rate is at premium (discount), i.e., the forward exchange rate is higher (lower) than the spot exchange rate, $1.7640/£ – The reason is that if firms use forward contracts to hedge when the forward rate is unfavorable, a certain foreign exchange loss will be shown in the income statement (see the example on Slides 11-31 and 11-32) • For the management, it is difficult to explain why there is still a foreign exchange loss after conducting a hedging transaction 11-48 Risk Management in Practice 6. Other derivatives – Recently, many other complex options are employed to hedge the exchange rate risk, like range forwards, participating forwards, average rate options, etc. – Consider that Trident possess a £1,000,000 account receivable to be settled in 90 days and the following information Spot rate $1.479/£ 90-day forward rate $1.470/£ 90-day dollar interest rate 3.25% 90-day pound interest rate 5.72% 90-day $/£ volatility 11% 11-49 Risk Management in Practice – Range forward • Buy a put option with a strike rate below the forward rate, and sell a call option with a strike rate above the forward rate • The benefits of the combined position – With a near-zero net premium (the premium from selling the call is used to finance the purchase of the put) – The foreign exchange risk is bounded in a range 11-50 Risk Management in Practice – Participating forward • Buy a put option with a strike rate below the forward rate, and sell a call option with a strike rate the same as the put option but only for a portion of the total currency exposure • The benefits of the combined position – With a zero net premium by a proper participation rate (53.18% here) – For all favorable exchange rate movements (those above $1.45/£), the hedger would enjoy 46.82% (=1 – 53.18%) of the differential between the uncovered position and the short position of the call 11-51 Risk Management in Practice – Average rate option • It is a more recent currency derivative contract • It is normally classified as a “path-dependent” currency option, because its payoff depends on averages of spot rates over some pre-specified period of time • There are two basic categories, the average rate option and the average strike option – The average rate call is with the payoff max(S K,0), where S is the average spot rate over the period – The average strike call is with the payoff max(ST S,0) • For firms that generate foreign-currency-denominated receivable or payable at a regular frequency, e.g., daily, since there are too many transactions, it is difficult and expensive for firms to hedge each transaction separately • The average rate option is a better alternative for these firms to hedge their transaction exposure with lower hedge costs 11-52