demand theory - Official Site of MOHAMMAD ABDUL MUKHYI

advertisement

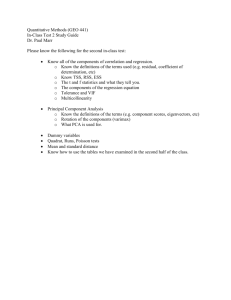

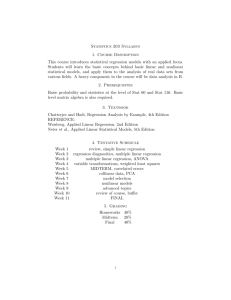

DEMAND THEORY DR. MOHAMMAD ABDUL MUKHYI, SE.,MM DEMAND FOR A COMMODITY Permintaan adalah sejumlah barang yang diminta oleh konsumen pada tingkat harga tertentu. Teori Permintaan adalah menghubungkan antara tingkat harga dengan tingkat kuantitas barang yang diminta pada periode waktu tertentu. Fungsi Permintaan: QdX = ƒ(Px, Py, Pz, I, T, Tech, ….) Hypothetical Industry Demand Curves for New Domestic Automobiles at Interest Rates of 6%, 8%, and 10% P P P 2 2 2 1 1 1 d1 0 2 3 Individual 1 d2 Q1 0 1 2 Individual 2 Q2 0 d3 3 5 Pasar Qx Permintaan Kentang di Indonesia Permintaan kentang untuk periode 1980-2008: QdS = 7.609 – 1.606PS + 59N + 947I + 479PW + 271t. QdS = quantitas kentang yang dijual per tahun per 1.000 Kg. PS = harga kentang per kg N = rata-rata bergeral jumlah penduduk per 1 milyar. I = pendapatan disposibel per kapita penduduk. PW = harga ubi per kg yang diterima petani. T = trend waktu (t = 1 untuk tahun 1980 dan t = 2 untuk tahun 2008). N = 150,73 I = 1,76 PW = 2,94 dan t = 1 Bagaimana bentuk fungsi permintaan kentang? Elastisitas Harga Permintaan Elastisitas Titik : % perubahan jumlah yang diminta Ed p % perubahan harga Q/Q Q P Ed p x P/P P Q Elastisitas Busur : Q P/n Ed p x P Q/n atau Q (P1 P2 ) / 2 Ed p x P (Q1 Q 2 ) / 2 Elastisitas Kumulatif : Ed p Q/N P/n x P/N Q/n atau Ed p Q P x P Q Elastisitas Silang : % perubahan jumlah barang X yang diminta Ec xy % perubahan harga barang Y atau (Qx/Qx) Qx Py Ec xy x (Py/Py) Py Qx Elastisitas Pendapatan : Ey % perubahan barang yang diminta % perubahan pendapatan atau Ey Qd Y Qd Y x x Y Qd Y Qd Elastisitas Harga, Total Revenue, Marginal Revenue : TR = P . Q MR = ΔTR / ΔQ 1 MR P1 E p Q = 600 – 100P Diminta : a. Buat fungsi pendapatan. b. Hitung nilai pendapatan marginal. c. Bila P = 4 dan EP = -2 hitung MR Jawab: a. Q = 600 – 100P P = 6 – Q/100 b. TR = P.Q TR = (6 – Q/100).Q = 6Q – Q2/100 MR = 6 – Q/50 MR optimal = 0 0 = 6 – Q/50 Q = 300 TR ($) 1000 900 800 700 600 500 400 300 200 100 0 TR = 6Q – Q2/100 TR TR ($) 0 200 1000 900 800 700 600 500 400 300 200 100 0 400 600 800 output Q = 600 – 100P D 0 200 output 400 600 MR = 6 – Q/50 800 1 1 MR 41 41 2 2 2 Qx = 1,5 – 3,0Px + 0,8I + 2,0Py – 0,6Ps + 1,2A Qx Px I Py Ps A = = = = = = penjualan kopi merek X harga kopi merek X pendapatan disposibel per kapita per tahun harga kopi pesaing harga gula per kilo pengeluaran iklan untuk kopi merek X Jika Px = 2; I = 2,5; Py = 1,8, Ps = 0.50 dan A = 1 berapa Q? Qx = 1,5 – 3,0(2) + 0,8(2,5) + 2,0(1,8) – 0,6(0,50) + 1,2(1) = 2 Tingkat Elastisitas : 2 E P 3 3 2 2,5 E I 0,8 1 2 E XY E XS EA 1,8 2 1,8 2 0,50 0,6 0,15 2 1 1,2 0,6 2 Supply Penawaran adalah sejumlah barang yang ditawarkan oleh produsen ke konsumen pada tingkat harga tertentu. Teori Penawaran adalah menghubungkan antara tingkat harga dengan tingkat kuantitas barang yang ditawarkan pada periode waktu tertentu. Fungsi Penawaran: QdX = ƒ(Px, Py, Pz, I, T, Tech, ….) Hypothetical Industry Supply Curve for New Domestic Automobiles Hypothetical Industry Supply Curves for New Domestic Automobiles at Interest Rates of 6%, 8%, and 10% Surplus, Shortage, and Market Equilibrium Comparative Statics of Changing Demand Comparative Statics of Changing Supply Comparative Statics of Changing Demand and Changing Supply Conditions Demand and Supply Curves Objectives • Understand how regression analysis and other techniques are used to estimate demand relationships • Interpret the results of regression models – economic interpretation – statistical interpretation and tests • Describe special econometric problems of demand estimation Approaches to Demand Estimation • 1. Surveys, simulated markets, clinics Stated Preference Revealed Preference • 2. Direct Market Experimentation • 3. Regression Analysis A. Difficulties with Direct Market Experiments (1) expensive and risky (2) never a completely controlled experiment (3) infeasible to try a large number of variations (4) brief duration of experiment (1) Specify variables: Quantity Demanded, Advertising, Income, Price, Other prices, Quality, Previous period demand, ... (2) Obtain data: Cross sectional v. Time series (3) Specify functional form of equation Linear Yt = a + b X1t + g X2t + ut Multiplicative Yt = a X1tb X2tg et ln Yt = ln a b ln X1t + g ln X2t + ut (4) Estimate parameters (5) Interpret results: economic and statistical Violating the assumptions of regression including (1) Multicollinearity- highly correlated independent variables (2) Heteroscedasticity- errors do not have the same variance (3) Serial correlation- error in period t is correlated with error in period t + k (4) Identification problems - data from interaction of supply and demand do not trace out demand relationship Transit Example • • • • • • • • • • • • • • • YEAR 19661200 19671190 19681195 19691110 19701105 19711115 19721130 19731095 19741090 19751087 19761080 19771020 19781010 Y Riders 15 15 15 25 25 25 25 30 30 30 30 40 40 P Price 1800 1790 1780 1778 1750 1740 1725 1725 1720 1705 1710 1700 1695 T Pop. 2900 3100 3200 3250 3275 3290 4100 4300 4400 4600 4815 5285 5665 I H Income Parking Rate 50 50 60 60 60 70 75 75 75 80 80 80 85 • • • • • • • • • • • • • • • • YEAR 19791010 19801005 1981995 1982930 1983915 1984920 1985940 1986950 1987910 1988930 1989933 1990940 1991948 1992955 Y Riders 40 40 40 75 75 75 75 75 100 100 100 100 100 100 P Price 1695 1690 1630 1640 1635 1630 1620 1615 1605 1590 1595 1590 1600 1610 T Pop. 5800 5900 5915 6325 6500 6612 6883 7005 7234 7500 7600 7800 8000 8100 I H Income Parking Rate 100 105 105 105 110 125 130 150 155 165 175 175 190 200 Linear Transit Demand Dependent Variable: RIDERS Method: Least Squares Date: 03/31/02 Time: 18:22 Sample: 1966 1992 Included observations: 27 Variable Riders = 85.4 – 1.62 price … Pr Elas = -1.62(100/955) in 1992 Coefficient Std. Error t-Statistic Prob. C PRICE POPULATION INCOME PARKING 85.43924 -1.617484 0.643769 -0.047475 1.943791 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.960015 0.952745 20.48984 9236.342 -117.0847 1.384853 492.8046 0.173373 0.495976 -3.26122 0.262358 2.453782 0.012311 -3.85616 0.349156 5.567113 0.8639 0.0036 0.0225 0.0009 0 Mean dependent var 1026.222 S.D. dependent var 94.25756 Akaike info criterion 9.043312 Schwarz criterion 9.283282 F-statistic 132.0525 Prob(F-statistic) 0 Multiplicative Transit Demand Dependent Variable: LRIDERS Method: Least Squares Date: 03/31/02 Time: 18:26 Sample: 1966 1992 Included observations: 27 Variable Ln Riders = exp(3.25)P-.14 … Coefficient Std. Error t-Statistic Prob. C LPRICE LPOPULATION LINCOME LPARKING 3.24892 -0.13716 0.613645 -0.13077 0.166443 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.973859 0.969107 0.015926 0.00558 76.22788 0.93017 3.26874 0.993937 0.021873 -6.27052 0.409148 1.49981 0.039913 -3.27646 0.032361 5.143338 0.3311 0 0.1479 0.0034 0 Mean dependent var 6.929651 S.D. dependent var 0.09061 Akaike info criterion -5.27614 Schwarz criterion -5.03617 F-statistic 204.9006 Prob(F-statistic) 0 Ch 3: DEMAND ESTIMATION In planning and in making policy decisions, managers must have some idea about the characteristics of the demand for their product(s) in order to attain the objectives of the firm or even to enable the firm to survive. Demand information about customer sensitivity to modifications in price advertising packaging product innovations economic conditions etc. are needed for product-development strategy • For competitive strategy details about customer reactions to changes in competitor prices and the quality of competing products play a significant role What Do Customers Want? • How would you try to find out customer behavior? • How can actual demand curves be estimated? From Theory to Practice D: Qx = f(px, Y, ps, pc, , N) (px=price of good x, Y=income, ps=price of substitute, pc=price of complement, =preferences, N=number of consumers) • What is the true quantitative relationship between demand and the factors that affect it? • How can demand functions be estimated? • How can managers interpret and use these estimations? Most common methods used are: a) consumer interviews or surveys to estimate the demand for new products to test customers reactions to changes in the price or advertising to test commitment for established products b) market studies and experiments to test new or improved products in controlled settings c) regression analysis uses historical data to estimate demand functions Consumer Interviews (Surveys) • Ask potential buyers how much of the commodity they would buy at different prices (or with alternative values for the non-price determinants of demand) face to face approach telephone interviews Consumer Interviews cont’d • Problems: – Selection of a representative sample • what is a good sample? – Response bias • how truthful can they be? – Inability or unwillingness of the respondent to answer accurately Market Studies and Experiments • More expensive and difficult technique for estimating demand and demand elasticity is the controlled market study or experiment – Displaying the products in several different stores, generally in areas with different characteristics, over a period of time • for instance, changing the price, holding everything else constant Market Studies and Experiments cont’d • Experiments in laboratory or field – a compromise between market studies and surveys – volunteers are paid to stimulate buying conditions Market Studies and Experiments cont’d • Problems in conducting market studies and experiments: a) expensive b) availability of subjects c) do subjects relate to the problem, do they take them seriously? BUT: today information on market behavior also collected by membership and award cards Regression Analysis and Demand Estimation • A frequently used statistical technique in demand estimation • Estimates the quantitative relationship between the dependent variable and independent variable(s) quantity demanded being the dependent variable if only one independent variable (predictor) used: simple regression if several independent variables used: multiple regression A Linear Regression Model • In practice the dependence of one variable on another might take any number of forms, but an assumption of linear dependency will often provide an adequate approximation to the true relationship Think of a demand function of general form: Qi = a + b1Y - b2 pi + b3ps - b4pc + b5Z + ε where Qi = quantity demanded of good i Y = income pi = price of good i ps = price of substitute(s) pc = price of complement(s) Z = other relevant determinant(s) of demand ε = error term Values of a and bi ? a and bi have to be estimated from historical data • Data used in regression analysis cross-sectional data provide information on variables for a given period of time time series data give information about variables over a number of periods of time • New technologies are currently dramatically changing the possibilities of data collection Simple Linear Regression Model In the simplest case, the dependent variable Y is assumed to have the following relationship with the independent variable X: Y = a + bX + ε where Y = dependent variable X = independent variable a = intercept b = slope ε = random factor Estimating the Regression Equation • Finding a line that “best fits” the data – The line that best fits a collection of X,Y data points, is the line minimizing the sum of the squared distances from the points to the line as measured in the vertical direction – This line is known as a regression line, and the equation is called a regression equation Estimated Regression Line: Yˆ a bX Observed Combinations of Output and Labor input Skatter Plot 600 Q 500 Q 400 Yˆ Y 300 200 100 0 0 100 200 300 400 L 500 600 700 800 Regression with Excel SUMMARY OUTPUT Regression Statistics Multiple R 0,959701 R Square 0,921026 Adjusted R Square 0,917265 Standard Error 47,64577 Observations 23 Evaluate statistical significance of regression coefficients using t-test and statistical significance of R2 using F-test ANOVA df Regression Residual Total SS MS F Significance F 1 555973,1 555973,1 244,9092 4,74E-13 21 47672,52 2270,12 22 603645,7 Coefficients Standard Error t Stat P-value Lower 95% Upper 95%Lower 95,0% Upper 95,0% Intercept -75,6948 31,64911 -2,39169 0,026208 -141,513 -9,87686 -141,513 -9,87686 X Variable 11,377832 0,088043 15,64957 4,74E-13 1,194737 1,560927 1,194737 1,560927 Statistical analysis is testing hypotheses • Statistics is based on testing hypotheses • ”null” hypothesis = ”no effect” • Assume a distribution for the data, calculate the test statistic, and check the probability of getting a larger test statistic value For the normal distribution: Z Z p X t-test: test of statistical significance of each estimated regression coefficient • bi = estimated coefficient • H0: bi = 0 t bi SE bi • SEβ: standard error of the estimated coefficient • Rule of 2: if absolute value of t is greater than 2, estimated coefficient is significant at the 5% level (= p-value < 0.05) • If coefficient passes t-test, the variable has an impact on demand Sum of Squares Sum of Squares cont’d TSS = (Yi - Y)2 (total variability of the dependent variable about its mean Y) RSS = (Ŷi - Y)2 (variability in Y explained by the sample regression) ESS = (Yi - Ŷi)2 (variability in Yi unexplained by the dependent variable x) This regression line gives the minimum ESS among all possible straight lines. The Coefficient of Determination • Coefficient of determination R2 measures how well the line fits the scatter plot (Goodness of Fit) RSS ESS R 1 TSS TSS 2 R2 is always between 0 and 1 If it’s near 1 it means that the regression line is a good fit to the data Another interpretation: the percentage of variance ”accounted for” F-test • The null hyphotesis in the F-test is H0: b1= 0, b2= 0, b3= 0, … • F-test tells you whether the model as a whole explains variation in the dependent variable • No rule of thumb, because the values of the Fdistribution vary a lot depending on the degrees of freedom (# of variables vs. # of observations) – Look at p-value (”significance F”) Special Cases: • Proxy variables – to present some other “real” variable, such as taste or preference, which is difficult to measure • Dummy variables (X1= 0; X2= 1) – for qualitative variable, such as gender or location • Linear vs. non-linear relationship – quadratic terms or logarithms can be used Y = a + bX1 + cX12 QD=aIb logQD= loga + blogI Example: Specifying the Regression Equation for Pizza Demand We want to estimate the demand for pizza among college students in USA What variables would most likely affect their demand for pizza? What kind of data to collect? Data: Suppose we have obtained cross-sectional data on randomly selected 30 college campuses (through a survey) The following information is available: average number of slices consumed per month by students average price of a slice of pizza sold around the campus price of its complementary product (soft drink) tuition fee (as proxy for income) location of the campus (dummy variable is included to find out whether the demand for pizza is affected by the number of available substitutes); 1 urban, 0 for non-urban area Linear additive regression line: Y = a + b1pp + b2 ps + b3T + b4L where Y = quantity of pizza demanded a = the intercept Pp = price of pizza Ps = price of soft drink T = tuition fee L = location bi = coefficients of the X variables measuring the impact of the variables on the demandfor pizza Estimating and Interpreting the Regression Coefficients Y = 26.27- 0.088pp - 0.076ps + 0.138T- 0.544 L (0.018) (0.018)* (0.020)* (0.087) (0.884) R2 = 0.717 adjusted R2 = 0.67 F = 15.8 Numbers in parentheses are standard errors of coefficients. *significant at the 0.01 level Problems in the Use of Regression Analysis: • identification problem • multicollinearity (correlation of coefficients) • autocorrelation (Durbin-Watson test) • normality assumption fails (outside the scope of this course) Identification Problem • Can arise when all effects on Y are not accounted for by the predictors P D?! P S D2 D3 D1 Q Can demand be upward sloping?! Q OR…? Multicollinearity • A significant problem in multiple regression which occurs when there is a very high correlation between some of the predictor variables. Resulting problem: Regression coefficients may be very misleading or meaningless because… – their values are sensitive to small changes in the data or to adding additional observations – they may even be opposite in sign from what ”makes sense” – their t-value (and the standard error) may change a lot depending upon which other predictors are in the model Multicollinearity cont’d Solution: Don’t use two predictors which are very highly correlated (however, x and x2 are O.K.) Not a major problem if we are only trying to fit the data and make predictions and we are not interested in interpreting the numerical values of the individual regression coefficients. Multicollinearity cont’d • One way to detect the presence of multicollinearity is to examine the correlation matrix of the predictor variables. If a pair of these have a high correlation they both should not be in the regression equation – delete one. Y X1 Y 1.00 -.45 X1 -.45 1.00 X2 .81 -.82 X3 .86 -.59 X2 X3 .81 .86 -.82 -.59 1.00 .91 .91 1.00 Correlation Matrix Autocorrelation • Correlation between consecutive observations • Usually encountered with time series data – E.g. seasonal variation in demand D Creates a problem with ttests: insignificant variables may appear significant time A test for Autocorrelated Errors: DURBIN-WATSON TEST • A statistical test for the presence of autocorrelation • Fit the time series with a regression model and then determine the residuals: n t yt yˆ t d 2 ( ) t t 1 t 2 n t 1 2 t The Interpretation of d: The Durbin-Watson value d will always be 0d4 Strong positive correlation 0 No correlation 2 Strong negative correlation 4 Multiple Regression Procedure 1. Determine the appropriate predictors and the form of the regression model – Linear relationship – No multicollinearity – Variables ”make sense” 2. Estimate the unknown a and b coefficients 3. Check the “goodness” of the model (R2, global F-test, individual t-test for each b coefficient) 4. Use the fitted model for predictions (and determine their accuracy) Additional Comments: • OCCAM’S RAZOR. We want a model that does a good job of fitting the data using a minimum number of predictors. A high R2 is not the only goal; variables used should be ”meaningful” • Don’t use more predictors in a regression model than 5% to 10% of n • Correlation is not causality! FORECASTING • Expert opinion –based methods – Delphi method • Data-based methods – Time series analysis • History can predict the future? – Regression analysis • Forecast the values of the Xi’s to get Y • Assumes the relationship between Xi’s and Y does not change