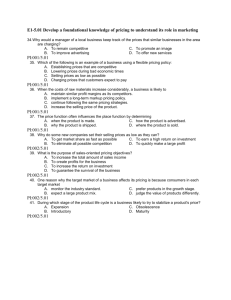

MANAGERIAL ECONOMICS 11th Edition

advertisement

MANAGERIAL th ECONOMICS 11 Edition By Mark Hirschey Pricing Practices Chapter 15 Chapter 15 OVERVIEW Pricing Rules-of-thumb Markup Pricing And Profit Maximization Price Discrimination Price Discrimination Example Multiple-product Pricing Joint Products Joint Product Pricing Example Transfer Pricing Global Transfer Pricing Example Chapter 15 KEY CONCEPTS competitive market pricing rule-of-thumb imperfectly competitive pricing rule-of-thumb markup on cost profit margin optimal markup on cost markup on price optimal markup on price Lerner Index of Monopoly Power price discrimination market segment first-degree price discrimination second-degree price discrimination third-degree price discrimination by-product common costs vertical relation vertical integration transfer pricing Pricing Rules-of-thumb Competitive Markets Profit maximization always requires setting Mπ = MR - MC = 0, or MR=MC, to maximize profits. In competitive markets, P=MR, so profit maximization requires setting P=MR= MC. Imperfectly Competitive Markets With imperfect competition, P > MR, so profit maximization requires setting MR=MC. MR = P[1 + (1/εP)] Optimal P* = MC/[1 + (1/εP)] Markup Pricing And Profit Maximization Optimal Markup on Cost Markup on cost uses cost as a basis. Markup pricing is an efficient means for achieving the profit maximization objective. Optimal markup on cost = -1/(εP + 1) Optimal Markup on Price Markup on price uses price as a basis. Optimal markup on price = -1/εP Price Discrimination Profit-Making Criteria Price discrimination exists if P1/P2 ≠ MC1/MC2. Ability to segment the market. Multiple markets with no reselling. Price elasticity of demand differs across submarkets. Degrees of Price Discrimination First degree: Different prices for each consumer. Creates maximum profits for sellers. Second degree: Block-rates or quantity discounts. Third degree: Different prices by customer age, sex, income, etc. (most common). Price Discrimination Example Price/Output Determination One-price Alternative Maximizes profits by setting MR=MC in each market segment. Without price discrimination, MR=MC for customers as a group. With price discrimination, MR=MC for each customer or customer segment. Profitable price discrimination benefits sellers at the expense of some customers. Graphic Illustration Multiple-product Pricing Demand Interrelations Cross-marginal revenue terms indicate how product revenues are related to another. Production Interrelations Joint products may compete for resources or be complementary. A by-product is any output customarily produced as a direct result of an increase in the production of some other output. Joint Products Joint Products in Variable Proportions If products are produced in variable proportions, treat as distinct products. For joint products produced in variable proportions, set MRA=MCA and MRB=MCB. Common costs are joint product expenses. Allocation of common costs is wrong and arbitrary. Joint Products in Fixed Proportions Some products are produced in a fixed ratio. If Q=QA=QB, set MRQ=MRA+MRB=MCQ. Joint Product Pricing Example Joint Products Without Excess By-product Profit-maximization requires setting MRQ=MRA+MRB=MCQ. Marginal revenue from each byproduct makes a contribution toward covering MCQ. Joint Production With Excess By-product (Dumping) Profit-maximization requires setting MRQ=MRA+MRB=MCQ. Primary product marginal revenue covers MCQ. Byproduct MR=MC=0. Transfer Pricing Transfer Pricing Problem Products Without External Markets Marginal cost is the appropriate transfer price. Products With Competitive External Markets Pricing transfer of products among divisions of a single firm can become complicated. Market price is the optimal transfer price. Products With Imperfectly Competitive External Markets Optimal transfer price is the marginal revenue derived from combined internal and external markets. Global Transfer Pricing Example Profit Maximization for an Integrated Firm Transfer Pricing with No External Market Optimal transfer price balances supply/demand. Competitive External Market with Excess Internal Demand Optimal transfer price is profit maximizing. Firm employs own and external inputs. Competitive External Market with Excess Internal Supply Firm supplies inputs to internal and external markets.